Saudi Arabia E-commerce Market Trends: Navigating Digital Adoption, Consumer Spending Patterns, and Growth Opportunities

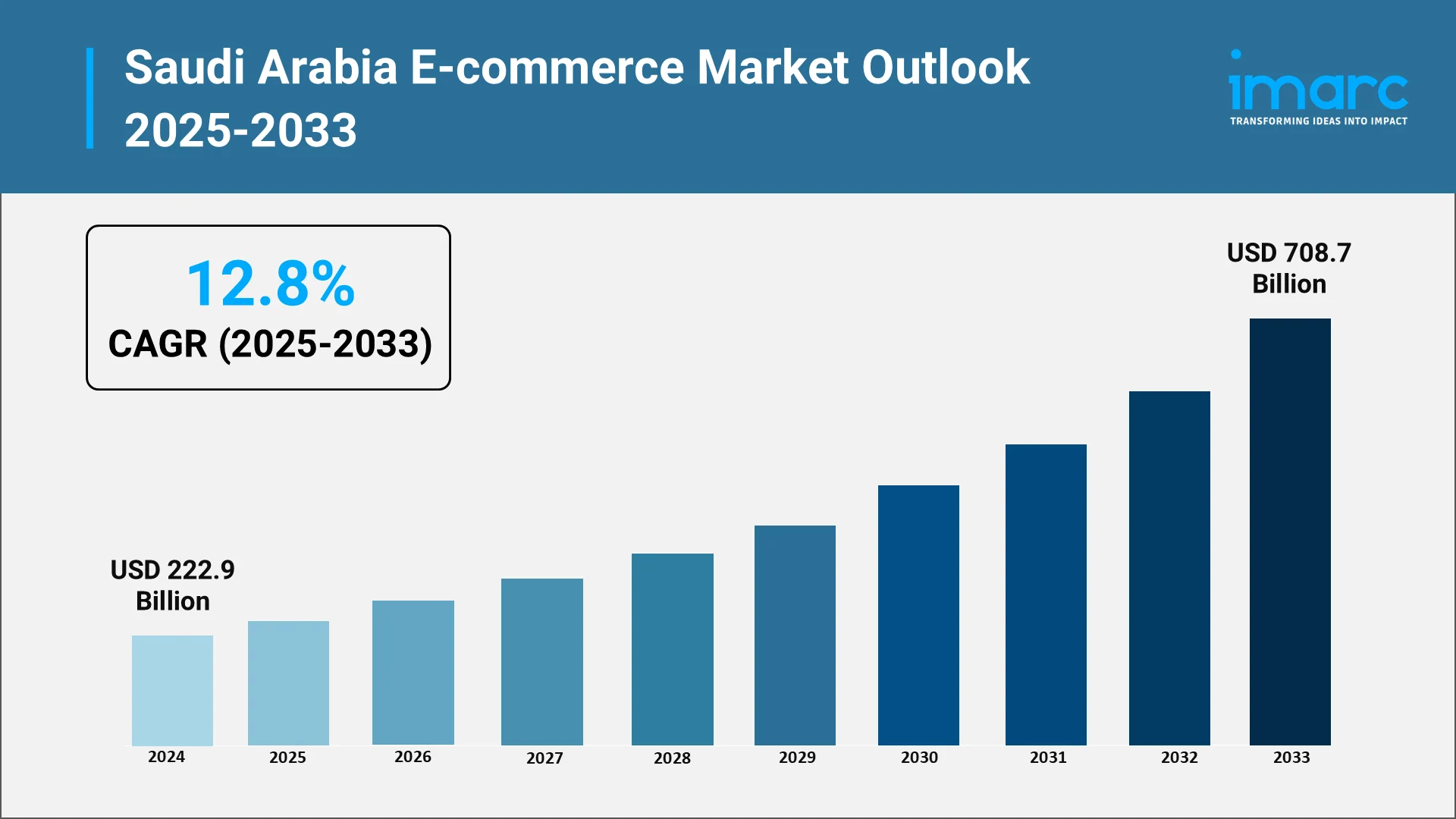

The Saudi Arabia e-commerce market is undergoing a major transformation, becoming one of the fastest-growing digital economies in the Middle East. It reached a value of USD 222.9 Billion in 2024 on account of the rapidly expanding digital landscape, government initiatives like Vision 2030, and the increasing adoption of mobile commerce (m-commerce) and digital payment solutions.

