Philippines Passenger Vehicles Lubricants Industry: Navigating Growth Through Innovation, Technology, and Sustainability

The Philippines passenger vehicles lubricants industry stands at a transformative juncture, driven by robust automotive sector expansion, technological innovation, and evolving consumer preferences toward high-performance products. As the Philippine economy demonstrates resilient growth and vehicle ownership continues to rise, the demand for premium automotive lubricants has accelerated significantly across the archipelago.

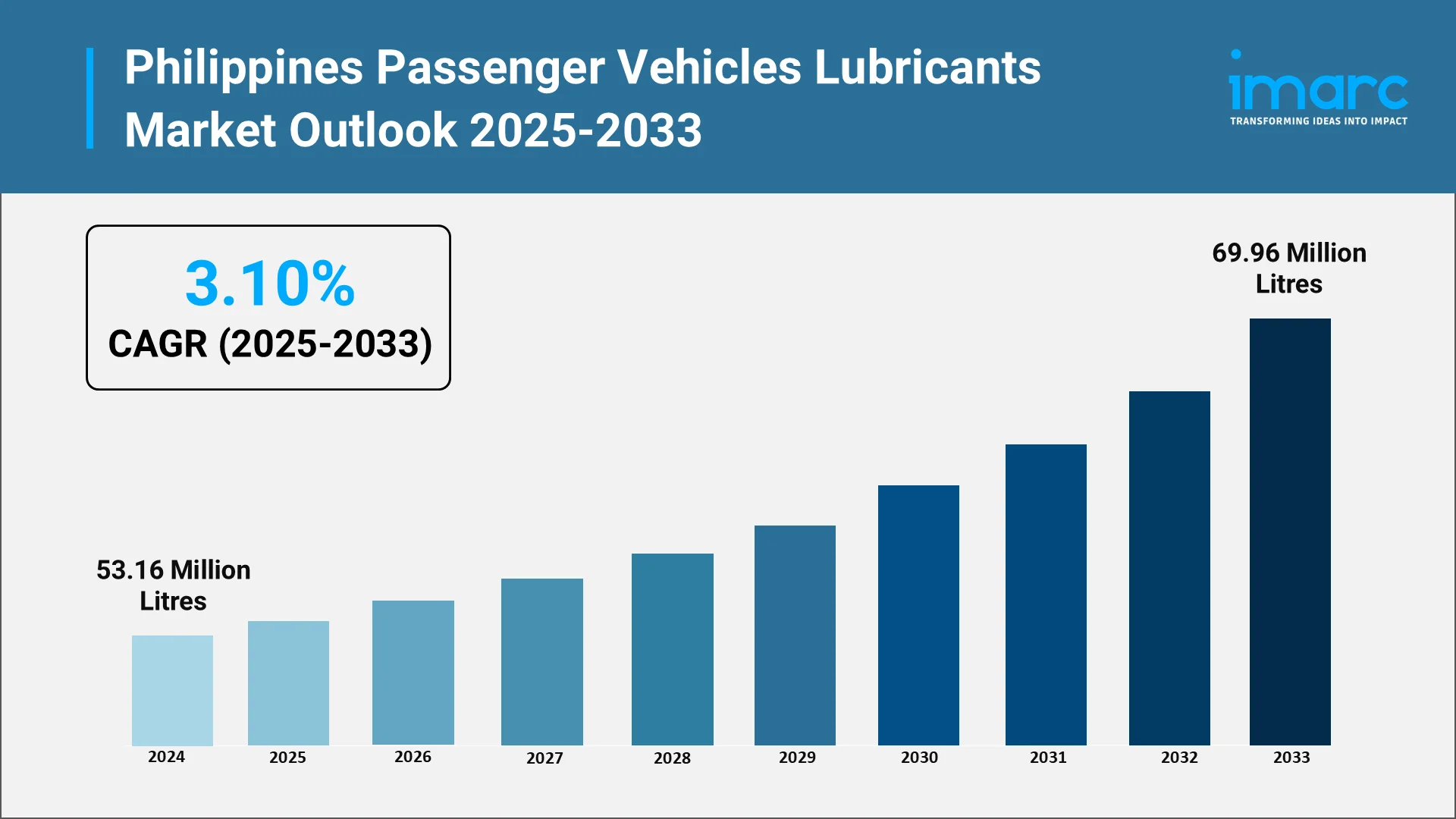

Market intelligence reveals compelling growth trajectories for the Philippines automotive lubricants market. The passenger vehicles lubricants market in the Philippines reached 53.16 Million Litres in 2024 and is projected to expand to 69.96 Million Litres by 2033, exhibiting a compound annual growth rate (CAGR) of 3.10% during the forecast period. This expansion reflects the confluence of multiple market drivers, including increasing vehicle registrations, heightened awareness of engine maintenance, and stringent environmental regulations mandating superior lubricant performance.

The Philippines automotive market landscape has demonstrated remarkable resilience and growth momentum. The Chamber of Automotive Manufacturers of the Philippines Inc. (CAMPI) and Truck Manufacturers Association (TMA) jointly reported that new motor vehicle sales reached 39,088 units in June 2024, representing a 7.6% year-over-year increase.

This comprehensive analysis examines the critical role of artificial intelligence and digital technologies, recent market developments, leading industry players, emerging opportunities and challenges, and the strategic outlook for stakeholders navigating this dynamic sector. Understanding these dimensions provides essential intelligence for corporate strategy teams, business development professionals, investors, and government agencies seeking to capitalize on the Philippines' expanding vehicle lubricants market.

Explore in-depth findings for this market, Request Sample

Role of AI, Impact, and Benefits in the Philippines Passenger Vehicles Lubricants Industry:

Artificial intelligence is revolutionizing the passenger vehicle lubricants sector through unprecedented levels of optimization, predictive capabilities, and operational efficiency. The integration of AI-driven technologies represents a paradigm shift from traditional lubricant management to intelligent, data-informed systems that enhance performance while reducing costs.

