How the Frozen Food Market is Shaping the Global Food Industry: Trends, Challenges, and Opportunities

Introduction:

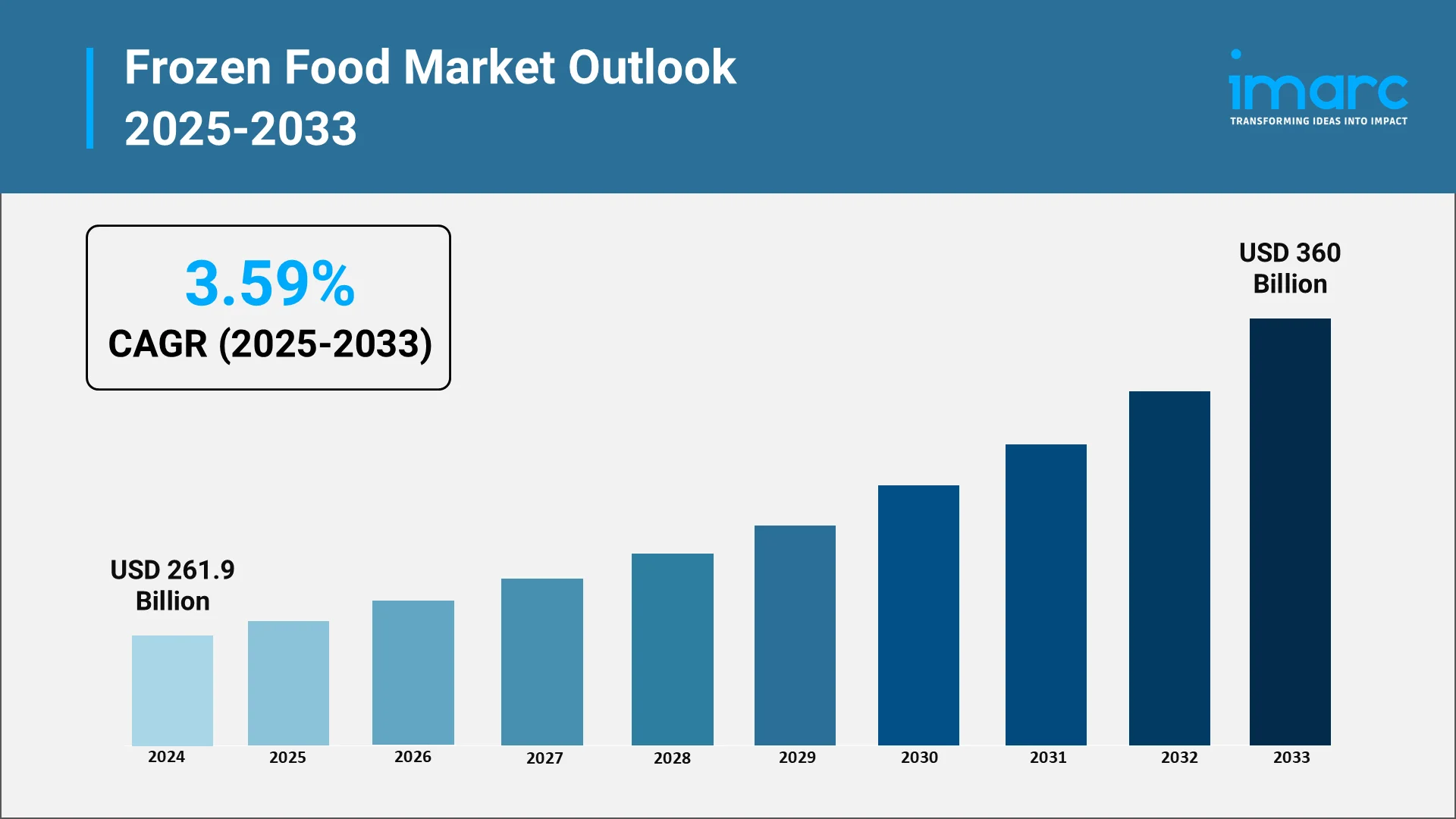

The global frozen food market is a dynamic, transformative force in the food industry, driven by its ability to deliver convenient, nutritious, and diverse meal solutions. Valued at approximately USD 261.9 Billion in 2024, the market is projected to reach USD 360 Billion by 2033, growing at a compound annual growth rate (CAGR) of 3.59% from 2025 to 2033. This robust growth is fueled by fundamental shifts, including urbanization, the rise of dual-income households, and a consumer demand for convenience without compromising nutritional value. Modern freezing technologies ensure high quality and extended shelf life, addressing the critical issue of food waste. The market is highly diversified, encompassing categories like frozen ready meals, fruits and vegetables, meat, seafood, desserts, and bakery items.

