Saudi Arabia Cosmetics Market Trends: Evolving Consumer Preferences and Beauty Innovation

Introduction:

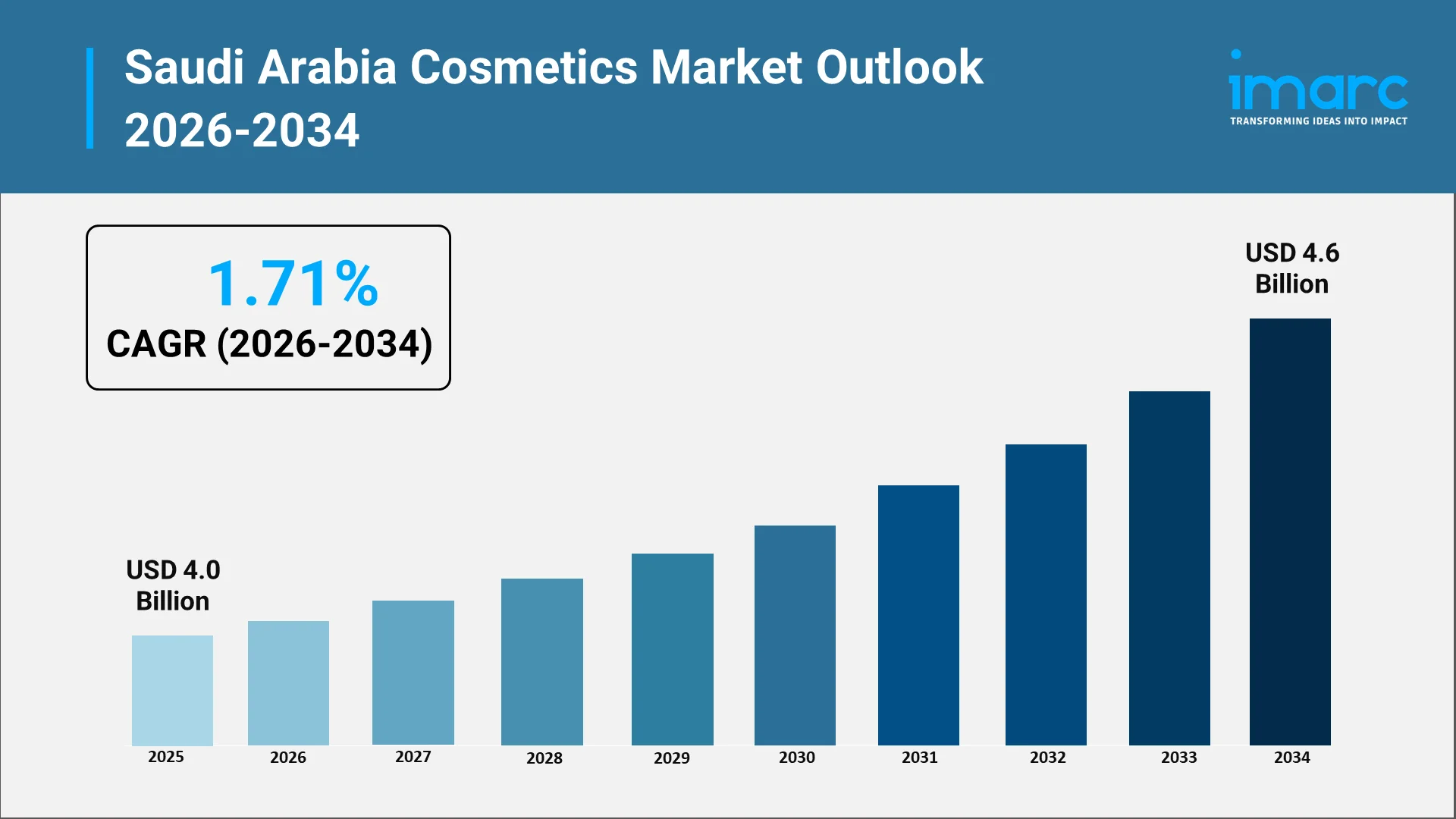

The Saudi Arabia cosmetics market has emerged as one of the most dynamic beauty sectors in the Middle East and Africa region. The Kingdom's beauty industry reflects a sophisticated blend of traditional Arabian beauty heritage and contemporary global trends, driven by a young, digitally savvy population with increasing purchasing power and growing appetite for premium beauty solutions. The Saudi Arabia cosmetics market size reached USD 4.0 Billion in 2025.

