How Government Policies Are Driving the India Auto Parts Manufacturing Industry

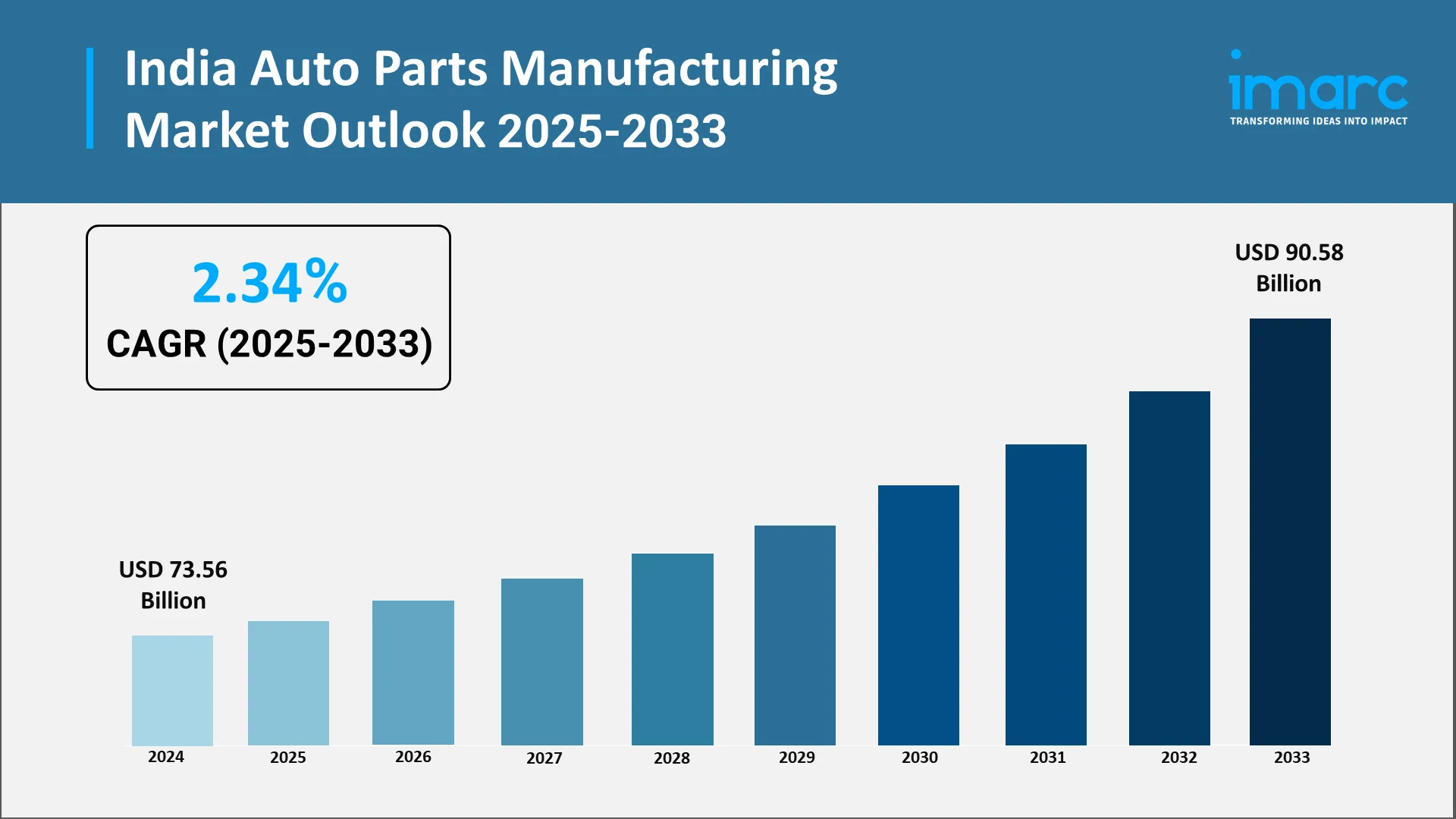

The Indian automotive sector has formed a vital part of the country's industrial and economic development for a long period. Over the years, the industry has transformed significantly, influenced by changes in technology, global trends, and consumer preference. Among the various factors shaping its trajectory, government policies have emerged as a decisive force driving growth, innovation, and competitiveness in the India auto parts manufacturing industry. Strategic initiatives, regulatory frameworks, and policy incentives have come together to strengthen domestic manufacturing capabilities, promote a culture of innovation, and encourage sustainable growth. The India auto parts manufacturing market size reached USD 73.56 Billion in 2024, and looking forward, the market is expected to reach USD 90.58 Billion by 2033, exhibiting a growth rate (CAGR) of 2.34% during 2025-2033, reflecting the steady impact of these supportive policies and initiatives on the sector’s expansion.