AI-Powered Formulation Development

The development of advanced lubricant formulations increasingly relies on machine learning algorithms that analyze extensive datasets from engine performance tests. AI systems identify optimal combinations of base oils and additives, ensuring lubricants are precisely tailored for specific applications such as high-temperature environments, heavy loads, or extended drain intervals.

Companies like Shell Lubricants and ExxonMobil are actively exploring AI applications to refine product formulations. These systems process thousands of variables simultaneously, predicting performance metrics including viscosity, pour point, flash point, and wear resistance with remarkable accuracy. This capability accelerates product development cycles while ensuring compliance with American Petroleum Institute and European Automobile Manufacturers' Association standards.

Predictive Maintenance Through IoT Integration

The convergence of AI with Internet of Things (IoT) technologies has created intelligent lubrication management systems. Modern vehicles equipped with IoT sensors continuously monitor lubricant condition, engine temperature, friction levels, and contamination rates in real-time. These data streams feed AI algorithms that predict optimal oil change intervals based on actual operating conditions rather than arbitrary time-based schedules.

This predictive approach prevents both over-lubrication and under-lubrication scenarios. Automotive service providers in the Philippines are increasingly adopting these technologies to offer personalized maintenance plans, ensuring timely lubricant changes and optimal engine health. The result is enhanced equipment uptime, reduced maintenance costs, and extended machinery lifespan.

Real-Time Performance Optimization

AI-enabled systems analyze continuous data streams from vehicle sensors to dynamically adjust lubrication strategies. Machine learning models determine optimal lubrication intervals based on real-time operating conditions, accounting for variables such as ambient temperature, driving patterns, load conditions, and terrain characteristics.

For passenger vehicles operating in the diverse Philippine climate and traffic conditions, this capability is particularly valuable. AI algorithms can differentiate between urban stop-and-go traffic in Metro Manila and highway cruising conditions, adjusting recommendations accordingly to maximize engine protection and fuel efficiency.

