GCC Anime Market Trends: Analyzing Rising Fan Engagement and Expanding Content Consumption

Introduction:

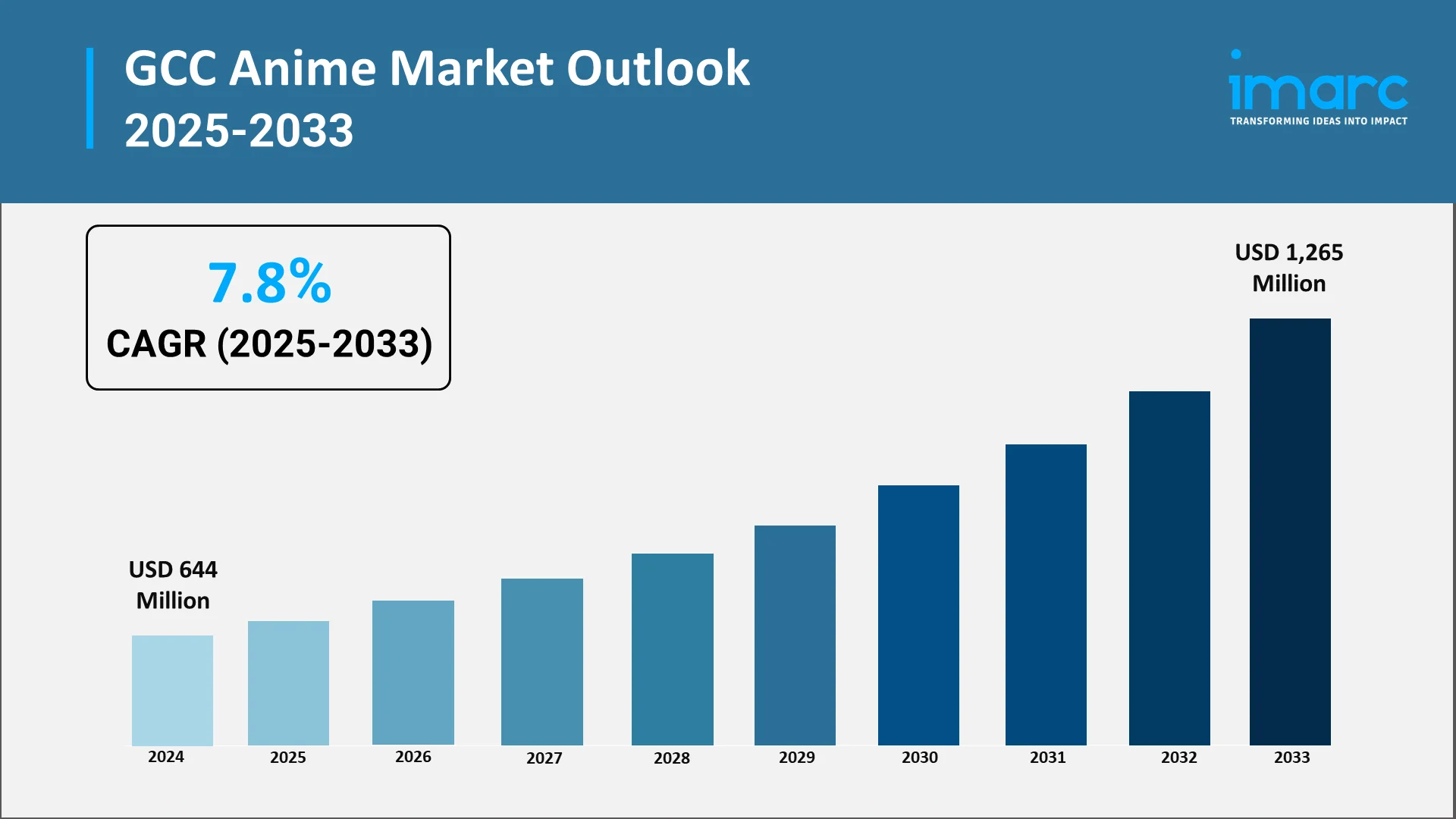

The market represents one of the most dynamic segments within the region's rapidly evolving entertainment landscape. The GCC anime market size reached USD 644 Million in 2024 as per IMARC Group and is projected to grow to USD 1,265 Million by 2033 at a CAGR of 7.8% during 2025-2033. Driven by a predominantly youthful population with strong digital literacy and growing disposable incomes, anime has transitioned from a niche interest to a mainstream cultural phenomenon across Saudi Arabia, the United Arab Emirates, Qatar, Bahrain, Kuwait, and Oman. Saudi Arabia alone had approximately 15 million anime viewers in 2024, representing nearly a quarter of all anime viewership in the Arab world. This transformation reflects broader shifts in consumer preferences toward Japanese pop culture, digital streaming platforms, and interactive entertainment experiences that resonate with modern audiences seeking diverse content beyond traditional Western media offerings.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming GCC Anime Industry:

Saudi Arabia's Vision 2030 and similar economic diversification initiatives across the GCC have fundamentally altered the landscape for entertainment industries, including anime. Saudi Arabia aims to inject USD 64 Billion into the entertainment industry by 2030, accompanied by the creation of over 100,000 jobs. These comprehensive reform programs prioritize the development of robust entertainment sectors, creative economies, and cultural tourism as alternatives to hydrocarbon-dependent economic models. Government support for international cultural events, relaxation of entertainment restrictions, and substantial investments in digital infrastructure have created favorable conditions for anime market development.

National strategies explicitly recognize youth entertainment preferences and seek to channel demand toward regulated, high-quality content offerings that align with cultural values while satisfying contemporary tastes. The establishment of entertainment authorities, media cities, and cultural zones throughout the GCC reflects official commitment to building sustainable creative industries. For the anime sector, this translates into easier licensing processes, support for fan conventions, development of local animation talent inspired by Japanese techniques, and integration of anime-related activities into broader entertainment complexes and tourism destinations.

Key Industry Trends:

Rise of Anime Streaming and OTT Platform Expansions in GCC

