GCC Car Rental Market Insights: Strengthening Mobility Infrastructure Through Innovation

.webp)

Introduction:

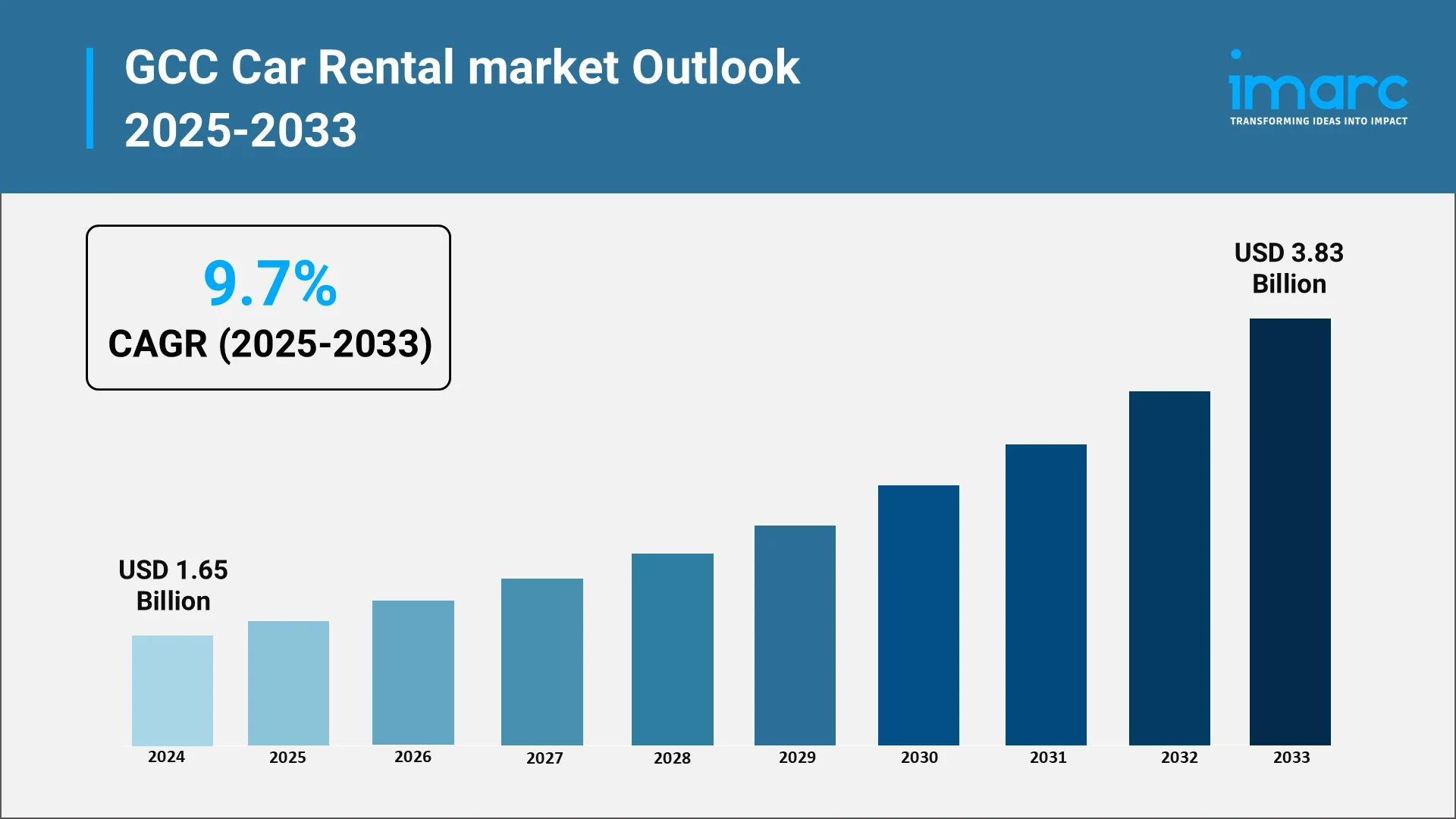

The GCC car rental market has emerged as a critical component of the region's transportation ecosystem, driven by robust tourism activity, expanding business travel, and a substantial expatriate population. Countries across the Gulf Cooperation Council are witnessing unprecedented demand for flexible mobility solutions that cater to diverse customer segments. The GCC car rental market size was valued at USD 1.65 Billion in 2024 as governments prioritize infrastructure development and sustainable tourism initiatives.

