Top Factors Driving Growth in the UAE Pet Food Market

Introduction to the UAE Pet Food Industry:

The UAE’s pet food sector has emerged as one of the most dynamic and lifestyle-influenced consumer categories. While historically smaller and more niche compared to mainstream food and beverage markets, the industry has grown in relevance due to changing demographics, international influences, and shifting consumer priorities. Residents across major cities are embracing pets as companions for emotional well-being and as part of a balanced lifestyle. This shift is reflected in rising interest in responsible pet care, specialized diets, and wellness-focused nutrition. In November 2024, Pet Corner inaugurated its 20th retail store in the UAE, expanding across four emirates and offering premium pet food, accessories, grooming services, and e-commerce solutions.

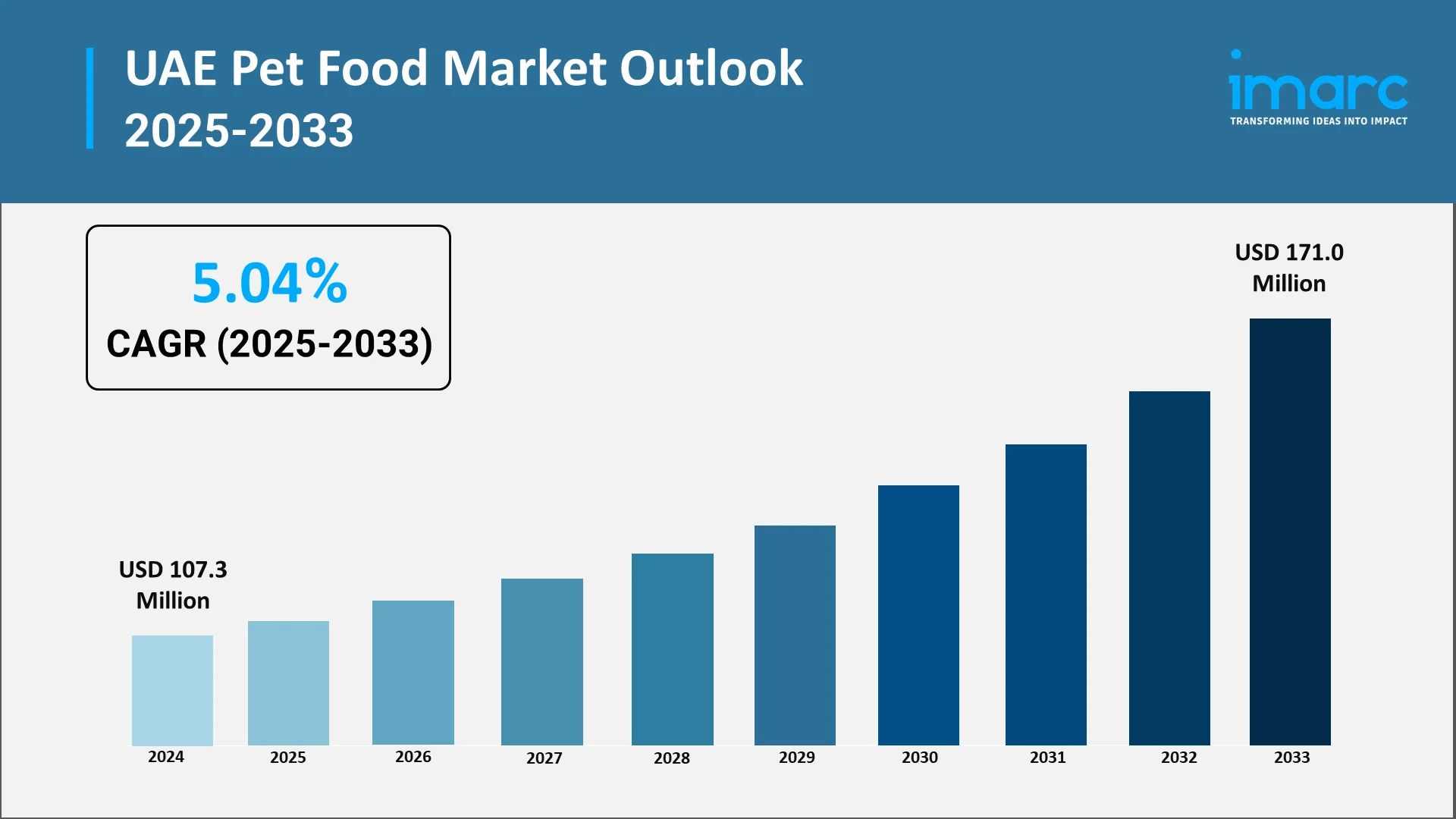

Within this environment, the UAE pet food market size is shaped primarily by consumer sophistication rather than volume-driven demand. The UAE pet food market size reached USD 107.3 Million in 2024. The market is expected to reach USD 171.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033. Further, pet owners frequently seek high-quality products with trusted formulations, clean ingredients, and convenient formats. Unlike regions where affordability is the dominant purchase motivator, the UAE market places greater emphasis on value, transparency, and premium experiences. As a result, brands focusing on innovation, ingredient integrity, and lifestyle alignment are best positioned to enhance their UAE pet food market share over time.

Another important characteristic of the sector is its alignment with global premium pet care standards. Because the UAE serves as an international hub with expatriate-rich demographics, consumer exposure to Western pet care practices strengthens demand for advanced nutrition, tailored diets, and innovative snack categories. Collectively, these factors support a robust UAE pet food market outlook, driven by a blend of cultural diversity, economic capacity, and evolving attitudes toward animal care.

Explore in-depth findings for this market, Request Sample

Rising Pet Humanization and Premiumization of Pet Food Products:

