How Big Will Be the India Spices Industry by 2033?

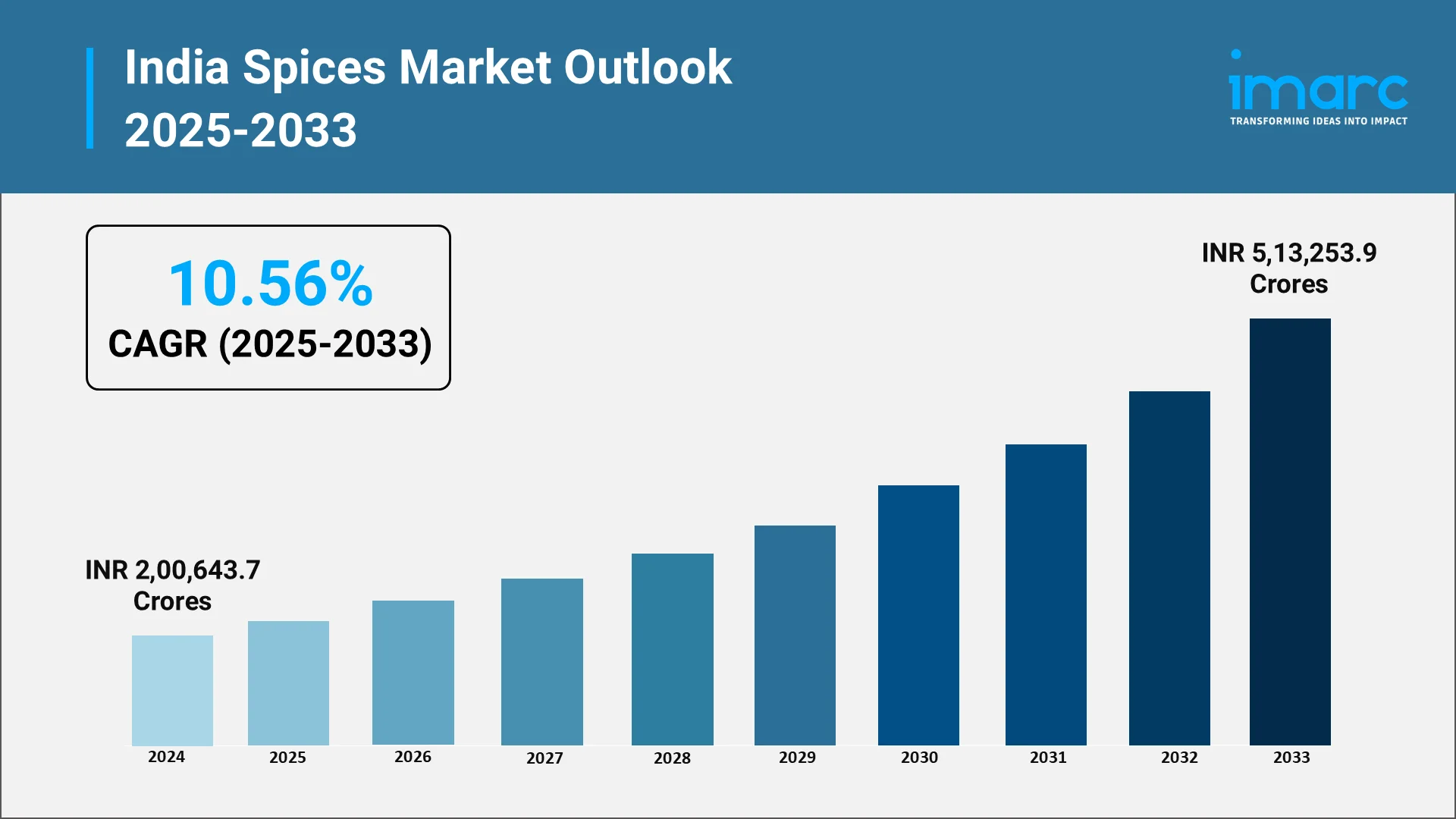

India's spice industry stands as a vibrant cornerstone of the nation's agricultural economy and cultural identity. As global consumers increasingly seek authentic flavors and natural ingredients, India's position as the world's leading spice producer continues to strengthen. The India spices market size reached INR 2,00,643.7 Crores in 2024. The industry is witnessing a remarkable transformation driven by changing consumer preferences, digital commerce expansion, and a decisive shift toward branded packaged products.

India Remains the World's Largest Spice Producer & Exporter:

India's dominance in the global spice trade is unmatched and historically rooted. The country cultivates an extraordinary variety of spices across diverse agro-climatic zones, from turmeric fields in Telangana to cardamom plantations in Kerala. This geographic advantage allows India to produce spices prized worldwide for their superior quality, aroma, and flavor intensity.

Domestic consumption remains exceptionally high, reflecting the central role of spices in Indian cuisine and traditional medicine. Every household, restaurant, and food processing unit rely heavily on spices, creating a massive internal market. The cultural significance of spices in daily cooking, religious ceremonies, and Ayurvedic practices ensures sustained demand across urban and rural areas.