Digital transformation is reshaping how consumers access rental services, with mobile applications and online platforms revolutionizing the booking experience. Fleet modernization efforts are introducing advanced vehicle technologies, including electric and hybrid options that align with regional sustainability goals. The convergence of smart travel solutions and innovative service models is creating new opportunities for market participants to differentiate their offerings and capture emerging customer preferences.

The GCC car rental industry growth trajectory reflects broader economic diversification strategies across the region. Enhanced connectivity through airports, seaports, and land borders has facilitated seamless travel experiences that rely on accessible rental services. Corporate leasing arrangements and long-term subscription models are gaining traction among businesses seeking cost-effective transportation alternatives.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming GCC Car Rental Industry:

Regional transformation initiatives, particularly Saudi Arabia's Vision 2030, are fundamentally reshaping mobility infrastructure and rental service expectations. These ambitious frameworks emphasize tourism expansion, entertainment sector development, and business ecosystem enhancement—all of which directly increase demand for flexible transportation options. Government investments in mega-projects, special economic zones, and cultural attractions are creating sustained rental vehicle requirements across both leisure and business segments. The strategic focus on becoming global tourism destinations necessitates world-class rental services that meet international standards while accommodating local preferences. Digital government initiatives and smart city developments are further catalyzing the adoption of technology-enabled rental platforms that integrate seamlessly with broader transportation networks and urban planning objectives. According to the United Arab Emirates Ministry of Economy and Tourism, the UAE's economic performance demonstrates strong momentum, with non-oil GDP rising by 5.3% in the first quarter of 2025 to reach AED 352 Billion, underscoring the robust economic environment supporting the rental market expansion.

Key Industry Trends:

- Increasing Demand for Short-Term Rentals Among Tourists and Business Travelers

Tourism campaigns and business-friendly policies across GCC nations are generating substantial short-term rental demand. International visitors increasingly prefer the flexibility and convenience of self-drive options over traditional transportation alternatives. Major tourism hubs are experiencing seasonal peaks that require scalable rental fleets capable of accommodating fluctuating visitor volumes. Business travelers constitute another critical segment, seeking reliable vehicles for meetings, conferences, and client engagements across multiple cities.

The GCC car rental market trends indicate growing preference for premium and luxury vehicle categories among affluent tourists. Cultural events, sporting tournaments, and entertainment festivals create concentrated demand periods that challenge rental operators to optimize fleet utilization. Airport locations remain dominant distribution channels, though hotel partnerships and downtown service centers are expanding to capture walk-in customers. Enhanced customer service standards and multilingual support are becoming essential differentiators in attracting and retaining international clientele. Regional airlines and hospitality groups are forming strategic alliances with rental providers to offer bundled travel packages.

- Growing Adoption of Digital Booking Platforms and Contactless Rental Services

Technology adoption is revolutionizing customer interactions throughout the rental journey. Digital booking platforms enable customers to compare options, review terms, and complete reservations through intuitive interfaces accessible via smartphones and computers. Mobile applications provide real-time fleet availability, transparent pricing, and instant confirmation features that eliminate traditional booking friction. Contactless vehicle pickup and return processes are gaining popularity, particularly among tech-savvy travelers seeking efficiency and minimal human interaction.

Artificial intelligence and machine learning algorithms are optimizing pricing strategies based on demand patterns, seasonal variations, and competitive positioning. Chatbots and virtual assistants offer 24/7 customer service, answering questions and fixing problems without the need for human participation. Payment integration with digital wallets, cryptocurrencies, and international credit systems accommodates diverse customer preferences. Automated damage assessment tools utilizing computer vision reduce disputes and expedite refund processes. The GCC car rental market research reveals that digital-first approaches are becoming competitive necessities rather than optional enhancements.

- Expansion of Electric and Hybrid Vehicle Fleets Across GCC Countries

Environmental consciousness and government sustainability mandates are accelerating electric and hybrid vehicle adoption in rental fleets. Several GCC nations are implementing policies that incentivize clean transportation options through subsidies, tax benefits, and preferential regulatory treatment. As per the Public Investment Fund (PIF), the Saudi Public Investment Fund and Saudi Electricity Company launched the Electric Vehicle Infrastructure Company (EVIQ), which plans to establish presence in more than 1,000 locations and install over 5,000 fast chargers by 2030 across Saudi Arabia, creating essential infrastructure that supports rental operators' electrification strategies.

