Key Challenges and Opportunities Shaping the Japan Urea Industry

Introduction: The Role of Urea in Japan's Economy

The Japan urea industry stands as a critical pillar supporting multiple sectors of the nation's economy, from agricultural productivity to automotive emissions control. As a nitrogen-rich compound essential for modern farming practices, urea plays an indispensable role in ensuring food security for Japan's population while simultaneously addressing stringent environmental standards through its industrial applications.

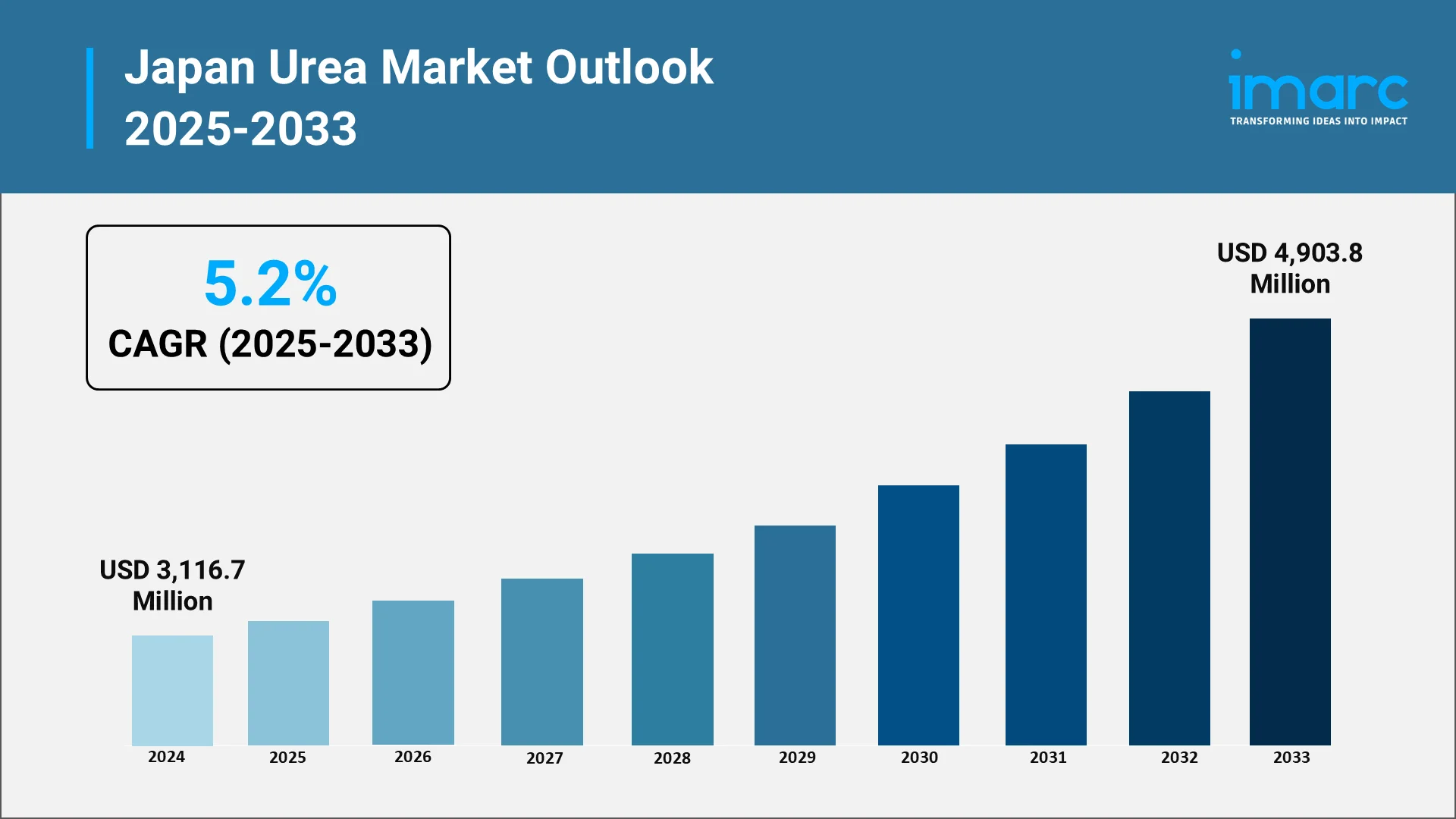

The Japan urea market reached a valuation of USD 3,116.7 Million in 2024, with projections indicating robust expansion to USD 4,903.8 Million by 2033, representing a compound annual growth rate (CAGR) of 5.2% during the forecast period. This growth trajectory reflects the fundamental importance of urea across Japan's agricultural landscape, automotive sector, and various industrial applications, positioning it as a strategic commodity in the nation's economic framework.

