Blue Ammonia Cost Model: Decoding Clean Energy Economics

What is Blue Ammonia?

Blue ammonia is one type of ammonia production that is meant to reduce carbon dioxide emissions. Traditional methods of ammonia production include sourcing hydrogen from natural gas, usually through steam methane reforming (SMR) or auto-thermal reforming (ATR) and then reacting this hydrogen with nitrogen (from air) through the Haber-Bosch process.

Key Applications Across Industries:

The "blue" suffix indicates that the carbon dioxide waste product produced in the course of hydrogen synthesis is captured (through Carbon Capture, Utilization, and Storage / CCUS) and not released into the environment. Consequently, blue ammonia has significantly lower lifecycle greenhouse gas emissions than "grey" ammonia (which does minimal or no CO2 capture), even though it is less carbon-neutral than "green" ammonia (which employs renewable or non-fossil energy for hydrogen). Technically, blue ammonia process flow usually involves preparation of natural gas feedstock, production of hydrogen by SMR or ATR, capture of CO2 emissions during the hydrogen production phase, separation and purification of hydrogen, ammonia synthesis through nitrogen + hydrogen at high temperature and pressure, and storage, handling, and transport of ammonia, with corresponding sequestration or application of captured CO2. The blue ammonia efficiency is largely dependent on the capacity to capture CO2 (capture rate), the distance the CO2 must be transported for storage, and how pure the rest of the value chain is (e.g., fugitive methane emissions). Blue ammonia has several potential uses: as low-carbon fuel to generate power or to co-fire in heat plants, as a carrier of hydrogen (shipped in ammonia form), for export markets (particularly when importers desire decarbonized ammonia), and as feed for fertilizers and industrial chemicals. Since ammonia can be liquefied relatively simply, it is a transportable, storable medium of hydrogen.

What the Expert Says: Market Overview & Growth Drivers

The global blue ammonia market reached a value of USD 113.26 Million in 2024. According to IMARC Group, the market is projected to reach USD 16,604.22 Million by 2033, at a projected CAGR of 68.5% during 2025-2033. The global blue ammonia market is being led by the imperative to decarbonize in heavy industry, power, and shipping, coupled with the practical imperative to utilize current fossil-fuel feedstocks while eliminating related CO2 emissions; blue ammonia made through steam-methane reforming or ATR with CO2 capture is a lower-carbon transitional fuel and hydrogen carrier without delay for complete scale-up of renewables.

Policy and economics are key: carbon pricing, tax credits (i.e., the U.S. 45Q credit), direct CCUS subsidies, and low-carbon fuel standards make blue projects more financeable and enhance project IRRs compared to grey ammonia. Supply-chain economics also come into play, localities with ready natural gas and existing Haber-Bosch capacity (Gulf Coast, Middle East, parts of Asia) can retrofit or grow more quickly for export markets that require low-intensity fuel sources, while clusters of industry will use locally manufactured low-carbon ammonia to green fertilizer, steel, and chemical production processes. The hydrogen economy drivers enhance demand since ammonia is a good hydrogen carrier for the transport of hydrogen over long distances and seasonal storage, facilitating low-carbon hydrogen accessibility by importers with limited renewable supplies. CCUS technological maturity, enhanced capture rates, and declining capture and compression costs enhance feasibility, while offtake commitments by utilities, shipping companies and petrochemical companies de-risking investments. On the other hand, green ammonia (electrolysis + renewables) competition and uncertain natural-gas prices represent a commercial hurdle that blue schemes have to overcome; hence, project finance, offtake guarantees, transparent certification/CO2 accounting requirements, and global trade structures for low-carbon ammonia are also demand drivers defining where and how rapidly the blue-ammonia market ramps up worldwide.

Case Study on Cost Model of Blue Ammonia Production Plant:

Objective

One of our clients reached out to us to conduct a feasibility study for setting up a medium scale blue ammonia production plant.

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the setup and operation of a proposed blue ammonia production plant in United States of America. This plant is designed to produce 600,000 tons of blue ammonia annually.