Supply Chain and Distribution Enhancement

AI-powered supply chain optimization is transforming lubricant distribution networks across the Philippines. Advanced algorithms forecast demand patterns, optimize inventory management, and enhance routing efficiency. This ensures lubricant products reach consumers and service centers precisely when needed, reducing stockouts and minimizing carrying costs.

Distributors leverage AI to analyze market trends, seasonal variations, and regional preferences, enabling data-driven decisions regarding product positioning and promotional strategies. This intelligence is particularly valuable in the Philippine market, where geographic dispersion and infrastructure variations create complex distribution challenges.

Recent Market News & Major Research and Development:

The Philippines passenger vehicles lubricants market has witnessed significant developments throughout 2024 and early 2025, reflecting intensified competition, technological advancement, and strategic partnerships among industry leaders.

Landmark Distribution Agreements

In July 2024, ExxonMobil announced a strategic partnership by appointing Juliana Holdings, Inc. as its official distributor for Mobil-branded lubricants throughout the Philippines. This collaboration positions Mobil to capture a larger share of the Philippine market, which consumes approximately 83 Million Liters of engine oil annually. Juliana Holdings will supply the complete portfolio of Mobil products, including Mobil 1, Mobil Super, Mobil Super Moto, and Mobil Delvac, to workshops and supply stores nationwide.

This development underscores the competitive intensity in the lubricants sector and the strategic importance multinational corporations place on distribution network expansion to reach the archipelago's dispersed customer base.

Product Line Expansions

FUCHS Lubricants marked its strategic expansion into Southeast Asia by launching its TITAN line in the Philippines in November 2024. The TITAN portfolio encompasses high-performance engine oils, gear oils, and brake fluids specifically engineered to enhance automotive efficiency, performance, and sustainability. This introduction reflects the growing demand for premium synthetic lubricants among Filipino consumers seeking superior engine protection and extended service intervals.

In April 2024, General Petroleum unveiled its comprehensive range of automotive lubricants in the Philippine market, including engine oils, transmission fluids, hydraulic oils, and specialty lubricants. The company emphasized its commitment to delivering innovative solutions backed by advanced technology and high-quality additives. To promote brand awareness, General Petroleum partnered with Angelspeed Motorsports for the GP Gymkhana event, highlighting product performance and reliability to automotive enthusiasts.

Synthetic and High-Performance Products

Motul Philippines, in collaboration with Infiniteserv International, launched the 8100 Power synthetic ester engine oil at the 2023 Trans Sport Show in May 2023. This product is specifically designed for high-performance road vehicles, offering enhanced protection against Low-Speed Pre-Ignition (LSPI) and optimized viscosity for improved reliability. The launch reflects the accelerating consumer shift toward synthetic and semi-synthetic lubricants driven by superior performance characteristics and extended drain intervals.

Infrastructure Enhancement Initiatives

In July 2024, Shell announced a significant infrastructure upgrade, enhancing over 500 self-owned Oilchange + stations across the Philippines. This initiative provides consumers with convenient access to quick and hassle-free oil change services, addressing the frequent maintenance requirements of passenger vehicles. The expansion recognizes that oil changes are routine necessities occurring every few months, making accessibility a critical competitive advantage.

Philippine Shell Petroleum Corporation also signed a three-year agreement with Chery Auto Philippines, whereby Shell's automotive lubricants will be utilized for after-sales maintenance of Chery automobiles. The partnership emphasizes Shell's Helix HX7 5W-40 multi-grade motor oil, specifically developed for enhancing motor engine performance and reliability.

Top Companies in the Philippines Passenger Vehicles Lubricants Industry:

The Philippines passenger vehicles lubricants market exhibits a fairly consolidated structure, with the top five companies commanding approximately 76.11% of market share. These industry leaders leverage extensive distribution networks, strong brand equity, and diversified product portfolios to maintain competitive advantages.

BP Plc (Castrol)

BP Plc, through its Castrol brand, represents one of the dominant forces in the Philippine lubricants market. Castrol's extensive product range encompasses conventional and synthetic engine oils, specialized formulations for high-performance vehicles, and products designed for electric vehicle applications. The company's strong market position derives from decades of brand building, technical expertise, and a comprehensive distribution network reaching urban centers and provincial markets throughout the archipelago.

