Philippines Retail Sector Industry: Convenience Food Boom, Key Sectors, Leading Retailers

_11zon.webp)

Introduction:

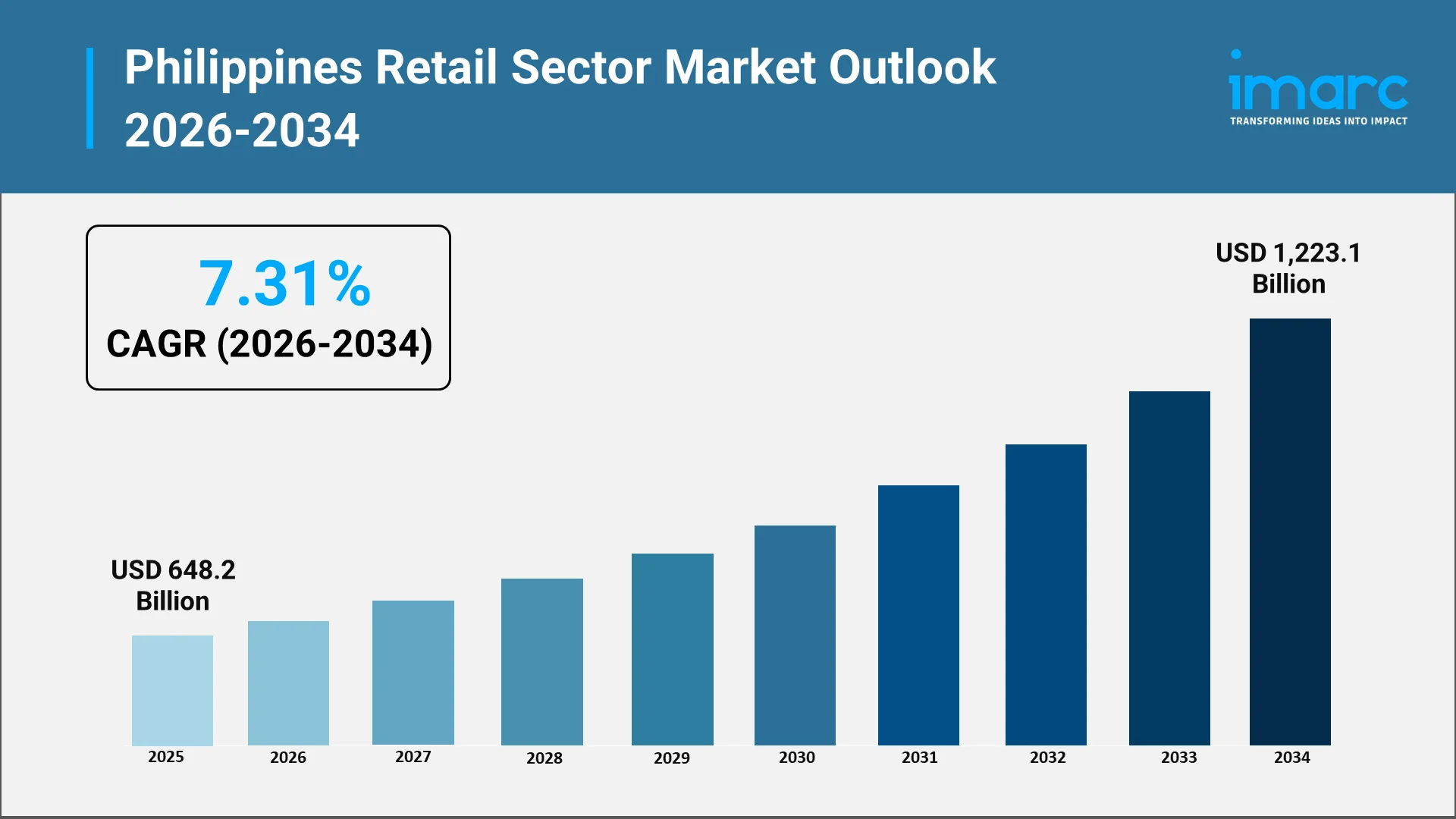

The Philippines retail sector has become a pluralistic and dynamic environment where old-fashioned stores coexist with high-tech contemporary formats enabled by digital strength. The Philippines retail sector market size reached USD 648.2 Billion in 2025. The market is projected to reach USD 1,223.1 Billion by 2034, exhibiting a growth rate (CAGR) of 7.31% during 2026-2034. Moreover, consumers desire quicker service, effortless convenience, and effortless experience whether shopping in store or ordering through the internet. Urbanization, busier lifestyles, and changing preferences have driven a robust increase in convenience foods like ready-to-eat meals, fast food snacks, and easy meal kits. Retailers are transforming their product offerings, store formats, and operational approaches to address these expectations, combining flexible technologies and enhancing logistics. As per sources, in December 2024, Jollibee Foods Corporation launched its “Signature Sips” beverage line and introducing the stand-alone Milksha concept store in January 2025, reflecting how Filipino-origin retailers are innovating in both product and format to meet modern consumer demands. Moreover, this change emphasizes a convergence of enduring retail capabilities with new and more efficient means of fulfilling daily consumer requirements.

Convenience food is also a leading force in retail transformation since it compels businesses to make investments in superior cold storage, food-handling procedures, and strong relationships with suppliers. Through such developments, these gains fortify other fresh and perishable categories as well. For consumers, this means more offerings that are easy to prepare but remain delicious, while for retailers, it means higher sales and customer retention. The increasing desire for quick, ready answers highlights a retail climate that prioritizes not just quickness but reliable quality.

Explore in-depth findings for this market, Request Sample

Recent Market News & Major Research and Development in the Philippines Retail Sector Industry:

- Shifts in format and consumer touchpoints: Recent developments show a broad reorientation toward mixed-format retailing. Brick-and-mortar outlets are being redesigned to accommodate experiential elements, dedicated pick-up hubs, quick-service food counters, and compact merchandising zones that prioritize convenience food. Smaller-format urban stores are proliferating in walkable neighborhoods and transit corridors, while larger outlets are experimenting with integrated meal-prep and demonstration kitchens. Watsons Philippines expanded in April 2024, opening 80 new stores and increasing its nationwide footprint to 1,166 outlets, strengthening access to health and beauty products across local communities. Meanwhile, digital channels are becoming fully integrated into the customer journey rather than existing as parallel options; retailers are designing journeys where online orders, express pick-up, and in-store returns form a single brand experience.

