Online Grocery Market Trends: Navigating Consumer Behavior and Digital Growth

Introduction:

The global online grocery market research landscape has undergone unprecedented changes in recent years, with an upward trend marking the way consumers engage with food retail. There has been a significant expansion in the size of the online grocery market, fuelled by changing consumer preferences, technological advances, and increased convenience associated with digital shopping. Households are showing a growing reliance on online platforms for regular essentials more than ever, making the sector a cornerstone of modern retail. In April 2025, JD.com soft launched its online UK supermarket Joybuy, offering same-day delivery in London postcodes and a range of branded and own-label groceries, marking a digital expansion in the online grocery market.

The online grocery industry is no longer just a convenient alternative to traditional shopping; it's reshaping the very dynamics of supply chains and retail ecosystems. Online grocery purchasing platforms are forming an important linkage toward improved supply chain efficiency, optimized inventory management, and streamlined last-mile delivery logistics. This integration goes well beyond the smoothing of operations and stimulates wider economic growth by generating opportunities for jobs and supporting ancillary industries related to packaging, logistics, and technology services.

The consumption pattern of online groceries denotes a tendency towards convenience, personalized experience, and quicker time for delivery. Thus, retailers and digital platforms will increasingly use emerging technologies, data analytics, and business model innovations to gain competitive advantage. This itself sets up a dynamic market that thrives best on agility, consumer-centricity, and operational excellence. Changes in the online grocery market epitomize the broader trend of digital adoption, with technology and convenience fundamentally reordering consumption patterns worldwide.

Explore in-depth findings for this market, Request Sample

Key Industry Trends:

Rise of Ultra-Fast Delivery Services

One of the main evolutions happening in the online grocery retail sector is the rise of ultra-fast delivery services. More and more, the modern consumer places a premium on immediacy, with groceries arriving in hours, not days. In June 2025, BigBasket announced plans to launch 10-minute food delivery across India by March 2026, expanding dark stores and targeting quick-commerce customers while partnering with Tata group brands like Starbucks and Qmin. Moreover, the result has been an explosion in hyper-local distribution centers, micro-fulfillment hubs, and route optimization technologies that will enable shorter delivery times without sacrificing product quality.

Ultra-fast delivery is shifting the bar on consumer expectations, pushing traditional retailers to rethink their logistics strategies and digital platforms to implement real-time order tracking, active inventory replenishment, and predictive ordering. In May 2025, Kiko Live launches COD, driving a 30% surge in Kirana revenues, enhancing trust, payment flexibility, and digital adoption in India’s online grocery market. Furthermore, it's also affecting the wider supply chain dynamic: the need for closer collaboration between suppliers, delivery partners, and technology providers. As a result of all these changes, the online grocery market shifts towards a faster and more responsive system where convenience and speed will be one of the prime differentiators. This trend is most evident in urban centers where high population densities and time-scarce lifestyles increase demand for instant gratification. Ultra-fast delivery services, positioned at the intersection between online orders and immediate consumer needs, will be instrumental not just in improving customer satisfaction levels but in making speed and efficiency a key competitive lever that drives the narrative in global online grocery market research.

Integration of AI and Machine Learning for Personalized Shopping

Artificial Intelligence (AI) and Machine Learning (ML) are becoming integral to the online grocery industry, enabling retailers to deliver highly personalized shopping experiences. As per the sources, in March 2025, Instacart launched AI-powered Smart Shop technology with Health Tags and Inspiration Pages, providing personalized grocery recommendations based on consumer habits, dietary preferences, and expert nutrition guidance. Additionally, these technologies analyze consumer behavior, purchase history, and preferences to recommend products, predict demand, and optimize pricing strategies. By leveraging AI-driven insights, online grocery platforms can anticipate consumer needs, streamline inventory management, and reduce operational inefficiencies. This personalization fosters greater engagement and loyalty, transforming the online shopping experience into a tailored journey that resonates with individual preferences. Furthermore, the integration of AI and ML facilitates dynamic pricing, promotional targeting, and automated replenishment systems. Retailers can better forecast demand fluctuations and minimize waste, supporting the sustainability goals increasingly valued by modern consumers. These advancements in predictive analytics and automated recommendations exemplify the ongoing online grocery market changes, positioning technology at the core of retail innovation and operational excellence.

