GCC Coconut Water Market Trends: Exploring Health-Driven Demand and Beverage Innovation

Introduction:

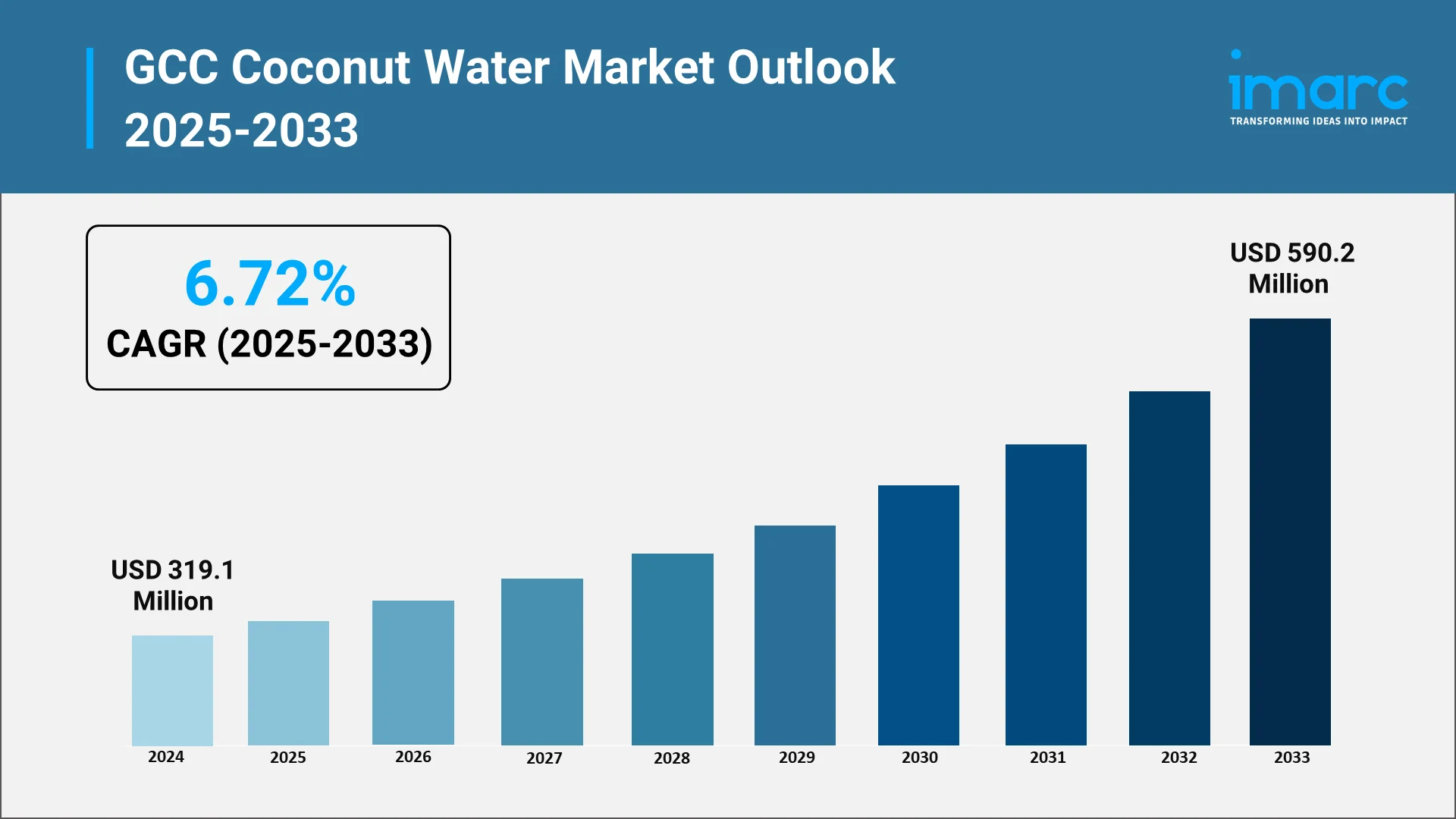

The GCC coconut water market is experiencing remarkable momentum as consumer preferences shift decisively toward natural hydration solutions and functional beverages. This transformation is propelled by heightened health consciousness, expanding fitness culture, and growing awareness of the nutritional benefits associated with coconut-based drinks. In 2024, the GCC coconut water market size reached USD 319.1 Million. Across the region, consumers are increasingly seeking clean-label alternatives to conventional soft drinks and artificially sweetened beverages, positioning coconut water as an ideal choice for health-oriented individuals.

