Binding Wire Cost Model: Material Cost Monitor

What is Binding Wire?

Binding wire is a low-cost, flexible steel wire, mainly utilized for tying, fastening, and bundling in applications of construction, industry, agriculture, and packaging.

Key Applications Across Industries:

Usually produced from mild steel wire rod by successive cold-drawing, annealing and surface-finishing processes, binding wire comes in an assortment of gauges (typically 18–24 AWG / 1.0–1.6 mm) and in a few forms: soft/annealed plain wire, galvanized (zinc-coated) wire for corrosion-proofing, and polymer/PVC-coated wire for better handling and durability. Manufacturing starts with wire-rod feeding, multi-stage drawing to the target diameter, continuous or batch annealing to make it ductile, with optional surface treatments (hot-dip galvanizing, electrolytic galvanizing, or coating). Coiled, looped or shaped into handy bundles, finished wire is supplied for on-site utilization. Binding wire is appreciated for its excellent ductility, low price, and simplicity of use, contractors twist it manually or with minimal tools to bind rebar, hold formwork, group pipes, or seal sacks. Buyers pay attention to quality parameters such as tensile strength, elongation, surface bonding (for coating), dimensional tolerance, and packaging integrity (kg/coil, loop size). Market players vary from integrated steel producers and wire-rod mills to niche small-to-medium binding-wire workshops for local construction markets. Due to its ease and low capital burden, the binding-wire industry tends to have many regional participants, supply chains localized, and rapid order fulfillment, features that render it a core commodity in building and industrial processes globally.

What the Expert Says: Market Overview & Growth Drivers

The global binding wire market reached a value of USD 1.35 Billion in 2024. According to IMARC Group, the market is projected to reach USD 2.13 Billion by 2033, at a projected CAGR of 4.7% during 2025-2033. The global binding wire market is dominated by construction and infrastructure activity, as rebar tying and formwork fastening are routine in residential, commercial, and civil construction.

Phases of high public and private expenditure on infrastructure (roads, bridges, mass housing, and commercial development) generate direct, anticipated growth in binding-wire consumption. Sharp urbanization and industrialization in the developing world, especially in South Asia, Southeast Asia and regions of Africa, maintain long-term demand as new homes, factories and utilities are constructed. Secondary demand drivers are agriculture and packaging (wire used for bale binding and bag sealing), furniture and fencing production, and seasonal surges related to harvests or disaster relief. Supply side has availability and price of steel wire-rod and scrap significantly impacting production economics; cheap raw-materials induce increased output while volatility tightens margins and may drive buyers to local suppliers. Technology and regulation also influence demand: better coating technologies (galvanizing, polymer coatings) prolong product life in corrosive environments, boosting take-up in coastal and industrial areas; tighter quality and safety norms in developed economies boost demand for certified product grades. Trends in logistics and distribution like expansion of e-commerce, chain building-materials retailers and just-in-time contracting further enhance market access for smaller producers and alter buying patterns. Finally, circular-economy and sustainability pressures promote recycling of steel feedstocks and more efficient wire manufacturing, and geopolitical changes and trade policy (tariffs, export controls) periodically redefine supply-chain geographies and regional competitiveness. All told, these drivers generate stable, construction-related demand moderated by raw-material cycles and local regulatory regimes.

Case Study on Cost Model of Binding Wire Manufacturing Plant:

Objective

One of our clients reached out to us to conduct a feasibility study for setting up a medium scale binding wire manufacturing plant.

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the setup and operation of a proposed binding wire manufacturing plant in India. This plant is designed to produce 300 tons of binding wire annually.

Manufacturing Process: Manufacturing process of binding wire entails a series of consecutive operations aimed at producing a ductile, flexible, and robust product for use in tying and fastening purposes, mainly in construction and industrial applications. The process starts with raw material selection, commonly low-carbon mild steel wire rods of 6–8 mm diameter. The rods are initially cleaned and descaled by means of acid pickling or mechanical brushing to eliminate rust, mill scale, and surface contaminants. The wire rods are then cold drawn through a series of progressively smaller dies on drawing machines to bring the diameter down to the desired gauge, most often between 0.8 mm and 1.6 mm, while enhancing tensile strength and surface finish. After being drawn, the wire is annealed, a process of controlled heating and cooling in furnaces to remove internal stresses and restore ductility and softness to make it easily bent and tied when needed. Depending on user needs, the wire could then be galvanized (hot-dip or electro-galvanizing) to apply a protective zinc layer that increases corrosion resistance or polymer coating for specialized use. The processed wire is then coiled, spooled, or looped into typical weights (1–50 kg bundles) to facilitate easy handling and transportation. During production, quality control tests such as diameter tolerance, tensile strength, elongation, and adhesion testing of the coating guarantee uniform product performance. This efficient yet precision-controlled manufacturing process enables manufacturers to achieve uniformity, reduce material loss, and provide the construction, agricultural, and packaging industries with affordable and dependable binding wire.

