Innovation Driving Change in India’s Textile Industry

.webp)

Introduction:

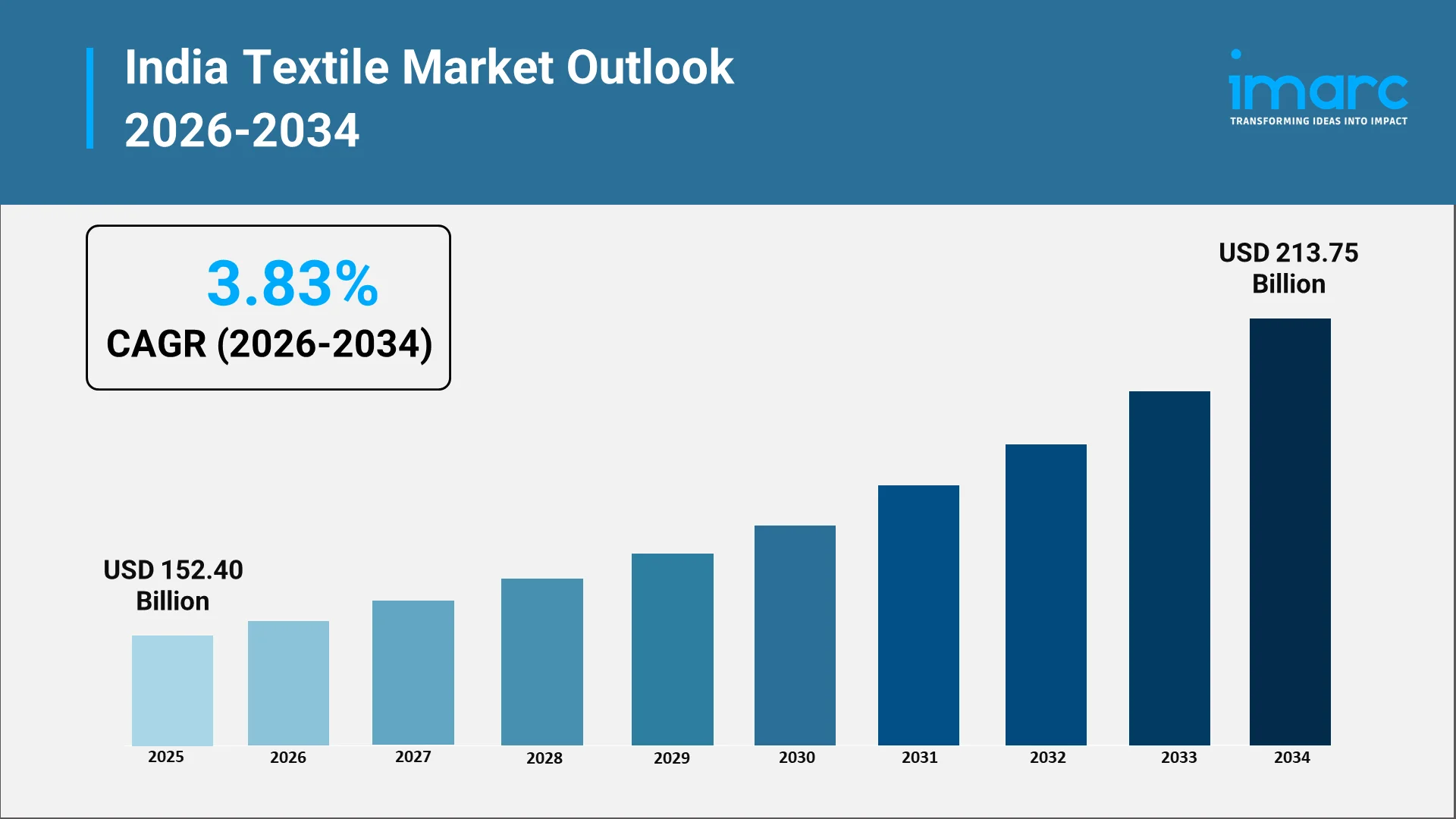

The drivers for changing India's textile sector include sustainability, modernization of production, and the introduction of advanced chemical solutions. The India textile market size was valued at USD 152.40 Billion in 2025. The market is projected to reach USD 213.75 Billion by 2034, exhibiting a CAGR of 3.83% from 2026-2034. It places the India textile chemicals market at an important position in this evolution, enabling everything from fiber processing to finishing. It is chemical innovations that allow the production of high-quality fabrics with superior texture, durability, and eco-efficiency. Growing demand for functional and performance textiles also influences how the India textile chemicals industry is developing new solutions to align with global standards in sustainability. These changes mark a decisive shift toward technology-driven textile production, where innovation defines competitiveness.

Explore in-depth findings for this market, Request Sample

Role of Textile Chemicals, Impact, and Benefits in the Indian Textile Value-Chain:

Textile chemicals are used in almost all stages of processing textiles, starting from pre-treatment, dyeing, and printing to finishing and coating. In the textile chemicals market in India, the chemicals improve fiber properties, ensure color fastness, enhance texture, and improve performance characteristics. Their contribution is not just for aesthetics but equally critical in improving manufacturing efficiency and meeting regulatory norms.

Pre-treatment chemicals serve to remove impurities and improve the absorbency of natural fibers such as cotton and silk. Advanced chemical formulation in dyeing and printing ensures that colors appear even and last long. Finishing chemicals set the final touches that define fabric quality: softness, wrinkle resistance, or water repellency. Besides these, functional finishes like antimicrobial, anti-odor, and UV-resistant coatings are fast becoming the standard in modern textile applications.

