Top Factors Driving Growth in the India Used Car Industry

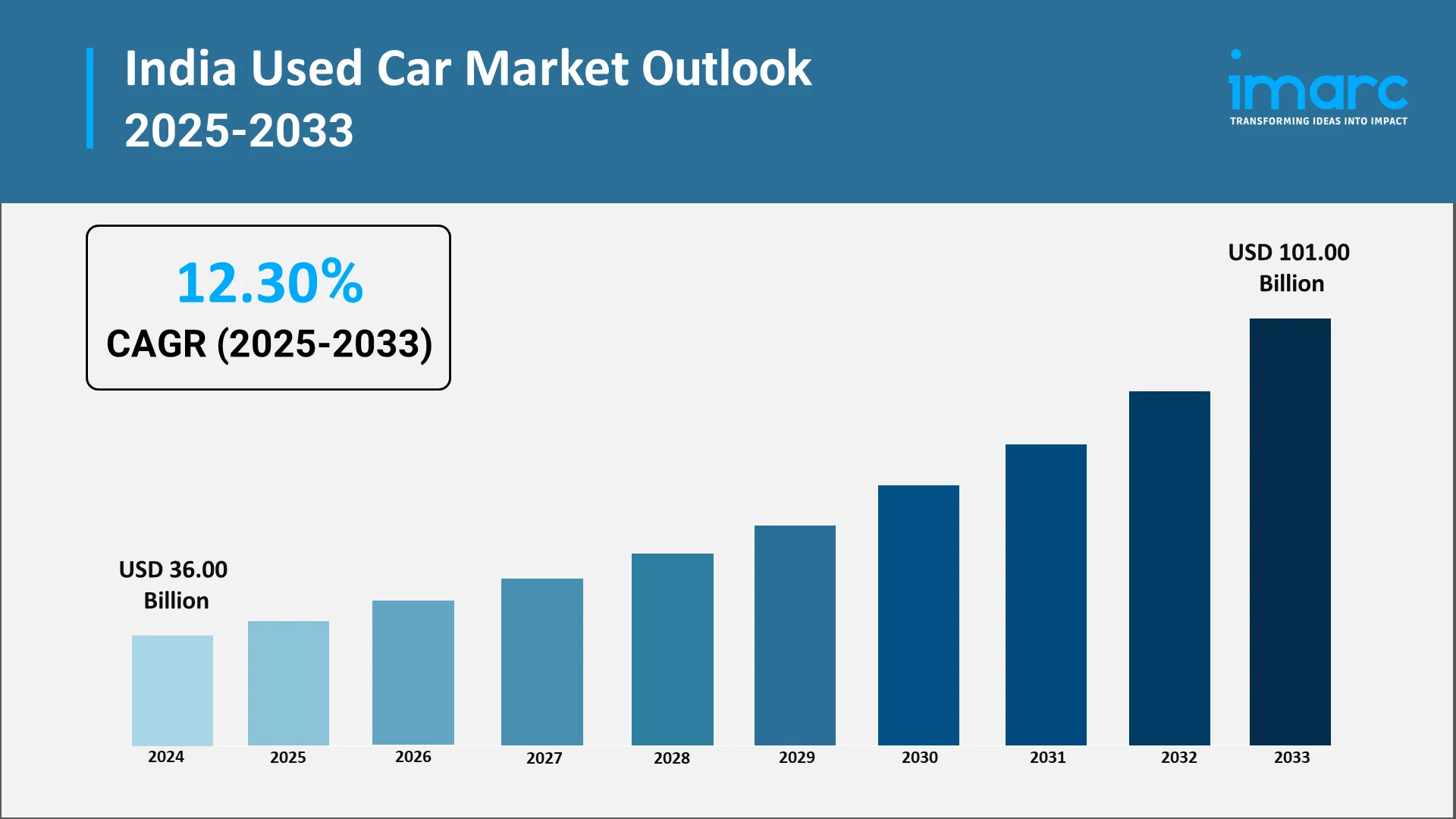

One of the world's most dynamic and quickly changing markets, India's automotive industry is undergoing revolutionary changes in both the new and used car markets. Despite general economic uncertainty, the used car industry has shown remarkable resilience and growth potential, making it a particularly vibrant part of this ecosystem. The India used car market size was valued at USD 36.00 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 101.00 Billion by 2033, exhibiting a CAGR of 12.30% from 2025-2033. This growth trajectory reflects broader economic shifts, technological breakthroughs, and changing consumer habits that are radically altering Indians' attitudes toward personal mobility and car ownership.

The pre-owned vehicle market in India has transitioned from an informal, fragmented space to an increasingly organized and professional industry. Multiple factors converge to create favorable conditions for sustained expansion, ranging from macroeconomic trends to digital innovations enhancing transparency throughout the buying journey.

This comprehensive analysis examines the key factors propelling the India used car industry forward, offering strategic perspectives for businesses, investors, and industry participants seeking to capitalize on this burgeoning opportunity.

