Key Challenges and Opportunities Shaping the Indian Organic Food Industry

India's organic food industry stands at the intersection of health consciousness, agricultural innovation, and sustainable practices. As consumers increasingly prioritize chemical-free nutrition and environmental sustainability, the sector faces transformative opportunities alongside significant operational challenges shaped by evolving dietary preferences, technology adoption in agriculture, and regulatory frameworks that collectively define market dynamics.

Growing awareness about lifestyle diseases, food safety concerns, and the environmental impact of conventional farming has accelerated the transition toward organic consumption patterns across premium urban consumers and middle-income households seeking healthier alternatives for their families. Health imperatives, environmental consciousness, and improved product accessibility through digital channels have created substantial market opportunities extending across metropolitan centers and emerging tier-2 cities.

However, the path to widespread adoption remains complex, marked by pricing barriers, supply chain inefficiencies, and certification challenges. Understanding these dynamics becomes essential for stakeholders ranging from corporate strategy teams and business development managers to investors and consulting firms seeking to navigate this evolving landscape. The following analysis examines critical factors shaping India's organic food sector and identifies strategic opportunities for market participants.

Explore in-depth findings for this market, Request Sample

Growing Preference for Chemical-Free and Clean-Label Food:

Consumer demand for clean-label products has emerged as a dominant force reshaping India's food industry. Health-focused families increasingly scrutinize ingredient lists, seek transparency about production methods, and actively switch to organic staples and snacks. This behavioral transformation reflects heightened awareness about the health implications of pesticide residues, synthetic fertilizers, and artificial additives in conventional products.

This preference shift manifests across multiple product categories spanning organic grains, pulses, vegetables, fruits, dairy, and processed foods. Urban households with young children demonstrate particularly strong inclination toward organic options, viewing them as investments in long-term health rather than mere consumption choices. The willingness to prioritize quality over cost considerations signals fundamental change in purchasing behavior among India's expanding middle class and affluent segments.

Notably, the regulatory landscape has evolved to support this consumer movement. In 2025, the Food Safety and Standards Authority of India (FSSAI) intensified focus on stricter labeling requirements and organic food standards, shaping industry practices toward greater transparency and consumer awareness. This regulatory emphasis on standardization and quality assurance strengthens consumer confidence while establishing clearer compliance frameworks for producers and retailers.

The clean-label movement extends beyond health considerations to encompass ethical and environmental dimensions. Consumers increasingly recognize organic farming's role in preserving soil health, protecting biodiversity, and reducing agricultural pollution. This holistic understanding drives sustained demand growth despite premium pricing, creating favorable conditions for market expansion.

Market Size and Growth Opportunity:

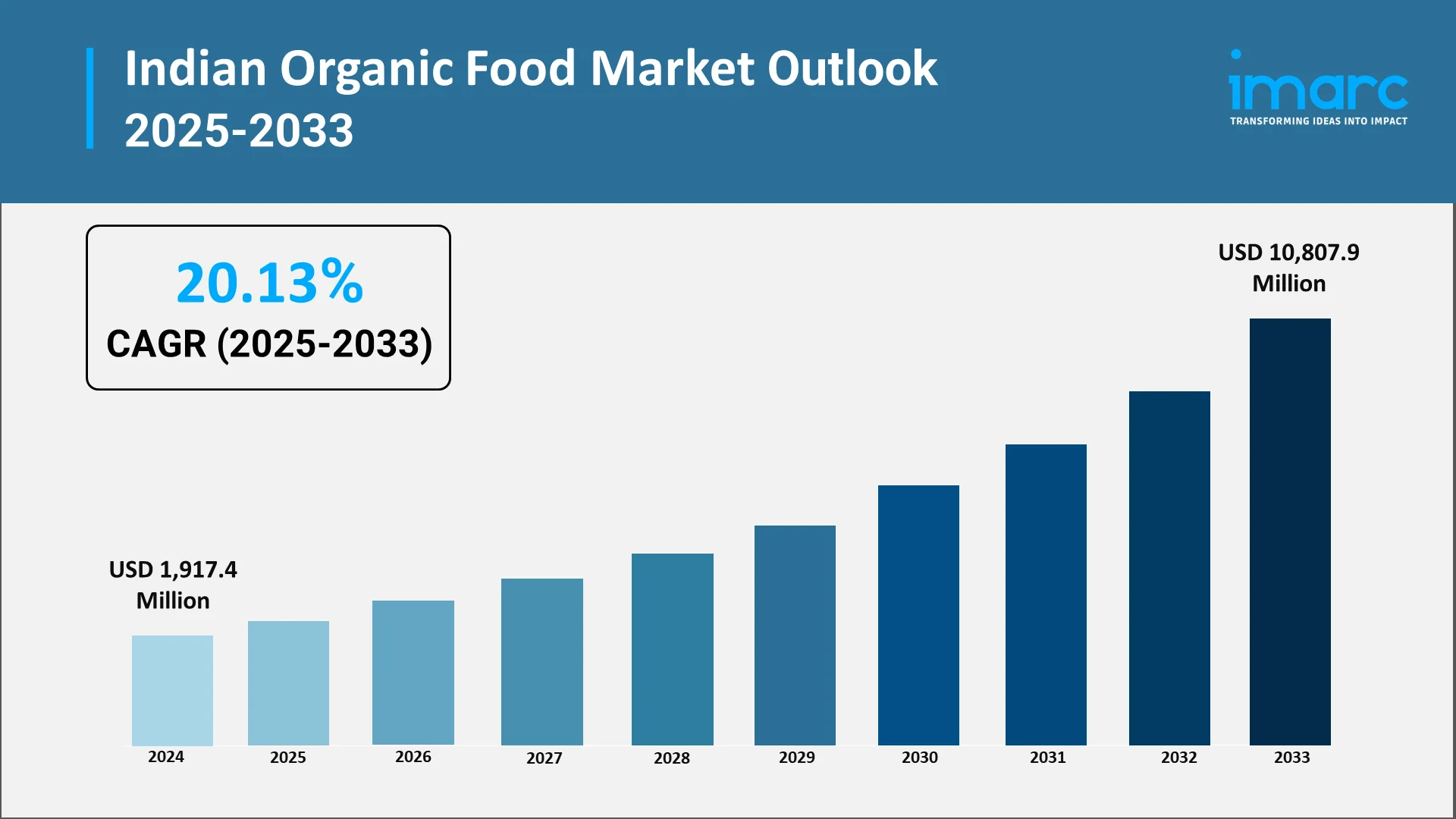

India's organic food market demonstrates substantial momentum driven by rapid adoption in metropolitan centers and tier-2 cities, particularly within packaged organic foods. In 2024, the Indian organic food market size reached USD 1,917.4 Million. The market is further projected to reach USD 10,807.9 Million by 2033, exhibiting a growth rate (CAGR) of 20.13% during 2025-2033. Market expansion reflects convergence of multiple favorable factors including rising disposable incomes, urbanization trends, retail infrastructure development, and enhanced product availability through modern trade channels and e-commerce platforms.

The growth trajectory appears particularly promising in urban clusters where health awareness, purchasing power, and retail accessibility converge. Metropolitan markets including Delhi-NCR, Mumbai, Bangalore, Hyderabad, Chennai, and Pune lead consumption volumes, while tier-2 cities demonstrate accelerating adoption rates as modern retail formats and organized distribution networks expand beyond primary urban centers.

The packaged organic foods category exhibits particularly robust growth dynamics. Consumer preference for convenience combined with quality assurance through branded packaging creates substantial opportunities for food processing companies and retail chains. Products including organic breakfast cereals, snacks, cooking ingredients, ready-to-eat items, and beverages demonstrate strong market traction among time-constrained urban professionals and health-conscious households.

Government initiatives supporting organic farming and certification further strengthen market foundations. The National Programme for Organic Production (NPOP) administered by the Agricultural and Processed Food Products Export Development Authority (APEDA) provides standardization frameworks, certification mechanisms, and quality assurance protocols that enhance consumer confidence while facilitating market access for producers. Export opportunities complement domestic growth, with India recognized globally as a significant supplier of certified organic products.

Higher Pricing Remains a Barrier for Mass Adoption:

Despite growing demand, premium pricing constitutes the most significant obstacle to widespread organic food adoption. Substantial price differentials between organic and conventional products restrict accessibility for middle-income households, limiting market penetration despite strong interest in healthier alternatives.