The India textile chemicals market share is expanding due to the increasing focus on high-performance fabrics and technical textiles. As global consumers demand more sustainable and durable products, Indian manufacturers are adopting green chemistry practices to reduce environmental impact. For instance, Archroma introduced its “NTR Printing System” — a biobased pigment printing solution deriving from renewable raw materials and designed for safer chemistry — in October 2024. This shift has created a wave of innovation, encouraging chemical suppliers to develop eco-friendly and biodegradable alternatives. The result is a more resilient and competitive textile ecosystem that supports both export potential and domestic demand.

Key Growth Drivers in India Textile Chemicals Market:

Multiple factors are driving up the India textile chemicals market size, including macro-economic and technological. Among these factors, one of the most influential ones is the growing demand for apparel, home furnishings, and technical textiles across both domestic and international markets. The strong manufacturing base of India, combined with the government's initiatives to boost exports, very strongly underpins growth in the India textile chemicals industry.

Growing Attention towards Green and Eco-Friendly Chemicals

Sustainability has become a central theme within the textile value chain. Manufacturers are increasingly investing in bio-based dyes, nontoxic finishing agents, and low water consumption dyeing technology. For example, Shree Pushkar Chemicals & Fertilisers Ltd has introduced its “DYECOLESR” series of reactive dyes — designed to bond more efficiently with cotton and reduce water and salt usage significantly. Green chemistry innovations are assisting not only in reducing environmental pollution but also in ensuring better export compliance with global regulations like REACH and ZDHC. In turn, this is driving the demand for sustainable formulations that appeal to environmentally aware brands and conscious consumers in India textile chemicals market.

Growth of the Technical Textiles Sector

Another driving factor is the rapid expansion of India's technical textile industry into automotive, medical, geotextiles, and protective clothing. Technical textiles have specific performance requirements that necessitate special chemical treatments to impart properties such as fire resistance, UV stability, and antibacterial protection. These factors have increased the demand for advanced auxiliaries and coating materials in the textile chemicals market in India, thereby strengthening its long-term growth prospects.

