Innovation Drives Growth in India's Cosmetics Industry

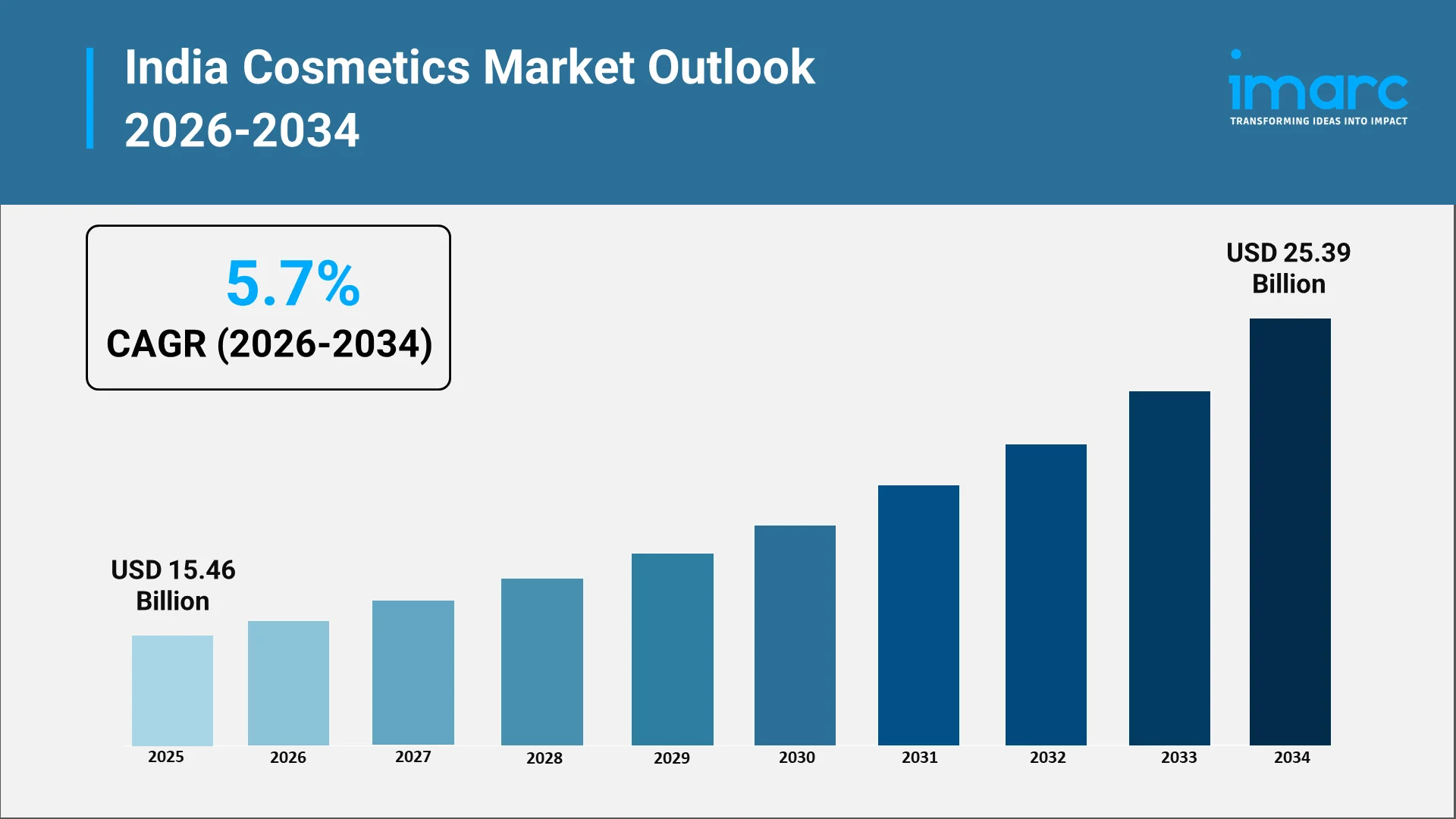

The beauty landscape in India is undergoing a major transformation propelled by creativity, research, and technology. The India cosmetics market size was valued at USD 15.46 Billion in 2025. Looking forward, the market is expected to reach USD 25.39 Billion by 2034, exhibiting a CAGR of 5.7% from 2026-2034. Innovation has become the bedrock of growth in the India Cosmetics market, with increased awareness and changing consumer preferences. New product development, eco-friendly formulation, and digital engagement tools are changing not only how beauty products are created but also how they will be marketed and consumed. This evolution reflects a larger cultural shift toward individuality, self-expression, and conscious consumption, making the cosmetics industry one of the most dynamic consumer sectors in India.

Modern consumers are not just looking for cosmetics for appearance improvement but for holistic well-being. Therefore, brands merge science, nature, and heritage into products that appeal to the diversity of beauty standards in India. The rise in acceptance of clean, cruelty-free, and customized beauty lines is a trend that the cosmetics market is taking in India. From sustainable packaging to AI skin analysis, the change is everywhere, showcasing the industry's ability to adapt to change.

