Top Factors Driving Growth in the Saudi Arabia Tire Market

Introduction to the Saudi Arabia Tire Industry:

The Saudi Arabia tire market is undergoing a significant transformation driven by the nation’s economic diversification, rapid urbanization, and growing vehicle ownership. As one of the largest automotive hubs in the Middle East, Saudi Arabia is witnessing increasing demand for both passenger and commercial vehicle tires across urban and industrial regions. The market encompasses original equipment manufacturers (OEMs) as well as the replacement tire segment, each contributing uniquely to the country’s tire ecosystem.

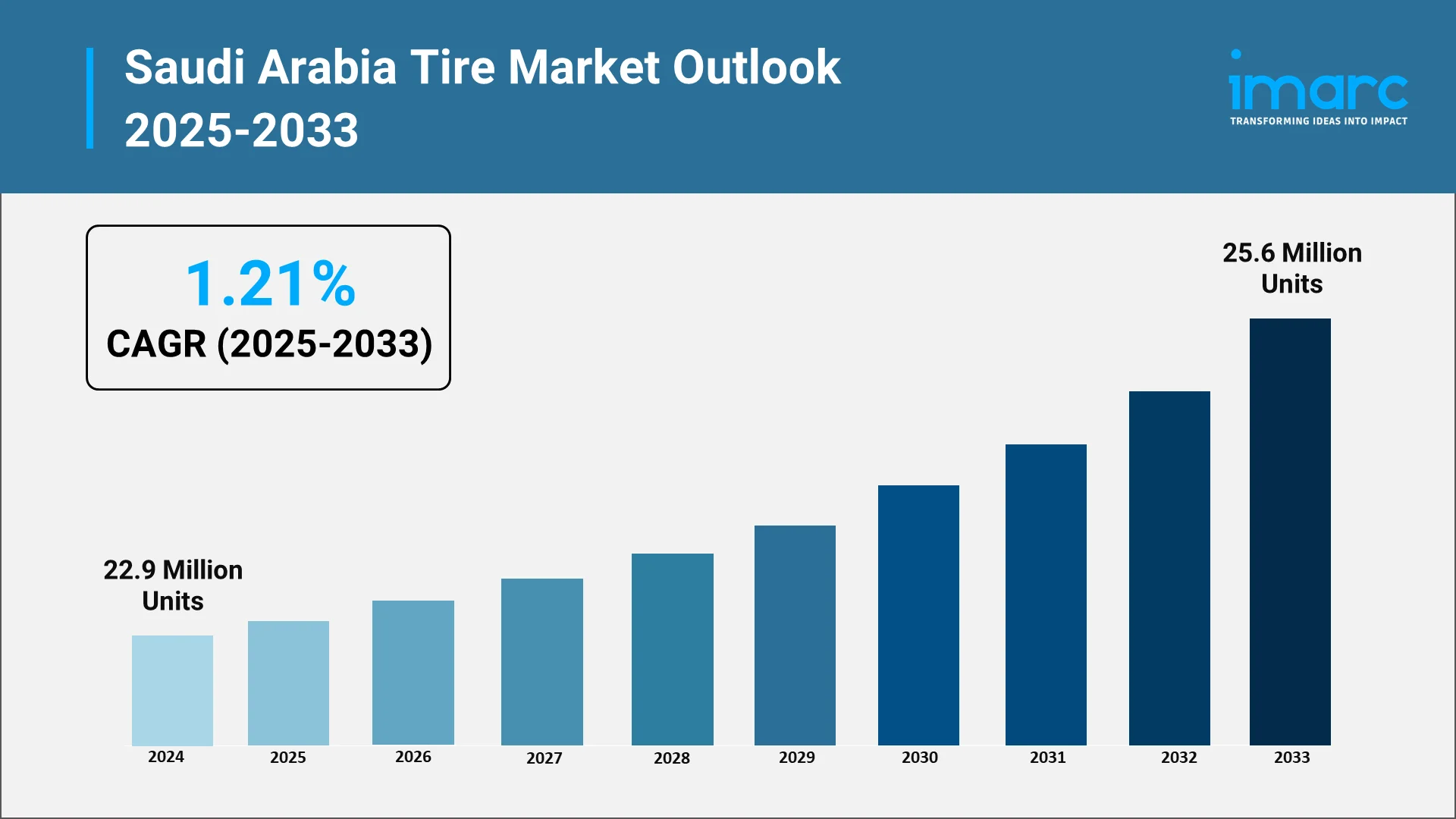

In 2024, the Saudi Arabia tire market reached 22.9 Million Units, driven by the strong push from Vision 2030 initiatives, infrastructure expansion, and the rise of logistics and e-commerce. Furthermore, the growing adoption of electric and hybrid vehicles is prompting tire producers to focus on innovation, sustainability, and efficiency. The KSA tire market is thus evolving into a strategically vital component of the broader automotive and industrial sectors, supported by regulatory reforms, technology adoption, and shifts in consumer behavior. Additionally, increasing investments in road connectivity and public transportation projects are further accelerating tire demand across both passenger and commercial vehicle categories. The expansion of automotive service centers and tire retail networks is enhancing product accessibility and aftersales support across major cities.

Explore in-depth findings for this market, Request Sample

Growing Demand for Replacement Tires Across Passenger and Commercial Vehicles:

A major contributor to Saudi Arabia tire market growth is the increasing demand for replacement tires, particularly in the passenger and commercial vehicle segments. As the average vehicle age in the Kingdom continues to rise, the need for periodic tire replacements has become more prominent. Harsh climatic conditions such as high temperatures and rough desert terrains accelerate tire wear and tear, creating recurring replacement cycles that fuel steady market revenue.

The surge in urbanization and intercity transport further amplifies tire replacement demand. Consumers increasingly prefer branded, high-performance tires that provide durability, comfort, and safety. Meanwhile, commercial fleet operators particularly in logistics, construction, and oil & gas are prioritizing tires that ensure operational efficiency, longevity, and lower maintenance costs.

