Top Factors Driving Growth in the Brazil Data Center Market

Overview of the Brazil Data Center Market:

The data center market in Brazil has emerged as a vital cog in Latin America's wheel of digital transformation. With the increasing adoption of digital technologies, the need for reliable, secure, and scalable data storage and processing infrastructures is rapidly rising among enterprises, governments, and consumers. Brazil, with its position as the largest economy in South America, presents itself as a natural hub for data center investments-a regional gateway to digital connectivity, cloud computing, and IT services.

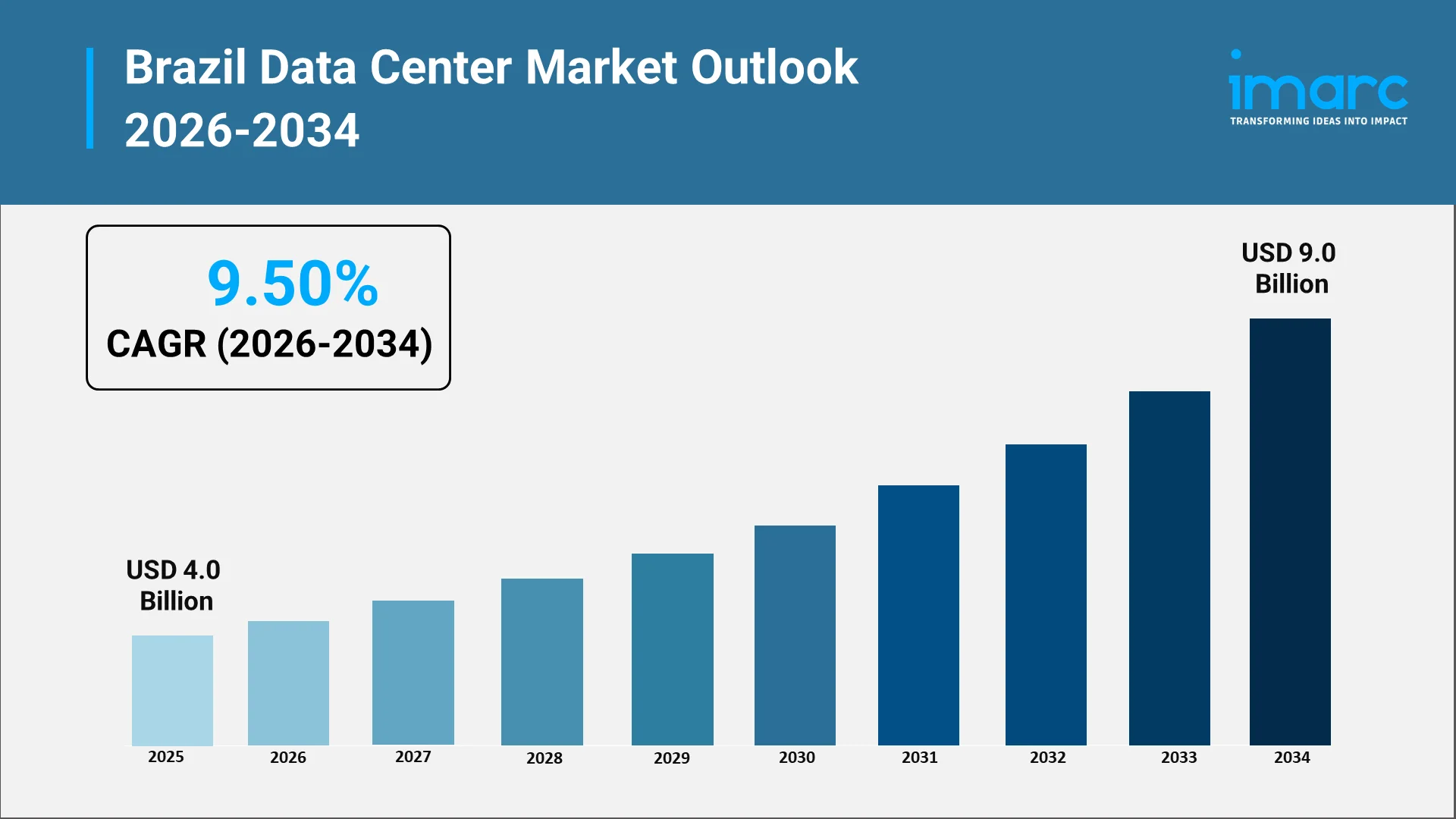

The Brazil data center market reached USD 4.0 Billion in 2025, and looking forward, the market is expected to reach USD 9.0 Billion by 2034, exhibiting a robust CAGR of 9.50% during 2026-2034. The market growth is underpinned by ever-increasing data consumption, expanding internet penetration, and accelerating enterprise digital initiatives. Organizations are moving away from traditional on-premise IT models toward flexible solutions such as cloud computing and colocation services. This movement will drive unprecedented demand for high-performance data center infrastructures that can support massive workloads, complex analytics, and low-latency connectivity.

Explore in-depth findings for this market, Request Sample

In addition, Brazil's government is committed to digital inclusion and modernization, hence promoting the growth of digital ecosystems through the construction of new facilities and fiber-optic networks. These factors, in addition to strong investor interest, make it rank among the most dynamic and fast-evolving data centre markets in the Southern Hemisphere.

Market Size and Capacity Expansion Trends:

The Brazil data center market continues to see ongoing growth, driven by increased demand for digital services from the banking, telecommunications, e-commerce, and media sectors. The increased adoption of companies on the internet platform has accelerated demand for computing facilities. This is driving a host of new projects targeted at hyperscale or edge computing facilities.

