Top Factors Driving Growth in the Vietnam Aquaculture Market

The Vietnam aquaculture market has transformed from traditional fishing practices into one of the world's most dynamic seafood production sectors. Vietnam now ranks as the fourth-largest aquaculture producer globally, supplying markets across Asia, Europe, and the Americas. Understanding what drives this growth is essential for investors, businesses, and policymakers looking to engage with this evolving industry.

Overview of Vietnam's Aquaculture Industry:

Vietnam's geography gives it natural advantages few countries can match. With a coastline stretching over three thousand kilometers and extensive river systems, the country offers diverse environments for cultivating everything from freshwater species to marine finfish. The Mekong Delta alone accounts for the majority of pangasius and shrimp production, making it the industry's epicenter.

The Vietnam aquaculture market includes several key subsectors: pangasius farming, shrimp cultivation (both black tiger and vannamei), tilapia, and increasingly high-value species like cobia, grouper, and lobster. Each has developed its own supply chains, processing facilities, and market relationships.

Government policies have been crucial to the sector's development. Regulations around water use, environmental protection, and food safety have become more sophisticated, building credibility with international buyers. Meanwhile, infrastructure investments in ports, cold storage, and processing facilities have enabled the industry to serve distant markets effectively.

The workforce combines traditional knowledge with modern methods. Families who've farmed for generations now integrate fish farming technology and scientific approaches into their operations, creating a unique advantage in both productivity and adaptability.

Explore in-depth findings for this market, Request Sample

Market Growth and Production Trends:

Production capacity has expanded through both new farming areas and intensification of existing operations. Farmers are adopting higher-density systems, better feed formulations, and recirculating technologies that boost output without expanding their environmental footprint proportionally.

Species diversification is changing the industry's profile. While pangasius and shrimp remain dominant exports, farmers are exploring high-value options like cobia, grouper, and lobster. This strategic shift reduces risk from price swings in any single commodity while opening new revenue opportunities.

Processing capabilities have evolved alongside production. Modern facilities with automated systems, cold chains, and quality labs let Vietnamese exporters meet international standards. Value-added processing like filleting, portioning, ready-to-cook products improves margins and market position for seafood export Vietnam operations.

Regional specialization has created expertise clusters around specific species. Certain provinces have become synonymous with particular products, developing ecosystems of hatcheries, feed suppliers, and technical services that reduce costs and accelerate innovation.

Key Factors Fueling Industry Expansion:

Global protein demand keeps rising, especially in developing economies where incomes are expanding and diets are changing. Vietnam's cost-competitive production puts it in a strong position to serve this expanding market.

Climate gives Vietnam a real edge. Favorable water temperatures and abundant rainfall mean year-round operations without the artificial heating or complex water management that farms in colder regions require. Lower costs translate to better margins.

Trade relationships have opened critical markets. Free trade agreements with major economic blocs reduce tariffs and create stable trading conditions that justify long-term investment. Better market access in premium destinations pushes quality standards higher throughout the supply chain.

The input supply industry has matured significantly. Domestic feed manufacturers now produce sophisticated feeds with optimal nutrition profiles, probiotics, and functional ingredients. Reducing import dependence shortens supply chains and enables faster innovation.

Financing tailored to aquaculture has become more available. Specialized lending products, insurance, and investment vehicles address the unique characteristics of aquaculture—seasonal cash flows and production risks. Access to appropriate capital lets farmers upgrade facilities and adopt new technologies without draining working capital.

Technological Innovations and Sustainable Practices:

Fish farming technology adoption has accelerated across Vietnam's aquaculture sector. Automated feeding systems optimize feed conversion by delivering precise amounts at the right times, reducing waste and improving fish health. These systems use sensors and algorithms that adjust to environmental conditions and feeding patterns.

Water quality monitoring tech enables real-time tracking of dissolved oxygen, pH, ammonia, and temperature. Early warning systems catch problems before they impact fish health, allowing quick interventions that prevent disease and losses. Mobile integration gives farmers unprecedented visibility into their operations.

Biosecurity has become more sophisticated as the industry recognizes the economics of disease prevention. Modern hatcheries use strict quarantine protocols, selective breeding for disease resistance, and vaccination programs that reduce antibiotic dependence. These practices align with international standards and consumer preferences.

Sustainable aquaculture principles increasingly guide operations. Recirculating systems dramatically cut water consumption and waste discharge by treating and reusing water multiple times. These closed-loop systems minimize environmental impact while enabling production intensification where water is limited.

