Saudi Arabia Luxury Market Trends: Navigating Consumer Evolution and High-End Lifestyle Transformations

Introduction:

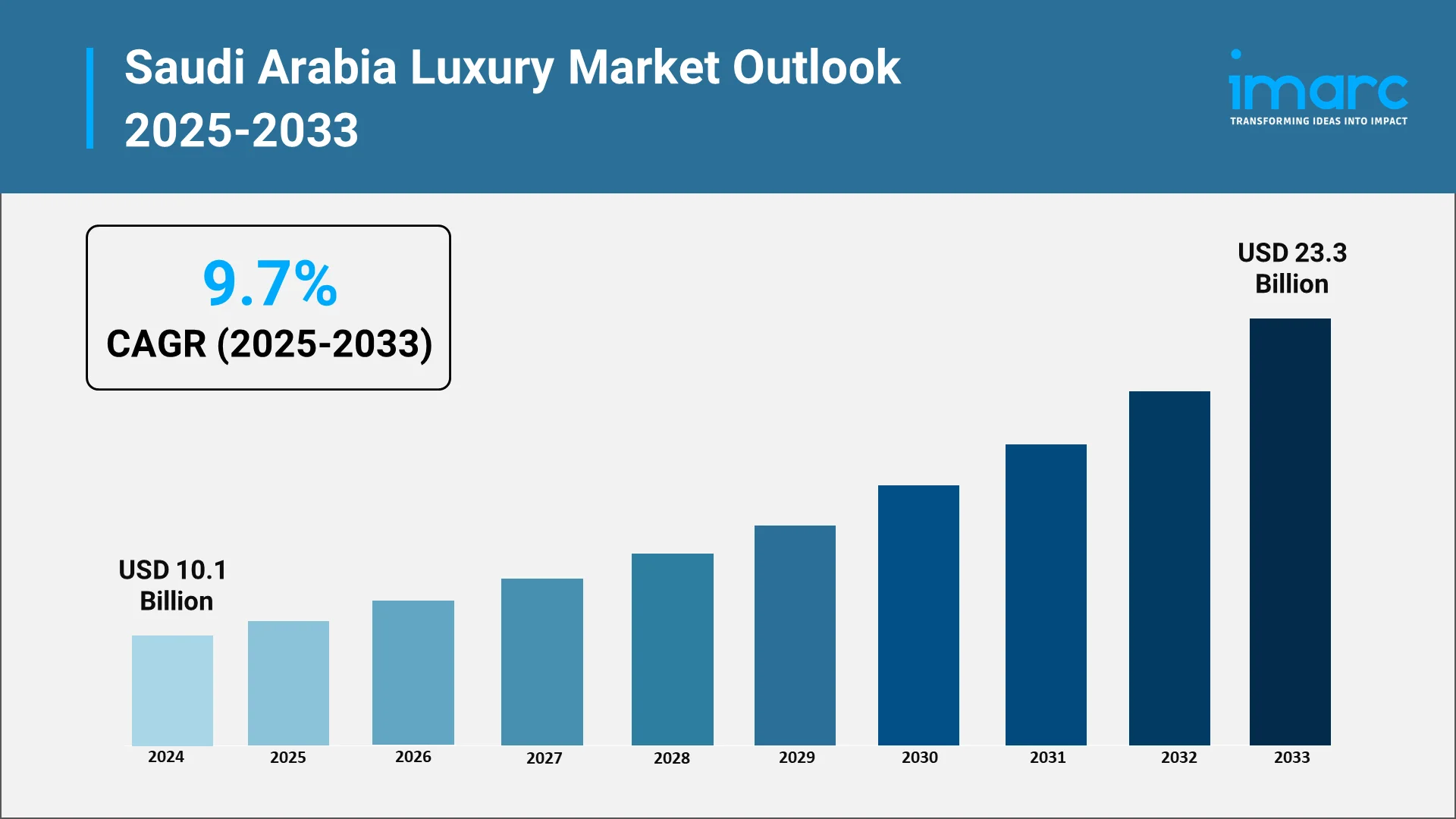

The Saudi Arabia luxury market represents one of the most dynamic and rapidly evolving segments within the Middle Eastern premium retail landscape. As the Kingdom undergoes comprehensive economic diversification and social transformation, luxury consumption patterns are experiencing unprecedented shifts that reflect changing demographics, evolving consumer preferences, and ambitious national development goals. In 2024, the Saudi Arabia luxury market reached USD 10.1 Billion.

