India Credit Card Market Analysis & Forecast

Introduction:

Over the last decade, digital payment systems in India have undergone a significant transformation, and credit cards have emerged as one of the major components of this financial revolution. Driven by increasing financial literacy, deeper penetration of digital banking, and a gradual shift towards cashless transactions, the Indian credit card market is growing at a rapid pace. As consumers look towards convenience, security, and flexibility in terms of credit, the credit card ecosystem has emerged as an integral component of the digital economy in India.

The Indian credit card industry is seeing a consistent adoption by millennials, urban professionals, and small business owners. With contactless payments, digital onboarding, and personalized reward programs, credit cards are no longer viewed solely as a borrowing instrument but also as lifestyle and financial management tools. Recently, the domestic card network RuPay was reported to account for around 16% of all credit-card spending in India. Therefore, the Indian credit card market share will continue to grow significantly with innovations, regulatory reforms, and enhancement in competition among issuers.

Credit Cards: Role, Impact, and Benefits in the Payment Ecosystem of India

Credit cards will continue to be at the forefront in increasing India's progress towards a less-cash, digital-first economy. Convenience, accessibility, and the ability to promote responsible credit behavior are changing consumer behavior and spending habits. Recently, a report by the International Trade Administration projected that India’s credit and charge card payments market will cross INR 25.91 lakh crore (approximately US $300 billion) by 2025, growing at around 14% due to expanding digital adoption, increased bank promotions, and a rise in non-cash spending. Beyond transaction efficiency, they come with reward points, travel miles, and cashback options that offer added customer stickiness.

In the wider perspective of the Indian credit card industry, act as financial enablers for consumers and merchants alike. They fill short-term liquidity gaps, enable large purchases, and present a clearly traceable spending pattern, which is very helpful in financial planning. E-commerce, subscriptions, and digital services have elevated this importance because an increasing number of customers prefer seamless, secure, and fast modes of payments.