The cosmetics industry in Saudi Arabia extends far beyond basic personal care, encompassing skincare, makeup, fragrance, haircare, and specialized dermatological treatments. This sector plays a pivotal role in shaping consumer lifestyles, influencing retail modernization, and contributing to economic diversification. The market's evolution mirrors broader societal changes including increased female workforce participation, shifting beauty standards, and greater exposure to international beauty cultures.

Saudi Arabia cosmetics brands operate within a unique ecosystem characterized by high brand consciousness, preference for luxury positioning, and strong cultural considerations around product formulation and marketing. The retail landscape has undergone remarkable transformation, with traditional perfume souks now complemented by world-class beauty megastores, standalone brand boutiques, and sophisticated e-commerce platforms.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming the Saudi Arabia Cosmetics Industry:

Vision 2030 has fundamentally reshaped the trajectory of the Saudi Arabia cosmetics industy by creating an enabling environment for industry growth and innovation. In April 2025, the Saudi Food and Drug Authority (SFDA) published a comprehensive report detailing its remarkable achievements from 2017 to 2022, highlighting the development of robust regulations for cosmetics, technical standards, and compliance systems that have enhanced product safety and regulatory efficiency across the Kingdom.

The initiative's focus on economic diversification has positioned the beauty and personal care industry as a strategic growth sector. Government support for retail development, tourism infrastructure, and entertainment venues has created new consumption occasions and distribution channels for cosmetics products.

Female empowerment initiatives under Vision 2030 have profoundly influenced cosmetics consumption patterns. The lifting of driving restrictions, expanded employment opportunities, and greater participation in public life have created new beauty needs around professional presentation, active lifestyles, and social engagement. Working women represent a particularly lucrative segment, seeking time-efficient beauty solutions and long-wearing formulations.

Tourism development under Vision 2030 has introduced Saudi consumers to international beauty standards while attracting foreign visitors whose spending contributes to cosmetics retail growth. The expansion of luxury hotels, shopping destinations, and entertainment complexes has elevated beauty service standards and product availability across the Kingdom.

Key Industry Trends:

- Rise of Premium and Luxury Beauty Products in Saudi Arabia

The Saudi cosmetics market trends exhibit strong premiumization, with consumers gravitating toward luxury beauty products that signal status, quality, and exclusivity. International luxury beauty houses have established prominent retail presences across major Saudi cities, leveraging sophisticated store designs, personalized consultation services, and exclusive product launches to cultivate loyal customer bases.

- Boom in Halal, Clean, and Ethical Beauty Products

Halal cosmetics represent one of the fastest-growing segments within the Saudi beauty market, driven by religious observance, health consciousness, and growing awareness of ingredient transparency. Consumers increasingly scrutinize product formulations, seeking certifications that guarantee compliance with Islamic principles regarding ingredient sourcing and manufacturing processes.

The clean beauty movement emphasizing natural ingredients, minimal processing, and transparency has gained substantial traction. Saudi consumers, particularly younger demographics, actively research ingredient lists, avoiding controversial compounds like parabens, sulfates, and synthetic fragrances.

- Growing Popularity of Dermatology-Backed Skincare and Clinical Beauty

Clinical beauty products and dermatologically tested formulations have experienced remarkable growth as Saudi consumers adopt increasingly sophisticated skincare approaches. The harsh desert climate, with intense sun exposure and low humidity, creates specific skincare challenges that drive demand for scientifically formulated solutions. Dermatologist-recommended brands have gained prestige status, with consumers viewing these products as investments in long-term skin health.