Integrated multi-trophic aquaculture shows innovative thinking about resource use. These systems cultivate multiple species at different levels in the food chain—waste from one species provides nutrients for another. The approach boosts productivity per unit of water while reducing environmental loading.

Certification programs for responsible practices have gained traction among producers targeting premium markets. Meeting standards from organizations focused on environmental sustainability and social responsibility lets producers differentiate their products and command better prices. Voluntary adoption of these standards reflects market sophistication.

Export Dynamics and Global Demand Trends

Seafood export Vietnam operations have achieved strong penetration across international markets. Vietnamese products reach consumers in Asia, Europe, the Americas, and beyond, demonstrating the ability to meet varied regulations and preferences. Geographic diversification reduces dependence on any single market and provides resilience.

Consumer preferences in key markets increasingly favor products meeting environmental and social responsibility criteria. Vietnamese exporters have responded with traceability systems, third-party certifications, and sustainability narratives that resonate with conscious consumers. These efforts address concerns about wild fish stocks and position farmed seafood as responsible.

Product innovation reflects sophisticated market understanding. Ready-to-cook items, value-added preparations, and portion-controlled packaging cater to convenience-oriented consumers in developed markets. Premium lines targeting foodservice and high-end retail emphasize quality attributes like organic certification or specific feeding protocols.

Distribution channels have expanded market reach. E-commerce enables direct-to-consumer sales that bypass traditional layers, while retail partnerships provide mass market access. Channel diversification reduces concentration risk and enables dynamic response to changing consumption patterns.

Trade infrastructure improvements, including port modernization, cold chain expansion, logistics optimization, have reduced transit times and preserved product quality. Better infrastructure also cuts waste and lets Vietnamese exporters serve distant markets effectively.

Future Prospects and Market Forecasts:

