Factors Driving Growth in the Contact Lenses Market

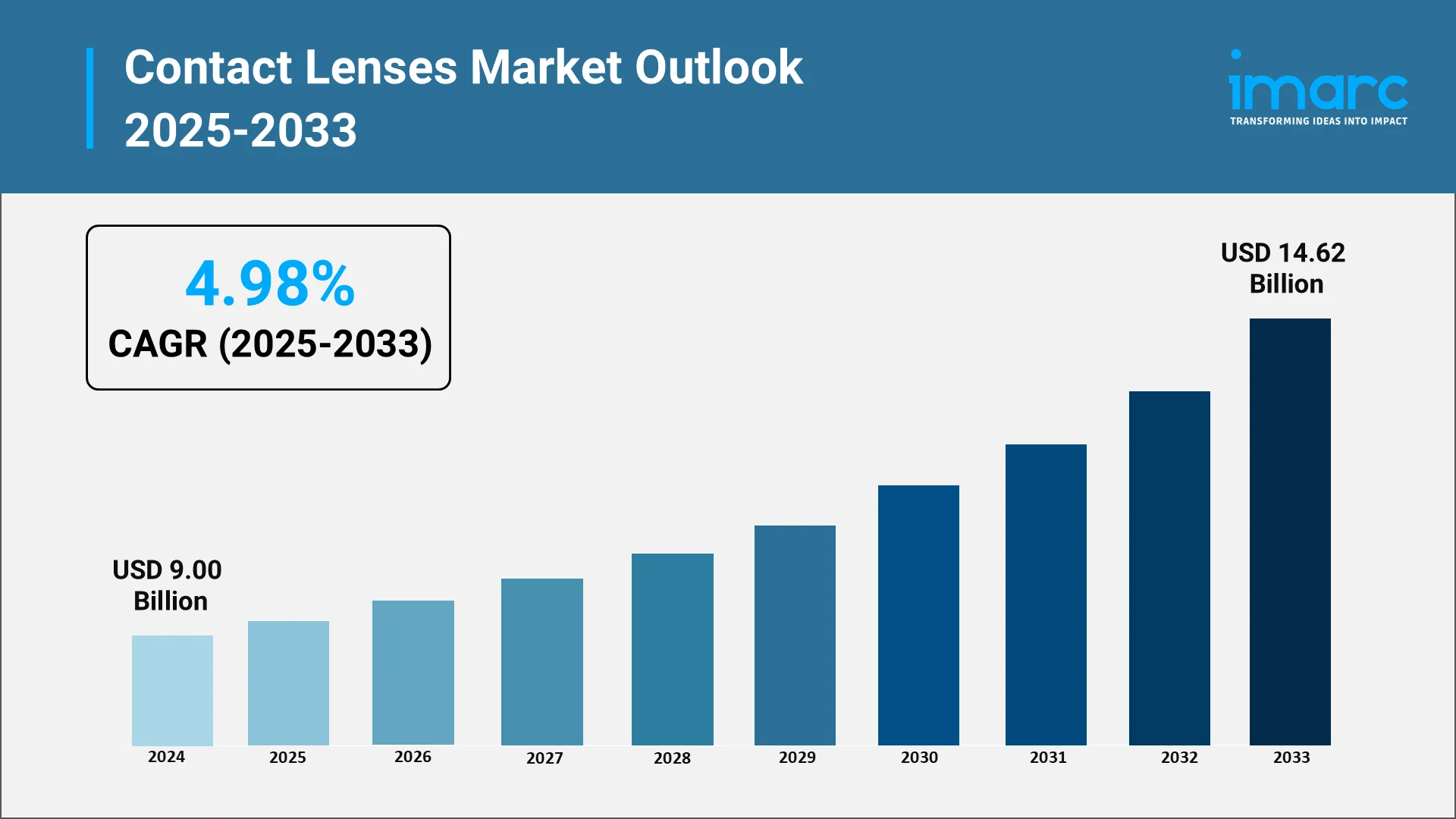

The contact lenses market represents a dynamic segment of the global vision care industry, characterized by continuous innovation and expanding demographic demand. As of 2025, the global contact lenses market size was valued at USD 9.00 Billion in 2024. The market is projected to reach USD 14.62 Billion by 2033, exhibiting a CAGR of 4.98% from 2025-2033.

Contact lenses have evolved from purely corrective medical devices to sophisticated vision solutions integrating advanced materials and cutting-edge technologies. The market serves millions of consumers globally, with the National Eye Institute reporting more than 45M contact lens wearers in the US alone as of December 2024. Leading companies including Alcon, Johnson & Johnson Vision Care, CooperVision, Bausch + Lomb, and Menicon drive market innovation through product launches, strategic acquisitions, and technological breakthroughs.

Market dynamics within the contact lenses market growth trajectory reflect complex interplay between demographic shifts, epidemiological trends, technological advancements, and evolving consumer behaviors. Understanding these growth drivers provides essential insights for industry stakeholders seeking to capitalize on emerging opportunities.