The convergence of rising disposable incomes, growing youth population, increasing female workforce participation, and enhanced tourism infrastructure is reshaping how luxury goods and experiences are consumed across the Kingdom. Understanding the Saudi Arabia luxury market trends requires examining multiple interconnected factors including generational wealth transfer, digital transformation, sustainability consciousness, and the emergence of new luxury consumer segments. The influence of the Saudi Arabia luxury market extends far beyond premium retail, touching tourism development, real estate investment, entertainment infrastructure, and the broader services economy.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming the Saudi Arabia Luxury Industry:

Vision 2030 acts as the initiating driver of transformation in the Saudi Arabia luxury market, therefore presenting premium brands and lifestyle providers with unprecedented opportunities. Given the strategic framework's focus on economic diversification, tourism development, and quality-of-life improvement, the support for Saudi Arabia luxury market growth emerges through many channels. Liberalization of the entertainment sector, development of cultural destinations, and investment in world-class infrastructure are some of the key drivers significantly changing the way luxury is consumed.

The Quality of Life Program under Vision 2030 targets the expansion of entertainment, cultural, and recreational options, thus benefiting luxury hospitality, dining, and experiential retail directly. Saudi Arabia cultivates a cosmopolitan atmosphere, well-suited for a luxury consumer mindset, through embracing international entertainment, concerts, sporting events, and cultural exhibitions. As noted by the Saudi Ministry of Tourism, the Kingdom welcomed 60.9 million visitors in the first half of 2025 for SAR 161.4 Billion in tourism spending, reflecting a 4% increase from 2024. These changes attract both domestic high-net-worth individuals looking for improved lifestyle experiences and international tourists of luxury exploring the emerging destinations within the Kingdom.

Regulatory reforms accompanying Vision 2030 have removed previous restrictions that limited certain luxury sectors, particularly in entertainment and mixed-gender social spaces. This is further supported by the introduction of tourist visas and the development of mega-projects such as NEOM, Qiddiya, and the Red Sea Project, demonstrating the Kingdom's commitment to establishing itself as a global destination for luxury. These mega-projects boast ultra-luxury residential developments, premium hospitality options, and high-end retail districts designed to global luxury standards.

Women's empowerment initiatives within Vision 2030 have particular importance for the Saudi Arabia luxury market share, with women being increasingly significant consumers of luxury goods, while their purchasing power and independence are on the increase. The driving restrictions lifted, more educational opportunities opened, and improving workforce participation rates have all combined to alter female consumption habits across categories such as fashion, beauty, automotive, and lifestyle luxury.

Key Industry Trends:

- Rapid Expansion of Luxury Retail in Riyadh, Jeddah & NEOM

Saudi Arabia is rapidly developing luxury retail infrastructure in key urban centers. Riyadh will attract flagship stores of prestigious international brands, while planned mixed-use complexes are under development, incorporating retail with hospitality and entertainment elements. Jeddah attracts religious tourism spend, while NEOM is one vision for ultra-luxurious living in the future, embracing the newest technology and sustainability considerations.

- Growing Demand for High-End Fashion, Footwear & Accessories

Fashion and accessories remain the cornerstone of luxury categories, with consumers showing increasing sophistication in brand awareness and appreciation for craftsmanship. Modest fashion has emerged as an important segment in line with cultural values. Highly sought-after items include luxury handbags and limited editions; meanwhile, luxury sneakers are gaining importance alongside traditional footwear.

- Increase in Luxury Beauty, Skincare & Fragrance Consumption

Beauty and fragrance represent fast-growing categories driven by cultural emphasis on personal grooming. Fragrance is considered particularly important in Saudi culture, creating demand for both international compositions and Arabic oud-based ones. Male grooming is growing well, with increasing numbers of younger men using skincare and fragrance products.

- The Rising Popularity of Ultra-Luxury Cars, Watches & Fine Jewelry

Ultra-luxury automotive brands continue to have strong positions, with consumers showing loyalty to heritage marques while embracing electric vehicles. Swiss luxury watches show a deep appreciation for horological craftsmanship. Fine jewelry holds cultural significance in terms of adornment and investment.

- Boom in Luxury Hospitality, Premium Malls & Experiential Shopping

Vision 2030 focuses on luxury hospitality development where international groups create flagship properties. Upscale or premium malls have become lifestyle destinations that combine shopping, dining, and entertainment. Experiential retail concepts create emotional brand connections beyond traditional transactions.

- Increasing Adoption of Online Luxury Shopping & Omnichannel Retail

E-commerce sites and social media have redrawn the landscape of luxury buying. Instagram and Snapchat provide new channels for brands to tell stories and partner with influencers. Omnichannel integration allows customers to smoothly shift between digital research and physical retail.