- Innovation in product development and private-label offerings: In product development, the emphasis is on freshness, taste authenticity, and time-saving preparation. Research and development labs and category teams are focusing on shelf-stable formats that preserve flavor, packaging that enhances reheating convenience, and portion-controlled servings that align with single-household consumption patterns. Private-label convenience ranges are being elevated—playing up artisanal ingredients, regional flavors, and health-forward formulations—to offer a curated alternative to national brands while preserving retailer margins and brand loyalty.

- Cold chain and logistics R&D: Reliable cold chain infrastructure has become central to ambitions in convenience food. Firms and logistics partners are piloting temperature-controlled micro-fulfillment centers close to urban centers, experimenting with last-mile refrigerated carriers, and refining inventory algorithms to reduce waste. Research into packaging technologies—barrier films, resealable systems, and microwave-friendly substrates, aims to extend shelf life without compromising taste or natural ingredient claims. These technical investments tighten the link between product innovation and operational execution.

Top Companies in the Philippines Retail Sector Industry:

Top companies in the Philippines retail sector include SM Retail, Robinsons Retail Holdings, Puregold Price Club, and AllDay Supermarket. These leaders expand nationwide, upgrade digital payments, and strengthen e-commerce logistics. By improving fresh food, private-label assortments, and convenience formats, they shape consumer expectations and competition across urban and emerging retail hubs.

- Large-format hypermarket and supermarket leaders

These operators anchor suburban and regional shopping patterns with broad assortments that cover fresh, frozen, and ambient categories supported by strong supplier networks and efficient logistics. Their role in convenience food is defined by the ability to integrate in-house food preparation alongside full fresh sections, giving shoppers a complete meal solution in one visit. Ready-to-eat counters, chilled meal displays, and meal-pairing bundles encourage shoppers to combine quick dining options with staple groceries. Their scale allows for continual refinement of recipes, frequent menu refreshes, and strong control over quality, price, and availability. They play a central role in shaping consumer expectations for freshness and value in convenience-led shopping.