One of the major GCC anime market trends is heavy investments of international streaming giants in acquiring extensive anime libraries while simultaneously commissioning Arabic subtitles and dubbing to serve regional audiences effectively. Recent partnerships demonstrate the acceleration of this trend. In November 2025, TOD streaming platform launched Crunchyroll anime content across the MENA region, with early viewership data showing strong engagement from Egypt, UAE, Kuwait, and Iraq. Similarly, in May 2025, Yango Play entered a major content partnership with Sony Pictures Entertainment and Crunchyroll to deliver anime with Arabic subtitles across the Middle East and North Africa. This localization effort demonstrates recognition of the GCC as a valuable market where language-appropriate content can significantly enhance viewer engagement and subscription retention. The convenience of on-demand viewing aligns perfectly with the lifestyle preferences of Gulf consumers who value flexibility in entertainment consumption patterns.

Regional streaming platforms have also entered the anime distribution space, recognizing the genre's appeal and seeking to differentiate their offerings from competitors. These platforms often combine anime with other Asian content, creating comprehensive entertainment packages that cater to diverse viewer preferences within single subscription services. The competitive dynamics among platforms have led to improved content quality, better user interfaces, and more aggressive pricing strategies that benefit consumers. Partnership announcements between streaming services and Japanese production committees have become increasingly common, ensuring simultaneous or near-simultaneous releases with Japanese broadcasts and reducing piracy incentives.

Growing Popularity of Anime Conventions, Cosplay Events, and Fan Communities

Anime conventions have become major attractions across the GCC, drawing casual fans and dedicated cosplayers who invest heavily in costumes and participation. These events support community building, creative expression, and strong commercial activity tied to Japanese pop culture. Large conventions now host voice actors, film screenings, cosplay competitions, and extensive merchandise sections, reaching attendance levels comparable to major Western events.

Cosplay has grown into a respected craft in the region, with creators using advanced techniques and building strong social media followings. Professional photography services cater to this demand.

Online fan communities reinforce these networks, sharing discussions, fan works, viewing groups, translation efforts, and culturally aware community spaces.