- Growing Interest in Sustainable, Ethical & Designer Luxury Products

Sustainability awareness arises in younger generations who are conscious of the environment. Designer collaborations create excitement from a combination of heritage and new ideas. Pre-owned luxury markets gain legitimacy through authentication services and brand-endorsed resale programs.

- High-Net-Worth Population on the Rise, Driving Luxury Spending

Saudi Arabia's growing high-net-worth population fuels market growth by wealth accumulation and lifestyle aspirations. Generational wealth transfer and entrepreneurial creation add new customers to the luxury market. Independent purchasing power makes female high-net-worth individuals increasingly important segments.

Market Segmentation & Regional Insights:

IMARC Group’s Saudi Arabia luxury market report has provided a detailed analysis based on the distribution channel, category, and gender.

- The market has been segmented based on the distribution channel into mono-brand stores, multi-brand stores, online stores, and others. According to the report, mono-brand stores dominate the distribution channel segment by offering exclusive, immersive brand experiences in high-end shopping districts that attract affluent consumers seeking authenticity and personalized luxury services.

- Based on the category, the market has been segregated into travel and hotel, cars, personal luxury goods, food and drinks, and others. Cars represent the largest category segment, driven by Saudi Arabia's affluent population and strong demand for prestigious automotive brands like Mercedes-Benz, BMW, Rolls-Royce, and Lamborghini across major cities.

- On the basis of gender, the market has been divided into male and female. Female consumers constitute the largest gender segment, propelled by strong cultural emphasis on beauty and personal care, with luxury spending 55% higher than men and increasing workforce participation enhancing purchasing power.

Forecast (2025-2033):

The Saudi Arabia luxury market size is expected to reach USD 23.3 Billion by 2033, showcasing a CAGR of 9.7% during 2025-2033. Increasing disposable income among Saudi Arabia's wealthy demography supports the direct capacity to spend on luxury. Similarly, the initiatives of economic diversification create new pathways of generating wealth, other than traditional oil-dependent sectors, thereby expanding the affluent consumer base.

Urban lifestyle shifts with modernization, growth in the entertainment sector, and cultural liberalization create environments where luxury consumption becomes more visible, accessible, and socially integrated. Tourism growth under Vision 2030 represents a significant demand driver across luxury hospitality, retail, and experiential categories. Religious tourism is attracting affluent Muslim visitors from all over the world who are looking for luxury stays and high-end shopping.

The expansion of luxury retail infrastructure and premium malls creates a very important physical environment in which the luxury brands can establish their presence and engage consumers. The increasing popularity of global luxury brands in the Saudi market brings international best practices with advanced service standards. The increasing preference of youth for premium fashion, lifestyle, and experiences speaks of generational shifts in the motivations for consuming luxury.

Conclusion:

The Saudi Arabia luxury market stands at a transformative juncture where economic diversification, social modernization, and demographic evolution converge to create exceptional growth opportunities across all categories of luxury. Vision 2030 encompasses a comprehensive framework that provides strategic direction and infrastructure investment, fundamentally enhancing the Kingdom's luxury ecosystem.

Major Saudi Arabia luxury market trends include retail expansion across key cities, digital transformation, sustainability consciousness, and experiential luxury, reflecting both global luxury evolution and distinctive local market characteristics. The growing high-net-worth population, especially among younger generations and female consumers, will continue to drive demand growth across various categories.

Partner with IMARC Group for Strategic Luxury Market Intelligence:

At IMARC Group, we empower luxury brands, retail developers, hospitality groups, and investors with comprehensive market intelligence.

- Our capabilities include data-driven market research deepening understanding of luxury consumer behaviors and spending patterns across Saudi Arabia's evolving landscape. We deliver strategic growth forecasting predicting emerging trends and competitive developments.

- Our competitive benchmarking analyzes brand positioning and market dynamics.

- We provide policy and infrastructure advisory keeping clients informed of regulatory developments and tourism initiatives.

- Through custom reports and consulting, we deliver insights aligned with your objectives for brand introduction, retail expansion, hospitality development, or investment evaluation.

IMARC Group equips luxury market leaders with intelligence to navigate Saudi Arabia's dynamic luxury landscape and capture growth opportunities. Join us in shaping the future of luxury in the Kingdom, where tradition meets transformation and extraordinary experiences await discerning consumers. Click here for more details: https://www.imarcgroup.com/saudi-arabia-luxury-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)