Pet humanization has become one of the strongest structural drivers for the UAE’s pet food sector. As households begin to treat pets with the same affection and consideration as family members, expectations for nutritional quality, safety, and dietary personalization increase proportionally. This emotional connection has accelerated the demand for gourmet treats, high-quality proteins, and culinary-inspired recipes formulated to elevate the daily feeding experience. In April 2025, Zabeel Pets, a new ready-to-eat pet food brand by Zabeel Feed, launched at Pet World Arabia, Dubai, offering premium nutrition, smart appliances, and innovative pet accessories.

Consumers increasingly perceive nutrition as an expression of care, leading them to prioritize meals that mirror human-grade food attributes in terms of texture, flavor variety, and ingredient transparency. This directly contributes to shifting purchasing habits across premium dry food, wet food, functional snacks, and supplementary nutrition categories. As a result, premiumization has become a defining feature of UAE pet food market trends, with many consumers gravitating toward superior formulations that promote longevity, vitality, and overall well-being.

This trend also encourages companies to highlight the craftsmanship and scientific expertise behind their offerings. Pet owners often prefer products that demonstrate integrity in sourcing, advanced processing technologies, and clearly communicated health benefits. As such, rising pet humanization continues to shape the direction of UAE pet food market growth, reinforcing demand for nutrient-dense, high-quality, and thoughtfully curated products.

Growing Demand for Organic and Natural Pet Food Formulations:

As global wellness culture gains momentum, the UAE has become increasingly aligned with clean-label and natural nutrition preferences. As per sources, in November 2025, Furchild opened a 15,000-sq-ft human-grade pet food facility in Dubai, offering raw, preservative-free meals for dogs and cats under HACCP- and ISO 22000-certified standards. Furthermore, pet owners are applying the same scrutiny to pet food labels as they do to their own dietary choices. This has created a strong market for organic, natural, minimally processed, and ingredient-transparent formulas. The rising interest in additive-free and preservative-free options underscores the shift toward holistic care and preventive nutrition.

Pet parents in the UAE often seek reassurance that the food they are providing supports optimal digestion, strong immunity, and balanced development. This has heightened demand for products formulated with identifiable, naturally derived ingredients that avoid artificial enhancers. As a result, the trend supports broader improvements in product quality and innovation, reinforcing long-term confidence in the UAE pet food market forecast.