Localization of Anime Content for Arabic-Speaking Audiences

Arabic localization of anime has grown into a skilled, multi-layered industry in the GCC, involving translation, cultural adaptation, voice casting, and technical work suited to right-to-left text. Dubbing studios now operate across the region, producing content in Modern Standard Arabic or local dialects. Training efforts have strengthened talent pipelines; Manga Productions alone has trained thousands of Saudis in partnership with major Japanese studios.

Success is visible in viewership, with titles like Future’s Folktales reaching massive global audiences. Fan debates about subs and dubs show a maturing market.

Localization teams also manage cultural notes, translation accuracy, and technical subtitling requirements, ensuring clear presentation without compromising artistic intent.

Increasing Collaborations Between Japanese Studios and GCC Media Companies

Strategic partnerships between Japanese studios and GCC media companies have grown quickly, giving Japanese creators regional market access while helping Gulf firms attract youth audiences with high-value content. Agreements span co-productions, long-term licensing, and joint ventures.

Collaboration surged in 2025. Manga Productions partnered with KOEI TECMO to publish Nioh 3 in the MENA region, and later with SEGA for Sonic Racing: Crossworlds. These deals highlight growing crossover between anime and gaming. Manga Productions also partnered with Bilibili to expand creative cooperation with China.

Recognition followed, including a Saudi Media Forum Award for Future’s Folktales season two. Talent-development programs and Gulf investment in Japanese projects further deepen these ties and support regional animation growth.

Growth of Anime Merchandise, Collectibles, and Gaming Tie-Ins

The anime merchandise market in the GCC has grown quickly, with specialty stores, online platforms, and pop-up shops offering clothing, figures, posters, accessories, and home items. Collectors seek limited editions, high-detail figurines, and event-exclusive goods, while a secondary market has formed around rare items. Official licensing has increased as Japanese rights holders partner with regional distributors, giving fans better quality and reducing counterfeits. Shoppers are now more aware of authenticity and often pay more for genuine products. Retailers enhance the experience with themed displays. Gaming tie-ins add another growth layer, with mobile, console, and PC titles tied to popular anime attracting strong regional engagement.

Market Segmentation and Regional Insights:

Revenue Source Insights

Television broadcasting remains an important revenue source in the GCC anime market, with youth-focused channels and specialty networks offering scheduled programming that reaches viewers who prefer traditional TV or lack streaming subscriptions. Advertising from youth-oriented brands supports free-to-air content, while pay-TV packages include anime channels as premium add-ons. Many viewers use TV to discover new series before shifting to streaming platforms for full-season viewing.

Theatrical releases of major anime films draw strong attendance across the Gulf. Fans value the shared cinema experience, and some chains now host recurring screenings or themed events. Rising turnout has encouraged distributors to shorten delays or match Japanese release dates.

Video sales, both physical and digital, continue to serve collectors who value ownership. Limited editions with special packaging and bonus items command higher prices. Digital stores offer convenience while preserving an ownership model distinct from streaming. Although smaller than during the peak of physical media, this segment remains meaningful for dedicated fans.

Internet distribution through streaming services drives the GCC anime market share. Subscriptions create steady revenue for platforms investing in anime libraries, while ad-supported tiers serve cost-conscious viewers. Digital platforms also gain from user data that helps refine recommendations and strengthen engagement.

Merchandising covers apparel, accessories, home goods, and collectibles. Character-themed products appeal across ages and budgets, and specialty stores have expanded in major cities. Mainstream retailers increasingly carry anime items, and online shops extend access to smaller markets.

Music tied to anime—theme songs, soundtracks, and character tracks—earns revenue through streaming, downloads, and occasional live concerts or orchestral events. Certain songs gain recognition beyond core fans, adding cultural visibility.

Pachinko revenue is largely Japan-specific and has minimal direct presence in the GCC due to regulations, but it remains part of the global revenue mix supporting anime production that later reaches Gulf audiences.

Live entertainment continues to grow, including conventions, fan gatherings, stage shows, character appearances, and themed attractions. Revenue comes from ticket sales, vendor fees, sponsorships, and on-site spending. The rise of virtual and hybrid formats has widened access and introduced new business models that blend physical and online participation.

