Top Factors Driving Growth in the UK ATM Market

Overview of the UK ATM Market:

The UK's ATM market, therefore, stands as an important pillar in its financial ecosystem for the benefit of millions of consumers and businesses who rely on timely, convenient, and secure ways of accessing cash. However, despite the rapid acceleration of contactless payments and digital banking, ATMs remain indispensable across the urban and rural areas. They serve far beyond the purposes of cash withdrawals: they are multichannel contact points for balance inquiries, fund transfers, and bill payments that bridge traditional and digital banking services.

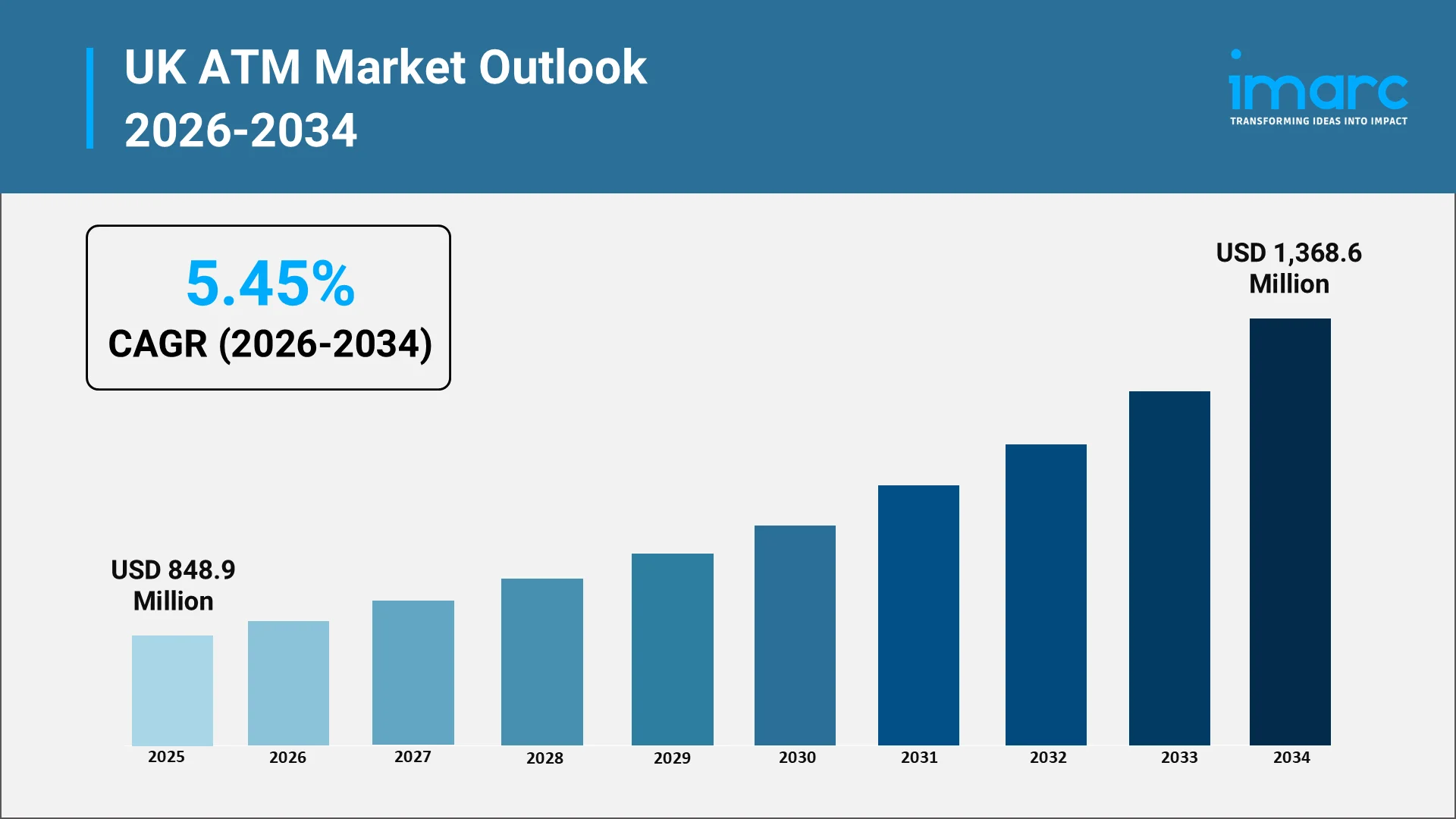

In the United Kingdom, ATMs are not simply cash-dispensing machines; they are part of the banking infrastructure. They support financial inclusion by guaranteeing access to cash in areas where there is a lack of bank branches or low levels of digital literacy. Reflecting this continued importance, the UK ATM Market reached USD 848.9 Million in 2025 and is projected to grow to USD 1,368.6 Million by 2034, registering a CAGR of 5.45% during 2026–2034. Secondly, ATMs support the continuity of the cash economy, enabling small enterprises, independent traders, and elderly citizens who depend on tangible transactions.

Currently, the market is rightly shaped by a balanced mix of banking institutions, IADs, and fintech firms. All combined, these players are upgrading the ATM networks by integrating real-time monitoring and introducing advanced security features for ATMs to counter fraud and cyber threats. As financial services evolve, so too does the UK's ATM network, with a continued move toward smarter, more connected solutions harmonizing with a growing landscape of digital banking evolution.

Explore in-depth findings for this market, Request Sample

Market Size and Transaction Trends:

The trajectory of the UK ATM market reflects a dynamic interplay between technological innovation, consumer habits, and financial policy. While digital payments have seen a noticeable rise, the need for cash persists across several user segments. Cash withdrawal trends remain particularly resilient among small business owners, rural communities, and cash-preference consumers who view cash as a budgeting tool or a means of privacy in transactions. According to research from LINK, 65% of UK adults said using cash gives them confidence they won’t face a payment outage, and 76% believe it is important to have the option to pay with cash.