Technological Advancements and R&D Investments

Innovation through R&D is redefining the landscape of the India textile chemicals industry. Much effort is being directed at developing high-efficacy dyes and multifunctional finishes through nanotechnology and polymer science. For example, Fineotex Chemical Limited has signed an MOU with SASMIRA – The Synthetic & Art Silk Mills’ Research Association to establish a state-of-the-art R&D centre focused on sustainable speciality chemicals that reduce water, time and energy consumption in textile wet processing. In this regard, technology shapes the future of textile chemicals through digitally controlled dyeing systems, enzyme-based pretreatments, and waterless processing. Such innovations are making processes efficient, less wasteful, and ultimately assure product consistency to strengthen the global competitiveness of India.

Regulatory Framework and Policy Landscape in the Textile Chemicals Industry:

The regulatory mechanism in India textile chemicals market maintains an enabling environment for environmental protection and consumer safety. The Environment Protection Act, Hazardous Waste Management Rules, and BIS certifications on usage, disposal, and labeling practices put chemical usage in the textile industry within the ambit of strict regulations. Manufacturers intending to export their products into other regions where environmental policies are strict have a number of these standards to adhere to.

India's regulatory ecosystem is gradually but surely changing to adopt less harmful and safer chemicals. Adoption of international best practices through programs like Zero Discharge of Hazardous Chemicals and Global Organic Textile Standard is on the rise in India textile chemicals industry. For example, OETI India—an official Zero Discharge of Hazardous Chemicals (ZDHC) Foundation Approved Solution Provider—has begun offering targeted training sessions across Indian textile hubs (such as Tiruppur, Delhi, Bangalore?and?Ahmedabad) on implementing ZDHC’s Chemical Management System framework. This provides a comprehensive platform for encouraging chemical manufacturers to consider sustainability at the formulation stage so that downstream processes will remain compliant with global environmental goals.

Furthermore, the drive toward circularity within the textile value chain is motivating closed-loop systems in which water, heat, and chemicals can be kept circular within production facilities. This trend is increasingly influencing regulatory policy changes, driving the India textile chemicals market share to promote companies demonstrating transparency, traceability, and eco-efficiency in their product portfolios.

Government Support / Initiatives for the Textile Chemicals Industry:

The strategic relevance of the textile industry is recognized by the Indian government, which has subsequently undertaken various initiatives to make it globally competitive. In this regard, the Production Linked Incentive (PLI) Scheme for Textiles, the National Technical Textiles Mission, and the Integrated Textile Parks Scheme have been of immense help as they facilitate investments in state-of-the-art manufacturing infrastructure and thereby give a boost to the India textile chemicals industry. Additionally, the government’s push through schemes such as PM MITRA Parks and the National Technical Textiles Mission (NTTM) further supports integrated textile parks, common infrastructure and advanced specialty textile segments—each of which in turn creates increased demand for high-performance textile chemicals used in processing, finishing and coatings.

The PLI Scheme provides impetus to the manufacturers for the adoption of better chemical technologies that improve the quality and sustainability of fabrics. The National Technical Textiles Mission aims at innovation in high-performance textiles, which intrinsically requires better chemical processing of textiles. This directly helps in expanding India textile chemicals market size by way of increasing demand for special coatings, adhesives, and finishing agents.

The development of R&D in green chemistry and nanotechnology applications continues with the help of government-supported research institutions and industry collaborations. Leading research institutions such as the South India Textile Research Association (SITRA) are actively working on “innovative silica nanoparticles and low-cost cross-linkers based hydrophobic chemical formulations” as alternatives to fluorinated finishes. Chemical manufacturers are also getting encouragement through incentives for the adoption of clean technology and wastewater treatment infrastructure for sustainable manufacturing practices. These initiatives support not only domestic industries but also position India's standing in the global textile chemicals market in India, aligning with global export opportunities.

Opportunities and Challenges in Textile Chemicals Industry:

The India textile chemicals market presents an array of opportunities thanks to innovation, digital transformation, and ecological targets. On the other side are challenges emanating from repeatedly fluctuating prices of raw materials, environmental regulations, and skilled manpower required for advanced chemical processes.