Export markets continue to expand as Indian spices gain recognition in international kitchens and food industries. According to the India Brand Equity Foundation, in FY25 (up to February 2025), India exported spices worth Rs. 29,016 crore (US$ 3.36 Billion), with the USA importing spices worth Rs. 5,136 crore (US$ 594.82 Million). Countries across North America, Europe, the Middle East, and Southeast Asia import substantial volumes. The growing global interest in ethnic cuisines and health-conscious eating has positioned Indian spices as essential ingredients in international food manufacturing.

Market Size & Growth Opportunity in Branded Packaged Spices:

The India spices market is experiencing a fundamental structural transformation as consumer preferences evolve. Recent industry reports by Government of India indicate that approximately 9% of India's overall agricultural exports and more than 40% of its horticulture exports come from the spice industry, maintaining its position as the world's largest producer, consumer, and exporter. The industry is expanding beyond its traditional unorganized sector base, with branded packaged spices and ready-mix blends capturing increasing market share. As a result, IMARC Group expects the market to reach INR 5,13,253.9 Crores by 2033, exhibiting a CAGR of 10.56% during 2025-2033.

Branded packaged spices are gaining traction across India's urban and semi-urban markets. Consumers are increasingly willing to pay premium prices for products that guarantee quality, hygiene, and consistent flavor. The convenience factor associated with pre-measured, ready-to-use spice blends appeals particularly to working professionals and younger consumers who seek authentic taste without extensive preparation time.

Ready-mix blends and specialized spice combinations have emerged as fast-growing product categories. Manufacturers are innovating with region-specific masala blends, international cuisine mixes, and health-focused formulations. The proliferation of cooking shows, food blogs, and recipe-sharing platforms has further stimulated demand for specialized spice products.

The growth trajectory of the branded spices segment significantly outpaces the traditional loose spices market. Rising disposable incomes, increased health awareness, and changing lifestyle patterns are driving consumers toward organized retail purchases. Modern retail formats provide branded spices with prominent shelf space and visibility, accelerating the transition from unbranded to branded purchases.

Rural market penetration presents substantial untapped potential for branded spice manufacturers. As rural incomes rise and retail infrastructure improves, previously underserved markets are becoming accessible. Companies that successfully develop appropriate packaging sizes and distribution networks for rural areas can unlock significant volume growth.

Explore in-depth findings for this market, Request Sample

Shift from Loose to Hygienic Branded Products:

The migration from loose spices to packaged products represents one of the most significant trends reshaping India's spice industry. Consumers are increasingly concerned about product quality, adulterant-free ingredients, and hygienic processing standards.

Quality assurance has become a primary purchase driver for educated consumers. Incidents of adulteration in loose spices have raised awareness about food safety. Branded manufacturers invest in quality control systems, laboratory testing, and certification processes that provide consumers with confidence. This quality differentiation allows branded products to command premium pricing while building customer loyalty.

Flavor consistency is another critical advantage that branded spices offer over loose alternatives. Branded manufacturers implement standardized sourcing, processing, and blending protocols that ensure uniform product characteristics. Professional chefs, home cooks, and food businesses value this consistency, which enables predictable recipe outcomes.

Packaging innovations have played a crucial role in the premiumization of the spices market. Modern packaging solutions preserve freshness, extend shelf life, and enhance convenience. Resealable pouches, grinder attachments, and portion-controlled sachets address specific consumer needs while serving as effective marketing tools at the point of purchase.

Health and wellness considerations are increasingly influencing purchase decisions. Many brands are introducing organic, pesticide-free, and traditionally processed spices that appeal to health-conscious segments. Clear labeling of nutritional information and certifications further strengthens consumer trust and willingness to pay premium prices.

D2C and Online Grocery Channels Expanding Reach:

Digital commerce is revolutionizing spice distribution in India, creating new pathways for brands to reach consumers directly. The rapid growth of online grocery platforms and direct-to-consumer channels is democratizing market access and enabling even small brands to achieve national reach.

E-commerce platforms like Amazon, Flipkart, and specialized grocery marketplaces have become important sales channels for spice brands. These platforms provide nationwide visibility and eliminate geographic barriers. Consumers in tier-two and tier-three cities now have access to premium and specialized spice products that were once available only in metropolitan areas.

Quick commerce platforms such as Blinkit, Zepto, Swiggy Instamart, and Dunzo have introduced ultra-fast delivery for daily essentials, including spices. The promise of delivery within minutes has changed consumer shopping behavior, encouraging more frequent purchases. For spice brands, quick commerce represents an opportunity to capture impulse purchases and build habitual consumption patterns.

Direct-to-consumer strategies are gaining traction as brands seek to build direct relationships with customers. Brand websites, mobile applications, and subscription models enable companies to bypass intermediaries, improve margins, and gather valuable consumer data. Subscription services for regularly consumed spices are particularly promising, offering convenience to customers while ensuring recurring revenue for brands.

Digital marketing capabilities have leveled the playing field for emerging brands. Social media platforms, influencer partnerships, and content marketing enable even small companies to build brand awareness and engage with target audiences. Recipe videos and user-generated content create authentic connections with consumers.