Expansion of Subscription-Based Grocery Models

Subscription-based grocery services have emerged as a significant trend within the online grocery industry. By offering curated weekly or monthly deliveries, these models cater to consumers seeking convenience, predictability, and tailored product selections. In April 2024, Amazon launched a new $9.99/month grocery delivery subscription for Prime and EBT users across 3,500 U.S. cities, offering free deliveries, one-hour windows, and unlimited pickups. In line with this, subscription models also allow retailers to secure recurring revenue streams while gaining valuable insights into consumer preferences.

Consumers benefit from the simplicity of scheduled deliveries, automated replenishment of essential items, and access to exclusive offers. For retailers, these models facilitate better inventory forecasting, reduced operational uncertainty, and improved supply chain coordination. Over time, subscription-based offerings are reshaping expectations around grocery shopping, reinforcing loyalty, and fostering long-term engagement. The growth of subscription models reflects a broader trend in the online grocery market changes, emphasizing convenience, personalization, and proactive customer engagement. These models complement existing digital platforms while simultaneously creating opportunities for innovation in packaging, product curation, and delivery efficiency.

Growth of Direct-to-Consumer Farm-to-Table Platforms

Direct-to-consumer (DTC) farm-to-table platforms are reshaping the online grocery industry by connecting producers directly with consumers. These platforms prioritize transparency, freshness, and quality, catering to health-conscious and ethically-minded shoppers who value traceability and locally sourced products. By eliminating intermediaries, DTC platforms enable better pricing, faster delivery, and closer alignment with consumer demands. This direct link between producers and consumers also supports sustainable agricultural practices and reduces supply chain complexity. Consumers increasingly seek products that are organic, seasonal, and regionally sourced, fueling the adoption of farm-to-table models within the global online grocery market research framework. The expansion of these platforms illustrates a shift in consumer priorities toward health, sustainability, and ethical sourcing. Retailers and technology providers are responding by creating digital marketplaces that highlight provenance, offer transparent pricing, and facilitate efficient logistics, marking a significant evolution in the online grocery market changes.

Adoption of Sustainable and Eco-Friendly Packaging Solutions

Sustainability has become a central focus within the online grocery industry, with retailers increasingly adopting eco-friendly packaging solutions. Consumers are prioritizing environmental responsibility, prompting companies to replace conventional plastic with biodegradable, recyclable, or reusable alternatives. In August 2024, Ocado launched a trial offering everyday groceries such as rice and pasta in refillable packaging, aiming to reduce single-use plastics and enhance sustainability in online grocery delivery. The integration of sustainable packaging is closely tied to supply chain efficiency, cost optimization, and brand reputation. Retailers that implement environmentally conscious practices can appeal to a growing segment of eco-conscious consumers while simultaneously complying with emerging regulatory frameworks. Sustainable packaging initiatives also extend to the design of delivery systems, including insulated containers, reusable bags, and minimalistic packaging strategies. These measures reflect a broader awareness within the online grocery market changes, highlighting the convergence of operational efficiency, consumer preference, and environmental stewardship.

Market Segmentation & Regional Insights:

The online grocery industry can be segmented based on product type, delivery model, and customer demographics. Categories include fresh produce, packaged foods, beverages, household essentials, and personal care items. Each segment presents unique opportunities and challenges, with consumer demand patterns influenced by lifestyle preferences, dietary trends, and geographic considerations.

Regional dynamics play a crucial role in shaping the global online grocery market research landscape. In urbanized areas, rapid delivery services and subscription models are more prevalent, driven by time-sensitive, convenience-focused consumers. In contrast, regions with emerging digital infrastructure see a gradual adoption of online grocery platforms, often characterized by hybrid models that combine in-store and online experiences.