Rental companies are progressively launching electric cars that appeal to eco-aware clients and support business sustainability initiatives. Hybrid vehicles offer transitional solutions that combine fuel efficiency with extended range capabilities suited to regional travel patterns. Educational campaigns are helping customers overcome range anxiety and understand the benefits of electric mobility. Premium electric models are particularly attractive to business travelers and luxury segment customers seeking cutting-edge automotive technology. Partnerships with charging network operators ensure convenient access to power infrastructure along popular routes and tourist circuits.

- Rising Corporate Leasing and Long-Term Vehicle Subscription Models

Corporate customers represent a stable revenue stream through leasing arrangements that provide predictable fleet requirements. Businesses across sectors including construction, logistics, consulting, and technology rely on rental solutions to manage transportation needs without capital expenditure commitments. Saudi Arabia's government introduced Cabinet Decree No. 545 in February 2025, which encourages government entities to prioritize vehicle leasing over purchasing, signaling strong institutional support that will significantly boost demand for leased vehicles.

Long-term vehicle subscription models offer flexibility that traditional ownership cannot match, allowing companies to scale fleet size according to project demands and operational fluctuations. Customized corporate programs feature dedicated account management, priority vehicle availability, and flexible billing arrangements. Fleet management services include fuel cards, maintenance scheduling, and replacement vehicle provisions during service periods. Technology integrations enable seamless expense tracking, driver behavior monitoring, and compliance reporting. The rising expatriate population across GCC countries creates sustained demand for long-term personal rental arrangements as an alternative to vehicle ownership.

- Integration of Telematics and IoT for Smart Fleet Management

Advanced telematics systems are transforming fleet operations through real-time vehicle tracking, performance monitoring, and predictive maintenance capabilities. Internet of Things (IoT) sensors collect comprehensive data on vehicle location, fuel consumption, driving patterns, and mechanical conditions. Fleet managers utilize sophisticated dashboards that provide actionable insights for optimizing vehicle utilization and reducing operational costs. Remote diagnostics identify potential issues before they result in breakdowns, minimizing customer inconvenience and repair expenses.

Driver behavior analytics enhance safety standards by identifying aggressive driving patterns, speeding incidents, and harsh braking events. Geofencing capabilities enable alerts when vehicles enter or exit designated areas, supporting both security and operational planning objectives. Smart fleet management systems integrate with booking platforms to provide customers with real-time vehicle availability and location information. Dynamic routing recommendations help customers navigate unfamiliar areas while avoiding traffic congestion. The data generated through IoT implementations creates valuable insights for strategic decision-making regarding fleet composition, replacement cycles, and service area expansion.

Market Segmentation & Regional Insights:

IMARC Group has categorized the GCC car rental market based on booking type, rental length, vehicle type, application, and end user.

Breakup by Booking Type:

- Offline booking maintains significance through walk-in customers at airports, hotels, and city centers, appealing to older demographics and tourists preferring personal interaction and immediate vehicle availability.

- Online booking experiences rapid growth driven by smartphone adoption and internet connectivity, offering instant price comparisons, contactless operations, and integrated promotional offers for tech-savvy customers.

Breakup by Rental Length:

- Short-term rentals dominate the market, serving tourists and business travelers requiring vehicles for days or weeks, supported by diverse fleet options and strategic airport and hotel locations.

- Long-term rentals attract residents, expatriates, and businesses seeking affordable alternatives to ownership, with monthly or annual leasing including maintenance, insurance, and roadside assistance.

Breakup by Vehicle Type:

- Luxury rentals cater to high-net-worth individuals and executives seeking premium vehicles for special events, corporate gatherings, and elegant travel in major GCC cities.

- Executive rentals serve corporate clients requiring mid-to-high-end sedans and SUVs balancing comfort, style, and functionality for business meetings and professional commutes.

- Economy rentals represent the largest segment, offering practical, cost-effective, and fuel-efficient vehicles for budget-conscious tourists, expatriates, and locals.

- SUV rentals thrive due to desert landscapes and road conditions, attracting tourists exploring off-road attractions, families needing spacious vehicles, and adventure tourism enthusiasts.

Breakup by Application:

- Leisure and tourism dominates the market, serving travelers requiring flexible transportation for sightseeing across urban and rural destinations throughout the GCC region.

- Business rentals provide executive vehicles with chauffeur-driven options for professionals attending meetings, conferences, and events in the region's commercial hubs.

Breakup by End User:

- Self-driven rentals offer freedom and independence to residents, tourists, and expatriates preferring to explore destinations at their own pace with GPS-enabled vehicles.

- Chauffeur-driven rentals appeal to high-net-worth individuals and business professionals valuing convenience, luxury, and professional drivers for stress-free travel experiences.

