Australia Dairy Industry: Sustainable Farming Surge, Economic Impact, and Opportunities

Introduction:

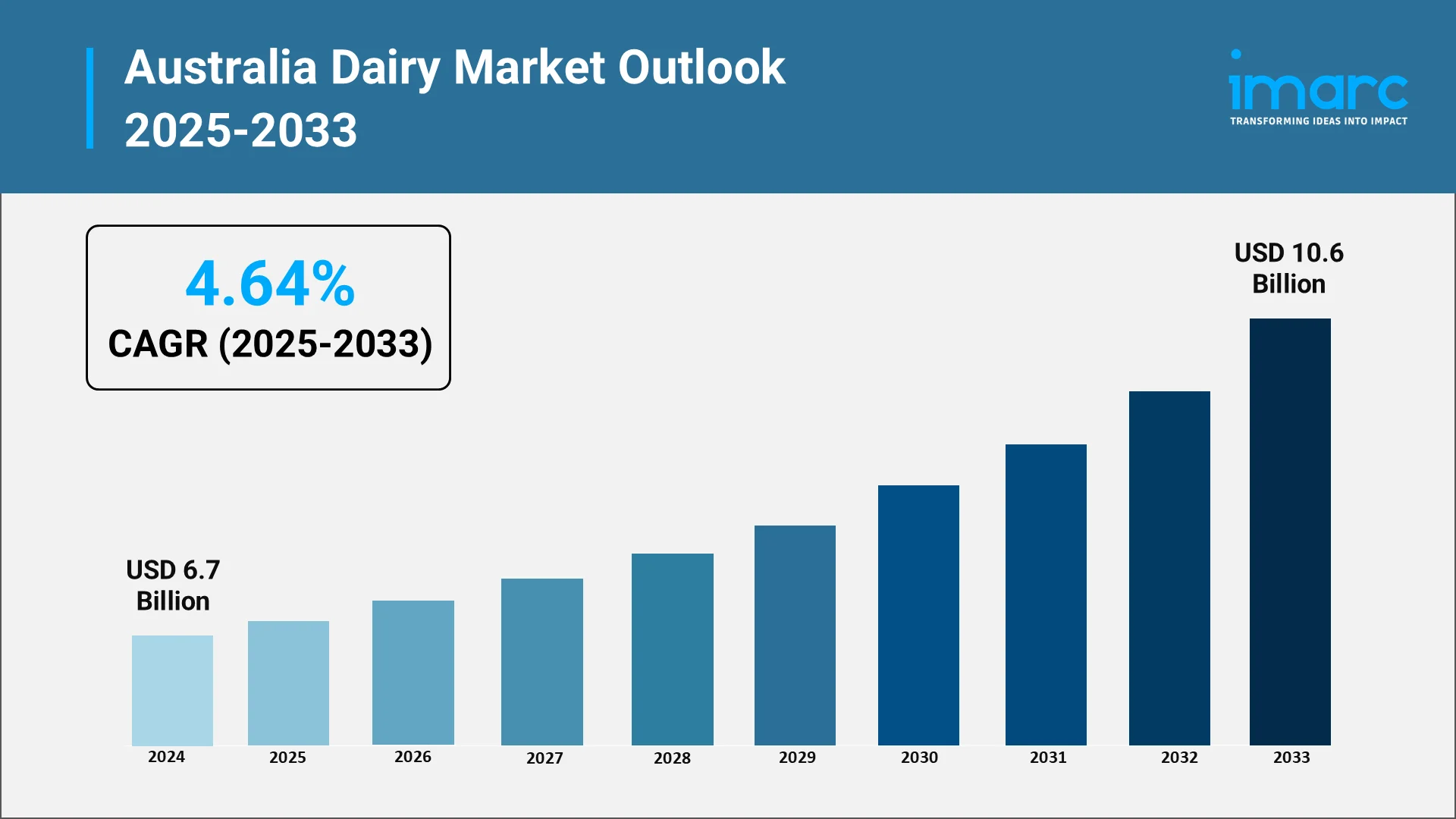

The Australia dairy industry stands as a vital pillar of the nation's agricultural economy, representing the third-largest rural sector and contributing significantly to both domestic food security and export earnings. In 2024, the Australia dairy market reached a valuation of USD 6.7 Billion and is projected to exhibit a robust compound annual growth rate (CAGR) of 4.64% from 2025 to 2033.