Explore in-depth findings for this market, Request Sample

Economic Accessibility and Affordability:

Cost considerations represent the most fundamental driver of used car demand in India. The substantial price differential between new and pre-owned vehicles makes car ownership accessible to a significantly broader demographic. Middle-class families and first-time buyers find the used car segment particularly attractive as it allows them to acquire reliable transportation at a fraction of new vehicle costs.

The expanding middle class continues to drive automotive demand, with many households seeking their first vehicle. Used cars provide an entry point into personal mobility without the financial burden of new vehicle depreciation. This affordability factor becomes even more significant when considering insurance costs, registration fees, and other ownership expenses.

Value retention awareness has increased among consumers who recognize that new vehicles depreciate most significantly in their first few years. By purchasing a used car, buyers avoid steep initial depreciation while acquiring functional vehicles. This economic rationale has strengthened the appeal of the pre-owned car market, particularly among financially savvy consumers.

Additionally, aspirational buyers are drawn to the used car channel as it gives them access to premium brands and higher-end models. Customers can satisfy their needs for quality and status while staying within their means by buying cars from luxury segments that would have been unaffordable when new.

Digital Transformation and Online Platforms:

Every facet of the used car buying and selling process in India has been completely revolutionized by the digital revolution. Online platforms have become extremely effective middlemen, bringing previously opaque and distrustful transactions a level of transparency, efficiency, and convenience which was never possible before. These online marketplaces allow for the seamless connection of buyers and sellers across geographical borders, aggregate enormous inventories from various sources, and provide sophisticated search and comparison tools with sophisticated filtering capabilities.

Technology-enabled solutions address longstanding pain points in the used car buying experience. Virtual vehicle inspections, detailed photo galleries, comprehensive vehicle history reports, and transparent pricing algorithms help buyers make informed decisions from their homes. Mobile applications have made browsing inventory and initiating purchases remarkably seamless, particularly appealing to younger consumers.

Data analytics and artificial intelligence power these platforms, enabling accurate vehicle valuations, predictive maintenance insights, and personalized recommendations. Such technological sophistication has elevated consumer confidence in online transactions, reducing traditional hesitations about purchasing used vehicles without extensive physical inspection.

The omnichannel approach adopted by leading players combines digital convenience with physical touchpoints. Customers can research online, schedule test drives, complete paperwork digitally, and receive home delivery, creating seamless experiences that cater to diverse consumer preferences.

Growth of Organized Players and Quality Assurance:

The emergence of organized retailers has professionalized the used car industry, establishing trust through standardized processes and quality certifications. National and regional chains have invested heavily in creating branded experiences that contrast sharply with traditional unstructured transactions. These organized players bring corporate governance, operational excellence, and customer-centric approaches to the market.

Certification programs represent critical trust-building mechanisms. Rigorous multi-point inspection protocols ensure vehicles meet defined quality standards. These certifications cover mechanical conditions, body integrity, accident history, and documentation authenticity. By providing warranties and guarantees, organized retailers mitigate perceived risks associated with used vehicle purchases.

Refurbishment services offered by established players enhance vehicle presentation and functionality. Professional reconditioning addresses cosmetic and mechanical issues, ensuring vehicles meet customer expectations. This value addition differentiates organized retailers from informal dealers and justifies premium pricing while delivering genuine value.

The after-sales support infrastructure built by organized players extends beyond the initial transaction. Maintenance packages, roadside assistance, and exchange programs create ongoing customer relationships and enhance the overall ownership experience. This comprehensive service orientation addresses traditional concerns about post-purchase support.

Enhanced Financing Options and Credit Access:

Financial inclusion initiatives have expanded credit availability for used car purchases across India. Banks, non-banking financial companies, and specialized auto finance providers have developed products tailored to the pre-owned vehicle segment. This financing ecosystem democratizes access by enabling consumers to spread costs over manageable installments.

The loan approval process has become increasingly streamlined through digital underwriting and alternative credit scoring models. Fintech innovations allow lenders to assess creditworthiness beyond traditional parameters, incorporating utility payments, rental history, and employment stability. This broader evaluation framework extends financing to previously underserved segments.

Competitive interest rates along with flexible repayment terms make used car loans attractive financial products. While rates remain higher than new car financing, the gap has narrowed as lenders recognize growing maturity and lower default risks in the organized market. Promotional offers and dealer-financer tie-ups further enhance affordability.

The integration of instant financing approvals into the car-buying journey represents significant convenience enhancement. Customers can receive loan decisions within minutes through digital platforms, eliminating traditional delays and paperwork burdens. This seamless integration removes a major friction point and accelerates transaction completion.

Urbanization and Evolving Mobility Needs:

Rapid urbanization across India creates concentrated demand for personal transportation solutions. As cities expand and populations grow, inadequate public transportation infrastructure drives individuals toward private vehicle ownership. The used car market serves this urban mobility need effectively, offering practical and economical solutions for commuting and family transportation.