Industry analysis indicates consumers demonstrate willingness to pay upto 20% for organic products. However, actual market pricing frequently exceeds these thresholds, particularly for fresh produce, creating affordability barriers that constrain expansion beyond affluent urban segments.

Multiple factors contribute to higher cost structures. Lower agricultural yields during organic transition reduce production efficiency, while organic cultivation requires more labor-intensive practices including manual weeding and natural pest management. Certification expenses and compliance requirements add substantial overheads, with small farmers often struggling to absorb these costs.

The pricing challenge becomes acute in tier-2 and tier-3 cities where purchasing power remains constrained. Middle-income families face difficult trade-offs between budget constraints and health aspirations, frequently opting for conventional products despite organic preferences. However, increased production volumes, improved supply chain efficiency, and government support initiatives may gradually narrow price differentials, expanding market access across broader consumer segments.

E-commerce and Subscription Delivery Improving Access:

The emergence of digital commerce platforms and subscription-based delivery models represents transformative development addressing traditional accessibility challenges. These innovations overcome geographic constraints, reduce intermediation costs, and provide convenient access to diverse organic products including fresh vegetables, dairy, grains, and specialty groceries through doorstep delivery services.

Specialized organic food e-commerce platforms and dedicated sections within mainstream grocery retailers have significantly expanded product availability. Consumers across metropolitan and tier-2 cities now access comprehensive organic ranges including regional specialties, seasonal produce, and artisanal items previously unavailable through conventional retail channels.

Subscription models offering regular delivery of organic milk, vegetables, fruits, and pantry staples demonstrate strong consumer adoption. These services provide convenience, consistent quality, and competitive pricing through direct sourcing from organic farmers and producer cooperatives, while enhancing customer retention and providing producers with predictable demand.

Digital platforms facilitate product transparency, certification verification, and quality assurance. Detailed product descriptions, farming practice information, certification details, and customer reviews enable informed purchasing decisions. Government digital initiatives strengthen this ecosystem. In October 2025, APEDA launched a pioneering web-based organic crop traceability system, making India the first country globally to implement such comprehensive digital tracking. This system monitors organic produce from cultivation through shipment, ensuring authenticity and quality compliance. Initially covering grapes, rice, and peanuts, platform expansion to additional crops will enhance consumer confidence and export competitiveness.

E-commerce enables direct farmer-to-consumer connections, reducing intermediation layers and improving price competitiveness while ensuring better remuneration for producers. Technology integration extends to supply chain optimization, cold chain management, and last-mile delivery efficiency, particularly crucial for perishable organic produce requiring careful handling.

Leading Companies in Indian Organic Food Market:

India's organic food sector features diverse participants ranging from established national brands to regional specialists and direct-to-consumer platforms. These companies have developed distinctive value propositions addressing specific consumer segments and product categories.

- Conscious Food Private Limited

Conscious Food specializes in certified organic pulses, grains, spices, and oils sourced from organic farmers. Emphasizing supply chain transparency and traditional processing methods, the company targets urban health-conscious consumers through retail and online channels, positioning itself as a trusted chemical-free food brand.

- Ecofarms

Ecofarms provides fresh organic produce, dairy, grains, and processed foods through integrated farming and distribution operations. Supporting certified organic farmers with technical assistance, the company targets metropolitan consumers via direct channels and retail partnerships, emphasizing traceability and quality assurance.

- Elworld Organic

Elworld Organic offers certified breakfast cereals, snacks, beverages, and cooking ingredients at accessible prices. Targeting urban families and professionals, the company maintains international certification standards while distributing through modern trade, e-commerce, and specialty stores for convenient, nutritious everyday wellness solutions.

- Mehrotra Consumer Products Pvt. Ltd.

Mehrotra Consumer Products delivers authentic organic pulses, grains, spices, and oils aligned with traditional Indian dietary preferences. Using traditional processing techniques and organic standards, the company targets households in urban and semi-urban markets, bridging traditional agriculture with modern organic consumption.

- Nature Bio-Foods Ltd

Nature Bio-Foods offers breakfast cereals, health foods, organic rice, pulses, honey, and herbal products through integrated operations. Holding international certifications, the company targets health-conscious consumers and specialized nutrition seekers via retail chains and online platforms with innovative value-added offerings.