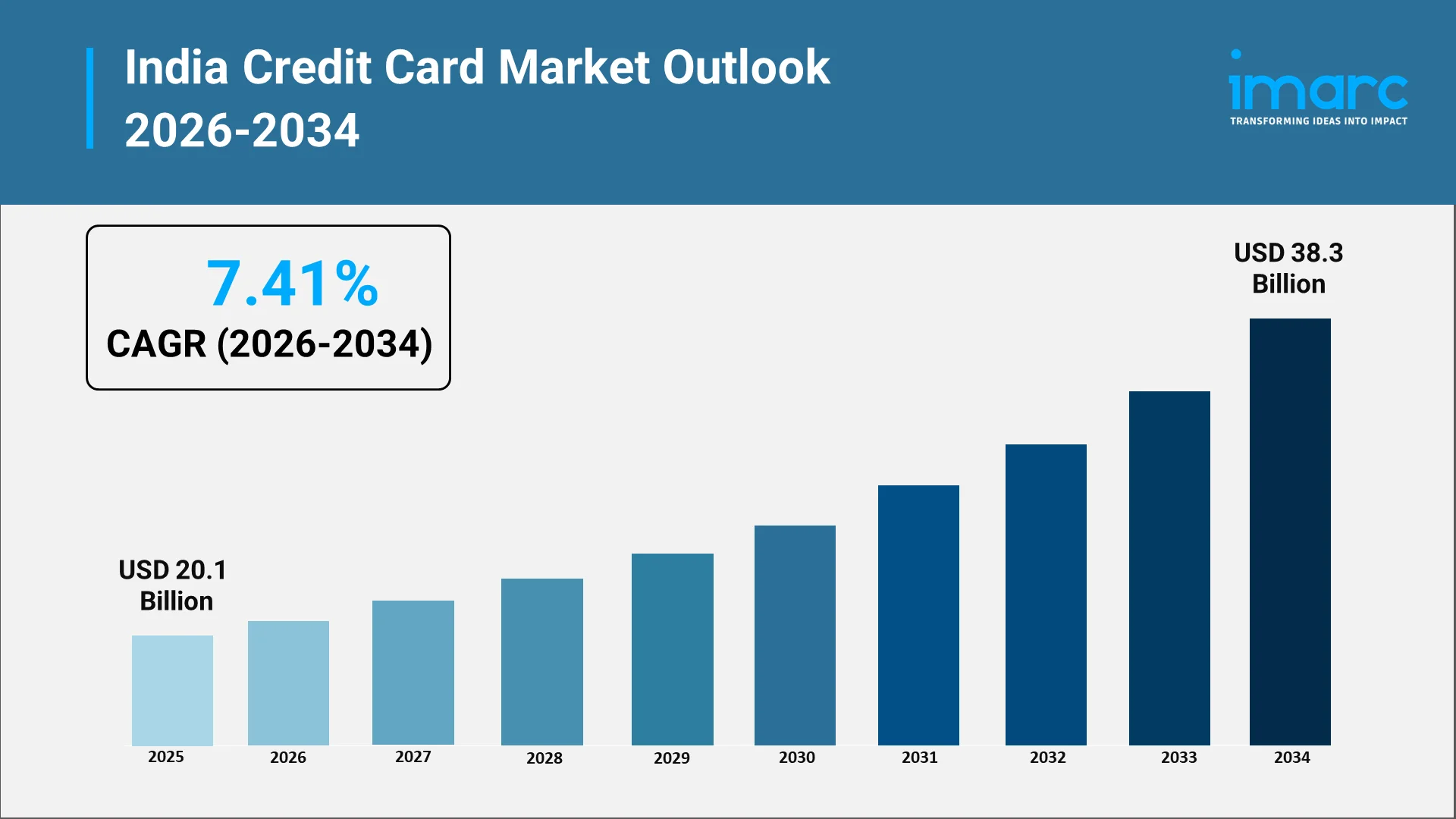

The India credit card market size reached USD 20.1 Billion in 2025. Looking forward, the market is expected to reach USD 38.3 Billion by 2034, exhibiting a growth rate (CAGR) of 7.41% during 2026-2034. Further, the integration of credit cards with Unified Payments Interface and mobile wallets has facilitated better interoperability, thereby expanding the credit card market size in India. This convergence enables users to make transactions with ease across multiple platforms with robust fraud protection and transparency. Credit cards would continue to be at the cornerstone of retail and corporate payment ecosystems as the Indian economy increasingly digitalizes.

Explore in-depth findings for this market, Request Sample

Key Growth Drivers in the India's Credit Card Market:

The various growth catalysts underpin the rapid evolution of the credit card market in India by speeding up the latter's growth and adoption across various demographics.

Increasing Disposable Income and Urbanization

The expanding middle class and urban workforce have ensured a rise in the number of people with disposable incomes and increasing demand for accessible financial instruments. As more and more consumers seek credit-based purchasing power, the use of credit cards for lifestyle, travel, and e-commerce transactions has risen exponentially.

Technological Advancements and Digital Infrastructure

Increased smartphone proliferation, deepened internet penetration, and rapidly growing fintech platforms have transformed the way people apply for, use, and manage credit cards. The deployment of advanced analytics and artificial intelligence helps to personalize card offers, detect fraud, and optimize customer experience. Recent data from Reserve Bank of India-reported industry trends show that credit card spends surged to INR 1.84 trillion in April 2025, underscoring how this digital shift is contributing significantly to the Indian credit-card industry’s high growth rate of transaction volume and card issuance. This digital shift has contributed significantly to Indian credit card industry statistics, reflecting the high growth rate of transaction volume and card issuance.

E-commerce and Contactless Payments

The main factors driving the use of credit cards include online shopping, travel bookings, and food delivery services. This shift to online modes of payment, induced by the pandemic, only worked to engender trust among customers in card systems. Contactless and tap-to-pay technologies have further strengthened the Indian credit card market share, promoting safety and convenience.