Tier-II and Tier-III cities represent particularly dynamic markets for used cars. Rising incomes in these urban centers, combined with limited new car dealership penetration, create favorable conditions for pre-owned vehicle growth. Local entrepreneurs and organized retailers are establishing presence in these emerging markets, bringing professional standards and expanded consumer access.

Changing lifestyle patterns influence vehicle preferences and upgrade cycles. Young professionals seek vehicles balancing affordability with modern features. Families prioritize space and safety, often finding ideal solutions in the used SUV and MPV segments. The flexibility to change vehicles more frequently at lower cost appeals to consumers whose needs evolve with life stages.

The emergence of shared mobility services has paradoxically supported used car demand by familiarizing non-owners with the benefits of personal transportation. Users of ride-hailing services often transition to vehicle ownership, with used cars providing an accessible entry point. Additionally, gig economy drivers source vehicles from the used car market.

Changing Consumer Perceptions and Trust Building:

Shifting attitudes toward used vehicles mark a significant cultural transition in India. Historical stigmas associated with pre-owned cars have diminished substantially as quality, transparency, and professional standards have improved. Younger generations particularly demonstrate openness to used purchases, viewing them as pragmatic and environmentally conscious choices rather than compromises.

The concept of certified pre-owned vehicles has reshaped consumer psychology by positioning used cars as legitimate, quality-assured products rather than uncertain gambles. Marketing campaigns by organized players emphasize reliability, value, and smart purchasing decisions, normalizing used car ownership across demographic segments. Celebrity endorsements and strategic advertising have further elevated the category's image.

Transparency mechanisms such as vehicle history reports, transparent pricing models, and detailed condition assessments address traditional information asymmetries. Buyers can access comprehensive data about previous ownership, accident history, service records, and actual vehicle conditions. This transparency empowers informed decision-making and builds confidence in the purchase process.

Social proof through customer reviews and testimonials plays an increasingly important role in trust formation. Online platforms showcase verified buyer experiences, creating community validation for used car purchases. Positive word-of-mouth and digital reputation systems incentivize sellers and platforms to maintain high standards, creating virtuous cycles of quality improvement.

Government Policies and Regulatory Framework:

Regulatory developments have progressively supported organized market growth while protecting consumer interests. Government initiatives aimed at formalizing the automotive resale ecosystem establish standards for documentation, taxation, and operational practices. These frameworks reduce ambiguity and create level playing fields that favor transparent, compliant businesses over informal operators.

Vehicle scrappage policies incentivize the retirement of aging, polluting vehicles while supporting used car market turnover. By encouraging owners to replace old vehicles, these programs increase the supply of newer used cars entering the market while removing less desirable inventory. Environmental considerations thus align with market development objectives.

Taxation reforms and simplified transfer procedures reduce transaction costs and administrative burdens. Streamlined registration transfer processes, unified taxation frameworks, and digital integration of transport department services make buying and selling used cars more efficient. These improvements remove historical friction points that deterred market participation.

Consumer protection regulations specific to used vehicle transactions establish recourse mechanisms for buyers facing fraud or misrepresentation. Legal frameworks that mandate disclosure of vehicle history, enforce warranty obligations, and penalize deceptive practices strengthen buyer confidence. Regulatory oversight ensures accountability and professional conduct across the industry.

Conclusion:

The India used car industry stands at an inflection point, propelled by converging forces that create unprecedented growth opportunities. Economic factors continue to drive fundamental demand as vehicle ownership aspirations spread across socioeconomic strata. Digital transformation has modernized the buying experience, while organized players have professionalized operations and built consumer trust through quality assurance mechanisms.

Financial inclusion initiatives democratize access through expanded credit availability, while urbanization patterns sustain robust demand for personal mobility solutions. Cultural shifts in consumer attitudes, supported by transparency mechanisms and positive ownership experiences, have destigmatized used car purchases. Supportive government policies and regulatory frameworks provide stability and direction for market development.

For stakeholders across the automotive value chain—from manufacturers and dealers to financiers and technology providers—understanding these growth drivers provides strategic advantages. The pre-owned vehicle segment will increasingly influence overall automotive market dynamics, creating ripple effects throughout related industries and shaping the future of personal transportation in India.

Choose IMARC Group for Unmatched Market Intelligence:

- Data-Driven Market Research: Deepen your understanding of used car market dynamics, consumer preferences, pricing trends, and technological disruptions through comprehensive research reports.

- Strategic Growth Forecasting: Predict emerging opportunities in vehicle categories, regional markets, digital platforms, and innovative financing models.

- Competitive Benchmarking: Analyze competitive positioning, operational strategies, and market share dynamics across organized and unorganized players.

- Policy and Infrastructure Advisory: Stay ahead of regulatory changes, government initiatives, and infrastructure developments affecting the automotive resale ecosystem.

- Custom Reports and Consulting: Receive tailored insights aligned with your specific business objectives—whether entering new markets, expanding operations, or optimizing your automotive portfolio. At IMARC Group, we empower automotive leaders with strategic intelligence to navigate India's dynamic used car industry and capitalize on transformative growth opportunities.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)