Saudi Arabia Data Center Market Trends: Digital Transformation, Cloud Expansion, and Vision 2030 Growth

Introduction:

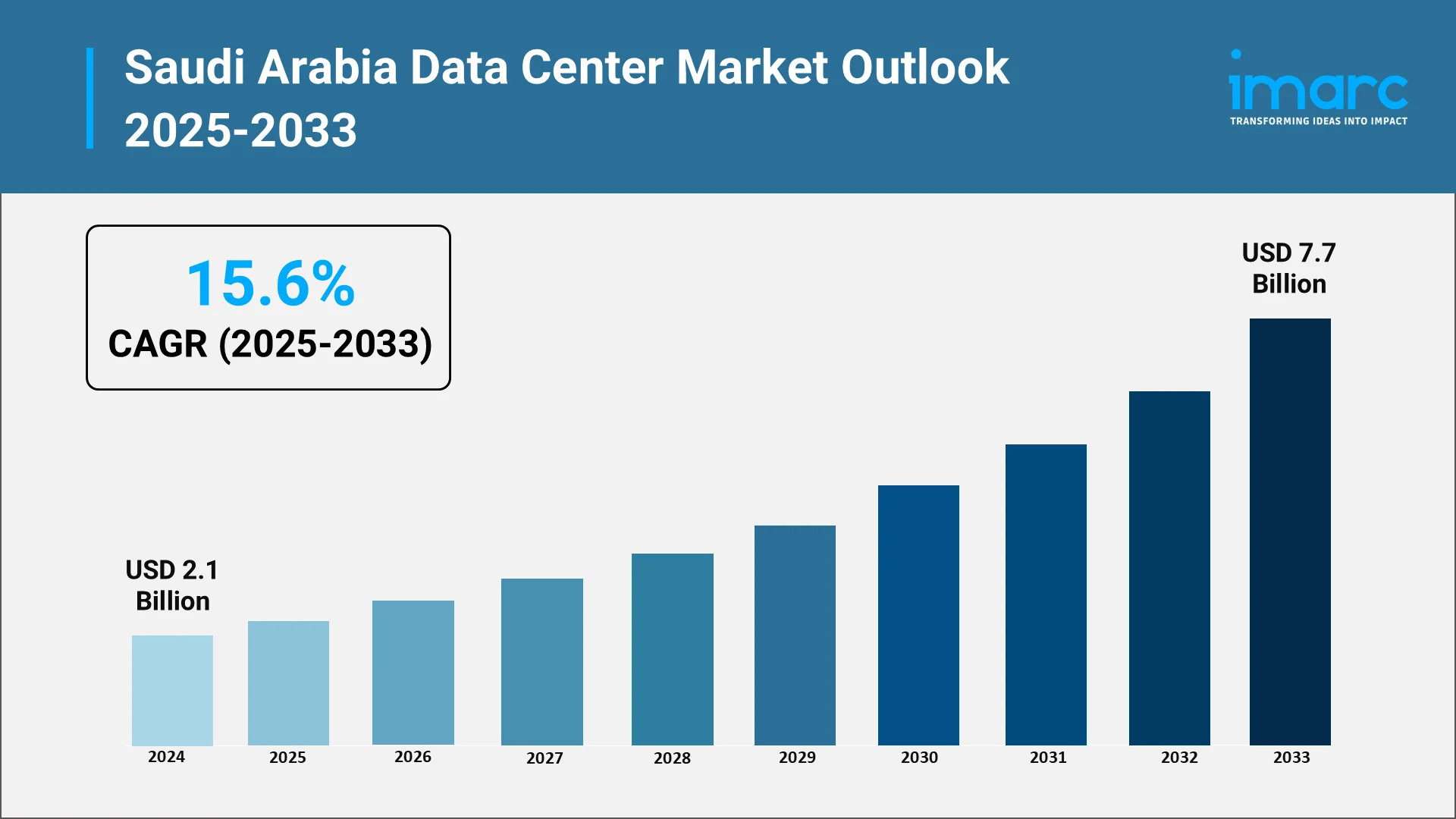

The Kingdom of Saudi Arabia stands at the forefront of a remarkable digital transformation that is fundamentally reshaping its economic landscape and technological capabilities. The data center market research in the country reveals a sector experiencing unprecedented momentum, driven by the nation's ambitious modernization agenda and its strategic positioning as a regional technology hub. As organizations across industries embrace digital-first strategies, the demand for robust, scalable, and secure data infrastructure continues to accelerate throughout the Kingdom. According to IMARC Group, the Saudi Arabia data center market size was USD 2.1 Billion in 2024. It is projected to reach USD 7.7 Billion by 2033 at a CAGR of 15.6% during the forecast period (2025-2033).