The preference for natural products also reflects environmental consciousness and ethical considerations. Many consumers appreciate sustainable sourcing practices, plant-based formulas, and responsibly produced proteins. These sentiments are increasingly influencing retail choices and strengthening the overall appeal of nature-aligned nutrition categories. Consequently, clean-label preferences are emerging as foundational elements of future UAE pet food market trends, signifying a meaningful shift in consumer priorities.

Expansion of E-commerce Channels and Online Pet Care Retailing:

Digital transformation is reshaping every facet of the UAE’s retail ecosystem, and the pet food sector is no exception. The rapid expansion of e-commerce platforms, online pet stores, and subscription-based delivery models has significantly improved accessibility, convenience, and variety. Pet owners enjoy the ability to browse multiple brands, compare formulations, read product reviews, and receive doorstep deliveries with predictable schedules.

These factors have made online retail a preferred channel for purchasing both mainstream and specialized products. Additionally, digital platforms allow consumers to explore niche diets, functional foods, and premium innovations that may not always be stocked in physical stores. The integration of mobile apps, digital loyalty programs, and personalized product recommendations further enhances the shopping experience.

This retail evolution not only strengthens consumer engagement but also boosts the long-term attractiveness of the UAE pet food market outlook. Companies that adapt proactively to digital trends are better positioned to expand their UAE pet food market share, especially among tech-savvy and convenience-driven households. As online visibility and accessibility increase, e-commerce will remain a key catalyst for sustained UAE pet food market growth.

Increasing Pet Adoption and Ownership Among Urban Households:

Urbanization and lifestyle evolution are important contributors to the UAE’s growing pet ownership culture. Many households view pets as sources of companionship, emotional balance, and family bonding. With growing awareness of the emotional and psychological benefits associated with pet companionship, adoption and fostering trends are gaining momentum across major emirates.

As more households welcome pets, demand for structured nutrition, consistent feeding routines, and quality-driven products rises accordingly. This behavioral shift encourages greater familiarity with nutritional science, ingredient quality, and the significance of diet-specific formulations. As a result, consumer expectations continue to propel innovation and product diversity across the market.

Growing ownership also strengthens recurring demand cycles. Once households begin feeding specialized diets, treats, or functional supplements, they are likely to maintain long-term purchasing commitments. This ensures steady expansion in the broader UAE pet food market size, supported by a continuously widening consumer base. Over time, this trend also contributes to stable UAE pet food market growth, reinforcing the sector’s resilience and its ability to adapt to evolving household structures.

Innovation in Functional and Customized Pet Nutrition Solutions:

Innovation has become a central driver of competitive differentiation within the UAE pet food industry. As pet owners increasingly understand the connection between nutrition and health outcomes, demand has shifted toward science-driven, functional formulations tailored to specific life stages, breeds, and lifestyle requirements. Products targeting digestive health, weight balance, immune function, mobility, skin and coat nourishment, and cognitive support are gaining prominence.

This surge in functional nutrition reinforces the importance of research-based product development. Manufacturers are integrating advanced ingredients such as prebiotics, probiotics, tailored amino acid profiles, and specialized proteins into their formulations. Such innovations cater to precise dietary needs, ensuring that pets receive targeted support based on age, activity levels, and overall health conditions. In October 2024, The Petshop became the first UAE retailer to launch Open Farm, offering sustainably sourced, traceable pet food from the USA, elevating premium nutrition and ethical standards for pets.

Customized nutrition is also becoming a defining feature of new product strategies. Many brands now emphasize personalized solutions, whether through breed-specific diets, limited-ingredient options, or specialized blends created for sensitive digestive systems. As per sources, in August 2025, Hurayra Pet Foods officially launched in the UAE with Euro Gulf, introducing the region’s first HMC halal-certified premium pet nutrition for cats and setting a new industry benchmark. Moreover, these innovations deepen consumer trust while enhancing the premium appeal of more advanced product lines.

As innovation accelerates, functional diets are expected to play a major role in shaping future UAE pet food market trends. This segment aligns strongly with premiumization, humanization, and wellness-driven consumer behavior, making it a core pillar of the evolving UAE pet food market forecast.