Explore in-depth findings for this market, Request Sample

The market's expansion is further supported by robust retail infrastructure development, enhanced cold-chain logistics, and the proliferation of modern trade channels including hypermarkets, specialty health stores, and convenience outlets. GCC natural drinks demand continues to accelerate as consumers prioritize products with minimal processing, no artificial additives, and transparent ingredient lists. The region's unique climate conditions, characterized by prolonged periods of intense heat and humidity, naturally amplify the need for effective hydration solutions, making coconut water particularly relevant for daily consumption.

GCC healthy beverages market dynamics are being shaped by multiple converging factors including rising disposable incomes, urbanization, and increased exposure to global wellness trends through digital media and international travel. The growing expatriate population, which includes significant numbers of South Asian and Southeast Asian communities familiar with traditional coconut water consumption, has also contributed to market normalization and broader acceptance. Additionally, the integration of coconut water into fitness regimens, sports nutrition programs, and post-workout recovery protocols has established the beverage as more than just a refreshment option but as a functional hydration tool.

The GCC coconut water industry growth trajectory reflects broader regional commitments to diversifying economies beyond traditional sectors and investing in health-oriented consumer goods markets. Government initiatives promoting healthier lifestyles, coupled with private sector innovation in product development and marketing, have created a favorable environment for natural beverage categories. As awareness of electrolyte replenishment, natural hydration, and plant-based nutrition continues to spread, coconut water is positioned to capture an increasingly significant share of the regional beverage landscape.

How Vision 2030 is Transforming GCC Coconut Water Market:

Vision 2030 initiatives across GCC nations are fundamentally reshaping the coconut water market through wellness-focused policies and infrastructure development. These transformation frameworks emphasize healthier lifestyles and sustainable consumption, directly supporting natural beverage categories. The National Strategy for Food Security also seeks to place the United Arab Emirates in the top 10 nations by 2021 and at the top of the Global Food Security Index by 2051. Additionally, it seeks to improve local production and create a complete national system centered on enabling sustainable food production through the use of contemporary technologies. Governments are implementing measures that discourage high-sugar drinks while promoting low-calorie alternatives, backed by public health campaigns and educational programs that drive hydration awareness. Infrastructure investments in modern retail formats, cold-chain logistics, and e-commerce platforms are removing traditional distribution barriers for premium natural beverages. Economic diversification goals are stimulating food and beverage entrepreneurship, with numerous regional startups and established companies launching coconut water brands tailored to local preferences. These coordinated efforts are establishing foundational conditions for sustained coconut water market expansion across all GCC member states.

Key Industry Trends:

Consumer awareness about excessive sugar intake has fundamentally altered beverage purchasing decisions across the GCC. Coconut water naturally contains essential electrolytes including potassium, magnesium, and sodium, making it an authentic functional hydration solution. Adults and children should limit their daily consumption of free sugars to less than 10% of their overall energy intake, according to a new WHO guideline. The clean-label movement has gained traction among millennials and Gen Z consumers who scrutinize ingredient lists and demand transparency, with products featuring minimal processing commanding premium prices.

-

Expansion of Flavored and Value-Added Coconut Water Variants

Manufacturers are diversifying portfolios with flavored variants incorporating tropical fruits such as pineapple, mango, and passion fruit. Value-added formulations containing probiotics, vitamins, and botanical extracts target specific consumer needs while commanding higher price points. Convenience-focused innovations including single-serve formats and multi-pack offerings expand usage occasions, enabling brands to occupy multiple price points and maximize market penetration.

- Increasing Adoption Across Gyms, Fitness Centers, and Wellness Retailers

Premium fitness chains, boutique studios, and yoga centers are stocking coconut water in retail sections and vending machines, capitalizing on post-workout consumption moments. Wellness-focused retailers including organic supermarkets and health food stores dedicate expanded shelf space with prominent displays. Corporate wellness programs incorporate coconut water into office offerings, while hotels and resorts integrate it into beverage menus and wellness packages.