The evolution of logistics networks, mobile payment adoption, and internet penetration further influence regional trends. Retailers in these markets are adapting strategies to align with local consumer behaviors, regulatory environments, and technological capabilities. As the online grocery market changes, regional differentiation continues to inform strategic investments, technology integration, and platform design.

Forecast (2025–2033):

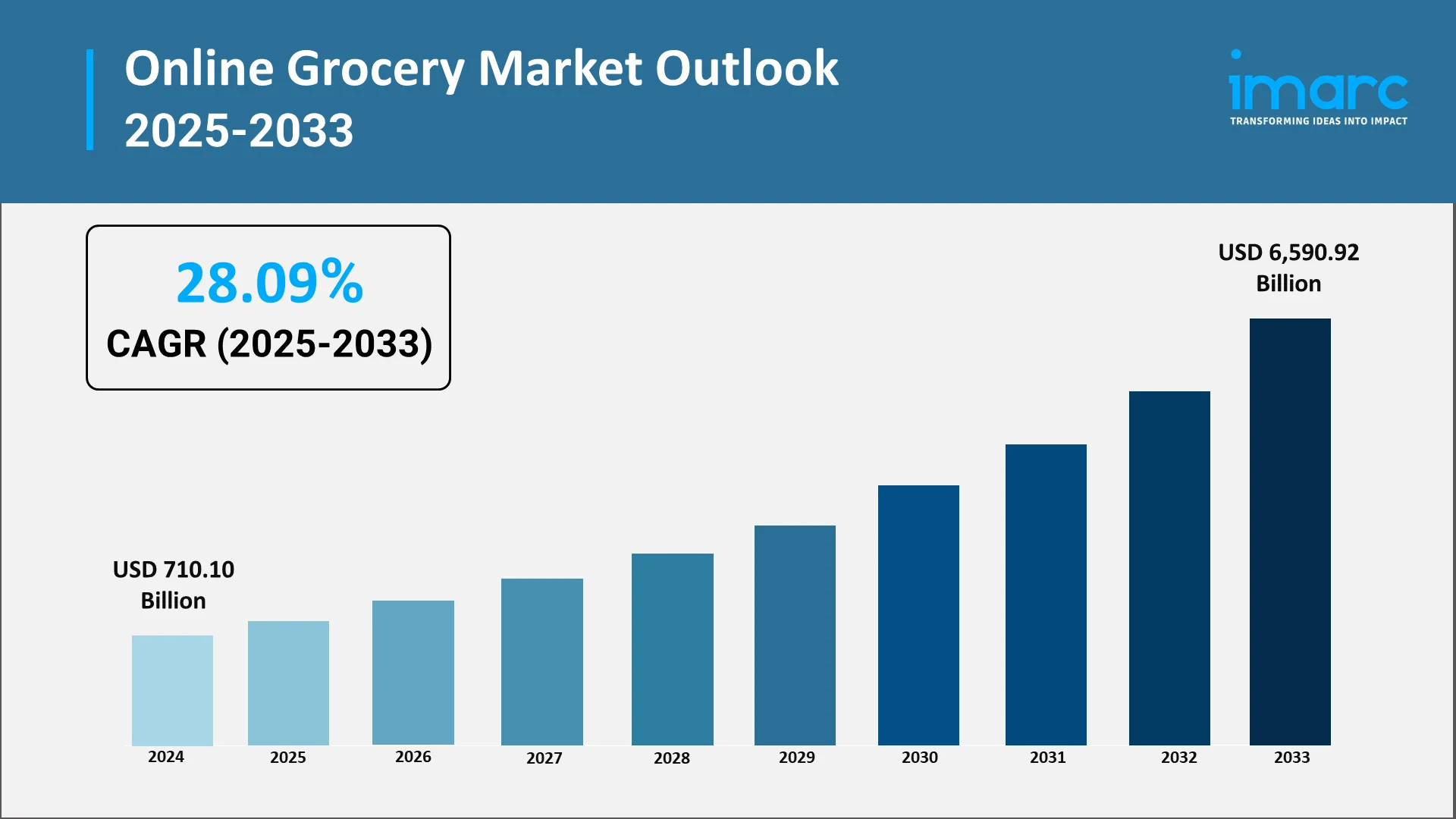

Going forward, the online grocery market is well-placed for sustained growth, underpinned by a number of key demand drivers. The shift toward convenience-driven consumer lifestyles remains a critical catalyst, with busy urban households placing an increasing premium on time-saving shopping solutions. As per sources, the global online grocery market size was valued at USD 710.10 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6,590.92 Billion by 2033, exhibiting a CAGR of 28.09% from 2025-2033. Furthermore, the rise of dual-income households further reinforces this trend, creating consistent demand for online platforms that streamline grocery procurement.