Beyond agriculture, technical-grade urea has emerged as a cornerstone of Japan's environmental compliance efforts, particularly through its role in diesel exhaust fluid (DEF) used in selective catalytic reduction (SCR) systems. This dual significance—agricultural and industrial—underscores the complex dynamics shaping the Japanese urea market and highlights the multifaceted challenges and opportunities confronting industry stakeholders.

Explore in-depth findings for this market, Request Sample

Current Market Landscape of the Japan Urea Industry:

The current Japan urea market landscape reveals a complex interplay of domestic production constraints and import dependencies.

The domestic production landscape faces significant headwinds. Japan's limited natural gas reserves—the primary feedstock for urea production—position the country as heavily import-dependent. According to energy security analyses, net imports accounted for 90% of Japan's total energy supply in 2022, creating structural vulnerabilities in the urea supply chain. This dependency exposes Japanese manufacturers and agricultural producers to global price volatility and geopolitical disruptions.

The agricultural sector remains the largest consumer of urea in Japan, driven by increasing demand for nitrogen-based fertilizers to enhance crop yields. Government initiatives promoting sustainable farming practices, coupled with subsidies on fertilizers, have further stimulated market activity. Simultaneously, the expanding automotive industry contributes significantly through the adoption of SCR systems that require high-purity urea for emissions reduction.

Key Challenges Facing the Japan Urea Market:

- Raw Material Cost Volatility and Energy Dependency

The most pressing challenge confronting the Japan urea industry stems from its profound dependence on imported natural gas—a critical feedstock for urea synthesis. Energy costs constitute 70-80% of total urea production costs globally, and Japan's unique energy vulnerability amplifies this challenge. The nation possesses negligible hydrocarbon resources and maintains extreme dependence on liquefied natural gas (LNG) imports for industrial processes.

- Import Dependency and Supply Chain Risks

Japan's heavy reliance on urea imports from concentrated geographic regions presents substantial supply chain risks. Approximately 84% of nitrogen fertilizer imports originate from China and Malaysia, creating potential vulnerabilities to export restrictions, trade policy changes, and regional disruptions. China's implementation of export restrictions in 2021, which reduced urea exports by 95% since 2020, forced Japan and other importing nations to rapidly diversify supply sources—a process that increases costs and operational complexity.

Maritime logistics challenges compound these difficulties. Global trade disruptions in 2024, including low water levels at the Panama Canal and political instability affecting Red Sea shipping routes, resulted in longer freight distances, elevated transportation costs, and increased insurance premiums. These factors directly impact the landed cost of imported urea in Japan.

- Environmental Regulations and Sustainability Pressures

Japan faces mounting pressure to balance agricultural productivity with environmental stewardship. The government's MIDORI strategy (launched in 2022) established ambitious targets including reducing chemical fertilizer use by 30% by 2050, expanding organic farming to 1 million hectares (25% of total farmland), and achieving zero carbon emissions in agriculture. These mandates create operational challenges for conventional urea-dependent farming systems.

Starting from fiscal 2024, Japan's agriculture ministry introduced environmental conditions for subsidy recipients, requiring farmers to submit checklists covering appropriate fertilizer use, fuel conservation, waste management, and biodiversity considerations. By April 2027, these requirements will extend to all agricultural subsidies, fundamentally reshaping incentive structures and potentially constraining conventional urea demand.

- Declining Agricultural Labor Force

Japan's agricultural sector confronts demographic headwinds, with a rapidly aging farmer population and persistent rural-to-urban migration patterns reducing the workforce available for crop cultivation. This structural challenge threatens long-term demand for agricultural inputs including urea, even as efficiency improvements and precision agriculture technologies partially offset labor constraints.