Production Process: Blue Ammonia processing consists of a number of sophisticated chemical and environmental processes that integrate conventional ammonia synthesis with carbon capture technologies to reduce greenhouse gas emissions. The process starts with the reforming of natural gas, wherein methane (CH4) is reacted with steam in a steam methane reformer (SMR) or auto-thermal reformer (ATR) to yield hydrogen (H2) and carbon dioxide (CO2). In traditional ammonia manufacture (also referred to as "grey" ammonia), such CO2 is emitted into the air. Blue ammonia manufacture, on the other hand, captures the CO2 produced using Carbon Capture, Utilization, and Storage (CCUS) systems, often in the form of chemical solvents like amines or physical absorption. The captured CO2 is compressed, transported, and stored underground in geological structures or injected for enhanced oil recovery or industrial use. After purifying hydrogen, it is mixed with nitrogen (N2), which is recovered from atmospheric air in the form of an air separation unit (ASU), in the process of Haber-Bosch. It takes place under high temperature (400–500°C) and high pressure (150–300 bar) conditions using an iron-based catalyst to produce ammonia (NH3). The ammonia produced is condensed, purified, and stored as liquid under moderate pressure or under refrigeration. Blue ammonia processing efficiency relies mostly on CO2 capture efficiency, generally above 90%, as well as reforming and synthesis condition optimization to minimize energy input. Blue ammonia, the final product, can be used directly as a low-carbon fuel, an energy carrier for hydrogen, or as a fertilizer feedstock, playing a substantial role in heavy industry and transport decarbonization worldwide.

Get a Tailored Feasibility Report for Your Project Request Sample

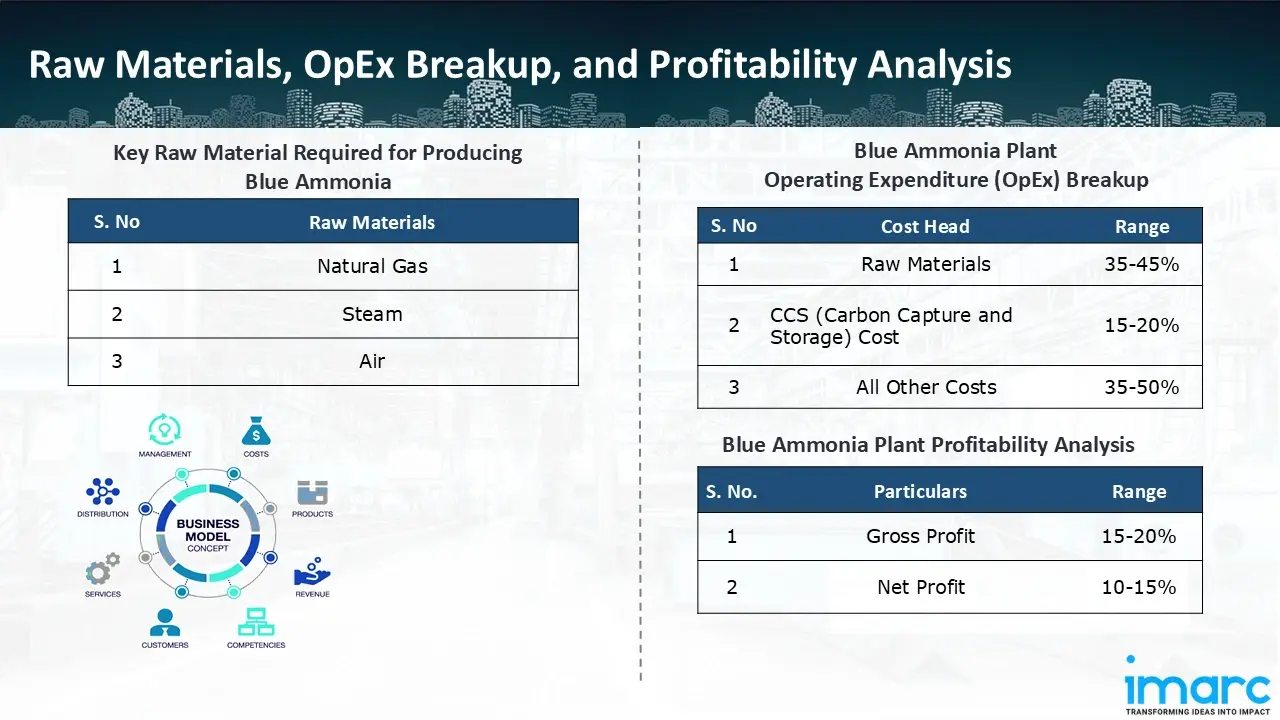

Raw Material Required:

The basic raw materials required for blue ammonia production include:

- Natural Gas

- Steam

- Air

Machineries Required:

- Pretreatment / Cleanup Units

- Sulfur Removal (E.G. Amine Treatment, Guard Beds)

- Particulate / Solid Filters

- Heat Exchangers, Preheaters

- Reformer(S) / Autothermal Reformer / SMR

- Autothermal Reformer (ATR) / Steam Methane Reformer (SMR) Reactors

- Air/Oxygen Injection Systems

- Catalyst Beds

- Shift Converters / Shift Reactors

- High-Temperature Shift (HTS) Reactor

- Low-Temperature Shift (LTS) Reactor

- Co2 Capture / Solvent Absorption Units

- Absorber / Absorber Towers

- Stripper / Regeneration Towers

- Solvent Handling (Amine / Physical Solvents)

- Heat Exchangers, Reboilers, Condensers

- Co2 Dehydration / Compression / Purification Trains

- Dehydration Units (E.G. Molecular Sieves, Dryers)

- Co2 Compressors (Multi-Stage Compression)

- Co2 Dryers, Cooling & Interstage Heat Exchangers

- Co2 Metering & Transport Interface

- H2 Purification Units

- PSA (Pressure Swing Adsorption) Or Membrane Separators

- Final Purification / Polishing Units

- Air Separation Unit (ASU) / Nitrogen Supply

- Cryogenic Air Separation Plant (For Nitrogen)

- Compression & Purification (If Non-Cryogenic N2 Source)

- Ammonia Synthesis Loop (Haber–Bosch Section)

- High Pressure Compressor

- Ammonia Converter Reactors

- Cooling / Condensation / Recycle Systems

- Heat Exchangers, Interstage Cooling

- Ammonia Refrigeration / Liquefaction

- Storage Tanks, Loading Equipment

- Utilities / Power / Steam Generation

- Steam Boilers / Waste Heat Recovery Units

- Turbines / Gas Turbines / Cogeneration (For Power, Steam)

- Cooling Towers / Heat Rejection Systems

- Pumps, Compressors, Blowers

- Electrical Systems, Switchgear

- Instrumentation, Control Systems

- Support Systems

- Catalyst Regeneration, Storage & Feed Systems

- Spares, Maintenance Systems

- Piping, Valves, Instrumentation & Control (I&C)

- Safety / Flare Systems / Venting Systems

Techno-Commercial Parameter:

- Capital Expenditure (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth. Furthermore, raw material cost in a blue ammonia production plant ranges between 35-45%, CCS (Carbon Capture and Storage) cost ranges between 15% to 20%, and all other costs ranges between 35-50% in the proposed plant.

- Profitability Analysis Year on Year Basis: We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins lie between a range of 15-20%, and net profit lie between the range of 10-15% during the income projection years, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the blue ammonia production plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, manufacturing, capital expenditure, and operational expenses. By addressing the specific requirements of producing 600,000 tons of blue ammonia annually, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights into strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale manufacturing ventures.

Latest News and Developments:

- In October 2025, NH3 Clean Energy Limited (NH3) and Oceania Marine Energy (Oceania) signed a Memorandum of Understanding (MoU) with Mitsui O.S.K. Lines, Ltd. (MOL; President & CEO: Takeshi Hashimoto, Headquarters: Minato-ku, Tokyo) about the establishment of clean ammonia bunkering operations in Western Australia's Pilbara region.

- In April 2025, the low-carbon ammonia production project "Blue Point" ("the Project") in Ascension Parish, Louisiana, USA, in collaboration with CF Industries Holdings, Inc. ("CF Industries") and Mitsui & Co., Ltd. ("Mitsui"), has finally been decided upon by JERA Co., Inc. ("JERA"). The project will build a low-carbon ammonia production facility in Ascension Parish, Louisiana, USA. With an annual nameplate capacity of over 1.4 million tonnes, it would be the largest ammonia production facility in the world.

- In January 2024, Tokyo-based INPEX Corporation and Oklahoma City-based LSB Industries have chosen KBR's blue ammonia technology for a large-scale, commercial-scale clean ammonia production and export project in the US Gulf Coast. As per the agreement, KBR will supply technology licensing and proprietary engineering design for a 1.1 million-ton-per-year ammonia plant that maximises output while capturing carbon.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104