- Influence of Social Media, Beauty Influencers & K-Beauty Trends

L'Oréal Groupe debuted at LEAP 2025 in Riyadh in February 2025, displaying more than 20 cutting-edge beauty tech solutions driven by artificial intelligence and cutting-edge technology. L'Oréal, the only beauty tech company present at this premier Saudi tech event, showcased innovative solutions like sustainable beauty products and AI-powered diagnostic tools, highlighting the Kingdom's rise as the GCC's largest beauty market and a major center for tech-powered consumer experiences.

Social media platforms have revolutionized beauty discovery, education, and purchasing in Saudi Arabia. Instagram, YouTube, TikTok, and Snapchat serve as primary channels for beauty content consumption, with Saudi influencers commanding substantial followings and significant purchase influence. The K-beauty phenomenon has profoundly impacted Saudi cosmetics preferences, introducing multi-step skincare routines, innovative product formats, and emphasis on skin health over heavy makeup.

- Expansion of E-Commerce and Omnichannel Beauty Retail Formats

E-commerce in Saudi Arabia has transformed cosmetics distribution, offering convenience, variety, and discretion valued by local consumers. The Kingdom boasts among the highest e-commerce penetration rates globally, with beauty and personal care representing a leading category in online retail. Specialized beauty e-commerce platforms have emerged alongside general marketplaces, offering curated selections, expert advice, virtual try-on technologies, and personalized recommendations.

- Growth of Organic, Natural & Sustainable Beauty Formulations

Organic cosmetics and natural formulations have transitioned from niche to mainstream, driven by health consciousness, environmental awareness, and preference for gentle ingredients. The natural beauty movement encompasses products featuring botanical extracts, plant-based oils, and minimal synthetic additives. Brands emphasizing ingredient provenance, traditional formulation wisdom, and sustainable sourcing practices resonate with consumers seeking authentic, transparent beauty solutions.

Market Segmentation & Regional Insights:

The Saudi Arabia cosmetics market exhibits distinct segmentation patterns across product type, category, gender, distribution channel and region.

Breakup by Product Type:

- Skin and Sun Care Products: Driven by harsh climatic conditions and growing awareness of UV protection, this segment dominates the market with high demand for moisturizers, sunscreens, anti-aging serums, and dermatologically-tested formulations.

- Hair Care Products: The segment encompasses shampoos, conditioners, hair treatments, and styling products tailored to address heat damage, humidity, and specific hair concerns prevalent in the Saudi climate.

- Deodorants and Fragrances: Representing a culturally significant category, this segment features premium perfumes, oudh-based fragrances, body sprays, and long-lasting deodorants that align with Saudi preferences for sophisticated scent profiles.

- Makeup and Color Cosmetics: This segment includes foundations formulated for local skin tones, long-wearing eye cosmetics, lip products, and face makeup designed to withstand high temperatures while meeting modest beauty standards.

Breakup by Category:

- Conventional: Traditional cosmetic formulations dominate this segment, offering established brands, proven performance, and competitive pricing across mainstream beauty products.

- Organic: Rapidly growing segment featuring natural, plant-based, chemical-free formulations that appeal to health-conscious consumers seeking clean beauty alternatives aligned with halal principles.

Breakup by Gender:

- Men: Expanding segment driven by growing male grooming consciousness, featuring skincare basics, beard care products, fragrances, and professional grooming solutions tailored to masculine preferences.

- Women: The largest segment encompassing comprehensive beauty routines, premium skincare, extensive color cosmetics, haircare, and fragrance products driven by increasing female purchasing power and social participation.

- Unisex: Emerging segment offering gender-neutral fragrances, skincare essentials, hair care products, and minimalist beauty solutions appealing to modern consumers seeking versatile, inclusive formulations.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets: Mass-market channel offering convenient access to everyday beauty essentials, value brands, and family-sized products with competitive pricing and promotional offers.

- Specialty Stores: Premium destination featuring curated brand selections, expert consultation, personalized services, exclusive launches, and immersive shopping experiences for discerning beauty consumers.

- Pharmacies: Trusted channel specializing in dermocosmetics, clinical skincare, therapeutic beauty products, and professional-grade formulations recommended by dermatologists and healthcare professionals.