- Convenience store chains

Small-footprint convenience outlets are positioned at the heart of the convenience food rise, strategically located near transit systems, offices, and dense housing clusters. They focus on fast-turnover products that require little or no preparation supported by compact refrigeration and hot-food facilities. Immediacy drives their merchandising approach, ensuring that items are easy to grab and consume on the move. Frequent restocking and localised assortment management help maintain freshness and relevance. These stores thrive on speed and accessibility, often becoming a reliable daily stop for workers, students, and commuters seeking quick, satisfying meal solutions. In March 2025, SM Investments announced plans to open at least 200 new Alfamart stores across Luzon, reinforcing rapid expansion of neighborhood convenience retail in the Philippines.

- Specialty fresh and perish-focused retailers

These retailers spotlight premium quality, curated sourcing, and strong culinary appeal as their key differentiators. Fresh produce, deli counters, and artisanal ready-to-eat offerings sit at the core of their strategy. In October 2025, Spinneys partnered with Ayala Corporation to enter the Philippines, targeting rising premium fresh-food demand driven by growing affluent shoppers, strengthening the country’s evolving retail sector landscape. Additionally, many collaborate with independent chefs, small-scale food makers, or local kitchens to introduce seasonal and small-batch menu items that feel crafted and authentic. Customers are drawn by a desire for superior ingredients and transparency in sourcing rather than simply low prices. This premium positioning allows these retailers to attract shoppers who want convenience without compromise on flavor or freshness.

- Pure-play e-commerce marketplaces and quick-commerce enablers

Online food retailing has become an essential channel for consumers prioritizing convenience and delivery efficiency. These digital players specialize in sending heat-and-eat products, snack packs, and fresh bundles directly to homes with same-day or even hour-specific delivery. Micro-fulfillment hubs and agile route planning underpin the promise of speed and reliability. They often serve as a complementary extension of traditional brick-and-mortar, particularly beneficial for shoppers who plan meals ahead or avoid travel during busy hours. Their success stems from combining digital convenience with dependable access to fresh, ready options.

- Multi-format omnichannel groups

These groups operate across retail formats, including large supermarkets, small convenience stores, specialised boutiques, and dedicated online channels. Integration enables shared supply chains, unified loyalty programs, and consistent quality standards. Their flexibility allows for quick experimentation, moving successful convenience products from one format to another and coordinating promotions to guide shoppers smoothly between channels. This interconnected approach supports strong brand presence and consumer familiarity no matter the shopping mission or platform used. In April 2025, Funko announced that its first Southeast Asia licensed store will open in the Philippines by June 2025, reflecting rising global retail investment and strong local fan-driven demand.

Opportunities and Challenges in the Philippines Retail Sector Industry:

Opportunities:

- Convenience-Focused Store and Product Expansion: Retailers can redesign store formats to cater to fast-paced consumer habits. Compact outlets in transport hubs and workplaces can emphasize grab-and-go meals, healthy snacks, and heat-and-eat dishes. This creates more frequent quick trips that lift sales with minimal shopping time required. Ready-meal coolers, express checkout points, and online pickup counters help deliver fast choices without long queues or large baskets. Retailers can rotate offerings tied to local tastes so menus stay exciting. Enhanced digital ordering paired with quick delivery and click-and-collect boosts accessibility for busy households. In March 2025, Philippine Seven Corporation noted strong performance in Visayas and Mindanao stores, driven by remote workers and freelancers boosting local spending despite overall convenience sales flattening. Further, by treating convenience food as a core category rather than a side offering, retailers can deepen daily relevance and encourage repeat visits. It strengthens brand identity around reliability and practical everyday value, making convenience formats a major growth engine.

- Private-Label Growth and Responsible Retailing Initiatives: Private-label convenience food offers retailers room to be more creative and competitive. They can introduce fresh meals, regional flavors, and portion-friendly options designed to suit students, office workers, and small families. Exclusive recipes turn the retailer into a destination for everyday meals rather than a generic store. Stronger margins from private labels support pricing flexibility and promotional activity without sacrificing profitability. As convenience food grows, retailers can lead in sustainability by optimizing packaging that protects freshness yet reduces waste. New recycle-ready materials, efficient cold chains, and improved inventory control all contribute to lower spoilage. Responsible sourcing of ingredients further strengthens trust and differentiates in a market where consumers want quality with accountability.