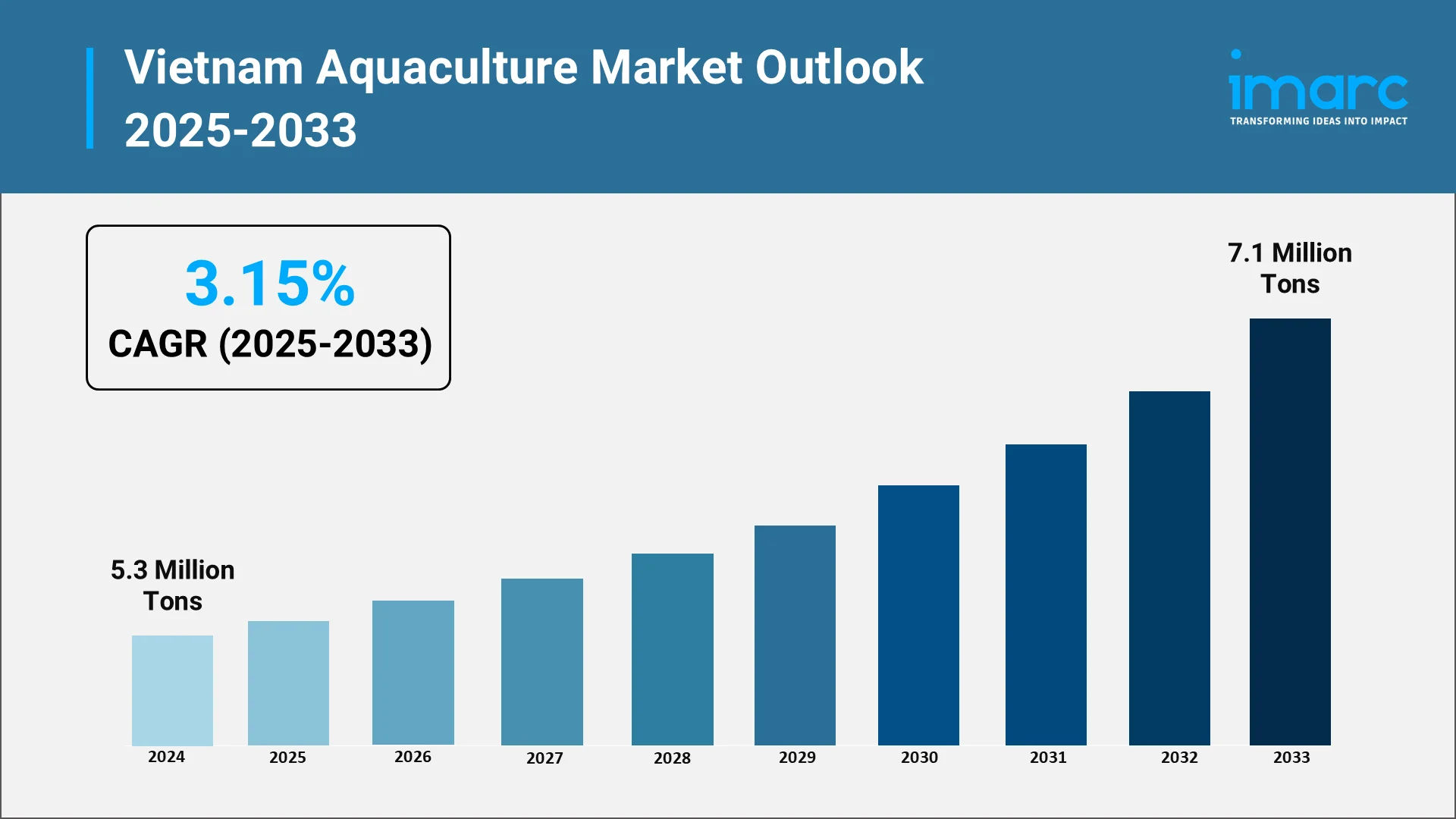

The Vietnam aquaculture market trajectory points toward continued robust development. Ongoing technological advancement promises further improvements in efficiency, environmental sustainability, and product quality. Emerging technologies—AI for farm management, genetic innovations through selective breeding, advanced feed formulations—will likely reshape how operations work.

Climate resilience will become increasingly critical. Rising sea levels, changing rainfall, and increased storm intensity pose real challenges requiring adaptive responses. Investment in resilient infrastructure, stress-tolerant species, and early warning systems will be essential for maintaining stable production.

Regulations will continue evolving as international standards for food safety, environmental protection, and labor practices become stricter. Producers who proactively adopt best practices and invest in compliance will maintain market access and competitive position.

Market segmentation will likely intensify. Premium markets will demand higher standards of quality, sustainability, and traceability, while value segments prioritize affordability. Successful operators will develop clear positioning and allocate resources to serve chosen segments effectively.

Human capital development represents both challenge and opportunity. As the industry becomes more sophisticated, demand for skilled workers with technical training and business acumen increases. Educational institutions, industry groups, and companies need to collaborate on workforce development.

Conclusion:

The Vietnam aquaculture market sits at an inflection point. Established strengths provide a foundation for sustained growth, while emerging opportunities promise new expansion avenues. The evolution from traditional methods to sophisticated, technology-enabled operations show remarkable adaptability. As global demand for sustainable protein intensifies, Vietnam is well-positioned to play an increasingly central role in seafood supply chains.

Success requires understanding the complex interplay of production economics, consumer preferences, regulations, and competitive dynamics. Stakeholders who grasp these nuances will capture disproportionate value as the industry continues its trajectory. The convergence of sustainable aquaculture practices, advanced fish farming technology, and expanding market access creates a uniquely favorable environment.

For investors, business developers, and policymakers, the Vietnamese aquaculture sector offers opportunities extending beyond traditional farming to input supplies, processing infrastructure, logistics, and technology platforms. How will you position to capture value in Vietnam's thriving aquaculture ecosystem?

Partner with IMARC Group for Strategic Intelligence:

- Data-Driven Market Research: Deepen your understanding of aquaculture production systems, species diversification, and technological innovations through comprehensive market research reports covering Vietnam's dynamic sector.

- Strategic Growth Forecasting: Anticipate emerging developments in Vietnamese aquaculture, from advanced breeding technologies and sustainable feed alternatives to evolving export regulations and shifting consumer preferences across global markets.

- Competitive Benchmarking: Analyze competitive forces, evaluate production methodologies, and monitor breakthroughs in disease management, water treatment, and value-added processing technologies.

- Policy and Infrastructure Advisory: Stay ahead of regulatory developments, government support programs, and certification requirements affecting production, export operations, and market access in key destinations.

- Custom Reports and Consulting: Receive tailored insights aligned with your goals—whether entering the Vietnamese market, investing in processing infrastructure, developing input supply businesses, or expanding export operations.

IMARC Group empowers industry leaders with the clarity and intelligence required to navigate Vietnam's dynamic aquaculture landscape. Partner with us to unlock opportunities in one of Asia's most promising food production sectors.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)