- Rise of E-Commerce and Subscription Models for Health Beverages

Coconut water brands leverage e-commerce to overcome distribution barriers and build direct customer relationships. Traditional retailers like Carrefour, Lulu Hypermarket, and Panda Retail integrate mobile apps, click-and-collect services, and same-day delivery to meet online grocery shopping demand.

- Shift Toward Sustainable Packaging and Ethical Coconut Sourcing

Coconut water marketers transition toward eco-friendly packaging including recyclable cartons and biodegradable materials. Ethical sourcing practices throughout coconut supply chains receive growing scrutiny, with certifications including organic, fair trade, and sustainability standards serving as powerful trust signals. Corporate social responsibility initiatives focusing on community development and environmental conservation create emotional connections with values-driven consumers, aligning with Vision 2030 environmental objectives.

Market Segmentation & Regional Insights:

The GCC coconut water market exhibits distinct segmentation patterns across multiple dimensions including type, flavor, form, packaging, distribution channel and country, each presenting unique opportunities and strategic considerations for market participants.

- On the basis of the type, the market has been segmented into sweetened and unsweetened coconut water. Unsweetened coconut water is high in demand as health-conscious consumers prioritize natural, zero-added-sugar options, while sweetened variants serve transitional consumers moving from conventional sugary beverages.

- Based on the flavor, the market has been categorized into plain and flavored. Plain coconut water is preferred due to consumer inclination for authentic taste and clean-label appeal, though flavored variants are experiencing accelerated growth through tropical fruit innovations targeting younger demographics.

- On the basis of the form, the market has been bifurcated into coconut water and coconut water powder. Liquid coconut water is widely consumed, while coconut water powder is emerging as a convenient alternative for travelers, fitness enthusiasts, and subscription-based delivery models.

- Based on the packaging, the market has been segregated into carton, bottles and others. Carton packaging leads due to extended shelf life, portability, and cost efficiency, while bottles (both glass and plastic) capture premium positioning and single-serve convenience consumption occasions.

- The market has been divided based on the distribution channel into supermarkets and hypermarkets, convenience stores, online retail stores and others. Supermarkets and hypermarkets offer wide product assortments and competitive pricing, while online retail stores are experiencing the fastest growth driven by quick commerce expansion and digital adoption.

- Country-wise, the market has been segmented into Saudi Arabia, UAE, Qatar, Oman, Kuwait and Bahrain. The demand for coconut water in Saudi Arabia and the UAE are driven by large populations, high urbanization, and advanced retail infrastructure, while Qatar, Kuwait, Bahrain, and Oman represent growing markets with increasing health awareness and expanding modern retail presence.

Forecast (2025–2033):

The GCC coconut water market is positioned for sustained expansion throughout the forecast period, driven by converging macroeconomic trends, demographic shifts, and evolving consumer preferences that collectively support long-term category growth. As per the IMARC Group, the market is anticipated to reach USD 590.2 Million by 2033, exhibiting a growth rate (CAGR) of 6.72% during 2025-2033. Health and wellness trends show no signs of moderating, with younger generations demonstrating particularly strong affinity for natural, functional beverages that align with active lifestyles and nutritional awareness. As these demographics mature and increase their purchasing power, coconut water consumption is expected to become increasingly normalized as a daily hydration choice rather than an occasional premium purchase.

- Rising Health and Wellness Trends: represent the most fundamental demand driver, as chronic disease prevalence, obesity rates, and diabetes concerns motivate both individual consumers and government health authorities to promote dietary improvements. Public health campaigns, educational initiatives, and regulatory measures discouraging excessive sugar consumption create favorable conditions for naturally low-sugar alternatives like coconut water. The integration of health tracking technologies, fitness apps, and wellness platforms into daily routines reinforces hydration awareness and provides digital touchpoints for coconut water marketing messages.

- Hot Climate Driving Hydration Demand: constitutes an enduring structural advantage for the coconut water category throughout the GCC region, where temperatures regularly exceed 40 degrees Celsius during extended summer periods. The physiological need for effective hydration and electrolyte replenishment creates consistent year-round demand that transcends discretionary consumption patterns affecting other beverage categories. Outdoor activities, tourism development, and infrastructure projects requiring outdoor labor all generate sustained hydration requirements that coconut water is uniquely positioned to address given its natural electrolyte composition.