- Nature Pearls Pvt Ltd

Nature Pearls focuses on premium certified organic grains, pulses, spices, oils, nuts, and dried fruits with minimal processing. Implementing rigorous quality testing and transparent supply chains, the company appeals to discerning consumers through upscale retail and online marketplaces.

- Natureland Organics

Natureland Organics offers extensive certified organic products including breakfast foods, cooking essentials, beverages, and snacks. Maintaining farmer cooperative partnerships and competitive pricing, the company targets mainstream consumers through widespread distribution across modern retail, traditional stores, and e-commerce platforms.

- Nourish Organic Foods Pvt. Ltd

Nourish Organic Foods specializes in premium organic grains, specialty rice, ancient millets, superfoods, and health-focused preparations. Emphasizing nutrient density and therapeutic benefits, the company targets health enthusiasts through health food stores, fitness centers, and online platforms.

- Organic India Pvt. Ltd.

Organic India is globally recognized for Ayurvedic products, tulsi tea, herbal supplements, and organic foods. Working with thousands of farmers through fair trade partnerships and promoting regenerative agriculture, the company bridges ancient wellness wisdom with contemporary organic lifestyles internationally.

- Phalada Agro Research Foundations Pvt. Ltd.

Phalada integrates research, farmer training, certification support, and marketing for organic rice, millets, pulses, and spices. Operating with a farmer-centric model emphasizing fair pricing, the company serves retail and institutional buyers while supporting smallholder farmers economically.

- Pure & Sure

Pure & Sure offers accessible, affordable certified organic staples including rice, flour, pulses, oils, and pantry essentials. Emphasizing value and reliability, the company appeals to middle-class families through strong retail presence and online channels, making organic food practical for everyday use.

- Sresta Natural Bioproducts Pvt. Ltd.

Sresta Natural Bioproducts produces certified organic grains, pulses, spices, and flours meeting international standards. Maintaining rigorous quality control and multiple certifications, the company serves domestic and export markets, differentiating through reliable supply and operational excellence.

- Suminter India Organics

Suminter India Organics operates vertically integrated operations producing organic spices, herbs, rice, pulses, and oils. Maintaining extensive farmer networks and international certifications, the company targets retail, institutional, and export markets, demonstrating Indian organic products' global competitiveness.

Conclusion:

India's organic food industry navigates a complex landscape characterized by substantial growth opportunities alongside operational challenges. The convergence of health consciousness, environmental awareness, regulatory support, and technological enablement creates favorable conditions for sustained expansion. However, realizing this potential requires addressing pricing barriers, supply chain inefficiencies, and scaling challenges.

Strategic imperatives for market participants include optimizing production efficiency to moderate pricing, leveraging digital platforms for expanded reach, ensuring quality consistency through robust certification, and innovating business models balancing profitability with affordability. The sector's evolution will feature increasing consolidation, vertical integration, technology adoption, and institutional support mechanisms enhancing operational capabilities.

For corporate strategy teams, business development managers, investors, and consulting firms, India's organic food market represents compelling opportunities across production, processing, distribution, and retail value chain segments. Success will favor organizations combining consumer insight, operational excellence, supply chain capabilities, and strategic positioning within evolving regulatory and competitive landscapes.

Choose IMARC Group for Unmatched Organic Food Market Expertise:

- Data-Driven Market Intelligence: Uncover comprehensive insights into organic food consumption patterns, production trends, certification frameworks, and distribution innovations through our specialized market research reports.

- Strategic Growth Forecasting: Anticipate emerging opportunities in organic dairy, packaged foods, fresh produce, and specialty segments by leveraging our regional analysis covering metropolitan and tier-2 market expansion dynamics.

- Competitive Intelligence: Evaluate market positioning, product portfolios, and strategic initiatives of leading organic brands while monitoring new entrants and disruptive business models reshaping competitive landscapes.

- Regulatory Advisory: Navigate India's organic certification requirements, FSSAI standards, NPOP compliance, and export regulations with our specialized guidance on policy developments affecting market operations.

- Custom Consulting: Access tailored insights for market entry strategies, product launches, supply chain optimization, and partnership opportunities aligned with your objectives in India's organic food industry.

Partner with IMARC Group for authoritative intelligence powering informed strategic decisions. Click here for more details: https://www.imarcgroup.com/indian-organic-food-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)