Government and Regulatory Initiatives

Programs such as "Digital India" and policies on supporting cashless payments have boosted the credit card market size in India. The RBI has introduced several guidelines aimed at ensuring transparency in interest rates, security of data, and credit reporting that would enhance consumer confidence and market integrity. Moreover, the government’s “Digital Payments Utsav” campaign (9 Feb – 9 Oct 2023) under the Ministry of Electronics and Information Technology (MeitY) sought to drive digital-payment adoption, especially among small merchants and underserved consumers.

Regulatory Framework and Policy Landscape in the India’s Credit Card Industry:

The Indian credit card industry operates within a well-structured regulatory framework led by the Reserve Bank of India. Such regulations are put in place to ensure transparency, consumer protection, and market stability. Guidelines by the RBI on card issuance, credit limits, data protection, and MDRs go on to shape the overall industry landscape.

Consumer Protection and Transparency

Similarly, to prevent unfair practices, the RBI has prescribed the mandatory declaration of key terms and conditions like interest rates, billing cycles, and penalty fees by all issuers. The regulator has tightened norms for unsolicited card issuance to ensure that the consumers have control over their credit profiles.

Data Privacy and Security

The increased digitalization of financial transactions has made the protection of customer data paramount. Tokenization and end-to-end encryption have been encouraged by the RBI to secure sensitive cardholder information. These measures are ensuring that the India credit card market continues to uphold trust and reliability among users.

Credit Risk Management and Reporting

Credit bureaus and other digital verification mechanisms have been integrated into the system to monitor repayment habits by borrowers and minimize the chances of defaults. This would raise the level of transparency and security in the lending ecosystem, thereby strengthening the Indian credit card market share.

Encouragement of Digital Innovation

The RBI actively promotes financial inclusion, and so does the government, by encouraging banks and fintech firms to be more innovative. Allowing credit card linking to UPI is one of the key milestones that expand the credit card market size in India and allure new customers from earlier untapped sections.

Top Credit Card Companies / Issuers in India:

The Indian credit card industry is shaped by a mix of traditional banks, private institutions, and emerging fintech players competing for market leadership. Their strategies emphasize innovation, personalization, and customer-centricity.

Public and Private Sector Banks

The major public and private banks dominate the India credit card market by utilizing their large customer bases and technological infrastructure. They promote diversified card portfolios, from entry-level to premium segments, to target different spending habits. Many of them collaborate with retail, travel, and e-commerce brands for enhanced value propositions. For example, in August 2025, IDFC FIRST Bank and IndiGo jointly launched the “IndiGo IDFC FIRST Credit Card” on both the RuPay and Mastercard networks, giving cardholders travel-related privileges, wide merchant acceptance and dual-network flexibility.

Fintech and Digital Banks

Fintech companies have disrupted the market with the introduction of instant approval cards, digital onboarding, and spend-tracking applications. AI-driven analytics integrated within their offering allows for deep personalization, further improving user experiences, especially for tech-savvy millennials and first-time credit users.

Co-branded Partnerships

In the Indian market, the rise of co-branded credit cards between banks and consumer brands, like airlines, online marketplaces, and hotels, has driven the market share. These cards have targeted benefits and exclusive deals that drive loyalty and repeated usage.

Rewards and Loyalty Programs

Reward mechanisms have emerged as the main differentiator among issuers, and cashback, air miles, and flexible redemption options enhance customer satisfaction while increasing transaction frequency. This competitive scenario has contributed considerably to the expanding credit card market size in India, assuring the availability of a variety for every consumer.

Opportunities and Challenges in India’s Credit Card Industry:

The India credit card market is at an important transformation juncture, offering immense potential for growth on one hand and structural challenges that need to be addressed on the other for sustainable development.