Emerging Opportunities

The move towards smart textiles, antimicrobial fabrics, and performance wear has brought in new business opportunities. Innovations in nanotechnology, enzyme-based processing, and digital dyeing would help the India textile chemicals industry meet these emerging requirements. Now that the global consumers are turning eco-friendly, India's emergence as a hub for green textile chemical manufacturing would be well-timed.

Apart from that, increasing joint ventures of domestic players with international chemical firms are promoting technology transfer and capacity expansion. With the rise in demand for quality textile exports, the share of the India textile chemicals market would grow attributed to better infrastructure, automation, and regulatory compliance.

Key Challenges

Despite the huge growth potential, the textile chemicals market in India still faces challenges concerning environmental sustainability and regulatory enforcement. Chemical effluent management and proper waste disposal continue to pose significant challenges, particularly among small- and medium-scale manufacturers. The high cost of sustainable chemical formulations can also deter widespread adoption, particularly in cost-sensitive markets.

Fluctuating crude oil prices affect raw material costs, resulting in supply-chain uncertainties in the India textile chemicals market size. Furthermore, there is inconsistency related to technology adoption due to the fragmented nature of the textile sector. Resolving all these issues demands policy alignment, capacity building, and greater collaboration between government bodies, research institutions, and industry players.

The Road Ahead: Innovation as the Catalyst for Transformation

The balancing of industrial growth with environmental responsibility is the future of the India textile chemicals market. The transitioning toward smart, sustainable, and high-performance textiles will continue to reshape the priorities in chemical innovation. Industry players are expected to develop multifunctional formulations that improve durability and comfort while reducing ecological impact.

The India textile chemicals industry will play a pivotal role in enabling product differentiation and compliance with international standards as India secures a stronger position in global textile exports. Such cooperation will be needed at all levels, including among chemical manufacturers, textile producers, and policymakers, for simultaneous innovation and sustainability. Digital tools will be increasingly adopted for process monitoring, predictive maintenance, and formulation optimization to further improve operational efficiency. The integration of renewable resources, bio-based solvents, and green finishing agents will also expand the textile chemicals market in India. The India textile chemicals market share is thus likely to sustain expansion for the next decade to come, in tune with the broader vision of the nation for self-reliance and sustainable industrial growth.

Conclusion:

From fiber processing to final finishing, innovation is recasting each layer of India's textile ecosystem. The India textile chemicals market stands at an interesting crossroads of sustainability, technology, and industrial growth that will drive the transition toward a cleaner, smarter, and more globally competitive sector. As the industry moves further into eco-friendly formulation, automation, and regulatory compliance, it will unlock newer value throughout the supply chain. The India textile chemicals industry is not just meeting present-day production needs but is also setting the foundation for future-ready textile manufacturing. With government support, global partnerships, and continuous innovation, India is poised to strengthen its leadership in the textile chemicals market in India, achieving growth in both domestic and international markets. The convergence of green chemistry and digital innovation ensures that the India textile chemicals market size will expand sustainably, positioning the country as a global hub for advanced textile solutions.

Gain Strategic Insights into India’s Textile Sector with IMARC Group:

The India textile chemicals market and the wider textile industry are experiencing rapid transformation driven by technological innovation, sustainability initiatives, and changing consumer demands. Navigating raw material sourcing, chemical formulations, and eco-friendly manufacturing processes requires reliable, data-backed insights.

IMARC Group delivers detailed research on market size, segmentation, and growth projections, covering critical aspects such as textile chemical consumption, production techniques, and the competitive landscape across manufacturers, suppliers, and end-users. Our studies also track trends in functional finishes, sustainable fibers, and compliance with evolving regulations, helping stakeholders stay ahead of industry shifts.

Through strategic forecasting, benchmarking, and custom market studies, IMARC Group empowers investors, manufacturers, and policymakers to identify opportunities, mitigate risks, and make informed decisions. We enable clients to capitalize on the growth of the India textile chemicals industry, fostering innovation, efficiency, and sustainable expansion across the sector.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)