With the ongoing urbanization and further expansion of the last-mile delivery network, better accessibility and more efficiency are foreseen. Retailers invest in state-of-the-art logistics systems, micro-fulfillment centers, and AI-powered routing solutions to respond to increasing expectations of timely and precise delivery. These developments are also closely aligned with wider changes in the online grocery market, which emphasize speed, convenience, and consumer satisfaction.

Adoption of subscription-based services, farm-to-table platforms, and sustainable practices will continue to shape market evolution. Coupled with personalization from AI and ML, eco-friendly initiatives position the industry for long-term growth while addressing evolving consumer preferences. The research on the global online grocery market shows that these innovations will drive competitive differentiation, operational excellence, and deeper consumer engagement.

The adoption rate, design of the platform, and choice of services will be influenced by regional nuances across geographies. Urban markets are likely to lead in advanced delivery and subscription models, while developing regions will see a gradual adoption of digital fueled by mobile commerce and evolving logistics infrastructure. These dynamics put together portray a promising outlook for the market and point toward continued growth of the online grocery market size during the forecast period.

Conclusion:

The online grocery industry continues to evolve at a rapid pace, driven by technology, consumer demand for convenience, and the pursuit of sustainability. Key trends such as ultra-fast delivery, AI-driven personalization, subscription-based models, direct-to-consumer farm-to-table platforms, and eco-friendly packaging solutions are reshaping the market landscape. The convergence of these trends is enhancing consumer experiences, improving supply chain efficiency, and expanding the online grocery market size across regions. The integration of advanced technology and innovative business models positions the online grocery market changes as a transformative force in modern retail, emphasizing speed, personalization, and sustainability.

With increasing urbanization, dual-income households, and evolving consumer lifestyles, demand for online grocery services is expected to grow steadily over the forecast period. Retailers and digital platforms that adapt to these shifts by leveraging AI, logistics optimization, and eco-conscious practices will remain at the forefront of industry evolution. For businesses and investors seeking to understand these dynamics in detail, IMARC Group offers unparalleled expertise, actionable insights, and strategic guidance. Explore our comprehensive global online grocery market research to gain a holistic view of market trends, opportunities, and pathways for growth in the digital grocery landscape.

IMARC Group Insight: We Offer Unmatched Expertise in Online Grocery Market

At IMARC Group, our expertise in the online grocery industry empowers businesses to navigate evolving trends, technological innovations, and consumer behavior with confidence. Our team leverages extensive global online grocery market research to deliver actionable insights that inform strategic decision-making and growth planning.

We offer a comprehensive suite of core services designed to support every facet of market analysis:

- Data-Driven Market Research: We provide in-depth analyses of market dynamics, segmentation, and regional insights to guide operational and strategic decisions.

- Strategic Growth Forecasting: Our forecasts enable businesses to anticipate shifts in consumer behavior, industry trends, and technological adoption, ensuring proactive planning.

- Competitive Benchmarking: We assess competitor positioning, strategies, and performance to identify opportunities for differentiation and market leadership.

- Policy and Infrastructure Advisory: Our consulting services evaluate regulatory frameworks, supply chain optimization, and infrastructure development to support sustainable expansion.

- Custom Reports and Consulting: We create tailored solutions that align with client-specific objectives, providing actionable insights to drive growth, innovation, and competitive advantage.

IMARC Group’s commitment to rigorous research and precise forecasting allows stakeholders in the online grocery market to make informed decisions, optimize operations, and capture emerging opportunities in a rapidly evolving digital landscape.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)