Rising Popularity of Electric and Hybrid Vehicles Boosting Tire Innovation:

The growing penetration of electric and hybrid vehicles (EVs and HEVs) across Saudi Arabia is reshaping the tire manufacturing landscape. These vehicles demand advanced tire designs optimized for instant torque, higher load capacity, and reduced rolling resistance. As government policies encourage sustainable mobility and energy transition, tire manufacturers are aligning their portfolios with evolving vehicle technologies.

Leading tire producers are developing EV-specific tire lines engineered for quieter rides, superior grip, and enhanced energy efficiency. These innovations often incorporate lightweight materials, aerodynamic sidewalls, and self-sealing technologies to minimize air loss and maximize battery performance. The ongoing establishment of EV charging infrastructure and incentives for green mobility are expected to accelerate EV adoption, further stimulating tire R&D investments. As such, the Saudi Arabia tire market trends increasingly reflect the intersection of electrification, innovation, and sustainability a direction that will define the next decade of tire design and performance optimization.

Expansion of Logistics and Construction Sectors Driving Heavy-Duty Tire Sales:

The expansion of Saudi Arabia’s logistics and construction industries has emerged as a powerful growth catalyst for heavy-duty tire sales. With major infrastructure projects such as NEOM, the Red Sea Project, and multiple industrial zones under development, the demand for commercial vehicles, heavy trucks, and off-road equipment has surged.

The growing network of highways and intermodal transport routes further increases vehicle utilization, leading to faster tire replacement cycles. Consequently, manufacturers are focusing on product innovations such as reinforced sidewalls, self-healing treads, and heat-resistant compounds to extend tire lifespan. This industrial upsurge positions the Saudi Arabia tire market size to expand steadily as businesses invest in high-performance, durable tire solutions tailored for demanding applications.

Additionally, the expansion of warehousing and freight distribution hubs across major cities such as Riyadh, Jeddah, and Dammam is fueling sustained demand for truck and trailer tires. Growing cross-border trade within the GCC is also encouraging fleet upgrades, creating opportunities for premium tire segments.

