Engine Oil Cost Model: Lubricant Blending & Packaging

What is Engine Oil?

Engine oil is a specific lubricant that serves to reduce friction, wear, and heat in an internal combustion engine's moving parts, allowing the smooth operation of such engines. Besides lubrication, it accomplishes other very important tasks: cooling, cleaning, sealing, and protection against corrosion.

Key Applications Across Industries:

The two major components of engine oil formulation are the base oil and additives. The base oils, mineral or petroleum-based, synthetic, and semi-synthetic, constitute approximately 70-90% of the formulation and provide the fluidity and viscosity for the best performance. Additives come in many forms, including detergents, dispersants, viscosity improvers, anti-wear agents such as zinc dialkyldithiophosphate (ZDDP), and antioxidants, which extend both protective and performance qualities of the oil under variable conditions. Engine oils can be differentiated according to their viscosity grade, as defined by the SAE (Society of Automotive Engineers), and performance standards such as API, ACEA, or ILSAC specifications. These classifications serve to ensure compatibility with various engine designs and environments. The continuing development of synthetic and low-viscosity oils has revolutionized lubrication technology, offering much improved thermal stability, oxidation resistance, and fuel efficiency when compared with more conventional mineral oils. The newest formulations also ensure compatibility with sophisticated emission control systems, minimizing the formation of pollutants and prolonging the service life of catalytic converters. Applications of high-performance lubricants have been fostered by the development of small, high-revving engines working at higher pressures and temperatures. Therefore, engine oil is a technologically manufactured fluid, not just a commodity or product for maintenance; it forms an integral part of the efficiency and longevity of modern automotive and industrial engines, their functionality, and compliance with environmental legislation.

What the Expert Says: Market Overview & Growth Drivers

The global engine oil market reached a value of USD 43.36 Billion in 2024. According to IMARC Group, the market is projected to reach USD 57.21 Billion by 2033, at a projected CAGR of 3.1% during 2025-2033. Various structural and technological drivers associated with industrial growth, automotive evolution, and sustainability transitions shape the global engine oil market. The continuously growing automobile and transportation sector, particularly in developing economies where vehicle ownership is on the rise, is one of the key drivers. In addition, despite electrification driving the future of mobility, the existing fleet of ICE vehicles around the world provides a regular stream of demand for lubricants, especially for motorcycles, commercial fleets, and heavy-duty uses. The industrial machinery and marine sectors are also important contributors because engine oils play an indispensable role in construction, agriculture, mining, and shipping operations, where reliability and protection are prime under extreme conditions.

Another factor contributing to growth is technological development. The formulation of synthetic and semi-synthetic oils with longer drain intervals, high temperature stability, and improved oxidative resistance has transformed the expectations of users regarding performance and maintenance cost. The move toward fuel-efficient, low-viscosity oils supports global efforts to reduce carbon emissions by improving engine performance and reducing frictional losses. Environmental awareness has spurred innovation in the industry in ways that continue to bring bio-based, low-sulfur lubricants to the market, meeting increasingly tough emission and disposal regulations. Further, the increasing demand for high-performance and turbocharged engines, both in passenger and commercial vehicles, is requiring high-end oils that will support the higher thermal load. Other emerging drivers are digitalization of vehicle maintenance, predictive analytics, and onboard diagnostics that help optimize oil change intervals and performance monitoring. Lastly, industrial automation, logistics, and defense investments continue to increase the scope of applications for non-automotive engine oils. These trends complement the resilience of the global engine oil market, ensuring its relevance in the wider transition to cleaner and more efficient mobility solutions.

Case Study on Cost Model of Engine Oil Manufacturing Plant:

Objective

One of our clients reached out to us to conduct a feasibility study for setting up a medium scale engine oil manufacturing plant.

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the setup and operation of a proposed engine oil manufacturing plant in India. This plant is designed to manufacture 25,000 kilo liter of engine oil annually.

Manufacturing Process: Engine oil manufacturing is a very precise, technologically driven process that incorporates chemical engineering, blending science, and quality control in the production of high-performance lubricants for modern engines. The entire formulation of engine oil starts with selecting a base oil. Base oils are derived either from refined crude petroleum-known as mineral oils-or from chemical synthesis known as synthetic oils. Mineral base oils are produced through crude oil refining steps such as distillation, solvent extraction, and hydrocracking, which eliminate impurities like sulfur, nitrogen, and aromatics. Synthetic base oils, on the other hand, are derived from controlled chemical reactions like polyalphaolefin synthesis or esterification and thus offer superior thermal and oxidative stability. Once the base oils are ready, the process that follows is the additive blending, where different kinds of performance-enhancing chemicals are added in order to obtain the desired characteristics. The commonly added additives include detergents that clean the engine components, dispersants that suspend impurities, anti-wear agents that protect the metal surface, viscosity index improvers that maintain the performance over a wide temperature range, antioxidants to prevent degradation, and friction modifiers for improved fuel economy. Blending normally takes place in computer-controlled mixing units that assure accurate dosing and homogenous dispersion of the additives within the base oil. The finished oil, following blending, is filtered and undergoes quality checking according to parameters like viscosity, flash point, pour point, and chemical stability in line with standards laid down by SAE, API, and ACEA. The oil is then filled into drums, cans, or pouches, labeled, and distributed. Along the chain, due care for quality and traceability ensures consistency, performance, and adherence to ecological and safety norms, producing engine oils that can deliver reliable protection, efficiency, and durability for a wide range of operating conditions.