The influence of Vision 2030 on digital infrastructure expansion and cloud adoption cannot be overstated. This comprehensive national blueprint has catalyzed massive investments in technology infrastructure, positioning Saudi Arabia as a destination of choice for global technology companies seeking to establish regional operations. The government's unwavering commitment to economic diversification has created fertile ground for the proliferation of data centers in Saudi Arabia, attracting both domestic and international stakeholders eager to participate in this growth trajectory. Moreover, PwC estimates that nearly 70 percent of Middle East companies plan to migrate most of their operations to the cloud within the next year, while public cloud adoption is projected to unlock USD 733 Billion in economic value by 2033 across the Middle East and North Africa region.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming Saudi Arabia Data Center Industry:

Vision 2030 represents a paradigm shift in how Saudi Arabia approaches economic development, with digital transformation serving as a cornerstone of this ambitious national strategy. The initiative has fundamentally altered the trajectory of the Saudi Arabia digital infrastructure market by establishing clear priorities for technology investment, workforce development, and regulatory modernization. Under this framework, the government has actively encouraged foreign direct investment in technology sectors while simultaneously nurturing domestic capabilities through education initiatives, startup incubators, and public-private partnerships. The digital transformation agenda embedded within Vision 2030 extends across virtually every sector of the economy, from healthcare and education to finance and government services, creating sustained demand for data center capacity. This comprehensive approach has accelerated the adoption of cloud computing, artificial intelligence, and advanced analytics across Saudi enterprises, necessitating significant expansion of data processing infrastructure. Furthermore, the initiative has prompted regulatory reforms that streamline licensing procedures, protect data sovereignty, and establish frameworks for international data flows, making the Kingdom increasingly attractive for technology investments. The transformation extends beyond mere infrastructure development to encompass a broader ecosystem of innovation, research facilities, and technology parks that collectively position Saudi Arabia as a regional leader in the digital economy.

Key Industry Trends:

Rapid Expansion of Hyperscale Data Centers by Global Cloud Providers

The entry and expansion of major global cloud providers including Amazon Web Services, Google Cloud, and Microsoft Azure represents one of the most significant developments in the cloud data center Saudi Arabia landscape. These technology giants have committed substantial resources to establishing regional cloud infrastructure within the Kingdom, recognizing Saudi Arabia's strategic importance as a gateway to the broader Middle East market. For instance, Amazon Web Services and HUMAIN announced plans to invest more than USD 5 Billion in a strategic partnership to build a groundbreaking AI Zone in the Kingdom. AWS is additionally investing USD 5.3 Billion to develop a new infrastructure region expected to become available in 2026.

The presence of these global players has catalyzed broader ecosystem development, attracting complementary technology vendors, systems integrators, and managed service providers. Local enterprises benefit from access to cutting-edge technologies including machine learning platforms, advanced analytics tools, and enterprise application suites delivered through local infrastructure. Additionally, these investments have stimulated workforce development as hyperscalers partner with educational institutions and training providers to develop local talent capable of designing, deploying, and managing cloud-native applications. The competitive dynamics among global providers have resulted in continuous service enhancements and pricing optimizations that benefit end-users throughout the market.

Rising Demand for Colocation and Managed Hosting Services

The colocation market Saudi Arabia has experienced substantial growth as enterprises seek flexible deployment options that balance control, cost efficiency, and scalability. Organizations increasingly recognize the advantages of housing critical infrastructure within professionally managed facilities that offer superior power reliability, cooling efficiency, connectivity options, and physical security compared to traditional on-premises environments. This shift reflects a broader maturation of the market as businesses optimize their IT strategies around hybrid architectures that combine colocation, cloud, and edge deployments.

Managed hosting services have emerged as a compelling option for organizations seeking to offload infrastructure management responsibilities while retaining dedicated resources. Service providers have responded by developing sophisticated offerings that combine physical infrastructure with comprehensive management layers including monitoring, maintenance, security operations, and technical support. The appeal of these services extends across enterprise segments, from large corporations seeking to optimize IT operations to mid-market companies lacking internal expertise for complex infrastructure management. Furthermore, specialized colocation offerings have emerged to serve specific vertical requirements including financial services, healthcare, and government sectors with enhanced compliance capabilities.