Explore in-depth findings for this market, Request Sample

Increasing Prevalence of Vision Disorders:

The escalating global prevalence of vision disorders represents the most fundamental driver propelling contact lenses market research and demand expansion. According to the World Health Organization, approx. 2.2 billion people globally suffer from near or distant vision impairment, creating massive addressable markets for corrective solutions.

Myopia, or nearsightedness, has emerged as a particularly alarming public health concern. Research published in Ophthalmology journal projects that myopia will affect approximately 49.8% of the global population by 2050, encompassing an estimated 4.758 billion individuals, while high myopia will impact 9.8% of the population, representing 938 million people who face elevated risks of vision-threatening complications.

Recent meta-analyses indicate that global childhood myopia prevalence increased from approximately 24.32% in 1990 to 35.81% in 2023, with projections suggesting continued escalation to 39.80% by 2050. Notably, myopia prevalence exhibits substantial geographic variations, with some urban Chinese and South Korean adolescent populations reporting rates exceeding 67% and 97% respectively.

Beyond myopia, other refractive errors including hyperopia, astigmatism, and presbyopia collectively affect hundreds of millions globally. The National Library of Medicine reports that nearly 80% of individuals experience presbyopia by age 40, while approximately one in three Americans experiences astigmatism according to NVISION Eye Centers data from 2022.

Key Growth Drivers in the Contact Lenses Industry

Multiple interconnected factors converge to accelerate expansion within the contact lenses industry, creating robust growth trajectories.

Technological Innovation and Material Advancements

Revolutionary developments in lens materials have fundamentally transformed product capabilities. Silicone hydrogel lenses have emerged as the dominant material category, commanding 55.59% revenue share in 2024. These advanced materials offer superior oxygen permeability, significantly reducing hypoxia-related complications including corneal swelling and discomfort.

The importance of lens surface technology cannot be overstated—human eyes blink approximately 14,000 times daily, with the eyelid sliding over the contact lens surface every 6 seconds. Moreover, the tear film overlying a contact lens is highly responsible for around 70% of the eye's refractive power, making surface wettability and stability critical for both comfort and visual quality.

Recent innovations exemplify ongoing momentum. In 2024, Bausch + Lomb introduced INFUSE for Astigmatism daily disposable lenses addressing blurred vision and dryness conditions. Apart from this, Alcon expanded its toric daily disposable portfolio with Precision1 and Dailies Total1, incorporating distinctive water gradient material design. Moreover, CooperVision expanded MyDay toric parameters by nearly 70%, providing premium options for astigmatic patients.

Daily Disposable Lens Adoption

The accelerating shift toward daily disposable lenses represents a pivotal market dynamic. Daily disposables accounted for 48.93% of contact lens market size in 2024 with a 5.01% CAGR projected through 2030. Consumer research indicates that 59% of wearers prefer single-use lenses due to superior convenience, enhanced hygiene benefits, and reduced infection risks.

Research on new contact lens wearers reveals significant satisfaction challenges that daily disposables help address. A recent U.K. study found that new wearers struggled with poor comfort (36%), poor vision (41%), and handling difficulties (25%), indicating that product innovation in daily disposable technologies directly addresses key barriers to adoption and retention.

Aging Population and Smart Contact Lens Developments

Global demographic trends strongly favor sustained market expansion. The United Nations Population Department projects that individuals aged 60+ will exceed 1.4 billion by 2030, representing substantial cohorts requiring multifocal or progressive lens solutions. Government-funded vision care programs targeting seniors further stimulate demand within this demographic segment.

Furthermore, emerging smart contact lens technologies incorporating biosensors and microelectronics represent frontier innovations. Dubai-based XPANCEO showcased prototypes at GITEX Global 2024 featuring biosensors measuring glucose, hormone, and vitamin levels in tear fluid. Intraocular pressure sensor-equipped lenses offer early glaucoma detection capabilities, while integrated microdisplay technologies enable augmented reality applications.

Government Support and Initiatives:

Government policies and public health programs significantly influence contact lenses market dynamics. In the United States, Congress authorized $6.5 million for CDC vision and eye health programs in Fiscal Year 2023, supporting comprehensive initiatives addressing vision impairment prevention and treatment.

The Early Detection of Vision Impairments for Children Act of 2024 (H.R. 8400) authorized $5 million annually from 2025 through 2029 for grants supporting state-level vision screening programs and integrated data collection systems, emphasizing early detection in medical and educational settings.

International initiatives further support market expansion. The 2030 In Sight global strategy, endorsed by the World Health Organization, aims to ensure accessible, inclusive, and affordable eye care services worldwide by 2030. China's government-led myopia prevention initiatives integrating school vision screening and compulsory outdoor activities demonstrate measurable impacts on childhood myopia prevalence.

The Vision Council Foundation launched its 2025 "Better Vision for Better Lives" campaign in November 2024, designed to increase vision care product access through public education campaigns, workforce development programs, and strategic partnerships.