Explore in-depth findings for this market, Request Sample

The Role, Impact, and Benefits of Frozen Food in the Global Food Industry:

Frozen foods play a multifaceted role in addressing contemporary food system challenges while delivering tangible benefits across nutrition preservation, food security, supply chain efficiency, and environmental sustainability.

- Nutritional Preservation: Advanced freezing technologies, particularly Individual Quick Freezing (IQF) and flash freezing methods, lock in essential nutrients at peak freshness. Research demonstrates that properly frozen vegetables retain comparable or superior nutritional profiles to fresh produce that has spent days in transit and storage.

- Food Waste Reduction: According to data published in August 2023, nearly 40% of all food in the United States is wasted. Frozen foods directly combat this problem by extending shelf life from days to months, allowing consumers to purchase in bulk without fear of spoilage while providing retailers with inventory flexibility.

- Supply Chain Resilience: Cold-storage operators including Lineage Logistics, Americold, and NewCold collectively placed 150 million cubic feet of new coastal storage online between Q1-23 and Q1-24. This capacity expansion shortens vessel-to-shelf lead times while protecting against seasonal fluctuations and climate-related crop variations.

- Economic Accessibility and Innovation: Frozen foods democratize access to diverse ingredients regardless of season or geographic location. The category also serves as a testing ground for culinary innovation, enabling manufacturers to introduce international cuisines and specialized dietary products with lower risk compared to fresh alternatives.

Key Growth Drivers in the Frozen Food Market:

- Urbanization and Lifestyle Changes: Global urbanization continues at an unprecedented pace, with dual-income households exhibiting distinct consumption patterns favoring frozen foods. The rise in dual-income households and busier lifestyles has fueled demand for frozen, ready-to-eat, and ready-to-cook meals. Time-constrained urban consumers prioritize convenience without sacrificing meal quality.

- Health and Wellness Trends: Consumers are increasingly looking for clean-label, organic, and plant-based frozen foods, prompting manufacturers to innovate and offer healthier alternatives. This trend encompasses reduced sodium content, elimination of artificial preservatives, incorporation of whole grains, and development of allergen-free options addressing specific dietary requirements.

- Plant-Based Food Movement: The flexitarian trend has created explosive demand for plant-based frozen options. This segment attracts not only committed vegetarians but also the broader flexitarian population seeking occasional meat alternatives.

- E-Commerce Expansion: Digital platforms enable direct-to-consumer models, subscription services, and detailed product information supporting informed purchasing decisions. Temperature-controlled delivery networks have matured to ensure product integrity throughout the last-mile journey.

- Technological Advancement: Continuous innovation in cryogenic freezing, modified atmosphere packaging, and intelligent cold chain monitoring enhances product quality while reducing operational costs. Modern packaging incorporates sustainability considerations through recyclable materials and portion-controlled formats that further reduce waste.

- Demographic Shifts: Millennials and Generation Z consumers show strong preference for frozen food products that combine convenience with variety. These demographics exhibit less stigma toward frozen foods and their digital fluency, openness to culinary experimentation, and environmental awareness align with contemporary frozen food offerings.

Regulatory Framework and Policy Landscape in the Frozen Food Industry:

The frozen food sector operates within a complex regulatory environment designed to ensure food safety, accurate labeling, and consumer protection.

- Food Safety Modernization Act (FSMA): The FSMA represents comprehensive reform of US food safety laws, establishing preventive controls for hazard analysis. FDA intends to publish guidance on preventive control for chemical hazards. Manufacturers must implement robust food safety plans identifying potential hazards and maintaining detailed documentation.