This remarkable growth trajectory is underpinned by multiple converging factors: rising consumer health consciousness, technological advancements in dairy farming and processing, increasing preference for premium and specialty dairy products, and robust government support promoting sustainability and innovation. The industry's commitment to sustainable farming practices, coupled with its strategic positioning in global markets, particularly across Asia, positions Australia's dairy sector for continued expansion despite challenges from climate variability and evolving consumer preferences.

As the industry navigates the complexities of 2025, dairy farmers and manufacturers are embracing innovation, sustainability, and diversification to maintain competitiveness while meeting the dual imperatives of profitability and environmental stewardship. This comprehensive analysis examines the latest market developments, key industry players, emerging opportunities, persistent challenges, and future outlook for Australia's dynamic dairy sector.

Explore in-depth findings for this market, Request Sample

Recent Market News and Major Research and Development:

The Australian dairy industry has witnessed significant developments throughout 2024 and early 2025, reflecting both innovation and adaptability in response to market demands and environmental considerations.

- Infrastructure and Manufacturing Advancements

In October 2024, Pure Dairy announced the construction of a groundbreaking 13,000-square-metre facility in Dandenong South, scheduled to launch in April 2025. This state-of-the-art manufacturing plant will revolutionize Australian dairy production through advanced automated processing systems and sustainable technologies, producing premium dairy and plant-based products for both domestic and international markets. The facility exemplifies Pure Dairy's commitment to innovation and environmental responsibility.

- Product Innovation and Market Diversification

September 2024 saw Fonterra Oceania unveiling an impressive variety of innovative dairy products across Australia and New Zealand, catering to evolving consumer preferences for convenience and bold flavors. Australian consumers welcomed new offerings including Mainland Sweet Cinnamon Spreadable and an expanded Bega cheese snacking range, demonstrating the industry's responsiveness to changing taste profiles.

In a landmark sustainability achievement, Ashgrove Cheese introduced "Ashgrove Eco-Milk" in Tasmania in April 2024—the world's first climate-friendly milk. This pioneering product represents a significant milestone in the industry's journey toward carbon neutrality and environmental stewardship.

February 2024 brought further product diversification as Brownes Dairy in Western Australia launched its Club Cheddar range, featuring innovative flavors including Vintage, Pickled Onion, Green Peppercorn, and Smokey Red. All products are manufactured using locally sourced Western Australian milk, supporting regional dairy farmers and reinforcing the farm-to-consumer connection.

- Research and Technological Development

The Victorian Government launched a USD 41 Million, five-year research partnership with the dairy industry as part of its Transformational Agriculture Strategy. This ambitious initiative focuses on two critical programs: the Future Forage Programme, which develops new and improves existing forage varieties to support climate adaptation, and the animal genetics program, which targets improved selection traits. Scientists project that by 2040, these advancements will deliver USD 248 per cow in additional value while reducing emissions by 10%, extending cow lifespan by 10%, and decreasing health and management costs by 10%.

The Dairy Innovation Hub at the University of Melbourne continues advancing critical research areas including dairy microstructure, separation technologies, functionalised milk streams, and dairy proteomics. These initiatives bridge the gap between academic research and industry application, improving processes and product quality across the sector.

Opportunities and Challenges in the Australia Dairy Industry:

The Australian dairy sector faces a complex landscape of promising opportunities alongside significant challenges that will shape its trajectory through 2025 and beyond.

Key Opportunities:

- Asian Market Expansion: Rising middle-class populations in Southeast Asia present substantial growth potential for Australian dairy exports. Australia's proximity to these emerging markets, combined with its reputation for high-quality, safe dairy products, provides strategic advantages. Strengthening trade relationships and leveraging free trade agreements can maintain competitive pricing and expand market share.

- Premium and Value-Added Products: Consumer demand for specialty products is accelerating. Expanding production of artisanal cheeses, organic milk, probiotic yogurts, lactose-free options, and dairy-based nutritional products enhances profitability margins. According to market analyses, cheese production is expected to increase to 375,000 metric tons in 2025, driven by strong domestic demand and export performance.

- Sustainability Certifications and Green Farming: Environmental sustainability has transitioned from optional to essential. More than 70 percent of Australian dairy farmers have implemented energy efficiency projects or used renewable energy, while 83 percent have fenced off all natural waterways. Adoption of eco-friendly practices and obtaining sustainability certifications boost Australia's reputation in premium markets and appeal to environmentally conscious consumers globally.