Explore in-depth findings for this market, Request Sample

Growing Trends and Opportunities in Indian Cosmetic Industry:

Innovation characterizes everything from product conceptualization to the final phase of consumer engagement in the cosmetics market of India. Brands reimagine beauty as a reflection of good health, sustainability, and inclusivity. The incorporation of modern science with the traditional heritage of skincare in India has resulted in a fusion that caters to the preferences of both the young and the old. In 2025, L’Oréal India launched the dermatologist-recommended brand La Roche-Posay across India, bringing advanced formulations such as Mela B3 Serum and Effaclar specifically tailored for Indian skin.

One of the most noticeable trends is the emergence of personalized beauty. Technology now enables tailored skincare and makeup solutions based on individual needs, skin tone, and climate. Consumers value experiences that align with their unique preferences, leading companies to invest heavily in data analytics and digital engagement platforms. These developments make the India Cosmetics market more customer-centric and responsive to changing habits.

Sustainability is another cornerstone of innovation. The modern-day conscious consumer favors products with minimal environmental impact. From biodegradable packaging to refillable containers and the use of plant-based ingredients, the notion of luxury is getting redefined. The use of green materials exemplifies how innovations connect business growth with social responsibility, reassuring that progress in the cosmetics industry within India would be ethical and inclusive. For example, Garnier India has committed to eliminate virgin plastic from all its packaging by 2025 and is working towards carbon-neutral manufacturing, as part of its “Green Beauty” programme.

Wellness-driven beauty has grown from a trend to a way of living. The link between skincare, mental health, and nutrition is now driving buying decisions. Consumers are increasingly thinking of beauty as self-care, and this shift offers new avenues to holistic product development. The blending of traditional botanicals with modern formulations illustrates how the cosmetics market size is diversifying while maintaining its cultural authenticity.

Inclusivity has also become an essential factor. With India’s diverse population, brands are expanding shade ranges, textures, and product types to cater to various skin tones and hair types. The celebration of natural beauty, combined with progressive marketing narratives, ensures that innovation extends beyond science to social representation. Together, these changes underscore how creativity and technology are elevating the India cosmetics market to global standards.

Major Challenges in the India Cosmetics market:

Despite significant growth, the India cosmetics market faces persistent challenges that test its resilience and adaptability. While innovation drives expansion, it also demands continuous reinvention, efficiency, and a careful balance between quality, authenticity, and affordability. A major hurdle is harmonizing traditional beauty practices with modern consumer expectations. Indian consumers value heritage routines yet remain discerning about global brands, requiring companies to invest in deep research, skilled formulation, and clear communication to build trust and stay relevant. Product differentiation in a highly saturated market is another critical challenge, as standing out demands creativity in design, storytelling, and innovation. Without a distinct value proposition, even high-quality products risk being lost in the competitive landscape.

Supply chain complexity further complicates growth. Diverse ingredient sourcing, manufacturing standards, and packaging requirements can increase costs or slow production, particularly for smaller brands struggling to scale efficiently. Investments in advanced manufacturing technologies and transparent sourcing systems are essential to support sustainable growth across the market. Regulatory compliance also remains a pressing concern. Meeting safety standards, labeling guidelines, and aligning with international norms for exports requires vigilance and strategic planning. Finally, rapid technological evolution from AI to augmented reality and biotech formulations poses both opportunity and risk. Brands that fail to integrate these innovations risk losing visibility in an increasingly digital marketplace. For the India cosmetics industry, sustained success depends on treating innovation not as a one-time achievement but as a continuous strategic commitment, balancing tradition, technology, and consumer expectations in an ever-evolving market.

Investment Opportunities in India's Cosmetic Sector:

The transformation of the India Cosmetics market has created fertile ground for investment and entrepreneurship. Rapid urbanization, together with rising disposable incomes and global exposure, has turned beauty into a powerful lifestyle category. In this expanding ecosystem, multiple opportunities exist both for domestic and international investors in manufacturing, technology, and retail.

Manufacturing innovation remains a key focus area. Local production facilities are evolving into technologically advanced hubs capable of handling diverse formulations and packaging solutions. Automated assembly lines and eco-conscious operations reduce costs and enhance efficiency, strengthening the foundation of the cosmetics industry in India. As brands increasingly prioritize sustainability, investment in renewable materials and circular packaging systems is becoming a defining business opportunity. For example, kdc/one and Clarion Group have announced a joint venture to build a purpose-designed manufacturing facility in Gujarat focused on injection-moulded and metallised beauty packaging for colour cosmetics and skincare.

Another avenue of growth is digital transformation. Online retailing has spawned direct-to-consumer models whereby the emerging brands can reach their audiences without the help of traditional intermediaries. Mobile applications for personalized engagement, virtual product trials, and influencer-led marketing campaigns form part of the modern beauty strategy. These digital opportunities are remodeling the cosmetics market in India by allowing each business to maintain a strong relationship with consumers and agile sales structures.