Opportunities and Challenges in the UAE Pet Food Industry:

The UAE pet food sector presents a wide range of opportunities driven by economic stability, diversity of consumer preferences, and growing demand for advanced nutrition. Premium brands, natural formulations, functional diets, and online retail platforms all hold strong potential for expansion. Additionally, increasing awareness of pet well-being encourages continuous innovation, strengthening the long-term UAE pet food market outlook.

However, the industry also encounters challenges that require thoughtful strategies. Consumer expectations regarding product quality, transparency, and ingredient authenticity continue to rise, making it essential for companies to maintain high standards throughout the supply chain. Market differentiation also becomes increasingly complex as brands introduce similar claims related to natural ingredients, functional benefits, and tailored formulations. Successfully navigating these challenges requires strong communication, innovation, and commitment to excellence, especially for companies seeking competitive advantage and higher UAE pet food market share.

Future Outlook for the UAE Pet Food Industry:

The future of the UAE pet food sector appears promising due to several reinforcing factors, including expanding pet ownership, premiumization, digitalization, and increased attention to health-centric diets. Over the coming years, cleaner labels, functional innovations, and personalized nutrition trends are expected to influence product development strategies across all categories. As consumer education improves, demand for transparent, ethically sourced, and scientifically backed formulations will intensify.

Digital ecosystems will continue to redefine purchasing behaviors, enabling companies to build stronger relationships with consumers through personalized recommendations, subscription services, and data-driven engagement. These advancements will contribute to sustained UAE pet food market growth, supporting long-term confidence in the sector.

The overall UAE pet food market forecast suggests that innovation, premiumization, and consumer empowerment will remain key pillars driving market evolution. This positions the industry for enduring expansion and increasing sophistication, supported by diverse lifestyle patterns and growing expectations for comprehensive pet wellness.

Conclusion:

The UAE pet food industry is poised for sustained growth, driven by evolving lifestyles, rising pet ownership, and heightened consumer focus on nutrition, quality, and convenience. Premiumization, pet humanization, and demand for organic, natural, and functional formulations are redefining the market landscape, while e-commerce expansion ensures greater accessibility and consumer engagement. Innovations in tailored nutrition solutions, breed-specific diets, and health-focused products are shaping differentiated offerings, strengthening brand positioning, and enhancing the overall UAE pet food market share. As households increasingly integrate pets into family life, demand for science-backed, ethically sourced, and transparent products will continue to rise, reinforcing confidence in the UAE pet food market forecast. Opportunities abound for brands that align with consumer expectations, leverage digital channels, and invest in functional and wellness-oriented products. Collectively, these factors underpin a robust UAE pet food market outlook, signaling enduring growth, sophistication, and innovation across the sector.

Choose IMARC Group as We Offer Unmatched Expertise and Core Services:

- Data-Driven Market Research: Access high-quality, data-rich reports that explore the core elements of the UAE pet food market, including rising consumer demand, evolving feeding habits, and innovations in premium, functional, and natural pet food formulations.

- Strategic Growth Forecasting: Leverage forward-looking analyses to anticipate shifts in pet nutrition preferences, adoption of organic and specialized diets, emerging online retail channels, and evolving household pet ownership patterns shaping the UAE pet food market outlook.

- Competitive Benchmarking: Evaluate the competitive dynamics shaping the UAE pet food industry, reviewing product portfolios, innovation pipelines, and positioning strategies of companies offering dry, wet, functional, and customized nutrition solutions.

- Policy and Infrastructure Advisory: Stay informed about regulatory requirements, quality standards, sustainability initiatives, and urban infrastructure developments that influence pet food manufacturing, distribution, and retail across the UAE.

- Custom Reports and Consulting: Receive tailored intelligence aligned with your organization’s goals, whether it involves launching new premium diets, expanding e-commerce channels, or exploring opportunities within the UAE pet food market forecast.

At IMARC Group, our purpose is to provide clarity, confidence, and strategic direction to businesses operating in the UAE pet food domain. By combining technical insight, market expertise, and forward-thinking perspectives, we help organizations navigate the complexities of the pet care ecosystem and unlock long-term growth in the UAE pet food market.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)