How Big Will Be the India Ice Cream Industry by 2033?

Ice Cream Becoming an All-Season Consumer Consumption Product:

The India ice cream market is experiencing a fundamental transformation in consumption patterns. Traditionally viewed as a summer indulgence, ice cream has evolved into a year-round treat that transcends seasonal boundaries. This shift reflects changing consumer attitudes and lifestyle preferences across urban and emerging markets.

Modern retail infrastructure and improved cold chain logistics have enabled consistent product availability throughout the year. Consumers no longer limit their ice cream consumption to hot summer months. Winter consumption has gained substantial traction, driven by festive occasions, celebratory gatherings, and the growing perception of ice cream as an everyday dessert rather than a seasonal luxury. Over the past ten years, ice cream consumption in India has increased fourfold, according to the Indian Ice Cream Manufacturing Association. On March 27, 2025, the Minister of State for Animal Husbandry and Dairying established Ice Cream Day in recognition of the industry's increasing importance to the country's economy.

The evolution of impulse ice cream formats has particularly contributed to this trend. Ready-to-consume frozen treats, chocolate-coated offerings, and ice cream tubes maintain steady sales across all seasons. Festival periods including Diwali, Christmas, and regional celebrations have become significant consumption occasions, further strengthening the all-season demand pattern. Leading manufacturers have adapted their production and distribution strategies to accommodate this shift, ensuring product quality remains consistent regardless of ambient weather conditions.

Market Size and Growth Opportunity:

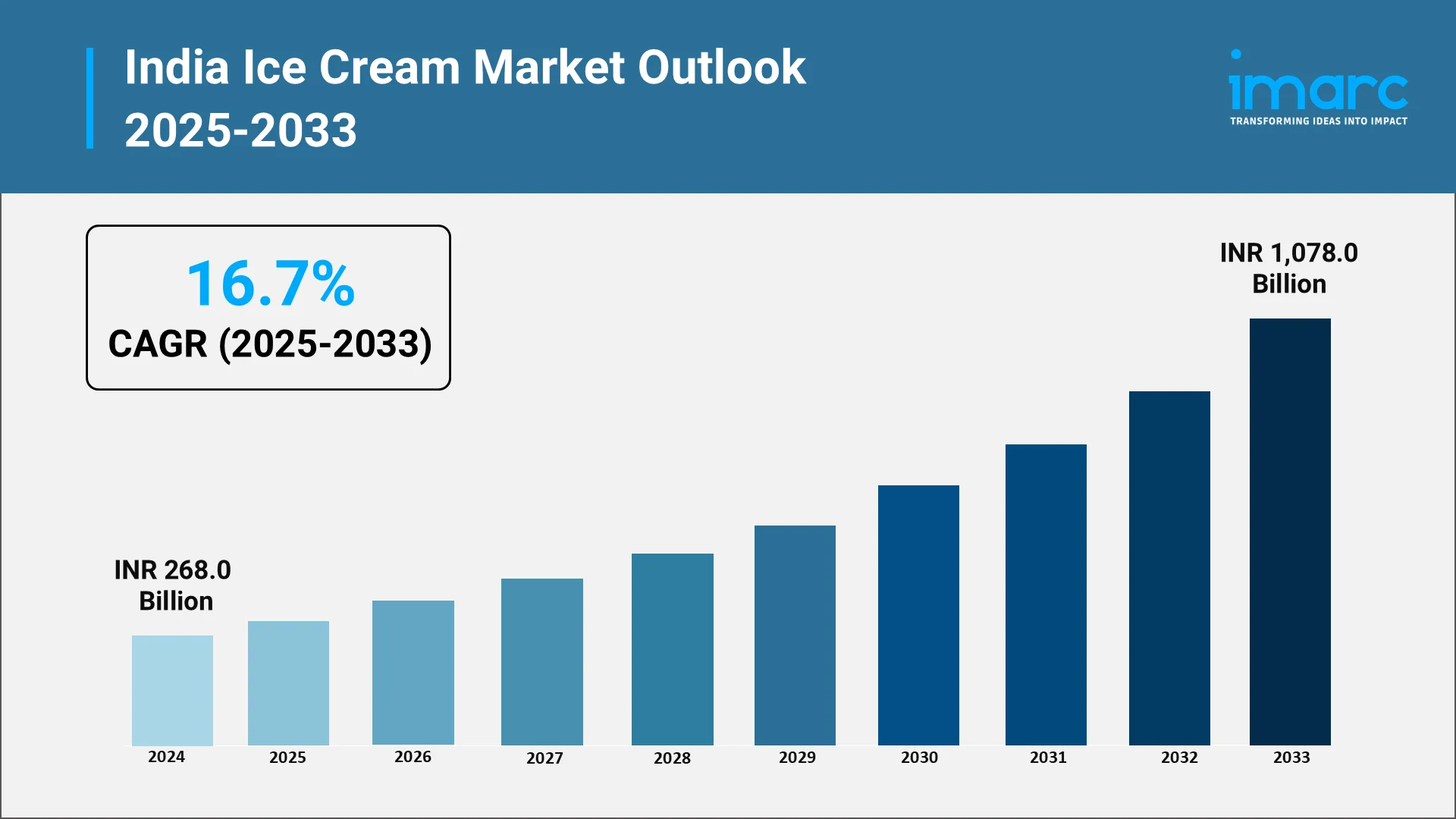

The Indian ice cream industry stands at a pivotal growth juncture, supported by favorable macroeconomic conditions and evolving consumer preferences. According to the IMARC Group, the India ice cream market size reached INR 268.0 Billion in 2024. Looking forward, the market is expected to reach INR 1,078.0 Billion by 2033, exhibiting a growth rate (CAGR) of 16.7% during 2025-2033. Rising disposable income across demographic segments has expanded the addressable market substantially. Middle-class households increasingly allocate discretionary spending toward premium food experiences, positioning ice cream as an accessible indulgence.

Cold chain expansion represents a critical enabler for market growth. Government initiatives through schemes like the Pradhan Mantri Kisan Sampada Yojana and the Integrated Cold Chain and Value Addition Infrastructure program have catalyzed infrastructure development. These programs provide financial assistance for establishing modern cold storage facilities, refrigerated transportation, and temperature-controlled distribution networks.

The dairy sector's robust foundation supports ice cream manufacturing capabilities across the nation. As a leading global milk producer, India processes substantial volumes through cooperative networks and private dairies. Urbanization trends continue reshaping consumption patterns. Metropolitan areas and tier-two cities demonstrate strong demand for organized ice cream brands, while rural penetration represents significant untapped potential. Modern retail formats including supermarkets, hypermarkets, and specialized ice cream parlors have proliferated, improving product accessibility and brand visibility across diverse geographies.

Distribution channels have evolved dramatically. Traditional wholesale networks coexist with modern trade formats, creating multi-layered distribution architectures. Regional distribution centers ensure efficient product movement from manufacturing facilities to retail touchpoints. Temperature-controlled warehousing and refrigerated vehicles maintain frozen state throughout distribution chains, critical for quality assurance.

Explore in-depth findings for this market, Request Sample

Premium and Artisanal Ice Creams Gaining Popularity:

Consumer preferences are shifting decisively toward premium ice cream offerings that emphasize quality, innovation, and distinctive flavor profiles. Artisanal ice cream brands have carved substantial market presence by focusing on natural ingredients, authentic flavors, and premium positioning. This segment appeals particularly to affluent urban consumers seeking elevated dessert experiences.

Gelato has emerged as a popular premium category, distinguished by its smooth texture and intense flavors. Italian-style gelato parlors have proliferated in major cities, introducing consumers to authentic preparation techniques and ingredient-forward recipes. Natural fruit flavors utilizing fresh seasonal produce have gained tremendous traction, with brands like Naturals achieving recognition for signature offerings including tender coconut, sitaphal, and black grapes.

Gujarat Co-operative Milk Marketing Federation announced that Amul brand revenue reached substantial levels in FY25, with the cooperative targeting continued expansion. The organization launched Amul Ice Lounge premium parlors featuring international flavors representing diverse global traditions, from Argentine dulce de leche to Turkish coffee and Belgian chocolate.

Health-conscious variants are reshaping the premium segment. Sugar-free, low-calorie, dairy-free, and organic options address evolving dietary preferences and lifestyle considerations. Manufacturers have introduced vegan ice creams using plant-based alternatives, responding to growing awareness around animal welfare and environmental sustainability. These innovations demonstrate the industry's responsiveness to changing consumer values and wellness trends, creating differentiated product categories that command premium pricing.

Regional and traditional flavors receive contemporary interpretations in premium formats. Kulfi, India's traditional frozen dessert, has been reimagined with modern packaging and premium ingredients while retaining its authentic character. Brands successfully balance heritage appeal with contemporary quality standards, creating products that resonate across generational cohorts.

Online Ordering via Delivery Platforms Boosting Sales:

The emergence of quick commerce has revolutionized ice cream accessibility and consumption patterns. Platforms including Swiggy Instamart, Zomato's Blinkit, and Zepto have established extensive dark store networks enabling rapid delivery of frozen products. These services promise delivery within minutes, fundamentally altering consumer purchasing behavior and expanding consumption occasions.

Late-night orders and impulse purchases have surged through these platforms. Quick commerce data reveals substantial ice cream orders during evening and nighttime hours, indicating that convenient delivery has created entirely new consumption windows. Festival periods witness particularly strong demand, with platforms reporting record orders during celebrations and special occasions.

Technology investments in temperature-controlled logistics have proven crucial for frozen dessert delivery. Platforms employ specialized cooling solutions ensuring product integrity throughout the delivery chain. IoT-enabled temperature monitoring, insulated delivery bags, and optimized routing minimize exposure to ambient conditions, maintaining frozen state from dark store to consumer doorstep.