E-commerce has significantly impacted multiple sectors in Saudi Arabia, including retail, logistics, and digital payments. Online retailers, marketplaces, and delivery platforms are reshaping consumer shopping experiences, contributing to the market's continuous expansion. The demand for convenience, variety, and competitive pricing has encouraged more consumers to shop online, shifting traditional retail patterns and spurring innovations in digital platforms and services.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming Saudi Arabia E-commerce Industry:

The e-commerce industry is significantly shaped by Saudi Arabia's ambitious economic diversification plan, Vision 2030. E-commerce adoption is being accelerated by significant investments in digital infrastructure, technological developments, and a cashless culture, all of which are part of the government's push for a digital-first economy. An atmosphere that is conducive to the growth of e-commerce companies is being created by the increased emphasis on innovation as well as governmental improvements that support online retail and e-payment systems. In line with the kingdom's long-term goals of economic modernization and diversification, this shift is also assisting local companies in gaining access to larger markets and foreign customers.

Key Industry Trends:

Rise of Online Shopping Driven by High Internet & Smartphone Penetration

According to the Saudi Internet Report 2024 by Communications, Space and Technology Commission (CST), the internet penetration in the country reached 99% and smartphones emerged as the commonly used devices for browsing the internet, holding a share of 99.4% as compared to other devices. This widespread connectivity has led to a surge in online shopping, particularly among the tech-savvy youth demographic. The country's high smartphone penetration further fuels the growth of mobile commerce (m-commerce), allowing consumers to shop on-the-go and making e-commerce platforms more accessible than ever before. The major Saudi Arabia e-commerce market trend is expected to continue, as more consumers embrace online retail for its convenience and range of offerings.

Expansion of Digital Payment Solutions & Buy Now Pay Later (BNPL) Services

Digital payment solutions are rapidly transforming the Saudi Arabia e-commerce landscape. For instance, the Saudi Central Bank (SAMA) partnered with Google Pay and Ant International in September 2025, to promote non-cash transactions by 2030 and attract 150 Million visitors, therefore making jobs and promoting economic development.

With the growing adoption of mobile wallets, secure online payment systems, and card payment methods, consumers are becoming increasingly comfortable with digital transactions. This shift is also facilitated by the government's push for a cashless society, supported by initiatives like the Saudi Payments Network (SPAN). Furthermore, Buy Now Pay Later (BNPL) services are gaining traction, offering consumers more flexible payment options, which in turn, boost consumer confidence and drive higher sales volumes for e-commerce businesses. BNPL services are especially popular among younger shoppers, who value financial flexibility and ease of payment.

Growth of Quick Commerce (Q-Commerce) for Groceries, Food, and Essentials

Quick commerce, or Q-commerce, is becoming one of the most significant trends in the Saudi e-commerce space. This model, which focuses on the rapid delivery of everyday items like groceries, food, and personal care products, is gaining momentum due to the demand for instant gratification and convenience. With platforms offering delivery within minutes or hours, Q-commerce meets the increasing desire for fast, efficient services, catering to consumers' busy lifestyles. As more delivery services expand across the kingdom's urban and suburban areas, Q-commerce is expected to become a major driver influencing the Saudi e-commerce share.

Increasing Popularity of Omnichannel Retail Strategies Among Brands

Brands in Saudi Arabia are increasingly adopting omnichannel strategies, which integrate online and offline shopping experiences. This approach allows consumers to interact with brands through multiple touchpoints, including websites, mobile apps, physical stores, and social media platforms, thereby strengthening the Saud Arabia e-commerce market growth. By offering a seamless and personalized shopping journey across various channels, businesses can cater to a broader audience, improving customer satisfaction and loyalty. Omnichannel strategies also enable brands to leverage the growing popularity of social commerce, where social media platforms play a crucial role in product discovery and purchase decisions.

Surge in Cross-Border E-commerce Demand for International Brands

Saudi consumers are increasingly turning to international e-commerce platforms to purchase products that may not be readily available in local markets. Cross-border e-commerce is on the rise, driven by the availability of global marketplaces like Amazon, eBay, and AliExpress. This trend reflects a shift in consumer preferences towards accessing a wider variety of products, often at competitive prices, with the added convenience of home delivery. E-commerce platforms are responding to this demand by enhancing their logistics and fulfillment capabilities to ensure efficient cross-border shipping and delivery.

Growing Adoption of AI, Personalization, and Data-Driven Customer Targeting:

Artificial intelligence (AI) and data analytics are playing an increasingly important role in the Saudi e-commerce market. Retailers are using AI to personalize the shopping experience by recommending products based on user behavior, purchase history, and browsing patterns. This level of personalization enhances customer engagement and increases conversion rates. Moreover, data-driven marketing strategies are allowing businesses to target consumers with more relevant, timely, and tailored offers. By leveraging AI, retailers can also optimize inventory management, improve supply chain efficiency, and predict future buying trends, leading to a more streamlined e-commerce ecosystem.

Market Segmentation & Regional Insights:

Type Insights:

- B2C E-commerce: Business-to-consumer (B2C) e-commerce is the dominant segment in Saudi Arabia, driven by the growing popularity of online shopping platforms for personal products. Categories like fashion, electronics, groceries, and beauty are leading the demand, as consumers increasingly prefer the convenience, variety, and competitive pricing offered by online retailers.