Growth of Smart Cities and Digital Government Driving Data Storage Needs

Saudi Arabia's ambitious smart city initiatives, exemplified by mega-projects designed to showcase sustainable urban development and technological innovation, are generating significant demand for data infrastructure. These visionary developments require extensive sensor networks, real-time data processing capabilities, and integrated platforms that connect transportation, utilities, public safety, and citizen services. The data volumes generated by smart city deployments necessitate substantial storage and processing capacity positioned to enable low-latency responses for time-sensitive applications.

Digital government transformation represents another powerful demand driver as ministries and agencies modernize service delivery through online platforms, mobile applications, and integrated citizen portals. The digitization of government services requires robust backend infrastructure capable of handling transaction volumes, storing citizen records securely, and enabling seamless interoperability across agencies. E-government initiatives extend to document management, licensing systems, healthcare records, and educational platforms, each contributing to aggregate data storage and processing requirements. The government's commitment to digital-first service delivery establishes sustained demand for data center capacity that will continue expanding as new services launch and existing platforms mature.

Increasing Investments in Renewable Energy-Powered Data Centers

Sustainability considerations have emerged as a defining characteristic of modern data center development, with operators increasingly prioritizing renewable energy sourcing and energy-efficient designs. Saudi Arabia's abundant solar resources present unique opportunities for powering data facilities with clean energy, aligning infrastructure development with broader environmental objectives. Progressive operators are implementing innovative cooling technologies, optimized power distribution systems, and intelligent workload management to minimize energy consumption and reduce operational costs.

The convergence of sustainability imperatives and economic considerations drives continuous innovation in data center design and operations. Operators are exploring advanced cooling approaches including liquid cooling systems that enable higher density deployments while reducing energy overhead. Building designs incorporate features that minimize heat gain and optimize airflow, while sophisticated management systems dynamically adjust power and cooling based on real-time workload patterns. These investments in sustainable infrastructure align with the preferences of enterprise customers increasingly required to demonstrate environmental responsibility throughout their supply chains. Furthermore, renewable energy integration supports Saudi Arabia's broader sustainability commitments while potentially providing cost advantages as solar generation economics continue improving.

Expansion of 5G Networks Enhancing Low-Latency Data Processing Demand

The rollout of fifth-generation wireless networks across Saudi Arabia is transforming connectivity paradigms and creating new requirements for distributed data processing infrastructure. Applications leveraging 5G capabilities including enhanced mobile broadband, massive machine-type communications, and ultra-reliable low-latency communications require computing resources positioned at network edges to deliver responsive user experiences. This architectural shift drives demand for edge data center deployments that complement traditional centralized facilities.

The proliferation of 5G-enabled applications spanning industrial automation, augmented reality, autonomous systems, and real-time analytics creates sustained demand for processing capacity distributed throughout metropolitan areas. Telecommunications operators are expanding their infrastructure portfolios to include edge computing capabilities that enable service delivery meeting stringent latency requirements. Enterprise adoption of 5G-dependent applications further accelerates demand for distributed infrastructure capable of processing data streams generated by connected devices, sensors, and mobile users. The symbiotic relationship between 5G networks and edge computing infrastructure establishes a foundation for innovative applications that will continue driving market expansion.

Market Segmentation and Regional Insights:

Breakup by Data Center Size:

- Large data centers serve as foundational infrastructure for enterprise deployments, offering substantial capacity suitable for organizations with significant but contained computing requirements. These facilities balance scale with operational flexibility, enabling tenants to expand capacity as business needs evolve.

- Massive facilities represent substantial infrastructure investments designed to accommodate growing enterprise workloads and multi-tenant colocation requirements. These data centers provide extensive capacity while maintaining the flexibility necessary to serve diverse customer requirements across multiple deployment models.

- Medium data centers address the requirements of mid-market enterprises and regional operations seeking professional hosting environments without the scale of larger facilities. These facilities offer cost-effective options for organizations with moderate capacity requirements and localized service needs.

- Mega data centers represent the largest infrastructure deployments, typically associated with hyperscale cloud providers and major technology companies. These facilities leverage massive scale to achieve operational efficiencies while serving cloud platforms, content delivery networks, and enterprise applications with global reach.

- Small data centers serve localized requirements including edge deployments, branch office connectivity, and specialized applications requiring proximity to end users or specific geographic positioning. These facilities play increasingly important roles as distributed computing architectures proliferate.

Breakup by Tier Type

- Tier 1 and 2 facilities provide foundational infrastructure suitable for non-critical applications and development environments where occasional downtime remains acceptable. These facilities offer cost-effective options for workloads with lower availability requirements.