Royal Dutch Shell Plc

Shell plc maintains a significant presence through its Pilipinas Shell Petroleum Corporation subsidiary, operating more than one thousand service stations nationwide. Shell's lubricant portfolio includes Shell V-Power, Shell FuelSave, Shell Helix car engine oils, Shell Advance motorcycle engine oils, and Shell Rimula truck and heavy-duty engine oils. Shell has demonstrated strategic agility through partnerships with automotive manufacturers. The company extended its collaboration with Isuzu Philippines Corp. until 2023, supplying lubricants, fuels, and other products.

Chevron Corporation

Chevron Corporation operates in the Philippines through Chevron Philippines Inc., offering Caltex-branded lubricants and fuels. The company's market position reflects strong brand recognition and a comprehensive product range serving diverse vehicle types and operating conditions. Chevron's technical expertise in lubricant formulation and quality assurance resonates with Filipino consumers seeking reliable engine protection.

TotalEnergies SE

TotalEnergies maintains a competitive position in the Philippine lubricants market through its diverse product portfolio and commitment to innovation. The company's focus on developing high-performance and environmentally sustainable lubricants aligns with evolving market preferences and regulatory requirements. TotalEnergies' global research and development capabilities enable rapid introduction of advanced formulations tailored to tropical operating conditions prevalent in the Philippines.

Petron Corporation

Petron Corporation represents the largest Philippine-owned petroleum company, operating over 2,400 service stations nationwide. The company's extensive Petron Car Care Centers (CCC) provide professional automotive services utilizing Petron's lubricants and oils. Petron's deep market understanding, local manufacturing capabilities, and expansive retail network create formidable competitive advantages.

The company offers multiple customer engagement programs, including the Petron Value Card for loyalty rewards, the Petron Fleet Card for corporate accounts, and co-branded credit cards with banking partners offering fuel rebates.

Opportunities and Challenges in the Philippines Passenger Vehicles Lubricants Industry:

The Philippines passenger vehicles lubricants market presents compelling opportunities alongside notable challenges that will shape industry dynamics through the remainder of the decade.

Strategic Opportunities:

Growing Vehicle Population and Sales Momentum

The Philippine automotive market has shown strong momentum, driven by rising vehicle ownership and steady growth in sales across both passenger and commercial segments. The Philippines automotive market size reached 475 Thousand Units in 2024. Looking forward, the market is expected to reach 1,050.58 Thousand Units by 2033, exhibiting a growth rate (CAGR) of 8.5% during 2025-2033. This expansion has directly fueled greater demand for automotive lubricants, creating sustained opportunities for market participants. The industry remains a vital contributor to the national economy, with its continued upward trajectory reinforcing the positive outlook for the country’s lubricants market.

Transition to Synthetic and Semi-Synthetic Lubricants

Consumer preference is shifting decisively toward synthetic and semi-synthetic lubricants due to superior performance characteristics, extended drain intervals, and enhanced engine protection. These products command premium pricing while delivering improved fuel efficiency and reduced maintenance frequency, creating favorable economics for both consumers and lubricant manufacturers.

The synthetic lubricant segment is experiencing steady expansion, reflecting a meaningful shift in market dynamics. Growth in the premium vehicle category is strengthening this trend, as more consumers opt for high-end models that require superior, high-performance lubrication. This rising preference for advanced automotive technologies is increasing demand for synthetic products that offer better efficiency, protection, and durability. As a result, manufacturers with the capability to develop sophisticated formulations are well-positioned to capture new opportunities within this evolving landscape.

Electric Vehicle Market Emergence

The Philippine electric vehicle market presents transformative opportunities for lubricant manufacturers willing to innovate. While electric vehicles require different lubricants than internal combustion engines, they still need specialized fluids for transmissions, thermal management systems, and other components.