Increasing Focus on Sustainable and Fuel-Efficient Tire Technologies:

Sustainability has become a defining theme in the Saudi Arabia tire market outlook, reflecting both global environmental goals and domestic regulatory priorities. Tire manufacturers are increasingly integrating eco-friendly materials and technologies to reduce carbon emissions and improve overall fuel efficiency. Low rolling resistance tires, for instance, are gaining popularity among both passenger and commercial vehicle users due to their ability to optimize fuel consumption and lower greenhouse gas emissions.

Additionally, the industry is adopting advanced production processes, including the use of renewable raw materials such as natural rubber and bio-based polymers. Tire recycling and retreading programs are also gaining traction as the government promotes circular economy initiatives. These efforts not only reduce waste but also lower operational costs for fleet owners. The shift toward sustainable tire manufacturing demonstrates how environmental responsibility and economic efficiency can coexist, strengthening the market’s competitiveness and alignment with Saudi Arabia’s long-term sustainability vision.

Government Regulations Promoting Safety Standards and Quality Compliance in Tires:

The Saudi government plays a critical role in shaping the direction of the tire industry by implementing stringent safety and performance standards. Regulatory bodies such as the Saudi Standards, Metrology and Quality Organization (SASO) and the Gulf Standardization Organization (GSO) enforce rules to ensure product reliability, energy efficiency, and consumer protection.

These standards cover aspects like rolling resistance, wet grip, tire labeling, and import certification, thereby elevating the quality benchmarks across the market. Moreover, authorities are emphasizing traceability through digital systems to combat counterfeit and substandard tire imports. By maintaining a strong compliance framework, the government ensures that only certified products enter the market creating a fair and transparent business environment for manufacturers, distributors, and consumers alike.

Opportunities and Challenges in the Saudi Arabia Tire Industry:

Opportunities:

- Expansion of Local Manufacturing Capabilities: Saudi Arabia’s industrial diversification plan is fostering opportunities for tire manufacturers to establish local production facilities. In August 2025, Saudi Arabia launched a tire production project in partnership with a Chinese firm and petrochemical giant Sabic. The Sandstone facility in Yanbu aims to produce 5 million tires annually by 2028. Construction will start in 2025, enhancing local manufacturing and reducing reliance on tire imports. The availability of industrial zones, low-cost energy, and government incentives for foreign investment make domestic manufacturing increasingly viable. Establishing localized production not only reduces dependence on imports but also enhances supply chain efficiency and product customization for regional needs.

- Rising Aftermarket and E-Commerce Expansion: The aftermarket segment presents robust growth potential as digitalization reshapes tire sales and distribution. The growing popularity of e-commerce platforms and online tire retailers allows consumers and fleet operators to compare prices, brands, and specifications more conveniently. This digital shift is also helping small and medium-sized distributors expand their reach beyond physical outlets. Furthermore, partnerships between tire brands and online marketplaces are improving last-mile delivery and installation services.

- Technological Advancements in Smart Tire Systems: Smart tire technologies equipped with embedded sensors are emerging as a major opportunity area. In April 2025, Hankook Tire launched its latest ultra-high performance tire, the 'Ventus evo,' in Saudi Arabia. This fourth-generation model offers improved braking, cornering, and fuel efficiency, utilizing AI-driven technology. Following successful rollouts in Europe and North America, Hankook aims to strengthen its market position in the Middle East with this innovative tire. These systems monitor tire pressure, temperature, and tread conditions in real time, helping fleet operators reduce maintenance costs and prevent accidents.

Challenges:

- Price Sensitivity and Intense Market Competition: Despite growing demand, the Saudi tire industry remains highly competitive, with numerous global and regional brands vying for market share. Price-sensitive consumers often prioritize affordability over premium features, pressuring manufacturers to balance cost efficiency with product quality. The presence of counterfeit and low-cost imported tires further complicates market dynamics, affecting brand credibility and profitability.

- Dependence on Imported Raw Materials: Saudi tire manufacturers face challenges due to reliance on imported raw materials such as synthetic rubber, carbon black, and steel cords. Supply chain disruptions, currency fluctuations, and rising global material costs can impact production timelines and profit margins. Encouraging domestic production of key inputs under industrial development programs could significantly reduce dependency, enhance production resilience, and promote long-term sustainability within the Saudi Arabia tire market share structure.