Challenges:

- Perishable Supply Chain and Food-Safety Demands: Convenience food requires dependable cold storage and rapid replenishment, making logistics more complex than traditional packaged products. Fresh meals spoil quickly if temperatures shift or deliveries are delayed, so forecasting must be precise to avoid both waste and shortages. Food-safety rules heighten the pressure, especially when stores heat or prepare meals on-site. Employees need ongoing training to maintain hygiene and prevent cross-contamination, along with documentation that passes audits and protects brand trust. Any lapse can create costly reputational damage. These requirements demand tighter supply chain coordination, more skilled staff, and advanced monitoring systems to ensure meals remain fresh, safe, and consistently available.

- Profitability, Skills Gaps, and Execution Pressures: Convenience food brings higher operating complexity because staff must manage chilled units, hot displays, and basic meal preparation while keeping service quick. Costs escalate if labor or replenishment processes are inefficient. Recruiting workers experienced with perishables and food handling can be challenging, especially across large store networks. Retailers sometimes rely on external kitchens, yet consistency in taste, presentation, and packaging must be maintained everywhere. Technology investments such as automated restocking, temperature-tracking, and demand forecasting can reduce waste and labor strain. Successful execution requires ongoing training and operational discipline so that fast service, product quality, and profitability remain aligned as demand rises.

Future Outlook: Philippines Retail Sector Industry

Strategic imperatives for resilient growth

- Retailers that prioritize three strategic imperatives will be best positioned to capture growth. First, invest in integrated, temperature-controlled logistics and micro-fulfillment to ensure consistent availability of fresh convenience items. Second, embed digital demand-sensing tools and agile inventory systems to match supply cadence to rapidly shifting consumption patterns. Third, cultivate a diversified product pipeline—private-label innovation, local culinary partnerships, and health-focused convenience ranges—to sustain relevance across demographic cohorts.

Technological and consumer-led convergence

- Technology will continue to tighten the link between consumer demand and fulfillment, with AI-enabled assortment decisions, frictionless checkout, and pricing that reflects freshness all helping reduce delays during routine food purchases. The rise of convenience food in the Philippines is not temporary but a long-term shift that reshapes retail competition. Retailers that master cold-chain reliability, meal innovation, and digital integration will win customer loyalty by making fresh, flavorful, and affordable ready-to-eat solutions easily accessible, turning everyday shopping moments into consistently fast and satisfying experiences.

Conclusion:

The Philippine retail market is gradually shifting toward a more convenience-driven market, with ready-to-consume and quick-prep food shaping store formats, logistics, and consumer interaction strategy. Retailers are taking advantage of the transformation to reimagine in-store designs, add new culinary areas, and strengthen online and on-demand delivery capacities. The changes address fast lifestyles, increasing urban populations, and increasing demand for speed and ease in everyday meals. Deeper alliances with local food makers and investments in freshness management serve to improve quality and accessibility. Sustainability continues to be a core focus, supporting sound sourcing and better packaging options. Convenience food is no longer a specialty or novelty, but a strategic driver that influences competitiveness and long-term growth throughout the nation's varied retail formats.

Choose IMARC Group as We Offer Unmatched Expertise in the Philippines Retail Sector Industry:

- Data-Driven Market Research: Deepen your knowledge of the Philippines retail sector through comprehensive research covering convenience-food expansion, store format evolution, omnichannel adoption, and changing shopper missions across urban and suburban locations.

- Strategic Growth Forecasting: Predict the future of retail by tracking the rise of grab-and-go meals, micro-stores near transit hubs, ready-to-eat assortments, and digital fulfillment services that enable faster, smarter consumer engagement.

- Competitive Benchmarking: Analyze competitive dynamics across supermarkets, convenience chains, specialty retailers, and e-commerce players while tracking innovation in meal solutions, fresh-food merchandising, and shopper experience upgrades.

- Policy and Infrastructure Advisory: Stay ahead of regulatory updates, responsible sourcing frameworks, cold-chain enhancement programs, and sustainability guidelines that influence operational standards and food-safety execution in retail.

- Custom Reports and Consulting: Get tailored insights for expansion planning, private-label meal development, cold-chain optimization, digital retail strategy, and smarter location decisions across high-traffic catchments.

At IMARC Group, we equip retail leaders with the intelligence needed to shape the next stage of growth for the Philippines, where convenience, quality, and everyday accessibility define shopping success.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)