Electric vehicle registrations surpassed 10,000 units in the first half of 2024, exceeding the entire previous year's total. Executive Order No. 12 extended zero-tariff policies on EVs and components until 2028, accelerating adoption. The Electric Vehicle Association of the Philippines confirmed rapid growth momentum, creating demand for e-fluids, e-greases, and specialized thermal management products.

E-commerce and Digital Distribution Channels

The expansion of e-commerce platforms and digital marketplaces creates new distribution channels for lubricant products. Online platforms enable manufacturers to reach consumers directly, bypassing traditional distribution networks while gathering valuable customer data. Digital marketing capabilities allow targeted campaigns based on vehicle type, driving patterns, and maintenance needs.

Government Infrastructure Investments

The Comprehensive Automotive Resurgence Strategy (CARS) Program, extended for an additional five years through presidential approval, continues providing fiscal support for automotive manufacturing. This program aims to attract investments, stimulate demand, and position the Philippines as a regional automotive manufacturing hub. Such initiatives create favorable conditions for ancillary industries, including lubricants and automotive care products.

Strategic Challenges:

Price Sensitivity and Competitive Pressure

The Philippine market exhibits significant price sensitivity, particularly in the mass-market segment. Consumers often prioritize cost over performance attributes, creating pressure on premium product positioning. The proliferation of lower-priced alternatives from emerging competitors intensifies price competition, compressing margins for established players.

Counterfeit Products and Quality Concerns

The presence of counterfeit and substandard lubricant products represents a persistent challenge threatening brand equity and consumer safety. These products undermine legitimate manufacturers through unfair pricing while potentially causing engine damage and warranty voidance. Addressing counterfeit proliferation requires coordinated industry action, regulatory enforcement, and consumer education initiatives.

Distribution Network Complexity

The Philippines' archipelagic geography creates distribution challenges, requiring extensive logistics networks to reach consumers across thousands of islands. Transportation costs, infrastructure limitations, and regional variations in demand complicate inventory management and distribution optimization. Manufacturers must balance comprehensive market coverage against cost efficiency.

Regulatory Compliance and Environmental Standards

Evolving environmental regulations and emission standards require continuous product reformulation and compliance investments. As the Philippines aligns with international environmental protocols, lubricant manufacturers must develop formulations meeting stricter specifications while maintaining performance and affordability. Compliance costs may disadvantage smaller players lacking research and development capabilities.

Consumer Education Requirements

Despite growing awareness, significant portions of the market lack a comprehensive understanding of lubricant specifications, performance benefits, and proper application. Many consumers rely on informal mechanics with limited technical knowledge, creating information asymmetries that hinder premium product adoption. Industry participants must invest in education programs to build consumer sophistication and drive value-based purchasing decisions.

Workforce Skills and Technical Expertise

The lubricants industry faces challenges in attracting and retaining skilled employees with specialized technical knowledge. As products become increasingly sophisticated, requiring expertise in synthetic chemistry, additive technology, and application engineering, talent development becomes critical for maintaining a competitive advantage.

Future Outlook: Philippines Passenger Vehicles Lubricants Industry

The Philippines passenger vehicles lubricants market is poised for sustained expansion through 2033, driven by favorable macroeconomic conditions, technological innovation, and evolving consumer preferences. Multiple convergent trends will shape the industry's trajectory over the coming decade.

Market Growth Projections

Authoritative market intelligence indicates strong momentum for the passenger vehicle lubricants segment. The sector is expected to expand steadily over the coming years, supported by a growing vehicle base and higher overall usage. As drivers keep their vehicles for longer and rely on them more frequently, lubricant consumption continues to rise. At the same time, increasing preference for premium, high-performance products is further boosting demand. Together, these factors point to a sustained growth trajectory for the market throughout the forecast period.

Technological Transformation

The integration of artificial intelligence, IoT sensors, and predictive analytics will accelerate throughout the forecast period. Smart lubrication systems capable of real-time condition monitoring, predictive maintenance recommendations, and automated ordering will become increasingly prevalent. These technologies reduce the total cost of ownership while improving vehicle reliability and performance.