ATMs in the UK are adapting to these behavioral shifts by diversifying their functions. Many now allow:

- Cardless withdrawals

- QR code-based transactions

- Top-ups for digital wallets

These innovations illustrate how cash and digital channels can coexist. They ensure that the ATM network remains relevant in a period where the financial landscape is evolving rapidly.

The broader ATM industry growth UK is also being reinforced by the growing need for 24/7 banking convenience. Even with the closure of physical branches, ATMs continue to serve as critical banking outlets, providing around-the-clock access. Their strategic placement in retail stores, transport hubs, and public areas ensures continuous engagement between customers and the financial system.

Overall, transaction patterns reflect a hybridized banking culture—one where digital efficiency coexists with tangible financial interactions, ensuring that cash remains a vital component of consumer choice in the digital age.

Key Factors Driving ATM Deployment:

Several fundamental drivers underpin the ATM industry growth UK, each contributing to the resilience and adaptability of the sector.

- Financial Inclusion and Accessibility: Despite the digitization of banking, cash access remains a critical social and economic necessity. ATMs act as lifelines for communities with limited internet access, elderly populations less comfortable with mobile platforms, and individuals preferring cash-based spending. This emphasis on financial inclusion continues to encourage both banks and IADs to deploy ATMs strategically across regions to maintain equitable access. For example, in November 2024 NatWest Group announced an expansion of its partnership with NCR Atleos, to modernise its self-service banking channel by upgrading more than 5,500 ATMs and multi-function devices across the UK.

- Branch Rationalization and Network Optimization: As banks streamline operations by reducing physical branches, ATMs serve as cost-effective extensions of their services. The rationalization of branch networks has increased the importance of ATMs in delivering key banking functions. These terminals reduce operational costs while preserving brand visibility and customer engagement, ensuring banks maintain a local presence without the expense of full-scale branch operations.