Explore in-depth findings for this market, Request Sample

Make in India: Boosting Domestic Auto Component Production

The Make in India initiative has emerged as one of the most influential policy interventions shaping the country’s auto components sector. Designed to establish India as a global manufacturing hub, the program has significantly strengthened domestic production capabilities across the automotive ecosystem. By incentivizing local manufacturing, it has encouraged OEMs to reduce dependence on imports and adopt a more integrated, India-centric supply chain. This strategic shift has enhanced the sector’s long-term stability by promoting capacity building, technological investment, and manufacturing expansion. The initiative has also supported a more competitive industrial environment equipped to meet global quality benchmarks.

The focus on indigenous manufacturing has contributed meaningfully to improved supply chain resilience, operational efficiency, and cost optimization for automotive companies. Shorter lead times and reduced logistics dependencies have enabled faster turnaround cycles and more agile production planning. Additionally, the emphasis on local sourcing has strengthened collaboration between OEMs and domestic component makers, fostering an innovation-driven ecosystem. These partnerships encourage co-development of advanced components that meet international performance and safety standards. As a result, the industry is witnessing growing technical competence, enhanced product quality, and broader export potential, ensuring India’s position as a reliable and competitive contributor to global automotive value chains.

The Make in India initiative also furthers other key economic imperatives, like creating jobs, developing skill bases, and increasing India's global exports in the automotive sector. For instance, under the PLI-Auto (Production-Linked Incentive) scheme, over 30,000 jobs were created by March 2024, according to the Union heavy industries minister. The government has successfully fostered a positive environment for innovation and competitiveness by encouraging a strong domestic supplier base, ensuring that the industry can build on its long-term growth prospects and contribute considerably to the national economy in the process.

Market Size & Growth Opportunity:

The Indian auto parts manufacturing sector is growing dynamically, pushed by several demand drivers. Surging domestic consumption, increased aftermarket services, and rising export demand from other countries have all combined to create new opportunities for manufacturers. With the OEMs focusing on quality, efficiency, and cost competitiveness, there has been a steady increase in production volumes and even diversification of types of components manufactured within the country.

The aftermarket consumption of parts is emerging as a crucial growth segment. The expanding vehicle population, extended life cycles of automobiles, and increasing consumer awareness with regard to maintenance and service have boosted the demand for high-quality replacement parts. For example, in H1 FY25, India’s auto components aftermarket grew to INR 47,416 crore, up from INR 45,158 crore a year earlier. This trend ensures steady revenue streams for auto component manufacturers while also encouraging innovation in product design and material usage.

Exports are another pillar of growth for the sector. Auto components have earned recognition in international markets for their quality, reliability, and cost efficiency. Supportive policies in terms of export incentives, simplification of customs procedures, and global trade agreements further enhance the competitiveness of this sector. In turn, this enables manufacturers to take advantage of emerging opportunities to scale operations, implement global best practices, and increase their presence in emerging markets across Europe, North America, and Asia.

EV Component Manufacturing: A Fast-Growing Segment

The arrival of EVs has indeed brought a paradigm shift in the automotive landscape and opened both challenges and unparalleled opportunities for the auto parts industry. In addition, their demand is aided by the subsidies, tax benefits, and initiatives pertaining to the development of infrastructure extended by government policies to encourage EV adoption. For instance, under the FAME II scheme, the government disbursed INR 5,294 crore in subsidies to EV manufacturers as of December 2023, while also sanctioning INR 800 crore for the creation of 7,432 public charging stations.

Consequently, the production of EV-specific components has expanded rapidly as the automotive landscape transitions toward electrification. Motors, battery packs, controllers, and power electronics now form the core of manufacturing activity, driving new opportunities for suppliers across the value chain. Domestic manufacturers are significantly increasing their investment in research and development to engineer components that meet global performance and safety standards. This focus on innovation supports greater technological self-reliance while enhancing product competitiveness in both domestic and export markets. At the same time, companies remain committed to improving cost efficiency and long-term reliability, ensuring that India can strengthen its position in the evolving global EV ecosystem.

Additionally, policies directed towards the development of EV infrastructure, such as charging stations and battery recycling facilities, indirectly contribute to the growth in the auto parts segment. Greater adoption of EVs has prompted manufacturers to diversify their portfolios, integrate new technologies, and forge strategic partnerships with global players in pursuit of emerging opportunities. For example, India’s Battery Waste Management Rules (2022) enforce Extended Producer Responsibility (EPR), compelling battery manufacturers and importers to set up a recycling ecosystem — a move that supports a circular economy and secures critical materials for the domestic auto parts industry. The focus on localization and self-reliance has re-affirmed India's position as a critical player within the global EV supply chain, creating a strong ecosystem that underpins innovation and growth.

