The Rise of Online Retail in India

India's consumer landscape is experiencing a profound transformation, driven by rapid digital adoption, evolving consumer preferences, and robust infrastructure development. The shift from traditional brick-and-mortar shopping to digital platforms represents more than a mere change in purchasing channels—it signifies a fundamental restructuring of how businesses engage with consumers and how millions of Indians access goods and services. The India online retail market has emerged as one of the most dynamic sectors in the nation's economy, reshaping everything from supply chain logistics to payment systems while creating unprecedented opportunities for entrepreneurs, established brands, and consumers alike.

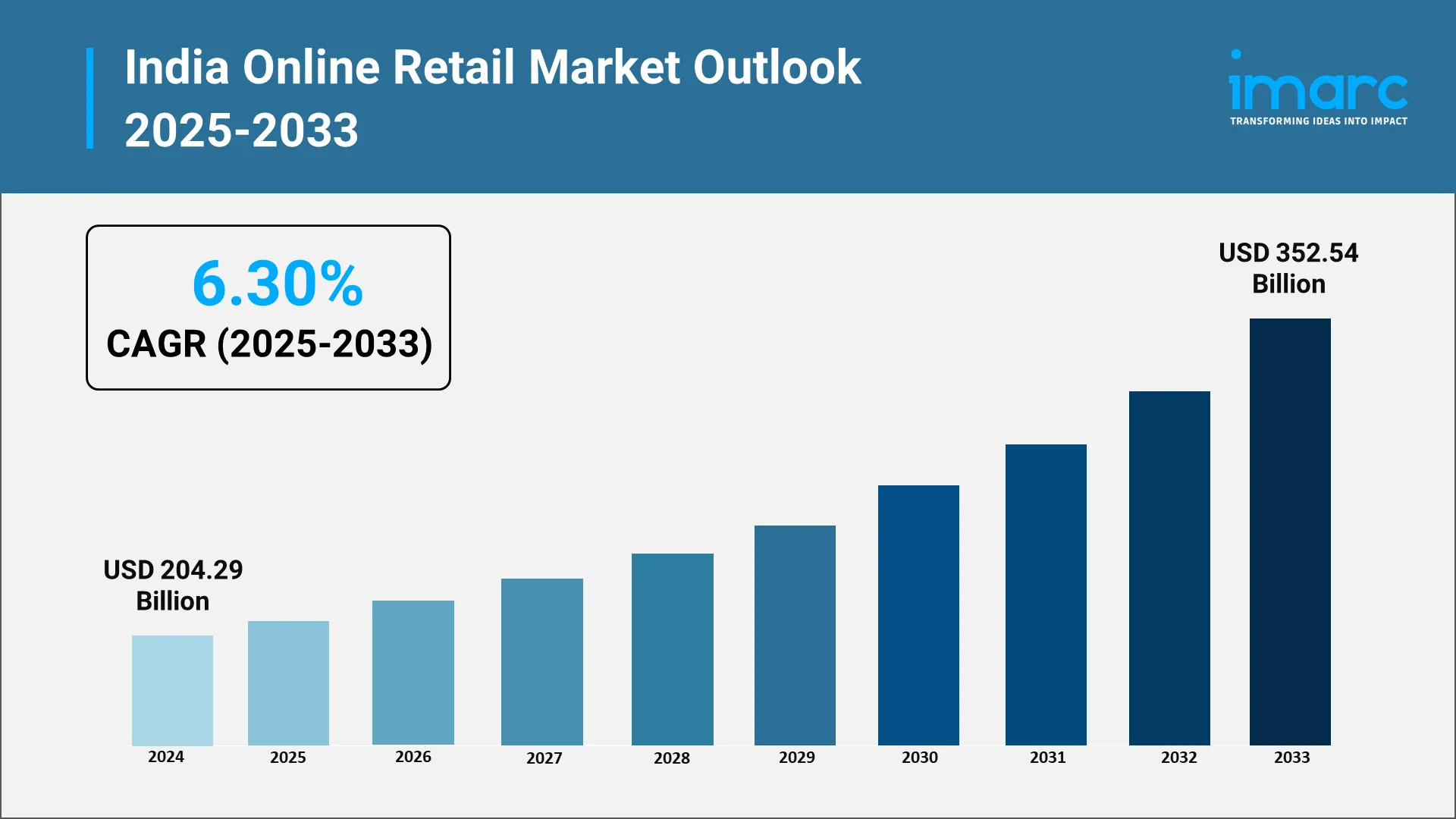

This transformation is underpinned by several converging factors such as widespread smartphone penetration, affordable data plans, improved digital payment infrastructure, and a young, tech-savvy population eager to embrace convenience. In 2024, the India online retail market size reached USD 204.29 Billion in 2024. IMARC Group further estimates the market to reach USD 352.54 Billion by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033 .As digital commerce continues its upward trajectory, understanding the mechanisms, regulations, and opportunities within this space becomes essential for businesses seeking to capitalize on India's consumer boom.