Country Insights:

Saudi Arabia holds the dominant segment as per the GCC anime market research, shaped by a young population, rapid entertainment-sector growth, and government backing through Vision 2030. Major cities host frequent conventions, themed events, and a wide range of specialty merchandise outlets and cafés. The country’s scale supports localized content efforts, and streaming services compete intensely for Saudi subscribers.

The United Arab Emirates functions as a regional hub. Dubai and Abu Dhabi attract fans from across the Gulf through major conventions, supported by strong digital infrastructure, a diverse entertainment sector, and expatriate communities — including Japanese nationals — that help sustain cultural and business ties. Anime fits naturally into the UAE’s globally minded media landscape.

Qatar benefits from high incomes, strong digital adoption, and growing interest in cultural programming. Its compact geography allows efficient events and distribution, and consumers show strong appetite for premium content and collectibles. Youth-oriented cultural initiatives sometimes incorporate anime themes.

Bahrain has a smaller but enthusiastic fan base, shaped by an open cultural environment and frequent participation in regional events, creating a close-knit community.

Kuwait shows strong engagement through online groups, local gatherings, active retail outlets, and high streaming consumption, with occasional inclusion of Japanese pop culture in cultural and educational programs.

Oman is in an earlier growth phase but shows rising interest through streaming, social media, and participation in regional events. Its emerging status offers room for early entrants as the market matures.

Forecast for 2025-2033:

The GCC anime market is set for steady expansion, supported by demographic advantages, rising digital literacy, improving creative-industry infrastructure, and shifting cultural attitudes. A young population forms the core audience, and higher education levels help deepen engagement with story-driven content and online fan spaces. Vision 2030 and similar national plans continue to strengthen the region’s entertainment ecosystem through investment and policy updates.

Younger viewers are shaping household media choices and looking for content that differs from traditional regional programming. Anime’s style, broad genre mix, and character-driven plots appeal to this group and remain part of their habits as their spending power grows.

Ongoing upgrades in telecom networks, widespread smartphone use, and a competitive streaming landscape expand access. Better payment systems and parental controls have eased earlier subscription hurdles. Improved recommendation tools also introduce anime to audiences who might not have sought it out.

Higher disposable incomes support spending on subscriptions, events, merchandise, and premium experiences. Growing comfort with pop culture has made fandom more visible across the Gulf.

Rising investment in licensing, events, localization, and retail reflects confidence in the region’s long-term potential. As content availability and event quality improve, audience growth reinforces additional investment, keeping the market on an upward path.

Conclusion:

The GCC anime market has moved from a niche following to a widely accepted entertainment category with clear commercial weight. Growth in streaming platforms, conventions, localization, collaborations, and merchandise shows strong momentum. Revenue comes from TV, cinema, online distribution, music, live events, and consumer products, giving the sector a solid base for further investment. Each GCC country—Saudi Arabia, the UAE, Qatar, Bahrain, Kuwait, and Oman—shows distinct patterns but forms a sizable combined opportunity. By 2033, rising youth populations, digital access, higher incomes, and supportive national strategies are expected to keep demand climbing and strengthen anime’s role in Gulf entertainment.

Choose IMARC Group for Comprehensive GCC Anime Market Intelligence:

Organizations seeking deeper understanding of the anime market in the GCC region need research that reflects its fast growth, cultural mix, and changing audience habits.

- IMARC Group provides data-led analysis covering viewing patterns, distribution performance, merchandise demand, and the competitive scene across the GCC. The team studies upcoming shifts in streaming, localization, fan communities, events, and licensing that are expected to guide the market in the years ahead.

- Benchmarking compares global streaming services, regional distributors, retailers, and event organizers to highlight what’s working and where openings exist. Tailored studies support goals such as entering the GCC market, expanding current operations, creating original content, or backing creative ventures.

IMARC Group gives entertainment leaders, investors, platforms, and cultural bodies the practical clarity needed to work confidently and tap the GCC anime market growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)