- Food Traceability Requirements: The FDA's Food Traceability final rule requires companies to come into compliance by January 20, 2026. This regulation mandates maintenance of specific key data elements throughout the supply chain, creating implementation challenges including system integration costs and operational complexity.

- Allergen Labeling: When the Food Allergy Safety, Treatment, Education, and Research Act took effect on January 1, 2023, it added sesame as the ninth major food allergen. Manufacturers must declare all major allergens while implementing controls to prevent cross-contamination during production.

- Packaging Regulations: State-level regulations create complex compliance landscapes. Colorado, Maryland, Rhode Island, and Minnesota have PFAS bans that took effect in 2024, while France will outlaw non-recyclable plastic in frozen packaging from January 2025. These divergent requirements necessitate region-specific packaging strategies.

- FDA Reorganization: In October 2024, FDA created the Human Foods Program to provide more holistic regulatory oversight. This structural change consolidates food policy and field operations, requiring industry adaptation to evolving guidance documents.

- Date Labeling Standards: USDA and FDA announced a joint Request for Information about food date labeling in December 2024, seeking to reduce consumer confusion and minimize premature food disposal through standardized practices.

Government Support and Initiatives for the Frozen Food Market:

Government agencies and industry associations actively support frozen food sector development through advocacy, research funding, and policy initiatives.

- AFFI Advocacy: The Government Action Summit, organized by the American Frozen Food Institute from April 1–3, 2025, brought together leaders of the industry to promote industry-supporting policy. Industry officials emphasized frozen food's significance in addressing food security and nutrition access while interacting directly with congressional offices to encourage its inclusion in government nutrition programs.

- Listeria Monitoring Programs: In order to test new sampling and testing methods for Listeria monocytogenes in low-risk, ready-to-eat foods, AFFI members requested that Congress mandate FDA support for a pilot project that was designed by stakeholders. The goal of this project is to develop science-based food safety regulations that safeguard the public's health without adding needless administrative strain.

- Food Waste Reduction Strategy: The United States Department of Agriculture (USDA), and United States Environmental Protection Agency (US EPA) released the National Strategy for Reducing Food Loss and Waste in June 2024, targeting a 50% reduction by 2030. Frozen foods contribute substantially through extended shelf life and portion control capabilities, with government recognition legitimizing industry sustainability claims.

- Infrastructure and Research Support: Government agencies support frozen food growth through infrastructure development initiatives, tax incentives, and agricultural research funding for optimal freezing methods and nutritional retention studies. Trade agencies facilitate exports through market development programs and sanitary certification support.

Top Frozen Food Companies Worldwide:

The global frozen food market features intense competition among multinational corporations, regional specialists, and innovative startups targeting niche segments.

- Nestlé S.A.: As a global leader, Nestlé showed swift responsiveness to the weight management trend driven by GLP-1 drugs by launching its new frozen food brand, Vital Pursuit, in May 2024.

- Conagra Brands, Inc.: A dominant force in frozen meals (including Healthy Choice and Birds Eye), Conagra specifically addressed the GLP-1 trend by introducing "GLP-1 friendly" labels on its Healthy Choice frozen meals in January 2025.company introduced GLP-1 friendly labels on Healthy Choice frozen meals.

- McCain Foods Limited: The world's largest producer of frozen potato products is prioritizing environmental sustainability. As of 2024, 71% of its potato acreage was covered by a regenerative agriculture program, directly supporting emissions reduction and meeting consumer eco-preferences.

- General Mills, Inc.: General Mills operates significant frozen food divisions producing frozen dough, breakfast items, and entrees. The company focuses on innovation through plant-based and protein-rich frozen products addressing evolving dietary preferences.

- Tyson Foods, Inc.: As a leading protein producer, Tyson leverages vertical integration for supply chain control across frozen meat and poultry. The company has expanded into plant-based offerings under its Raised & Rooted brand.

- Kraft Heinz Company: Kraft Heinz offers frozen foods including Delimex Crispy Quesadillas and Ore-Ida products targeting convenience-seeking consumers. The company continues expanding its portfolio with healthier and organic options.