- Cash Resilience and Consumer Preference: Although contactless payments have become mainstream, cash remains embedded in the UK’s transactional culture. Consumers continue to view cash as a tool for managing daily expenses and avoiding debt. This sustained preference for cash—especially among lower-income households and small merchants—fuels ongoing investment in ATM networks.

- Technological Modernization: The modernization of ATM systems—through remote management, predictive maintenance, and software upgrades—is a major driver of growth. Enhanced connectivity allows operators to improve uptime, optimize cash replenishment schedules, and deliver advanced services such as currency conversion and bill payments. This evolution extends the ATM’s functionality beyond simple withdrawals, enhancing overall user experience.

- Regulatory and Industry Collaboration: Collaborations between financial institutions, payment processors, and regulators have also strengthened ATM deployment strategies. Initiatives promoting shared infrastructure and interoperability ensure that consumers have continuous access to cash, regardless of their bank affiliation. This collaborative framework supports long-term sustainability in a competitive environment. For example, in June 2025, Tietoevry Banking published a white-paper outlining how “ATM Pooling” — banks forming a consortium to run a shared ATM network — can reduce operating costs by up to 40%, while improving access and infrastructure efficiency.

These intertwined factors continue to shape a market that remains essential to financial stability, customer convenience, and the wider banking infrastructure of the United Kingdom.

Digital Banking and Cash Access Trends:

The intersection of physical and digital banking channels is redefining the future of the UK ATM Market. As digital transformation accelerates, the integration between mobile apps and ATM networks is becoming more seamless. Customers can now:

- Initiate withdrawals from smartphones

- Use biometric verification for access

- Monitor transaction history in real time

These capabilities create a unified banking experience.

However, even as digital banking gains momentum, cash retains symbolic and practical importance. For many consumers, cash is still synonymous with control, privacy, and inclusivity. This reality underscores why maintaining a robust ATM network is crucial for ensuring equitable access to money, particularly in rural or underserved areas where digital penetration is limited.

In parallel, digital banks and fintech startups are beginning to collaborate with ATM providers to offer hybrid banking solutions. These partnerships allow digital-only banks to provide physical touchpoints for cash access, addressing one of their long-standing limitations. The result is a more integrated banking ecosystem that blends virtual efficiency with physical availability.

The broader trend of digital banking evolution is also pushing ATM providers to rethink their service models. By offering contactless authentication, near-field communication (NFC) transactions, and instant card issuance, ATMs are evolving into smart terminals that complement online services. These advancements ensure that the UK ATM market remains aligned with the nation’s broader financial digitization strategy—bridging the gap between tradition and innovation.

Technological Upgrades and Security Features:

As technology redefines the landscape of financial services, ATMs in the UK are undergoing significant transformations in design, operation, and protection. ATM security has become a top priority as threats evolve from physical skimming devices to sophisticated cyberattacks. Consequently, both banks and independent operators are deploying multi-layered security frameworks to safeguard consumer data and maintain trust.

Key advancements include:

- Advanced Authentication Systems: Biometric identification—using fingerprints, facial recognition, or iris scanning—enhances both security and convenience by reducing dependency on physical cards and PINs.

- End-to-End Encryption and Software Protection: Modern ATMs employ encrypted communication channels and secure operating systems to mitigate data breaches. Real-time monitoring platforms detect irregularities, enabling immediate response to suspicious activities. For example, in December 2023 Auriga enhanced its ATM management software to include additional encryption layers and software integrity checks, ensuring that only authorised code executes on the machines and strengthening protection even in environments lacking HSMs.

- Anti-Fraud and Skimming Prevention Technologies: Upgraded card readers and anti-skimming devices protect users from physical tampering. Some ATMs incorporate jamming mechanisms that prevent unauthorized devices from being installed.

- Contactless and Mobile-Integrated Interfaces: Integration with digital wallets allows customers to withdraw cash using smartphones, reducing the risk of card-related fraud. This contactless approach also supports hygiene-conscious consumers in the post-pandemic context.