Explore in-depth findings for this market, Request Sample

Online Retail in India: Impact and Benefits for India's Consumer Economy

The growth of India online retail sector has contributed to many economic and social dividends that accrue well beyond the virtual marketplace. A most profound consequence has been the democratization of access to goods and services. Consumers in tier-2 and tier-3 cities, as well as rural areas, now have the same range of products as their urban counterparts, shrinking the geographical dividing lines that hindered consumer choice historically.

Digital retail platforms have also contributed in a big way to the creation of jobs in various segments of the economy. Right from warehouse operations and logistics management to customer service and technology development, the online retail industry in India has opened employment avenues for millions of people. The delivery personnel, packaging staff, digital marketing professionals, and software developers are just a small fraction of the workforce that this sector supports.

The benefits for consumers are no less impressive: online retail involves unparalleled convenience for shoppers, who can browse through long lists of products, instantly compare prices, read customer reviews, and make purchases sitting comfortably in their homes at any time of day. The nature of competition in digital marketplaces has also lowered prices and raised standards of service, with platforms competing furiously for customer loyalty through discounts, faster delivery, and enhanced experiences.

According to industry reports by IBEF, more than 900 million internet users are expected in India, providing a huge addressable market for the e-commerce platforms. In addition, the integration of digital payments has accelerated the movement toward a cashless economy in India, with improved transparency of transactions and increasing financial inclusion. And the ripples are seen in the ancillary industries too-with logistics and warehousing sectors witnessing unprecedented growth along with technology services, digital advertising, and fintech solutions.

Key Growth Drivers Fueling India's Online Retail Market:

Several interrelated factors are driving the phenomenal growth of the India online retail market. All of this is rooted in India's rapidly improving digital infrastructure. In the last ten years, internet penetration has grown leaps and bounds, backed by the availability of affordable smartphones and one of the lowest data rates in the world. This level of digital accessibility has brought hundreds of millions of new users online, creating a massive addressable market for e-commerce platforms.

Demographic trends strongly favor continued digital retail growth. India boasts one of the youngest populations in the world, with a median age in the late twenties. This is a demographic that is inherently comfortable with technology, values convenience, and shows high digital engagement. As this population segment enters its peak earning and spending years, their purchasing power and digital-first shopping preferences will drive sustained market expansion.

The landscape of payment infrastructure has indeed been one of transformation. The broad-based adoption of digital wallets, Unified Payments Interface, and mobile banking has removed many of the points of friction that earlier impeded online transactions. It allows consumers to complete a purchase with ease and devoid of cash or card dependencies while businesses see quicker settlement cycles and reduce costs per transaction.

The development of capabilities in logistics has been phenomenal, with significant investments being made by companies in supply chain infrastructure, warehousing facilities, and delivery networks. Innovations such as hyperlocal delivery, express shipping options, and technology-enabled route optimization have dramatically improved delivery speed and reliability. These improvements directly address previous consumer pain points relative to delivery times and product quality.

Product category expansion has also driven growth: while electronics and fashion were among the early online bestsellers, groceries, furniture, home appliances, beauty products, and even automobile parts have started to take up significant shares of digital markets. The rapid rise of the Indian online grocery market further highlights how essential categories are shifting to digital channels. Social commerce is yet another emerging driver of growth: enabling shopping features on social media platforms opens up new discovery and purchase paths that prove particularly popular with younger consumers.

Key Regulations and Policies Shaping India's E-Commerce Industry:

The regulatory framework for the India online retail market share has significantly changed as policymakers seek to strike a balance between innovation and growth on one side, and consumer protection with fair competition on the other. These regulations must be firmly understood by any business operating within or entering the Indian digital retail space.

One of the most significant regulatory frameworks is the Foreign Direct Investment policy for e-commerce. The current regulations differentiate between marketplace and inventory-based models, where foreign investment is allowed in marketplace models if platforms act only as an intermediary between buyers and sellers. However, inventory-based models come with restrictions on foreign ownership wherein the platforms maintain and sell their own stock.

Much attention has been paid to the strengthening of consumer protection regulations. The Consumer Protection Act lays down clear directives on product liability, unfair trade practices, and consumer rights in digital transactions. E-commerce platforms are now required to ensure transparent pricing, clear return and refund policies, and exact product descriptions. These provisions empower consumers and set accountability standards that raise overall market quality.

Data privacy and security regulations are becoming increasingly strict. Platforms should have robust protection mechanisms for information, obtain explicit consent for collecting and using data, and be transparent on how personal information is processed. India, too, is on the path of developing comprehensive data protection legislation; therefore, compliance requirements are expected to further increase.

In addition, the taxation frameworks have also been updated for digital commerce. The establishment of the system of Goods and Services Tax created a unified tax structure, which simplifies compliance for businesses operating across multiple states. Competition regulations are in place to ensure fair market practices and ward off monopolistic behaviors. Regulatory bodies monitor anti-competitive issues, such as predatory pricing and exclusive product arrangements.