Get a Tailored Feasibility Report for Your Project Request Sample

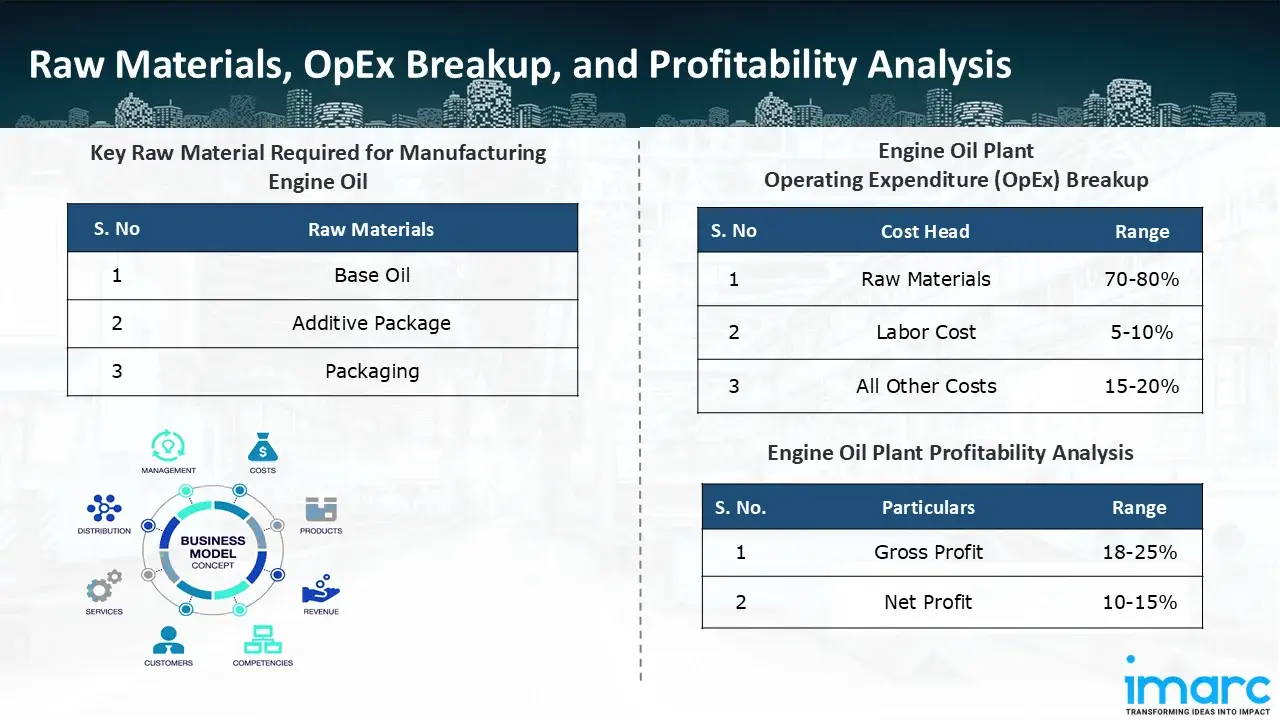

Raw Material Required:

The basic raw materials required for engine oil manufacturing include:

- Base Oil

- Additive Package

- Packaging

Machine Section or Lines Required:

- Blending Tanks

- Filling Line

- Laboratory (QC)

Techno-Commercial Parameter:

- Capital Expenditure (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth. Furthermore, raw material cost in engine oil manufacturing plant ranges between 70-80%, labor cost ranges between 5% to 10%, and all other costs ranges between 15-20% in the proposed plant.

- Profitability Analysis Year on Year Basis: We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins lie between a range of 18-25%, and net profit lie between the range of 10-15% during the income projection years, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the engine oil manufacturing plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, manufacturing, capital expenditure, and operational expenses. By addressing the specific requirements of manufacturing 25,000 kilo liter of engine oil annually, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights into strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale manufacturing ventures.

Latest News and Developments:

- In September 2025, Veedol Corporation, a prominent player in the lubricant industry, has made a strategic move in the Indian market with the launch of two new fully synthetic engine oils. With the formal launch of "SwiftPower" and "SynthGlide," the company significantly increased the range of products it offered.

- In August 2025, Shell India has introduced Shell Helix Ultra, a premium motor oil that has been updated to meet the advanced 2025 API SQ Standard. A new packaging design for its Shell Helix lubricant line was also presented at the event, giving it a more modern appearance.

- In July 2025, North Sea Lubricants announced the launch of WAVE POWER EXCELLENCE PC 0W-20, a brand-new premium engine oil developed to meet the latest technical demands of modern engines. This new product was announced to become available via their global distributor network from August 2025.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104