- Technological Innovation: The industry is embracing advanced technologies including robotic milking systems, precision feed management, IoT-enabled herd monitoring, and data analytics tools. These innovations optimize productivity, reduce labor costs, improve animal welfare, and enable more sustainable resource management. The DairyBio program, a joint venture between Dairy Australia, Agriculture Victoria, and the Gardiner Foundation, represents a USD 60 Million commitment over five years to deliver advanced plant and animal genetics.

- Domestic Market Growth: Fresh milk consumption is forecast to reverse a five-year decline, increasing by 0.4 percent in 2025. Strong domestic demand for cheese, yogurt, and dairy spreads offsets flat milk consumption, while consumers increasingly prefer locally produced, high-quality dairy products and are willing to pay premium prices to support Australian farmers.

Challenges:

- Climate Variability and Environmental Risks: Dry conditions in key regions including southwestern Victoria and South Australia remain persistent challenges, emphasizing the urgent need for sustainable water management and drought-resilient farming practices. Climate change impacts including heat stress, rainfall deficits, and extreme weather events directly affect milk production volumes and pasture quality. The Australian dairy industry contributes approximately 1.6 percent of total national greenhouse gas emissions, necessitating continued focus on emissions reduction strategies to meet the industry's commitment of reducing GHG intensity by 30 percent by 2030.

- Competition from Plant-Based Alternatives: The growing popularity of plant-based dairy alternatives poses competitive pressure on traditional dairy products. Consumers concerned about health, ethics, or environmental impact are increasingly exploring non-dairy options, requiring continuous innovation and product differentiation from dairy producers.

- Labor Shortages and Succession Challenges: The industry faces ongoing labor shortages exacerbated by the demanding nature of dairy farming—long hours with minimal downtime. A concerning trend shows that younger generations are increasingly deterred from entering the industry, with a low percentage of farmers under 35 years of age, raising questions about long-term sustainability and succession planning.

- Regulatory Compliance and Food Safety Standards: Meeting stringent regulatory requirements regarding animal welfare, environmental impact, sustainability reporting, and export standards poses both costs and complexity. While these standards maintain Australia's reputation for quality, they can present challenges for smaller producers struggling to meet compliance requirements.

Future Outlook: Australia Dairy Industry

The Australian dairy industry is strategically navigating a future defined by cautious growth and the absolute need for pivotal adaptation. The sector is projected to reach a market valuation of USD 10.6 Billion by 2033.

Key areas of focus for the 2024–2025 period and beyond include:

- Climate & Risk: Climate adaptation and the implementation of drought-resilient farming practices are the paramount strategic challenges for maintaining long-term productivity.

- Market Strategy: Focus is on diversification into high-growth Southeast Asian export markets. Domestically, cheese production remains the largest consumer, utilizing 43% of fluid milk.

- Operational Mandate: Success is tied to the urgent adoption of precision farming/digital transformation and global leadership in sustainability (aligned with 2030 goals) to secure long-term efficiency and profitability.

Unlock Strategic Insights with IMARC Group:

- Data-Driven Market Research: Deepen your understanding of the Australia dairy industry, including production trends, consumer preferences, sustainable farming innovations, and technological advancements through precision biologics, automation systems, and digital monitoring platforms. Access in-depth market research reports that illuminate pathways to profitability and sustainability.

- Strategic Growth Forecasting: Predict emerging trends in dairy production and consumption—from specialty cheese markets and protein-enriched products to plant-based hybrids, climate-adaptive farming systems, and evolving export dynamics across global regions.

- Competitive Benchmarking: Analyze competitive forces shaping the dairy landscape, review corporate strategies of major players, monitor processing innovations, and track breakthroughs in genetic improvement, feed optimization, and environmental management technologies.

- Policy and Regulatory Advisory: Stay ahead of evolving regulatory frameworks, government support programs, sustainability mandates, and trade agreements affecting dairy production, processing, and export opportunities.

- Custom Reports and Strategic Consulting: Obtain tailored insights aligned with your organizational objectives—whether launching new dairy product lines, investing in processing infrastructure, expanding into emerging markets, or implementing sustainability certifications for competitive differentiation.

At IMARC Group, our mission is to empower dairy industry leaders, investors, and stakeholders with the clarity and intelligence required to navigate market complexities and capitalize on growth opportunities. Join us in supporting a sustainable, profitable, and innovative Australian dairy future—because every strategic decision matters. For reference, refer to this link: https://www.imarcgroup.com/australia-dairy-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)