Technology Adoption: Improving Quality and Efficiency

Government policies not only promote production incentives but also actively encourage the adoption of advanced technologies that enhance efficiency, precision, and overall competitiveness. Automation, robotics, and CNC machining are being integrated across manufacturing lines, enabling higher accuracy, reduced errors, and faster output. These technologies significantly lower operational costs by minimizing manual intervention and improving material utilization. As manufacturers embrace digital systems and smart machinery, they achieve better consistency and reliability in component production. This technological shift positions the industry to compete more effectively in global markets, while also supporting long-term innovation, higher productivity, and adherence to stringent international quality standards.

The supportive policy frameworks have facilitated global supply tie-ups, enabling domestic manufacturers to access advanced technologies and best practices. For example, under India’s PLI-Auto scheme, companies such as Varroc Engineering and Pinnacle Mobility (EKA) secured approvals in 2025, which encourages collaboration across borders and helps bring in global expertise. Collaborations with international companies facilitate knowledge transfer, skill development, and process optimization, which enhance competitiveness at par with global standards.

The broader push toward modernization is also prompting manufacturers to upgrade their digital capabilities, particularly through real-time monitoring and data-driven process control. The integration of IoT-enabled sensors, production analytics, and predictive maintenance systems allows facilities to anticipate machinery issues before they escalate, reducing unplanned downtime. These digital tools also help optimize energy consumption, streamline workflow planning, and improve overall equipment effectiveness. As factories transition toward smarter ecosystems, the increased transparency in production cycles strengthens traceability and quality assurance. This digital evolution further aligns domestic manufacturing with global benchmarks, reinforcing both operational resilience and long-term technological advancement.

Top Companies in India Auto Parts Manufacturing Market:

The auto parts manufacturing landscape in India is shared between various established and upcoming players committed to driving innovation, quality, and global competitiveness. Many leading companies such as Motherson Sumi, Bosch, Bharat Forge, Uno Minda, Varroc, and Endurance Technologies have been actively shaping industry standards and expanding market reach.

These companies have leveraged government initiatives, strategic collaborations, and technological advancements to enhance their product portfolios and optimize manufacturing capabilities. For example, in 2024, Motherson Group partnered with REE Automotive, raising over $45 million to support EV supply-chain collaboration, enabling them to manage sourcing, logistics, and assembly for electric trucks. Their focus on quality, operational efficiency, and market diversification ensures that they remain competitive both domestically and internationally. By maintaining a balance between innovation, cost-efficiency, and global benchmarks, these players significantly contribute to the growth and resilience of the Indian auto parts sector.

Conclusion:

The Indian auto parts manufacturing industry is evolving into a more resilient and globally competitive sector, driven by strong policy support, technological progress, and expanding domestic capabilities. Government initiatives have encouraged higher levels of localization, supply chain stability, and industry-wide innovation, enabling companies to meet the evolving requirements of OEMs and international markets. The sector is increasingly integrating advanced manufacturing systems, automation, and digital tools to enhance efficiency and product quality. These developments, reinforced by strategic incentives and regulatory clarity, have positioned the industry to scale production, reduce dependence on imports, and unlock long-term opportunities across diverse automotive segments.

The rapid shift toward electric mobility has emerged as a major catalyst for modernization within the auto parts industry. Manufacturers are investing in research, new materials, and EV-specific components while forming collaborations that bring global expertise into domestic operations. Simultaneously, the aftermarket and export segments continue to expand, boosting revenue diversification and strengthening India’s presence in international supply chains. The adoption of smart manufacturing practices, including IoT-enabled systems and predictive maintenance, further elevates productivity and operational reliability. With sustained policy backing and a focus on innovation-led growth, India’s auto parts industry is well positioned to support future mobility transitions and global demand.

IMARC Group: Your Partner for Insights and Strategic Guidance

The Indian auto parts manufacturing industry is continuously changing with several emerging opportunities from policy, technology, and market dynamics. In such a chaotic scenario, actionable insights, detailed market data, and strategic foresight become mandatory. IMARC Group brings unparalleled expertise in providing customized solutions to companies looking to thrive in this environment.

- Data-Driven Market Research: IMARC provides comprehensive, research-backed market insights that help businesses understand growth patterns, demand drivers, and emerging trends.

- Strategic Growth Forecasting: Using advanced analytics and forecasting models, IMARC enables companies to plan their expansion strategies with confidence.

- Competitive Benchmarking: By evaluating competitors’ performance, market positioning, and strategic initiatives, IMARC helps businesses identify opportunities for differentiation.

- Policy and Infrastructure Advisory: IMARC offers guidance on navigating policy frameworks, regulatory changes, and infrastructure developments, ensuring informed decision-making.

- Custom Reports and Consulting: Tailored market reports, segment-specific insights, and consulting services enable businesses to make strategic investments and optimize operations effectively.

IMARC's commitment to actionable insight enables companies to leverage opportunities created by government policies, technological adoption, and growing market demand to achieve sustainable growth and competitive advantage in the Indian auto parts market.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)