The factors contributing to capacities include IoT device proliferation, AI-driven analytics, and 5G deployment. Facilities are now moving beyond being mere centers of data storage towards becoming intelligent digital ecosystems handling real-time data processing, automation of processes, and complex workloads. This evolution forces operators to shift toward more modular and scalable designs to quickly respond to changes in business needs. For example, Scala Data Centers (in partnership with Nokia and Lightera) completed Latin America’s first test of hollow-core fibre at its São Paulo campus—achieving a 32% latency reduction over conventional optical fibre, illustrating how infrastructure is being re-imagined to support high-density, low-latency workloads.

Meanwhile, colocation facilities are also playing an important role in increasing capacity. Many enterprises prefer outsourcing their IT infrastructure to colocation providers for cost efficiency, reliability, and access to advanced technologies. These colocation trends are fast redefining how companies manage IT operations, enabling them to put greater focus on core competencies rather than managing physical infrastructure.

Additionally, sustainability is emerging as a defining trend in capacity planning. Operators are prioritizing energy-efficient designs, renewable power integration, and advanced cooling systems to minimize environmental impact. This focus on green growth aligns with global standards, enhancing Brazil’s attractiveness for international investors and hyperscale operators looking for environmentally responsible expansion opportunities.

Key Drivers of Infrastructure Investments:

Various reasons, including technological, economic, and strategic ones, are driving the evolution of the Brazil data center market.

The strongest drivers are the surge in digital transformation across industries. Enterprises are now reimagining their operations by automating, investing in AI, and deploying cloud technologies that need a robust and secure digital backbone. The expansion of digital payment systems, e-commerce platforms, and online services has increased the demand for localized computing power, data storage, and cybersecurity solutions. For instance, Amazon Web Services (AWS) announced a $1.8 billion investment in Brazil through 2034 to expand its cloud and data center infrastructure, supporting enterprises’ digital transformation and growing demand for local cloud services.

Another factor that will spur investments into the sector is the need for low-latency connectivity. Video streaming, cloud gaming, and IoT solutions have all reached mainstream status, meaning data needs to be processed closer to end-users. This has triggered the building of edge computing facilities in key Brazilian cities, assuring faster response times and improved user experiences.