Innovation in ingredients is driving significant investment potential in India’s cosmetics market. Demand is rising for plant-based, cruelty-free, and ethically sourced components, while entrepreneurs explore indigenous herbs, oils, and natural extracts aligned with the wellness trend. This fusion of traditional knowledge with global expectations supports long-term market growth and positions India as a hub for innovative cosmetic solutions.

Beyond metropolitan areas, Tier-2 and Tier-3 cities are emerging as key growth markets, where affordable and accessible products resonate strongly. Investors who tailor pricing, packaging, and branding to local preferences can secure high customer loyalty. Rising digital penetration and the growing need for skilled professionals in formulation, cosmetic chemistry, and digital marketing further enhance opportunities, ensuring sustainable development and global competitiveness for India’s cosmetics industry.

Leading Brands in India Cosmetic Market:

The metamorphosis of the cosmetics market in India is driven not only by technological and cultural factors but also by visionary brands that epitomize innovation. Such players set benchmarks with their creativity, sustainability, and approach toward the consumer while shaping the industry's contours, locally and globally.

From heritage-inspired brands that are redefining traditional beauty with a modern relevance, to the integration of ancient wellness into sophisticated product lines, they prove that cultural authenticity coexists well with global aesthetics. This fusion appeals to consumers valuing both efficacy and emotional connection, thereby strengthening the foundation of the cosmetics market in India. For example, research into the rise of “I-Beauty” describes how Indian skin-care brands are blending Ayurvedic botanicals like turmeric, neem and ashwagandha with modern biotech actives and inclusive formulations that cater to the country’s diversity.

Another powerful force is digital-first brands, born online, which thrive on personalization, data analytics, and agility to trends. Conventional retail models have been disrupted through interactive platforms and direct communications. The success of these businesses has shown how innovation can democratize beauty and increase access to this industry in India among many demographics.

Meanwhile, established players continue to evolve by embracing sustainability and premiumization. They are re-engineering product lines, redesigning packaging, and enhancing inclusivity in order to resonate with young audiences. Their adaptive strategies preserve the legacy while capturing contemporary aspirations-a balance that strengthens their presence within the India cosmetics market share spectrum.

Another strong direction that leading brands have taken in recent years is the development of community building. Modern consumers look for transparency and emotional connection, not transactional relationships. A brand that builds a relationship with authenticity through storytelling, user-generated content, and ethical production earns deeper trust and advocacy. These efforts give new meaning to loyalty in the cosmetics market in size India and prove that innovation goes beyond product development into purposeful brand building. For example, Juice Cosmetics has launched a campaign educating consumers about ingredients and packaging, reinforcing that relationship of trust. Moreover, collaborations among technology companies, ingredient suppliers, and beauty firms are accelerating this process. Brands are improving formulation quality, reducing time to market, and offering unique experiences by leveraging knowledge across industries. This way, the approach of collaboration is positioning the India cosmetics market as an innovation hub for the global world rather than just a consumer market.

Conclusion:

Innovation has become the heartbeat of the India Cosmetics market, driving transformation at every level — from concept and formulation to retail and consumer experience. The industry’s evolution reflects a fusion of science, tradition, and technology, where creativity meets responsibility. With consumers seeking authenticity, sustainability, and individuality, the cosmetics industry in India continues to evolve into a space that celebrates diversity and self-expression. The future growth of the cosmetics market in India depends on the ability of brands and investors to anticipate emerging preferences and adapt swiftly. Success will hinge on integrating ethical practices, digital intelligence, and cultural relevance. As local and global influences converge, innovation will remain the central pillar sustaining competitiveness and credibility in the cosmetics market in size India. Eventually, the growing share of the India Cosmetics market is not only an economic opportunity but a redefinition of beauty: all-inclusive and sustainable, empowering. Continuous innovation and collaboration will see the cosmetics segment in India setting new benchmarks globally on aspects pertaining to creativity, responsibility, and growth.

Unlock Growth Opportunities in India’s Cosmetics Industry with IMARC Group:

The India cosmetics market is evolving rapidly, driven by rising consumer awareness, digital adoption, and demand for innovative, sustainable, and personalized beauty solutions. Navigating this dynamic landscape requires accurate, data-driven insights into product trends, consumer behavior, and competitive strategies.

IMARC Group provides comprehensive research on market size, segmentation, and growth forecasts, covering key areas such as skincare, haircare, color cosmetics, and premium versus mass-market products. Our analysis also examines emerging trends in natural and organic formulations, e-commerce penetration, and regulatory developments shaping the industry.

Through strategic forecasting, competitive benchmarking, and customized market studies, IMARC Group equips brands, investors, and product developers to identify opportunities, manage risks, and make informed decisions. We help clients capitalize on the growth of the India cosmetics market, driving innovation, brand differentiation, and sustainable success across this fast-expanding sector.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)