Breakup by Country:

- Saudi Arabia's market benefits from religious tourism with over two million Hajj pilgrims annually, Vision 2030 initiatives, and growing expatriate populations in Riyadh and Jeddah.

- The UAE leads the regional market with thriving business and tourism sectors, attracting millions of international visitors to Dubai and Abu Dhabi with sophisticated digital infrastructure.

- Qatar's market grows steadily through global business positioning, international event hosting, and sustained post-FIFA World Cup 2022 tourism demand.

- Bahrain's compact geography and regional connectivity support its car rental market with cross-border travel demand and strategic positioning as a Gulf business hub.

- Kuwait's market serves local and expatriate populations with growing demand for both short-term tourist rentals and long-term corporate leasing solutions.

- Oman's market benefits from natural tourism attractions, adventure travel opportunities, and government initiatives promoting tourism diversification and economic development.

Forecast (2025–2033):

The GCC car rental market forecast is expected to reach USD 3.83 Billion by 2033, exhibiting a CAGR of 9.7% from 2025-2033, supported by multiple favorable dynamics. Regional population growth, particularly in the 25-45 age demographic, creates expanding customer bases with mobility requirements. International tourism campaigns and visa liberalization measures are expected to generate sustained visitor increases that directly translate to rental demand.

Growth in Tourism and Hospitality Sector remains a primary demand driver as governments invest heavily in destination marketing and attraction development. The meetings, incentives, conferences, and exhibitions segment continues expanding as GCC cities compete for international event hosting opportunities. Rising Business Travel & Corporate Leasing Demand reflects economic diversification success and growing intra-GCC trade relationships. Technology sector expansion, financial services growth, and manufacturing investments are generating professional mobility requirements.

Government Mobility Initiatives and Smart Transportation Projects are integrating rental services into comprehensive urban planning frameworks. Public-private partnerships are creating seamless intermodal transportation networks where rental vehicles complement metro systems, buses, and ride-hailing services. Expansion of Digital Rental Ecosystems encompasses not only booking platforms but comprehensive mobility solutions that integrate multiple service providers. Infrastructure investments in roads, airports, and border crossings facilitate seamless travel experiences that benefit rental operators.

Conclusion:

The GCC car rental market stands at a transformative juncture where traditional service models are evolving into sophisticated mobility solutions powered by technology and customer-centric innovation. Regional transformation initiatives are creating unprecedented opportunities for operators who can deliver seamless, flexible, and sustainable transportation options. Strategic investments in fleet modernization, particularly electric and hybrid vehicles, will prove essential for maintaining competitive relevance and meeting evolving regulatory expectations.

Choose IMARC Group for Unmatched Expertise in Mobility and Transportation Intelligence:

- Data-Driven Mobility Intelligence: Deepen your knowledge of tourism-driven demand, corporate leasing trends, and changing consumer preferences (e.g., preference for SUVs, luxury vehicles, or subscription models). Our reports analyze fleet mix, utilization rates, and the impact of mega-events like Expo 2030 and FIFA World Cup on short-term rentals.

- Strategic Digital & Fleet Forecasting: Predict emerging trends in vehicle access, including the rapid adoption of AI-powered dynamic pricing, mobile booking applications, and contactless rental technology. Forecast the transition to Electric Vehicle (EV) fleets and the required charging and maintenance infrastructure across key GCC cities.

- Competitive Operator Benchmarking: Analyze competitive forces among major global (Hertz, Avis, Sixt) and local/regional players (Yelo, Udrive, ekar). Review their digital transformation strategies, customer experience metrics, and fleet acquisition costs to optimize your market positioning and margins.

- Regulatory and Insurance Advisory: Stay one step ahead of evolving regulatory paradigms for the rental and leasing sectors, including licensing requirements, insurance mandates, and new VAT/tax frameworks. Understand the impact of unified GCC tourism visas on cross-border rental services.

- Custom Reports and Consulting: Get tailored insights geared to your organizational objectives—be it launching a new subscription-based mobility product, optimizing your fleet mix for better ROI, expanding into a new GCC market (like KSA's Vision 2030 projects), or implementing AI-driven fleet management systems.

At IMARC Group, we empower mobility industry leaders with the strategic clarity and market intelligence required to navigate complex regional dynamics successfully. Partner with us to strengthen your competitive position in the transforming GCC transportation ecosystem—because informed decisions drive lasting success. For detailed report, click: https://www.imarcgroup.com/gcc-car-rental-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)