The logistics infrastructure supporting online commerce has improved dramatically, making direct delivery to consumers economically viable. Third-party logistics providers and warehousing networks have matured, reducing delivery costs and improving reliability. This infrastructure development is particularly beneficial for the spices category, where products have long shelf lives.

Top Companies in India Spices Market:

The competitive landscape of India's spice industry features a mix of heritage brands with decades of consumer trust and dynamic new entrants leveraging modern marketing strategies. The market leaders have built strong positions through consistent quality, wide distribution networks, and brand recognition.

- Aachi Masala Foods (P) Ltd

Aachi Masala specializes in authentic South Indian spice blends, masalas, and instant mixes. Based in Chennai, the company maintains strong regional presence across southern states, offering traditional recipes and consistent quality. Targeting households seeking authentic regional flavors, Aachi leverages heritage and taste authenticity.

- Aashirvaad Spices (ITC Limited)

Aashirvaad Spices, under ITC Limited's FMCG portfolio, offers premium ground spices and blended masalas. Leveraging ITC's extensive distribution network and brand equity, the company targets middle and upper-income households seeking quality assurance, hygiene standards, and consistent taste across diverse culinary applications.

- Badshah Masala

Badshah Masala offers diverse spice blends, ground spices, and specialty masalas targeting northern and western Indian markets. Known for authentic taste profiles and competitive pricing, the company serves households and food service sectors through established distribution channels, emphasizing traditional recipes and regional flavor preferences.

- Catch Foods (DS Group)

Catch, owned by DS Group, offers innovative spice blends, sprinklers, and specialty seasonings targeting young, urban consumers. Combining traditional spices with modern formats and flavors, the company emphasizes convenience and experimentation, maintaining strong retail presence through creative marketing and contemporary packaging designs.

- Everest Food Products Private Limited

Everest dominates India's branded spices market with extensive product portfolio including ground spices, blended masalas, and specialty seasonings. Operating for decades with consistent quality and innovative product development, the company maintains nationwide distribution, targeting diverse consumer segments through strong brand recognition and reliability.

- Goldiee Group

Goldiee produces spices, masalas, and food ingredients serving retail and institutional markets. Offering competitively priced products across northern India, the company focuses on value-conscious consumers and food service sectors through efficient manufacturing, quality control, and regional distribution networks ensuring market penetration.

- Mahashian Di Hatti Private Limited (MDH)

MDH represents India's iconic spice brand with extensive global presence. Founded in 1919, the company offers comprehensive spice range including ground spices, blended masalas, and specialty products. Targeting households worldwide, MDH maintains legendary status through consistent quality, authentic taste, and founder's recognizable brand persona.

- Orkla India Pvt Ltd. (Eastern Condiments)

Orkla India operates Eastern Condiments brand offering ground spices, masalas, and seasonings across southern and eastern markets. Acquired by Norway's Orkla Group, the company combines regional expertise with international standards, targeting households seeking authentic regional flavors and consistent quality through established distribution networks.

- Patanjali Ayurved Limited

Patanjali offers comprehensive spice range under Ayurvedic wellness positioning at competitive prices. Leveraging Swadeshi appeal and founder Baba Ramdev's influence, the company targets value-conscious consumers across urban and rural markets through extensive retail networks, emphasizing natural processing and traditional Indian values.

Conclusion:

India's spice industry is poised for transformative growth as traditional market structures give way to modern branded products, digital distribution channels, and quality-conscious consumption patterns. The convergence of strong domestic demand, expanding export opportunities, and evolving consumer preferences creates a compelling investment thesis for stakeholders across the value chain.

The shift toward branded packaged spices represents more than a commercial opportunity—it reflects a fundamental evolution in how Indian consumers perceive and purchase food products. As awareness about food safety and quality assurance continues to rise, the premium that consumers are willing to pay for trusted brands will expand.

Choose IMARC Group for Unmatched Market Intelligence:

At IMARC Group, we empower industry leaders with the clarity and intelligence required to capitalize on the vibrant India Spices Market. We offer tailored market intelligence services to guide your strategic decisions:

- Data-Driven Market Research: Deepen your knowledge of spice production, consumption patterns, and trade dynamics across major varieties like chilli, turmeric, and cumin through in-depth market research reports.

- Strategic Growth Forecasting: Predict emerging trends in the spices value chain, from the rise of organic and blended spices and new processing technologies to changing export regulations and consumer preferences.

- Competitive Benchmarking: Analyze competitive forces in the market for packaged and branded spices, review company strategies, and monitor breakthroughs in quality control, traceability, and value-added spice derivatives.

- Policy and Infrastructure Advisory: Stay one step ahead of Spices Board of India policies, FSSAI regulations on quality and adulteration, and government-sponsored programs affecting spice parks and export incentives.

- Custom Reports and Consulting: Get tailored insights geared to your organizational objectives—be it launching new spice blends, investing in e-commerce distribution, or building a compliant global export strategy.

Partner with IMARC Group to transform market insights into competitive advantages in India's dynamic spice industry. Click here: https://www.imarcgroup.com/india-spices-market, for more details.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)