Opportunities Driving Growth in the Urea Industry

- Automotive Sector Expansion through Diesel Exhaust Fluid

The diesel exhaust fluid (DEF) market presents the most dynamic growth opportunity for Japan's urea industry. DEF consists of high-purity urea and deionized water, serving as the active agent in SCR systems that convert harmful nitrogen oxides (NOx) into harmless nitrogen and water vapor.

Asia-Pacific markets, including Japan, have witnessed double-digit growth in DEF demand following the introduction of stringent emission regulations. Japan's automotive industry increasingly adopts SCR technology across heavy-duty commercial vehicles, construction equipment, and agricultural machinery to meet environmental standards.

The rising penetration of diesel-powered equipment in construction and infrastructure development sectors further amplifies DEF consumption. As urbanization accelerates and infrastructure projects expand across Japan, emission-compliant diesel machinery sustains market demand.

- Industrial Applications Beyond Agriculture

Technical-grade urea serves diverse industrial applications that extend far beyond traditional agricultural uses. The compound functions as a key component in manufacturing resins, adhesives, and coatings widely deployed in automotive, construction, and furniture industries. Additionally, urea finds applications in pharmaceuticals, cosmetics (due to its moisturizing properties), and as a de-icing agent—creating multiple revenue streams that insulate the market from agricultural sector volatility.

The industrial sector's reliance on urea for producing plastics and synthetic materials provides stable baseline demand independent of seasonal agricultural cycles. This diversification strengthens market resilience against sector-specific disruptions.

- Technological Innovation in Urea Production and Application

Ongoing advancements in urea production technologies offer pathways to address cost and sustainability challenges. Innovations include energy-efficient synthesis methods, carbon capture integration, and alternative feedstock development that could reduce dependence on natural gas. For example, emerging plasma-based synthesis methods leverage high-energy species to produce reactive intermediates, facilitating urea formation under milder conditions compared to conventional high-pressure processes.

In application technologies, precision agriculture tools including soil sensors, variable-rate application systems, and AI-driven nutrient management platforms enable more efficient urea utilization. These technologies reduce waste, minimize environmental impact, and optimize input costs—addressing both economic and regulatory pressures simultaneously.

- Bio-Based and Enhanced Efficiency Fertilizers

The development of bio-based fertilizers and enhanced efficiency formulations represents a transformative opportunity. Japan's NEDO (New Energy and Industrial Technology Development Organization) highlighted in their 2024 Agritech Report that research into biostimulants, biochar, and low-carbon nitrogen-based fertilizers is accelerating, particularly in response to supply chain vulnerability and environmental concerns.

Impact of Government Policies and Sustainability Goals:

- The MIDORI Strategy and Agricultural Transformation

Japan's comprehensive MIDORI strategy (officially launched in 2022) represents the nation's most ambitious agricultural sustainability initiative. The strategy establishes transformative objectives aimed at building sustainable food systems adapted to Asia-Monsoon climate conditions.

These mandates fundamentally reshape the operating environment for the urea industry. While initially appearing to constrain conventional urea demand, the strategy simultaneously catalyzes innovation in enhanced efficiency products, precision application technologies, and integrated nutrient management systems that could expand premium market segments.

- Basic Law on Food, Agriculture and Rural Areas Amendment

In 2024, Japan's Diet amended the Basic Law on Food, Agriculture and Rural Areas for the first time since its 1999 promulgation. The amendment prioritizes food security in response to increasing international instability and supply chain vulnerabilities exposed during recent global crises. This renewed emphasis on food security could paradoxically support sustained fertilizer demand despite environmental constraints, as policymakers balance productivity imperatives against sustainability objectives.

- Environmental Subsidy Conditionality

The agriculture ministry's phased introduction of environmental conditions for all subsidies (complete implementation by April 2027) represents a powerful policy lever reshaping farmer behavior. Applicants must demonstrate appropriate fertilizer use, fuel conservation, waste management compliance, and biodiversity consideration. This framework incentivizes adoption of precision agriculture technologies, enhanced efficiency fertilizers, and integrated nutrient management approaches—creating market opportunities for innovative urea products and application services.