Apart from that, data sovereignty regulations encouraged companies to store and process data within their borders. This has presented the opportunity for players, both domestic and international, to create new facilities that are in tune with local legal frameworks. Brazil has thus seen a wave of infrastructure investments catering to both domestic demand and regional markets.

Foreign direct investment also plays an important role. Global technology companies continue to invest in the local data center infrastructure, as well as forging partnerships with Brazilian firms to develop connectivity and build out services. Strategically situated, Brazil provides access both to Atlantic submarine cables and to the neighboring markets of South America.

Role of Cloud Computing and Hyperscale Operators:

Cloud computing has become the cornerstone of the Brazil data center market and changed the way businesses deploy and scale their IT infrastructure. While the enterprises are migrating workloads to the cloud, service providers are extending their local presence in order to meet rising demand for performance, security, and compliance. For example, Equinix has expanded its São Paulo campus to support growing demand for cloud interconnection and hybrid IT solutions, highlighting the increasing importance of local cloud infrastructure in Brazil.

The growing demand for cloud services in Brazil is attributed to the expansion of hyperscale operators. Global cloud giants are opening large-scale facilities across prime metropolises to cater to data-intensive applications, such as artificial intelligence, machine learning, and big data analytics. Hyperscale data centers, hallmarked by vast computing and storage resources, are the backbone of the fast-growing cloud ecosystem in Brazil.

The impact of hyperscale expansion goes far beyond capacity. This growth is catalyzing ancillary industry creation in cooling systems, power solutions, cybersecurity, and fiber connectivity-all vital for a strong digital ecosystem. It is creating partnerships and integrating the supply chains of local companies, bringing about technology transfer and innovation.

In addition, Brazilian companies are gaining interest in the hybrid cloud model. Enterprises consider both private and public cloud environments to find an optimal balance between flexibility, control, and security. It is especially good for companies that deal with sensitive data, such as financial, healthcare, and government. Data center operators have continued to expand their service portfolios as cloud adoption accelerates to support hybrid and multi-cloud strategies.

Eventually, the interaction of cloud computing and hyperscale investments is changing the face of Brazil's digital economy to open up new vistas for different business models, efficient service delivery, and increased competitiveness in the global digital economy.

Government Regulations and Energy Efficiency:

The regulatory landscape significantly shapes the path of the Brazil data center market. Policymakers have been instrumental in bringing forward a number of initiatives that offer opportunities for digital development while ensuring the protection, sustainability, and reliability of data.

One of the most influential policies in place is that of data protection laws, mandating the secure handling of personal and enterprise data. These have helped restore international investor and cloud provider confidence in the country by indicating that Brazil will not fall behind global standards of cybersecurity and privacy.

Another critical dimension is energy policy. Data centers are among the most energy-intensive infrastructure types, and the Brazilian government has stressed the importance of renewable energy integration and the adoption of energy efficiency measures. In response, operators are upping investment in green technologies-solar and wind power among them-to limit their carbon footprint and ensure a long-term, sustainable business. For example, ODATA has partnered with Casa dos Ventos to source wind power from the Babilônia Sul complex in Bahia, supplying its Brazilian data centers with renewable energy and supporting sustainable operations.

Meanwhile, public-private partnerships are upgrading the nation's power and connectivity infrastructure to make it more conducive for operators to set up new facilities. Initiatives to spread broadband access, modernize the national grid, and extend fiber-optic connectivity are giving a boost to the ecosystem, where the market can keep expanding.

The emphasis on energy-efficient operation also interrelates with Brazil's broader environmental commitments. In this vein, the efficient cooling technologies, waste heat recovery systems, and intelligent power management further place Brazil in a strategic position to contribute toward international sustainability goals and to remain competitive. This strategic approach serves the dual purpose of benefiting the environment while strengthening the resiliency of operations against unstable energy costs.