- B2B E-commerce: Business-to-business (B2B) e-commerce is also expanding in Saudi Arabia, particularly in industries like manufacturing, wholesale distribution, and enterprise solutions. This segment is characterized by bulk transactions and long-term business relationships, with businesses leveraging digital platforms to streamline procurement processes and reduce operational costs.

Regional Insights:

- Northern and Central Region: The Northern and Central regions, including Riyadh, the capital city, are key hubs for e-commerce activity in Saudi Arabia. With a high concentration of businesses, young consumers, and strong internet penetration, these areas drive significant demand for both B2C and B2B e-commerce. Riyadh, as the economic center, is particularly influential in shaping digital retail trends.

- Western Region: The Western region, home to Jeddah and Mecca, is a major commercial and religious center. The presence of a large expatriate population and frequent international trade makes this region highly active in both e-commerce and cross-border retail. Online shopping for products like fashion, electronics, and groceries is growing rapidly in this region, supported by strong logistical and shipping infrastructure.

- Eastern Region: The Eastern region, home to important industrial cities like Dammam and Khobar, is vital for the e-commerce sector, particularly for B2B transactions related to oil and petrochemicals. With a prosperous economy driven by the oil and gas industry, the demand for industrial supplies and equipment through e-commerce platforms is growing, alongside an increasing appetite for consumer goods.

- Southern Region: The Southern region, including cities like Abha and Najran, has seen an uptick in e-commerce adoption due to improvements in internet access and logistics networks. While historically less developed in terms of online shopping, the region is catching up, with increased participation in sectors like fashion, electronics, and groceries as platforms extend their reach to smaller towns and rural areas.

Forecast (2025–2033):

As per IMARC Group, the Saudi Arabia e-commerce market size will reach USD 708.7 Billion by 2033, at a CAGR of 12.8% during 2025-2033, driven by several key factors:

- Rising Digital Literacy: As internet access and smartphone usage increase, digital literacy is improving, particularly among younger generations. This demographic is more likely to embrace online shopping and new technologies.

- Growing Preference for Online Convenience: Consumers in Saudi Arabia are increasingly seeking convenience, particularly in terms of product variety, competitive pricing, and home delivery options. This shift is driving demand for e-commerce in sectors such as groceries, fashion, and electronics.

- Expanding Online Grocery and Fashion Sales: The growing popularity of online grocery shopping and fashion retail is expected to remain a key growth driver. Consumers are becoming more accustomed to purchasing perishable items online, especially with the advent of Q-commerce.

- Investments in Logistics, Warehousing, and Digital Payment Ecosystems: The expansion of logistics networks and digital payment systems is enhancing the e-commerce infrastructure, improving the overall shopping experience and enabling businesses to scale rapidly.

Conclusion:

The Saudi Arabia e-commerce market is undergoing a period of rapid growth and transformation, driven by advancements in technology, a supportive regulatory environment, and changing consumer behavior. Vision 2030 is playing a pivotal role in creating an ecosystem that fosters innovation and digital adoption, which is benefiting both businesses and consumers alike. As the market continues to evolve, key trends such as mobile commerce, digital payments, Q-commerce, and AI-powered personalization will shape the future of e-commerce in the kingdom. Businesses that adapt to these trends and embrace technological advancements will find ample opportunities to grow and thrive in this dynamic market.

In conclusion, Saudi Arabia presents a wealth of opportunities for e-commerce players, with an expanding market that is ripe for innovation, improved consumer experiences, and increased market penetration. The combination of favorable economic policies, high digital adoption, and a young, tech-savvy population will continue to drive the country's e-commerce growth over the coming years.

Choose IMARC Group for Unmatched Saudi Arabia E-commerce Market Intelligence:

- Data-Driven Insights: Access detailed reports on Saudi Arabia’s e-commerce trends, consumer behaviors, digital payments, and emerging market dynamics tailored to the local landscape.

- Strategic Growth Forecasting: Identify growth opportunities in sectors like online retail, quick commerce (Q-commerce), and logistics, with insights into regional trends and demographic drivers shaping future demand.

- Competitive Intelligence: Analyze strategies of leading e-commerce platforms, retailers, and emerging players, gaining valuable insights into market positioning and competitive advantages in Saudi Arabia.

- Policy Advisory: Stay informed on regulatory developments and government initiatives impacting e-commerce, ensuring alignment with local standards and compliance.

- Custom Consulting: Receive bespoke analysis to meet your specific business needs, whether for market entry, expansion, or optimizing operations in Saudi Arabia’s evolving e-commerce market. At IMARC Group, we equip businesses with the insights needed to succeed in this dynamic market.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)