- Growth of Organic & Clean-Label Preferences: reflects a fundamental shift in consumer attitudes toward food and beverage ingredients, with particular emphasis on transparency, authenticity, and natural formulations. This trend is amplified by increasing education levels, digital information access, and exposure to global wellness movements through social media and international travel. Premium organic coconut water segments are experiencing particularly robust growth as affluent consumers prioritize product quality and sourcing credentials over price considerations. The expansion of organic certification infrastructure and retail distribution networks for premium products further supports this segment's development.

- Expanding Retail & Cold-Chain Distribution: infrastructure improvements throughout the GCC are systematically removing historical barriers to natural beverage market penetration including limited refrigerated shelf space, inadequate temperature-controlled logistics, and concentrated distribution networks. Ongoing investments in modern trade formats, warehouse facilities, and last-mile delivery capabilities are enabling broader product availability across geographic markets and consumption occasions. The proliferation of convenience stores with refrigerated sections, fuel station retail formats, and workplace vending machines creates new touchpoints for coconut water purchases at moments of immediate consumption need.

Conclusion:

The GCC coconut water market trends examined throughout this analysis reveal a category experiencing fundamental transformation driven by health consciousness, lifestyle evolution, and infrastructure development across the region. The convergence of consumer demand for natural hydration solutions, supportive government policies aligned with Vision 2030 initiatives, and expanding distribution capabilities has established conditions for sustained long-term growth. Key trends including flavored product innovation, sustainable packaging adoption, digital commerce expansion, and fitness channel integration are collectively broadening coconut water's appeal beyond early adopter segments toward mainstream market penetration.

Strategic opportunities exist for brands capable of balancing authentic positioning with product innovation, premium quality with accessible pricing, and global scale with local market understanding. The most successful market participants will demonstrate agility in responding to evolving consumer preferences while maintaining consistency in core value propositions centered on health, naturalness, and functional benefits. Distribution excellence, digital marketing sophistication, and sustainability credentials will increasingly differentiate leaders from followers in what remains a relatively fragmented but rapidly professionalizing market landscape.

Choose IMARC Group for Comprehensive Market Intelligence and Strategic Guidance:

As the GCC coconut water market continues its dynamic evolution, businesses require sophisticated analytical capabilities and strategic insights to navigate competitive complexities and capitalize on emerging opportunities. IMARC Group delivers unmatched expertise through comprehensive services tailored to the unique requirements of beverage industry stakeholders, investors, and strategic decision-makers.

- Data-Driven Market Research: Access detailed analysis of consumer preferences, distribution dynamics, competitive positioning, and regulatory developments shaping the coconut water landscape through meticulously researched market intelligence reports. Our quantitative and qualitative methodologies provide actionable insights into consumption patterns, pricing strategies, and growth trajectories across all GCC markets.

- Strategic Growth Forecasting: Leverage our proprietary forecasting models to anticipate emerging trends including flavor innovations, packaging developments, and channel evolution. Our scenario planning capabilities enable stakeholders to evaluate multiple future pathways and develop resilient strategies that perform across diverse market conditions and competitive scenarios.

- Competitive Benchmarking: Gain comprehensive visibility into competitor strategies, product portfolios, distribution networks, and marketing approaches through systematic competitive intelligence. Our benchmarking frameworks identify best practices, performance gaps, and differentiation opportunities that inform strategic positioning and resource allocation decisions.

- Policy and Infrastructure Advisory: Stay informed about evolving regulatory requirements, food safety standards, labeling regulations, and sustainability mandates affecting coconut water production, importation, and marketing throughout the GCC. Our advisory services help navigate complex compliance landscapes while identifying opportunities created by policy developments.

- Custom Reports and Consulting: Access tailored analytical support designed around specific organizational objectives whether entering new markets, evaluating acquisition targets, optimizing product portfolios, or developing go-to-market strategies. Our consulting engagements deliver customized recommendations grounded in rigorous analysis and deep industry expertise.

At IMARC Group, our mission is empowering beverage industry leaders with the clarity and intelligence required to make confident strategic decisions in rapidly evolving markets. Partner with us to transform market complexity into competitive advantage—because informed decisions drive sustained success. For more details, click: https://www.imarcgroup.com/gcc-coconut-water-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)