- Research and Development Support

Government-backed research institutions including JIRCAS (Japan International Research Center for Agricultural Sciences) and NEDO actively support development of sustainable agricultural technologies. JIRCAS's Biological Nitrification Inhibition (BNI) research, for instance, aims to develop wheat varieties that naturally suppress soil nitrification, potentially reducing nitrogen fertilizer requirements while maintaining yields. Such innovations could transform long-term demand dynamics for conventional urea products.

Future Outlook for the Japan Urea Industry:

The Japan urea market trajectory through 2033 reflects competing forces—traditional agricultural demand pressures, environmental sustainability imperatives, and expanding industrial applications, particularly in automotive emissions control. The projected 5.2% CAGR indicates moderate but sustained growth, driven primarily by technical-grade urea demand for DEF applications and specialty agricultural formulations rather than conventional bulk fertilizer consumption.

Short-Term Outlook (2025-2027)

The near-term outlook suggests continued price volatility linked to global energy markets and geopolitical developments. Fertilizer prices stabilized in 2023-2024 following the extreme 2021-2022 spike; however, remain elevated relative to pre-pandemic levels. The outlook for 2024-2025 appears stable according to FAO analysis, though shocks to energy markets represent persistent risk factors.

Implementation of environmental subsidy conditions will accelerate adoption of precision agriculture technologies and enhanced efficiency fertilizers, creating differentiation opportunities for producers offering premium products with demonstrated sustainability credentials. Import-dependent Japanese stakeholders will continue diversifying supply sources to mitigate concentration risks.

Medium-Term Outlook (2028-2030)

The medium-term horizon witnesses intensifying impacts from Japan's MIDORI strategy targets and broader sustainability transitions. Conventional agricultural urea demand may face headwinds from the 30% chemical fertilizer reduction target, but this constraint could be offset by productivity improvements from precision agriculture, development of nitrogen-efficient crop varieties, and expansion of protected cultivation systems.

DEF demand continues robust expansion, driven by fleet replacement cycles, infrastructure project acceleration, and potential adoption of SCR systems in additional vehicle categories. The automotive application segment likely becomes increasingly important to overall market dynamics.

Long-Term Outlook (2031-2033 and Beyond)

Long-term market evolution depends critically on successful commercialization of transformative technologies. Breakthrough developments in biological nitrogen fixation enhancement, plasma-based urea synthesis, or alternative nitrogen delivery systems could fundamentally restructure demand patterns. Japan's push toward carbon neutrality in agriculture by 2050 necessitates revolutionary rather than evolutionary approaches to nutrient management.

Strategic market positioning will favor companies demonstrating genuine commitment to sustainability, offering differentiated products addressing specific agronomic or industrial needs, and maintaining operational flexibility to adapt to rapidly evolving regulatory frameworks.

Why Choose IMARC Group for Urea Market Intelligence:

- Comprehensive Market Research: Gain deep insights into urea market dynamics, production technologies, agricultural and industrial applications, pricing trends, and regulatory developments through meticulously researched reports combining quantitative analysis with qualitative expert perspectives.

- Strategic Growth Forecasting: Access detailed projections of market evolution across agricultural fertilizers, technical-grade industrial applications, and diesel exhaust fluid segments. Our forecasts incorporate policy impact assessments, technological disruption scenarios, and demographic shifts to deliver robust planning foundations.

- Competitive Intelligence: Understand the competitive landscape through analysis of key manufacturers, suppliers, distributors, and emerging players. Evaluate strategic positioning, capacity expansion plans, product innovation pipelines, and market share dynamics to inform your competitive strategy.

- Regulatory and Policy Advisory: Stay ahead of Japan's evolving regulatory environment, including MIDORI strategy implementation, subsidy conditionality, emission standards, and food security policies. Our advisory services help organizations anticipate policy changes and adapt proactively.

- Custom Research and Consulting: Access tailored research designed specifically for your organizational objectives—whether evaluating market entry strategies, assessing M&A opportunities, optimizing supply chain configurations, or developing new product offerings for Japanese market segments.

For more details, please click on this link: https://www.imarcgroup.com/japan-urea-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)