Opportunities and Challenges in the Frozen Food Market:

The frozen food market presents substantial opportunities for growth while confronting significant challenges requiring strategic responses.

Opportunities

- Plant-Based Protein Expansion: The plant-based segment continues exhibiting strong growth with significant market penetration potential. Consumers increasingly seek sustainable protein alternatives, creating opportunities for products delivering satisfactory taste and nutrition comparable to animal-based options.

- Premiumization: Premium ready meals with international cuisines and chef-created recipes have gained popularity among higher-income consumers. Opportunities exist through restaurant partnerships and authentic ethnic recipes that deliver experiential value beyond basic convenience, supporting higher margins.

- Functional Foods: Opportunities exist to fortify frozen products with elevated protein content, omega-3 fatty acids, probiotics, and micronutrients addressing dietary deficiencies. Products targeting specific health objectives can command premium positioning.

- Sustainability Leadership: Increasing frozen storage temperature from zero to five degrees Fahrenheit could reduce energy consumption by 25 terawatt hours annually and avoid 17 Mt CO2 equivalents globally. Leadership in sustainable practices creates competitive advantages while reducing operational costs.

Challenges

- Infrastructure Constraints: Average US supermarkets operate only 109 linear feet of freezer cases in 2024, constraining shelf placement and increasing slotting fees. Infrastructure investment requirements for refrigerant compliance create financial barriers for independent retailers.

- Packaging Complexity: Divergent state-level packaging regulations create compliance burdens. Companies must develop multiple specifications for different jurisdictions while maintaining cost competitiveness. Biodegradable alternatives often exhibit inferior performance characteristics.

- Raw Material Volatility: Manufacturers face agricultural commodity price fluctuations and supply disruptions. The North Sea saithe fishery is anticipated to lose its Marine Stewardship Council certification on June 30, 2025, restricting sustainable ingredient availability.

- Consumer Perception: Despite quality improvements, frozen foods battle negative perceptions regarding nutritional value compared to fresh alternatives. Educational initiatives require sustained investment without guaranteed returns.

Conclusion:

The frozen food market is at a pivotal juncture, poised for unprecedented growth driven by robust fundamentals: irreversible demographic trends (urbanization, household structure changes) and a demand for convenience without compromising nutrition. This expansion is supported by continuous technological advancements in preservation, intelligent packaging, and cold chain management. The industry is highly responsive, integrating plant-based alternatives, premium offerings, and functional foods to align with consumer values like health and sustainability. Success hinges on authentic sustainability commitments, digital engagement, and diverse product portfolios. Ultimately, embracing the complex regulatory environment strengthens consumer confidence and provides a competitive advantage.

Choose IMARC Group for Unmatched Expertise and Core Services:

Transform your strategic positioning in the rapidly evolving frozen food landscape with IMARC Group's specialized market intelligence services. Our comprehensive analytical capabilities deliver actionable insights empowering food manufacturers, retailers, investors, and supply chain partners to make informed decisions in this dynamic industry.

- Data-Driven Market Research: Deepen your knowledge of frozen food consumption patterns, product category performance, and technological advancements such as IQF systems, blast freezing technologies, and smart cold chain solutions through in-depth market research reports.

- Strategic Growth Forecasting: Predict emerging trends in the frozen food sector, from plant-based innovations and premium meal offerings to sustainability initiatives and e-commerce expansion strategies across global regions.

- Competitive Benchmarking: Analyze competitive forces in the frozen food market, review product portfolios of major players like Nestlé, Conagra, and McCain Foods, and monitor breakthrough developments in freezing technologies and sustainable packaging solutions.

- Policy and Infrastructure Advisory: Stay one step ahead of regulatory changes, food safety requirements, traceability mandates, and sustainability standards affecting frozen food production, distribution, and market accessibility.

- Custom Reports and Consulting: Get tailored insights geared to your organizational objectives—be it launching new frozen product lines, entering emerging markets, investing in cold chain infrastructure, or developing sustainable packaging solutions for the frozen food industry.

At IMARC Group, our goal is to empower food industry leaders with the clarity and intelligence required to thrive in the competitive frozen food market. For more details, click: https://www.imarcgroup.com/frozen-food-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)