Opportunities:

Expansion into Tier II and Tier III Cities

With increasing financial literacy and deeper internet penetration, there is huge untapped potential in smaller cities and rural regions. Targeted marketing and simplification of onboarding processes could help extend the reach of the Indian credit card industry beyond metropolitan areas. Recently, under the government’s PM SVANidhi scheme, authorities announced plans to issue credit cards with a INR 30,000 limit to street vendors along with enhanced subsidized loans, aiming to strengthen financial inclusion and expand formal credit access in semi-urban and rural areas. This initiative reflects the government’s focus on extending digital and credit infrastructure to underserved communities.

Integration with Emerging Payment Ecosystems

Linking a credit card with UPI, mobile wallets, and BNPL services is creating hybrid models. This integration has improved convenience while broadening the Indian credit card industry statistics through higher transaction volumes and diversified usage patterns.

Data Driven Personalization

AI and data analytics are allowing banks to design products to exactly meet particular lifestyle needs. Personalized credit limits, reward schemes, and dynamic interest rates improve customer engagement, hence boosting the Indian credit card market share among digitally active consumers.

Green and Sustainable Credit Products

With sustainability gaining importance, eco-friendly cards made up of recycled material have been introduced by issuers, offering rewards on spending that is environmentally friendly. It is such initiative that can expand the credit card market size in India by attracting socially responsible consumers.

Challenges:

High Competition and Market Saturation

Though the urban penetration is high, intense competition exists in the India credit card market among issuers, with thin profit margins and aggressive customer acquisition strategies. The challenge remains in customer loyalty retention due to similar offerings.

Credit Risk and Default Concerns

Along with increased card adoption, credit discipline needs to be maintained among its new users. Irresponsible spending and delays in repayments will increase non-performing assets, thereby affecting the stability of the Indian credit card industry.

Cybersecurity and Fraud Risks

Notwithstanding advanced encryption technologies, cyber threats also remain a challenge. As transactions increasingly go online, investors will need to invest in advanced fraud detection tools to protect users and maintain confidence in the India credit card market.

Regulatory and Compliance Complexities

Evolving regulatory frameworks, data protection norms, and cross-border transaction rules require constant adaptation. Compliance costs can challenge smaller players seeking to scale within the Indian credit card market share structure.

Conclusion:

The India credit card market is evolving dynamically, driven by technological innovation, consumer empowerment, and regulatory modernization. While the nature of digital payments is rapidly changing, credit cards will remain one of the main drivers of financial inclusion, offering convenience and credit availability. With increasing digital literacy, deepening collaboration with fintechs, and emerging technologies changing consumer engagement, the Indian credit card industry is expected to see strong growth over the next few years. However, the sector also needs to overcome cybersecurity, competition, and credit management challenges if it is to sustain the trajectory. The credit card market size in India will see considerable expansion with a proactive regulatory environment, ongoing innovation, and strategic outreach to underpenetrated regions. At a time when inclusive growth and digital transformation are the cornerstones of economic development, the Indian credit card industry would have a defining role in shaping India's future of cashless commerce and financial empowerment.

Partner with IMARC Group for Comprehensive Insights into India’s Credit Card Industry:

Understanding the dynamics of the India credit card market requires in-depth analysis of evolving consumer behavior, digital payment adoption, and financial inclusion strategies. As the market advances through innovations such as contactless payments, UPI-linked credit cards, and AI-driven fraud detection, stakeholders need a trusted research partner to navigate this transformation with clarity and precision.

IMARC Group offers comprehensive intelligence on market size, segmentation, and growth forecasts, covering key parameters such as spending patterns, credit penetration across demographics, and emerging product categories. Our research also tracks competitive positioning among leading issuers, evolving regulatory frameworks, and the impact of fintech collaborations on transaction ecosystems.

Through custom studies, strategic forecasting, and benchmarking, IMARC Group enables banks, fintech firms, investors, and policymakers to identify emerging opportunities, manage risks, and craft data-driven strategies for sustainable growth. We empower clients to capitalize on India’s accelerating digital finance revolution, driving innovation, inclusion, and profitability across the expanding credit card landscape.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)