Competitive Landscape and Future Forecast:

The data center market in Brazil has a mix of domestic and international players, each helping to make the environment both highly competitive and innovative. While the local operators have deep regional knowledge and established customer relationships, the global players bring technological expertise, scalability, and financial resources. This diversity has created a thriving ecosystem in which partnerships and joint ventures are common.

Competitive dynamics in the market are shifting as demand increasingly favors high-capacity, efficient, and secure facilities. This sets operators apart in the delivery of value-added services that include managed hosting, cybersecurity, and connectivity solutions. As clients demand an increasingly integrated offering, providers are moving beyond traditional co-location services to deliver end-to-end infrastructure solutions.

The market in the future will be shaped by further digitalization, integration of emerging technologies, and a continued emphasis on sustainability. Artificial intelligence and machine learning will continue to play an ever-more significant role in further optimizing data center operations to enable predictive maintenance and intelligent resource allocation.

The deployment of 5G will also accelerate the use of edge computing, a field that calls for smaller, decentralized facilities capable of supporting latency-sensitive applications. This development will further strengthen Brazil's position as a digital powerhouse in Latin America.

The trends related to colocation will also change further, wherein the enterprises will seek hybrid solutions that include physical infrastructure with virtualized services. The data center operators that can offer flexible, scalable, and energy-efficient models would be best positioned to capture emerging opportunities.

In all, the Brazil data center market is poised for strong growth over the next several years, driven by supportive macroeconomic conditions, innovative technologies, and a very firm commitment to digital innovation. With organizations in various sectors progressing toward data-driven decision-making and digital agility, Brazil's data center landscape will undoubtedly continue to form a cornerstone in regional growth.

Conclusion:

The Brazil data center market is poised at an important juncture in the overall digital economy. Rapid cloud adoption, robust infrastructure development, regulatory support, and a strong focus on sustainability are shaping its growth trajectory. As businesses further digitize their operations and consumers seek faster, more reliable experiences with digital technologies, data centers in Brazil will undoubtedly make key contributions to driving the nation's technological future.

From hyperscale expansion to green innovation, the market is at the front of the new digital era where resilience, scalability, and intelligence set the baseline. Understanding these transformative dynamics is crucial for stakeholders across the ecosystem as they seek to unlock sustained growth and competitive advantage in Brazil’s evolving data landscape.

IMARC Group: Delivering Strategic Intelligence for Brazil’s Evolving Data Center Landscape

- Data-Driven Market Research: Our detailed reports provide comprehensive coverage of the Brazil data center market, including investment trends, hyperscale developments, colocation demand, energy efficiency initiatives, and digital transformation indicators across major industries.

- Strategic Growth Forecasting: We help you identify the key trends shaping Brazil’s digital infrastructure—from edge computing and 5G-enabled workloads to cloud adoption cycles, AI-driven analytics, and evolving enterprise IT modernization strategies.

- Competitive Benchmarking: Evaluate the competitive landscape by analyzing the strategies of leading data center operators, cloud service providers, colocation companies, and hyperscale investors. We monitor new facility announcements, capacity expansions, partnerships, and technological differentiators.

- Policy and Infrastructure Advisory: Stay ahead of Brazil’s regulatory environment, including data sovereignty rules, environmental standards, renewable energy policies, and government-backed digital initiatives that influence market entry, expansion, and long-term investment decisions.

- Custom Reports & Consulting: Receive tailored insights aligned with your organizational objectives—whether you aim to develop new data center facilities, invest in green infrastructure, expand cloud services, or explore opportunities in connectivity, fiber networks, and digital ecosystems.

At IMARC Group, our mission is to empower stakeholders across Brazil’s rapidly evolving data center landscape with clarity, intelligence, and strategic foresight. Partner with us to unlock actionable insights and stay competitive in one of Latin America’s fastest-growing digital infrastructure markets.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)