Get a Tailored Feasibility Report for Your Project Request Sample

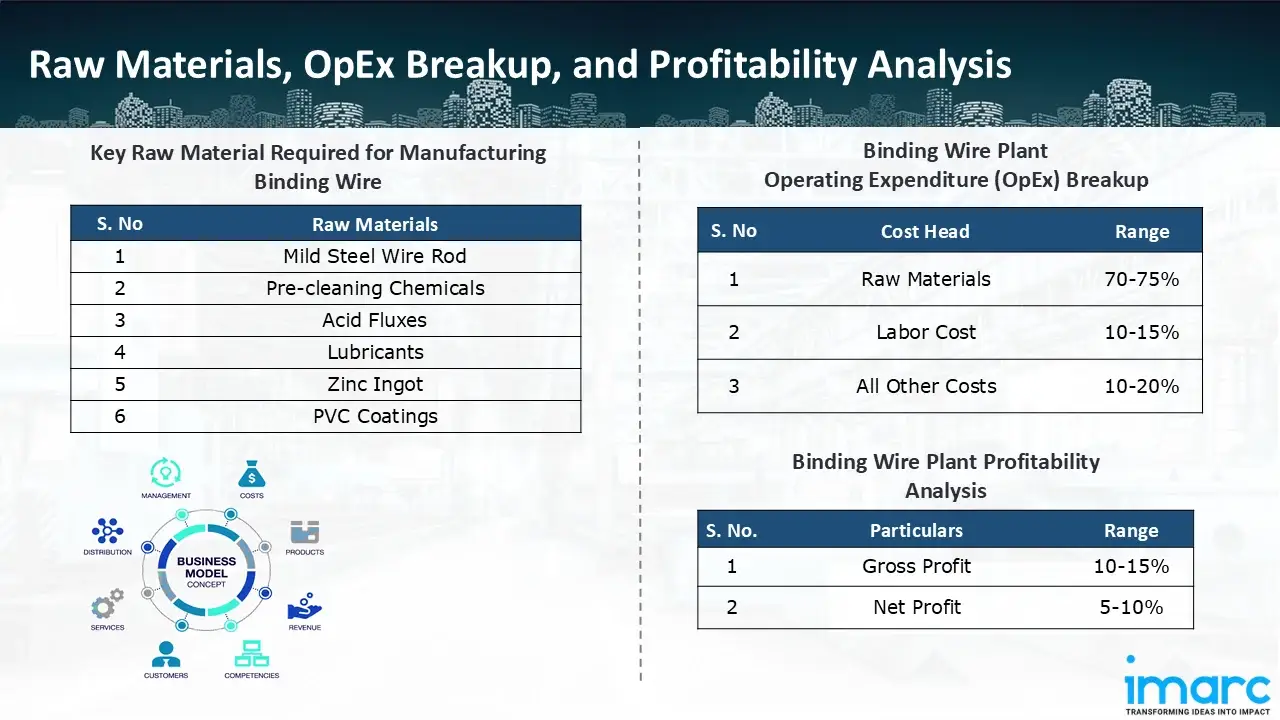

Raw Material Required:

The basic raw materials required for binding wire manufacturing include:

- Mild Steel Wire Rod

- Pre-cleaning Chemicals

- Acid Fluxes

- Lubricants

- Zinc Ingot

- PVC Coatings

Machineries Required:

- Wire Rod Pay-Off Stand

- Pickling Tanks

- Washing & Neutralizing Tanks

- Mechanical Descaler (Rotary Wire Brush / Sand Blasting Unit)

- Wire Drawing Machine (Multi-Pass, Horizontal / Vertical)

- Lubrication System (Lime/Soap Powder Bath)

- Capstan Rollers

- Annealing Furnace

- Batch / Bell Furnace (Gas-Fired / Electric)

- Furnace (Vertical Heating Chamber)

- Continuous Annealing Line, Galvanizing Bath (For Zinc Coating)

- Oil Coating System (Light Anti-Rust Oil)

- Coiling Machine / Automatic Winder

- Coil Stretch Wrapping / Film Wrapping Machine

- Binding & Packing Unit (Strapping, Weighing and Bagging)

- Lubrication / Emulsion Preparation & Filtration System

- Compressed Air System

- Cooling Water System / Chiller

- Fume Extraction / Ventilation System

- Effluent Treatment Plant

- Scrap Handling / Chip Conveyor / Baler

- Tension Controllers / Brakes / Dancer Systems

- Speed Encoder / Capstan Controllers

- Universal Tensile Testing Machine

- Micro-Hardness Tester / Rockwell / Vickers

- Optical Micrometre & Laser Diameter Gauges

- Surface Roughness Gauge

- Salt-Spray Chamber

- Chemical Analyzer / Spectrometer

- Spare Dies

- Tooling & Consumables

- Drawing Lubricant / Emulsions

- Cutter Blades

- Coil Mandrels and Bearings

Techno-Commercial Parameter:

- Capital Expenditure (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth. Furthermore, raw material cost in a binding wire manufacturing plant ranges between 70-75%, labor cost ranges between 10% to 15%, and all other costs ranges between 10-20% in the proposed plant.

- Profitability Analysis Year on Year Basis: We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins lie between a range of 10-15%, and net profit lie between the range of 5-10% during the income projection years, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the binding wire manufacturing plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, manufacturing, capital expenditure, and operational expenses. By addressing the specific requirements of manufacturing 300 tons of binding wire annually, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights into strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale manufacturing ventures.

Latest News and Developments:

- In July 2025, The Indian Ministry of Steel has mandated that all steel and steel products falling under chapters 72 and 73 of the ITC (HS) codes must comply with 151 specified Indian Standards. The Steel and Steel Products (Quality Control) Order, 2024 (QCO) incorporates these criteria. Importers are now required to confirm that the raw materials used in these items meet the applicable Indian Standards in addition to making sure the products comply with QCO regulations.

- In March 2025, the FIB Group declared that it has designed and installed bell furnace systems specifically for the manufacture of cold heading wire and binding wire. These furnaces are designed to accommodate varying wire diameters and coil sizes, and they can manage loads ranging from 7 to 75 tonnes per cycle. This is a useful piece of equipment for producers of binding wire.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104