Government Initiatives Driving India's Online Retail Industry:

Government programs and initiatives have played a catalytic role in accelerating the growth of the India online retail market size. Recognizing digital commerce as a strategic priority for economic development, authorities have implemented numerous schemes designed to enhance infrastructure, support businesses, and promote digital literacy.

The Digital India initiative represents a comprehensive vision for transforming the country into a digitally empowered society and knowledge economy. This program has driven investments in broadband connectivity, mobile network expansion, and digital services infrastructure that form the foundation for e-commerce growth.

As per Press Information Bureau (PIB), since its introduction in 2016, the Government e-Marketplace (GeM) has generated cumulative GMV of approximately Rs. 15,00,000 Crore (US$ 171.3 Billion) as of August 2025, demonstrating its ability to promote inclusive and transparent digital public procurement. This milestone demonstrates the government's commitment to digitizing procurement and creating opportunities for businesses across India.

According to Policy Circle, by the beginning of 2025, ONDC had grown its network to 72 seller applications, reaching over 1,200 cities, and onboarded over 7 lakh sellers. The Open Network for Digital Commerce initiative aims to democratize e-commerce by creating an open, interoperable platform that reduces dependency on major marketplaces and empowers small businesses across the country.

Startup India and related entrepreneurship support programs have nurtured the e-commerce ecosystem by providing funding access, regulatory simplifications, and mentorship for new ventures. Financial inclusion programs, particularly the push toward digital payments, have directly supported e-commerce growth by creating incentives for digital payment adoption and building supporting infrastructure.

Skill development initiatives address the growing demand for digital commerce talent. Training programs in areas such as digital marketing, logistics management, data analytics, and software development help create the skilled workforce that e-commerce platforms require, ensuring that employment growth within the sector is sustainable.

Key Opportunities and Challenges in India's Online Retail Industry:

The online retail industry in India presents numerous promising opportunities alongside significant challenges that businesses must navigate carefully. Understanding both dimensions is essential for developing effective strategies in this dynamic market.

The untapped potential in tier-2, tier-3, and rural markets represents perhaps the most significant opportunity. While major cities account for substantial e-commerce volumes, hundreds of millions of potential consumers in smaller cities and rural areas remain underserved. As internet connectivity improves and digital literacy increases in these regions, platforms that successfully adapt their offerings will capture significant growth.

Category expansion offers another major opportunity. While certain product segments have achieved strong online penetration, numerous categories remain primarily offline. Groceries, healthcare products, automobile accessories, and various service offerings present substantial whitespace. Technology integration presents continuous opportunities for differentiation and efficiency gains through artificial intelligence, machine learning, augmented reality, and automation.

However, significant challenges accompany these opportunities. Infrastructure limitations, particularly in logistics and last-mile delivery, remain obstacles in many regions. Poor road connectivity, address standardization issues, and limited warehousing capacity in smaller cities create operational difficulties and increase costs.

Building and maintaining consumer trust presents ongoing challenges. Concerns about product authenticity, data security, and payment safety can deter potential customers, particularly first-time online shoppers. Platforms must invest continuously in quality assurance, secure payment systems, and transparent policies to build confidence.

Intense competition and margin pressures characterize the market. With numerous platforms competing for customers, heavy discounting and promotional spending have compressed profitability. Achieving sustainable unit economics while maintaining growth requires careful balance between customer acquisition costs, retention investments, and pricing strategies.

Regulatory compliance poses ongoing challenges as frameworks continue to evolve. Businesses must invest in legal expertise, compliance systems, and adaptable operational processes to meet changing requirements regarding taxation, data protection, consumer rights, and competition practices.

Partner with IMARC Group for Unmatched Market Intelligence:

At IMARC Group, we deliver comprehensive market intelligence tailored to the evolving needs of businesses navigating India's online retail transformation. Our core services provide the strategic insights necessary for informed decision-making in this dynamic sector.

- Data-Driven Market Research: Gain deep understanding of consumer behaviors, competitive dynamics, platform strategies, and category-specific trends through rigorous quantitative and qualitative analysis that illuminates the digital retail ecosystem.

- Strategic Growth Forecasting: Anticipate market developments, technology adoption patterns, regional expansion opportunities, and category evolution through sophisticated modeling that identifies emerging opportunities before they become obvious.

- Competitive Benchmarking: Understand competitive positioning, platform differentiation strategies, logistics capabilities, and technological advantages through systematic analysis that reveals what separates market leaders from followers.

- Policy and Infrastructure Advisory: Navigate regulatory requirements, compliance obligations, and infrastructure developments affecting digital commerce operations through expert guidance that minimizes risk and identifies policy-driven opportunities.

- Custom Reports and Consulting: Receive tailored insights addressing your specific strategic questions—whether planning market entry, evaluating expansion opportunities, or optimizing operational efficiency in India's digital retail landscape.

IMARC Group empowers businesses with the clarity and intelligence required to succeed in India's rapidly evolving online retail market. Partner with us to transform market complexity into strategic advantage—because in the digital economy, informed decisions drive sustainable growth. Click here, https://www.imarcgroup.com/india-online-retail-market, for more information.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)