- Tier 3 data centers deliver concurrently maintainable infrastructure enabling routine maintenance without service interruption. These facilities serve enterprise applications requiring enhanced reliability while balancing capital and operational costs.

- Tier 4 facilities represent the highest reliability tier with fully fault-tolerant infrastructure designed to withstand component failures without service impact. These premium facilities serve mission-critical applications where downtime carries significant business consequences.

Breakup by Absorption

- Non-Utilized capacity represents available infrastructure ready for deployment as customer demand materializes. This inventory enables rapid provisioning for new requirements while indicating market supply conditions and future absorption potential.

- Utilized capacity reflects active deployments serving customer workloads across colocation, cloud, and enterprise hosting models. Utilization rates provide insights into market dynamics, pricing pressures, and requirements for additional capacity development.

Breakup by Region

- Northern and Central Region encompasses the capital city of Riyadh and surrounding areas representing the primary concentration of government, financial services, and corporate headquarters. This region attracts substantial data center investment given proximity to major enterprise customers and government agencies.

- Western Region includes Jeddah and Makkah, serving as a commercial hub with significant demand from retail, logistics, and hospitality sectors. The region's importance as a commercial and pilgrimage destination drives requirements for robust digital infrastructure.

- Eastern Region houses the Kingdom's energy sector operations concentrated around Dammam and surrounding industrial areas. Energy companies and supporting industries generate significant data processing requirements for operational technology and enterprise systems.

- Southern Region represents an emerging market with growing infrastructure requirements as development initiatives extend throughout the Kingdom. Expanding economic activity and population growth create nascent demand for localized data processing capabilities.

Forecast (2025–2033):

The market outlook for the Saudi Arabia data center market research period spanning 2025 through 2033 reflects sustained expansion driven by cloud migration, artificial intelligence adoption, and rising digital transaction volumes. Enterprise digital transformation initiatives continue accelerating as organizations recognize the competitive advantages enabled by modern technology platforms. The proliferation of cloud-native applications, data analytics solutions, and customer-facing digital services generates consistent demand for scalable infrastructure capable of supporting dynamic workload requirements.

Demand drivers extend across multiple dimensions including government digitalization programs, technology investment inflows from international sources, increased data traffic from consumer and enterprise applications, proliferation of Internet of Things devices across industrial and consumer domains, and enterprise modernization initiatives spanning legacy system replacement and business process automation. The convergence of these factors establishes a robust foundation for continued market expansion throughout the forecast period. Furthermore, Saudi Arabia's strategic positioning as a regional technology hub attracts investments that serve broader Middle Eastern markets while satisfying local requirements. The maturation of the ecosystem, evidenced by expanding hyperscaler presence, domestic operator capabilities, and supporting service provider networks, creates favorable conditions for sustained growth trajectory.

Conclusion:

The Saudi Arabia data center market stands at an inflection point characterized by transformative investments, expanding capabilities, and sustained demand growth. Vision 2030's influence permeates every aspect of market development, from regulatory frameworks to investment priorities, establishing conditions conducive to continued expansion. The entry of global hyperscalers has elevated market sophistication while creating competitive dynamics that benefit enterprise customers throughout the Kingdom. Sustainability imperatives drive innovation in facility design and operations, aligning infrastructure development with broader environmental objectives.

Regional dynamics reflect the Kingdom's economic geography, with concentrated demand in primary commercial centers complemented by emerging requirements across developing regions. The expansion of 5G networks and edge computing architectures creates new infrastructure requirements that extend beyond traditional centralized deployments. Smart city initiatives and digital government transformation establish sustained demand drivers that will persist throughout the forecast period and beyond.

Choose IMARC Group As We Offer Unmatched Expertise and Core Services

- Strengthen your understanding of Saudi Arabia’s data center rollout, tech adoption paths, and facility upgrades through targeted research that explains market movement and positioning.

- Track upcoming shifts in cloud growth, edge deployments, greener facility designs, and how capacity is spreading across the country.

- Review the colocation field by comparing operators, their strengths, service changes, pricing moves, and partner activity that shapes buyer decisions.

- Keep up with new rules, national programs, and incentives affecting licensing, construction, operations, and cross-border data movement.

- Request custom studies built around your goals, whether entering the market, expanding sites, weighing investments, or forming tech alliances in the region.

IMARC Group equips tech leaders with clear guidance to act confidently in Saudi Arabia’s fast-building digital sector and make choices that deliver stronger results.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)