Expansion of E-Commerce and Online Retail Channels:

The rapid proliferation of e-commerce platforms represents a transformative force reshaping contact lens purchasing behaviors. According to Vision Council data released in April 2025, online contact lens sales increased from 35% in Q4 2024 to 39% in Q1 2025, reflecting accelerating digital channel adoption.

Online and e-commerce distribution channels demonstrate the fastest growth trajectory, expanding at a 5.76% CAGR as prescription verification systems mature and subscription delivery models simplify replenishment. Digital platforms offer transparent pricing, extensive product selection, home delivery convenience, and direct manufacturer relationships eliminating traditional retail markups.

Major manufacturers have strategically invested in direct-to-consumer capabilities while maintaining traditional optical retail partnerships, creating omnichannel distribution strategies. E-commerce expansion particularly benefits consumers in geographically dispersed or underserved markets, democratizing access to premium lens technologies and competitive pricing.

Growing Awareness of Eye Health and Vision Care:

Escalating public awareness regarding eye health importance represents a critical enabler driving contact lenses market expansion. Educational campaigns and professional advocacy initiatives elevate vision care prioritization within broader health paradigms.

National campaigns such as India's 2024 National Myopia Week, reaching more than 50 million individuals, exemplify coordinated efforts promoting early vision screening and corrective intervention adoption. The International Agency for the Prevention of Blindness Love Your Eyes campaign generated close to 20 parliament screenings, above 6.5 million consumer pledges, and 542M media impressions in 2022 alone.

Growing digital literacy enables consumers to research vision conditions and treatment options, fostering informed decision-making. Fashion and lifestyle trends increasingly integrate vision correction as aesthetic elements, with cosmetic and colored contact lenses appealing to fashion-conscious consumers seeking eye color modification beyond medical necessity.

Opportunities and Challenges in the Contact Lenses Industry:

The contact lenses industry confronts both substantial opportunities and significant challenges shaping competitive dynamics.

Key Opportunities:

- Myopia Control Lenses: Specialized designs engineered to slow myopia progression expand rapidly through 2030, addressing urgent public health priorities

- Emerging Markets Expansion: India's contact lenses market alone projects growth from USD 0.80 Billion in 2024 to USD 1.30 Billion by 2033

- Smart Lens Commercialization: Health monitoring and augmented reality capabilities could unlock entirely new market categories

- Sustainability Initiatives: CooperVision's "plastic neutral" lenses and recyclable packaging address environmental consciousness

Primary Challenges:

- Alternative Vision Correction Competition: LASIK and PRK surgical procedures offer permanent alternatives, with approximately 700,000 LASIK procedures performed in the US annually

- Compliance and Safety Concerns: Improper lens care contributes to serious complications requiring sustained educational investment

- Price Pressure: E-commerce expansion intensifies competition while reducing product differentiation

- Regulatory Complexity: Smart lens technologies face uncertain regulatory pathways across multiple jurisdictions

Future Outlook for the Contact Lenses Industry:

The contact lenses market trajectory through 2030 reflects optimistic growth projections underpinned by favorable demographic trends and technological innovation. North America currently dominates the market, holding a market share of over 38.0% in 2024 driven by accelerating myopia prevalence and rising purchasing power. Technological convergence integrating artificial intelligence, biosensors, and digital health platforms promises continued innovation extending contact lens capabilities beyond traditional vision correction.

Personalization trends will deepen as advanced manufacturing techniques including 3D printing enable cost-effective production of lenses tailored to individual requirements. Sustainability imperatives will increasingly influence product development as environmental consciousness shapes consumer preferences and regulatory requirements.

Partner with IMARC Group for Strategic Contact Lenses Market Intelligence:

As the contact lenses market continues evolving, organizations require sophisticated market intelligence and strategic insights to capitalize on emerging opportunities. IMARC Group delivers unmatched expertise through comprehensive research services tailored to vision care industry stakeholders.

- Data-Driven Market Research: Access comprehensive intelligence on contact lens market dynamics, prevalence trends for myopia and other vision disorders, technological advancements, and consumer behavior patterns across demographic segments and geographic markets.

- Strategic Growth Forecasting: Anticipate market evolution through analytical frameworks projecting emerging trends in technologies, materials science, distribution channels, and regulatory landscapes across global regions.

- Competitive Benchmarking: Understand competitive dynamics through analysis of leading manufacturers, product pipelines, pricing strategies, and market positioning across premium, mid-market, and value segments.

- Policy and Infrastructure Advisory: Navigate complex regulatory environments, reimbursement frameworks, and government initiatives affecting manufacturing, distribution, and market access strategies.

- Custom Reports and Consulting: Receive tailored analytical services aligned with your organizational objectives—whether launching new products, evaluating market entry strategies, or optimizing distribution networks.

At IMARC Group, our mission is to empower vision care industry leaders with the clarity and intelligence required to excel within the rapidly evolving contact lenses market. Partner with us to transform market insights into competitive advantages—because clear vision extends beyond correcting sight to understanding market dynamics and making informed strategic decisions.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)