- Counterfeit Products and Quality Control Issues: The prevalence of counterfeit or low-quality tires remains a persistent challenge, undermining consumer trust and safety. Unregulated imports and inadequate enforcement in certain distribution channels allow substandard products to enter the market. These tires pose significant risks, including reduced performance, faster wear, and increased accident probability. Authorities are intensifying inspection mechanisms and digital traceability systems to curb this issue.

Future Outlook for the Saudi Arabia Tire Industry:

The Saudi Arabia tire market is projected to reach 25.6 Million Units by 2033, exhibiting a CAGR of 1.21% during 2025-2033, driven by continued infrastructure investment, industrial growth, and technological innovation. As the automotive sector evolves toward electrification, automation, and sustainability, tire manufacturers will increasingly focus on producing advanced, eco-friendly, and smart tire solutions tailored to regional requirements. The ongoing digital transformation in retail and aftersales services will further redefine how consumers and businesses engage with tire brands.

In the long term, local manufacturing, regulatory support, and cross-sector partnerships will shape the next growth phase of the Saudi Arabia tire market. Companies that align their strategies with national industrial goals emphasizing innovation, compliance, and customer-centricity will gain a competitive edge in this dynamic and fast-evolving industry.

How IMARC Group is Guiding Innovation and Strategic Growth in the Saudi Arabia Tire Market:

The Saudi Arabia tire market is undergoing significant transformation, driven by rapid urbanization, expanding automotive sales, and evolving transportation infrastructure. As the nation advances its industrial and logistics capabilities under Vision 2030, IMARC Group plays a crucial role in guiding stakeholders with strategic intelligence and data-backed insights. The firm’s deep expertise in market forecasting, competitive benchmarking, and demand analysis enables clients to make informed decisions and capitalize on emerging opportunities across the tire value chain.

- Market Insights: IMARC Group provides comprehensive insights into the factors shaping the Saudi Arabia tire market. The firm analyzes key growth drivers such as rising vehicle ownership, expansion in the e-commerce and logistics sectors, and the increasing preference for premium and energy-efficient tires. Through detailed industry assessments, IMARC Group identifies how changing consumer behavior, technological advancements in tire materials, and government sustainability initiatives are influencing market dynamics and future demand.

- Strategic Forecasting: With advanced forecasting methodologies, IMARC Group helps clients anticipate market trends and prepare for future shifts in tire production and consumption. The firm evaluates how macroeconomic indicators, automotive manufacturing activities, and infrastructure investments will impact tire demand across passenger cars, commercial vehicles, and off-road segments.

- Competitive Intelligence: IMARC Group offers in-depth analysis of the competitive landscape within the Saudi tire industry. By studying evolving business models, retail channel developments, and customer engagement strategies, IMARC Group equips clients with actionable intelligence to strengthen their market positioning and enhance brand competitiveness.

- Policy and Regulatory Analysis: As Saudi Arabia enhances its environmental and safety regulations, IMARC Group supports clients in understanding and adapting to evolving policy frameworks. The firm assesses the impact of government initiatives promoting fuel efficiency, tire recycling, and import regulations on market operations. This enables industry participants to remain compliant while pursuing sustainable growth strategies aligned with national objectives.

- Customized Consulting Solutions: IMARC Group provides tailored consulting services designed to address the unique challenges of the Saudi Arabian tire sector. From market entry assessments and distribution optimization to consumer behavior analysis and growth strategy formulation, the firm delivers data-driven solutions that align with client goals. Its analytical rigor and strategic expertise empower businesses to navigate a competitive landscape while maximizing profitability and operational efficiency.

As the market evolves, IMARC Group continues to be a trusted partner offering clients strategic foresight, actionable insights, and customized advisory solutions that drive innovation and strengthen competitiveness in the Kingdom’s dynamic tire industry. For detailed insights, data-driven forecasts, and strategic advice, see the complete report here: https://www.imarcgroup.com/saudi-arabia-tire-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)