- Online Stores: Fastest-growing channel offering extensive product variety, competitive pricing, home delivery, virtual consultations, beauty tutorials, and personalized recommendations through e-commerce platforms.

Breakup by Region:

- Northern and Central Region: Anchored by Riyadh, this region represents the largest market with high concentration of luxury retail, corporate professionals, affluent consumers, and sophisticated beauty infrastructure driving premium product demand.

- Western Region: Led by Jeddah and including Mecca and Medina, this cosmopolitan region features strong international influence, religious tourism, diverse consumer base, and significant demand for halal-certified premium cosmetics.

- Eastern Region: Centered around Dammam and Al-Khobar, this region benefits from oil industry expatriate populations with higher disposable incomes, multicultural beauty preferences, and strong demand for international prestige brands.

- Southern Region: Emerging market comprising cities like Abha and Khamis Mushait, showing growing beauty consciousness, expanding retail infrastructure, and increasing adoption of modern cosmetic products among younger demographics.

Forecast (2026-2034):

The Saudi Arabia cosmetics market size is projected to reach USD 4.6 Billion by 2034, exhibiting a growth rate (CAGR) of 1.71% during 2026-2034, driven by favorable demographic trends, economic development, and evolving consumer behaviors. Key demand drivers include rising disposable incomes as economic diversification creates employment opportunities across sectors. The Kingdom's young population entering peak earning years will sustain consumption growth.

The ongoing shift toward premium beauty products will continue driving market value expansion. Social media influence will intensify as platform penetration deepens and influencer marketing matures. The growing expatriate population contributes to market diversity, introducing beauty practices and preferences from source countries while creating demand for international brands.

Expansion of beauty retail chains into underserved geographic markets will democratize access to quality products and expert advice. Increasing preference for high-performance skincare reflects growing consumer education and willingness to invest in long-term skin health.

E-commerce growth will continue reshaping distribution dynamics, with online channels capturing increasing share of beauty transactions. Innovation in product formats, ingredient technologies, and delivery systems will drive category evolution.

Conclusion:

The Saudi Arabia cosmetics market stands at an exciting inflection point, characterized by the convergence of traditional beauty values and contemporary global trends. The industry's transformation reflects broader societal changes including female empowerment, digital adoption, and lifestyle modernization catalyzed by Vision 2030 initiatives.

Major trends shaping the market include sustained premiumization, the rise of halal and clean beauty, growing influence of clinical dermatology, social media's transformative impact, e-commerce expansion, and increasing demand for natural and sustainable formulations. These trends create opportunities for brands that authentically address Saudi consumer needs while delivering international quality standards.

Choose IMARC Group for Unmatched Expertise in Beauty Market Intelligence:

- Data-Driven Market Research: Deepen your understanding of Saudi Arabia's cosmetics landscape, consumer preferences, and emerging beauty technologies through comprehensive market research reports covering skincare innovations, color cosmetics trends, fragrance developments, and retail evolution.

- Strategic Growth Forecasting: Anticipate emerging opportunities in halal beauty, clinical skincare, K-beauty adoption, and sustainable cosmetics by analyzing demographic shifts, regulatory changes, and consumer behavior patterns across Saudi regions.

- Competitive Benchmarking: Analyze competitive dynamics among international luxury brands, regional players, and emerging local cosmetics companies in Saudi Arabia, reviewing product pipelines, distribution strategies, and marketing innovations shaping market leadership.

- Policy and Infrastructure Advisory: Navigate regulatory frameworks governing cosmetics registration, halal certification requirements, e-commerce regulations, and retail licensing procedures affecting market entry and expansion strategies.

- Custom Reports and Consulting: Access tailored insights aligned with your strategic objectives—whether launching new beauty brands, expanding retail footprints, investing in manufacturing facilities, or developing targeted marketing campaigns for Saudi consumers.

At IMARC Group, our mission is to empower beauty industry leaders with the intelligence and clarity needed to succeed in Saudi Arabia's dynamic cosmetics market. Partner with us to unlock growth opportunities in this transformative beauty landscape—because informed decisions drive sustainable success. Click here: https://www.imarcgroup.com/saudi-arabia-cosmetics-market, for more detailed report.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)