Hindustan Unilever has reported that quick commerce represents a substantial portion of their ice cream business, highlighting the channel's commercial significance. This distribution innovation has particularly benefited new and emerging brands, providing shelf space and visibility that traditional retail channels might not readily offer. Specialty offerings including sugar-free and dairy-free variants have found strong traction through these platforms, especially in metropolitan markets where health-conscious consumers actively seek alternative formulations.

Food delivery platforms Swiggy and Zomato have extended their reach into frozen dessert delivery through restaurant partnerships and dedicated ice cream sections. Their established logistics infrastructure and extensive customer base provide additional distribution channels for manufacturers. The convenience of ordering ice cream alongside meals or as standalone desserts has normalized online purchasing for frozen products.

Top Companies in India Ice Cream Market:

The Indian ice cream market features a competitive landscape with established cooperatives, multinational corporations, and regional specialists competing across various segments and price points. These companies have invested substantially in manufacturing capabilities, distribution networks, and brand building to capture market opportunities.

- GCMMF (Amul) operates through India's largest dairy cooperative, leveraging its extensive distribution network and value-driven positioning. The brand offers affordable products across multiple formats with flavors tailored to Indian preferences, supported by robust cold chain infrastructure.

- Kwality Walls, a Hindustan Unilever subsidiary, combines global expertise with local insights. The brand excels in marketing, product innovation, and retail execution across premium and mainstream segments, utilizing branded freezers and strong trade relationships.

- Vadilal Group represents heritage and quality with decades of experience. Known for unique flavor innovations and manufacturing excellence, the company operates through company-owned parlors and franchisee networks while maintaining export operations.

- Mother Dairy, backed by the National Dairy Development Board, emphasizes natural ingredients and nutritional value. The brand targets middle-income households with quality products at reasonable prices through integrated retail infrastructure.

- Hatsun Agro Products demonstrates rapid private sector growth with strong regional presence in southern India. The company operates multiple brands, emphasizing operational flexibility, competitive pricing, and dense distributor networks.

- CreamBell focuses on urban markets with quality-driven positioning. The brand differentiates through continuous innovation, contemporary marketing, modern manufacturing facilities, and strategic geographic expansion supported by strong distributor partnerships.

Conclusion:

The India ice cream industry stands poised for substantial expansion, driven by favorable demographic trends, infrastructure development, and evolving consumer preferences. The transformation from seasonal to year-round consumption patterns has broadened market potential significantly. Rising disposable incomes and urbanization continue creating opportunities for organized players across premium and mainstream segments. The youthful demographic profile, with substantial millennial and Gen Z populations, provides a consumer base receptive to innovation and willing to experiment with new flavors and formats.

Cold chain infrastructure improvements and digital commerce adoption have addressed historical distribution challenges, enabling consistent product availability and quality maintenance. Quick commerce platforms have particularly revolutionized accessibility, creating new consumption occasions and purchase behaviors. Innovation in product development responds to sophisticated consumer demands for premium experiences, health-conscious formulations, and authentic flavors. The competitive landscape features established cooperatives, multinational corporations, and emerging specialists, each contributing unique value propositions and market dynamics.

Looking ahead, the industry's trajectory appears promising. Government support for dairy and cold chain infrastructure, combined with private sector investments in manufacturing and distribution, creates enabling conditions for market expansion. Geographic penetration into tier-two and tier-three cities represents significant untapped potential, while rural markets offer long-term growth horizons as incomes rise and modern retail formats expand.

Sustainability initiatives are gaining prominence, with manufacturers exploring eco-friendly packaging solutions and energy-efficient production processes. Environmental consciousness among consumers influences purchasing decisions, particularly among younger demographics. Brands that successfully integrate sustainability commitments with product quality position themselves advantageously for long-term market leadership in this evolving landscape.

Partner with IMARC Group for Strategic Market Intelligence:

- Comprehensive Market Research: Access in-depth analysis of consumption patterns, distribution dynamics, premium segment evolution, and technological advancements across impulse, take-home, and artisanal ice cream categories.

- Future-Forward Growth Forecasting: Anticipate emerging trends in premium offerings, health-conscious formulations, plant-based alternatives, flavor innovations, quick commerce penetration, and regional market development across metropolitan and emerging cities.

- Strategic Competitive Intelligence: Evaluate competitive positioning, monitor extensive product portfolios, track breakthrough innovations in flavors and formats, and analyze distribution strategy evolution across traditional retail and digital channels.

- Infrastructure and Distribution Expertise: Navigate complex cold chain requirements, forge strategic quick commerce partnerships, optimize modern retail expansion, and develop robust temperature-controlled logistics networks ensuring product integrity.

- Tailored Consulting Solutions: Receive precisely customized insights aligned with organizational objectives for market entry strategies, manufacturing capacity expansion, innovation pipeline development, or geographic footprint optimization initiatives.

At IMARC Group, we empower industry leaders with strategic clarity and actionable intelligence to capitalize on substantial growth opportunities in India's dynamic frozen dessert landscape. Click here: https://www.imarcgroup.com/ice-cream-market-india

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)