- Predictive Maintenance and IoT Integration: IoT-enabled ATMs can self-diagnose issues and alert service providers in real time. This minimizes downtime and ensures uninterrupted service availability—an essential factor in user satisfaction.

Together, these innovations reinforce consumer confidence and enhance operational efficiency. As cybersecurity standards strengthen and banking infrastructure modernizes, the UK ATM market is expected to continue evolving into a highly resilient, tech-enabled segment of the financial industry.

Competitive Landscape and Market Outlook:

The UK ATM Market thrives on a competitive ecosystem that includes banks, independent deployers, and technology vendors. Each stakeholder brings a unique perspective:

- Banks prioritize customer service and brand trust

- Independent deployers focus on network coverage and cost efficiency

Competition has fueled innovation in both hardware and software aspects of ATM management. Cloud-based monitoring platforms, modular ATM designs, and real-time analytics now allow operators to maximize uptime and reduce service costs. Partnerships between ATM manufacturers and fintech companies are expanding service capabilities, turning ATMs into financial kiosks offering multiple functionalities beyond cash dispensing.

In the near future, sustainability will emerge as an additional competitive differentiator. Energy-efficient ATMs, recyclable components, and optimized logistics are expected to play a more significant role in shaping environmentally responsible operations.

The market outlook remains positive, driven by the coexistence of cash and digital payment systems. While the use of cash may fluctuate, it continues to hold socio-economic importance in preserving inclusivity, privacy, and financial independence. With the ongoing digital banking evolution, the ATM sector is transitioning from traditional cash machines into intelligent service nodes that support multi-channel financial engagement.

Overall, the ATM industry growth UK will hinge on how effectively stakeholders balance technological modernization with universal access. Those investing in secure, interoperable, and data-driven infrastructure will lead the next phase of transformation in the nation’s cash and digital banking ecosystem.

Conclusion:

The UK ATM market is undergoing a profound transformation driven by technological innovation, evolving consumer behavior, and strategic modernization. Even as digital payments surge, ATMs continue to play a critical role in ensuring financial accessibility and stability. Enhanced connectivity, advanced security measures, and integration with digital banking channels are redefining the role of ATMs within the banking infrastructure.

Future growth will rely on maintaining a balance between modernization and inclusivity—ensuring that while digital tools expand, physical cash access remains reliable and universal. The convergence of cash-based services and digital platforms illustrates how adaptability can sustain market relevance in a rapidly changing financial landscape.

Ultimately, the ATM industry growth UK reflects not a decline in cash, but a reinvention of access. By embracing innovation while preserving trust, the UK stands as a model of how traditional and modern banking can coexist—powering a resilient, inclusive, and future-ready financial ecosystem.

Choose IMARC Group as We Offer Unmatched Expertise and Core Services:

Empowering Financial Institutions with Data, Insight, and Strategy

- Data-Driven Market Research: Gain an in-depth understanding of the UK ATM market, including deployment trends, transaction volumes, cash usage behavior, and innovations in ATM technology such as contactless withdrawals, biometric authentication, and software-driven security solutions.

- Strategic Growth Forecasting: Identify emerging opportunities in ATM modernization, digital banking integration, and cash management strategies amid the shift toward a cashless economy. Predict future trends in hybrid banking models and ATM network optimization.

- Competitive Benchmarking: Evaluate key players in the UK ATM ecosystem, assess market shares, track equipment upgrades, and monitor innovations by ATM manufacturers, network operators, and financial service providers.

- Policy and Infrastructure Advisory: Stay ahead of evolving regulations, payment system policies, and government initiatives shaping the accessibility, security, and sustainability of ATM networks across urban and rural areas.

- Custom Reports and Consulting: Access tailored insights to align with your business objectives—whether expanding ATM networks, integrating digital payment interfaces, or investing in next-generation cash recycling systems.

At IMARC Group, we empower financial leaders with actionable intelligence to navigate the evolving payments landscape. Join us in shaping the future of secure, accessible, and inclusive banking in the UK.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)