Nanotechnology-enhanced lubricants incorporating advanced additives will gain market share, offering superior friction reduction, wear protection, and thermal stability. These formulations are particularly beneficial for high-stress applications and extreme operating conditions, commanding premium pricing while delivering demonstrable performance benefits.

Sustainability and Environmental Focus

Environmental sustainability will emerge as a defining competitive factor. Consumer awareness regarding environmental impact is driving demand for biodegradable lubricants, bio-based formulations, and products manufactured through sustainable processes. Manufacturers investing in green chemistry, renewable feedstocks, and circular economy principles will capture environmentally conscious market segments.

Regulatory pressures will intensify, with stricter emission standards and disposal requirements favoring high-performance lubricants that enable cleaner combustion and extended service intervals. Companies demonstrating environmental leadership through product innovation and operational practices will enhance brand reputation and customer loyalty.

Electric Vehicle Adaptation

As electric vehicle adoption continues to gain momentum, lubricant manufacturers must shift their portfolios toward e-fluids, advanced thermal management solutions, and specialized greases designed for electric drivetrain components. Although EVs use fewer lubricants than conventional engines, they rely on highly specialized formulations that offer superior performance and protection. This creates opportunities for premium, technology-driven products tailored to the unique demands of electric mobility.

The successful EV transition requires substantial research and development investment, technical expertise in electric vehicle lubrication requirements, and strategic partnerships with automotive manufacturers and charging infrastructure providers. Early movers establishing strong positions in the EV lubricants segment will capture disproportionate value as the market transforms.

Consolidation and Strategic Partnerships:

Market consolidation is likely to intensify as larger players acquire smaller competitors to expand geographic coverage, enhance product portfolios, and capture economies of scale. Strategic partnerships between lubricant manufacturers and automotive OEMs will proliferate, creating opportunities for co-branded products, exclusive supply agreements, and collaborative product development.

Distribution partnerships with e-commerce platforms, automotive service chains, and fleet operators will become increasingly important as traditional retail channels evolve. Companies building comprehensive omnichannel distribution capabilities spanning physical retail, e-commerce, and direct-to-consumer models will maintain competitive advantages.

Investment Attractiveness:

The Philippines passenger vehicles lubricants market presents compelling investment opportunities for:

- Corporate Strategy Teams seeking to enter or expand presence in Southeast Asian automotive markets with favorable demographics and growth trajectories.

- Private Equity Investors evaluating opportunities in automotive aftermarket sectors with recurring revenue characteristics and defensive growth profiles.

- Manufacturing Companies considering local production capabilities to serve Philippine and regional markets while capturing favorable government incentives.

- Technology Providers developing AI, IoT, and digital solutions for automotive maintenance and lubrication management applications.

- The market's projected growth, combined with structural trends toward premium products and technological sophistication, creates favorable conditions for strategic investments and business expansion initiatives.

Empowering Your Strategic Decisions with IMARC Group:

Choose IMARC Group for unmatched expertise and comprehensive analytical services tailored to the Philippines passenger vehicles lubricants industry. Our specialized capabilities deliver actionable intelligence that transforms market understanding into competitive advantage.

- Data-Driven Market Research: Gain deep insights into lubricant consumption patterns, consumer preferences, competitive dynamics, and technological advancements including synthetic formulations, bio-based alternatives, and digital lubrication management platforms through exhaustive market research reports.

- Strategic Growth Forecasting: Anticipate emerging trends in automotive maintenance, predict shifts toward premium products, forecast electric vehicle impacts on lubricant demand, and identify regional growth opportunities through sophisticated predictive modeling and scenario analysis.

- Competitive Benchmarking: Analyze competitive positioning across the Philippines passenger vehicles lubricants landscape, evaluate product portfolios and pricing strategies, monitor distribution network expansions, and assess technological capabilities including AI-driven formulation development and IoT integration initiatives.

- Policy and Infrastructure Advisory: Navigate evolving regulatory frameworks governing automotive emissions, lubricant specifications, and environmental compliance requirements. Understand government programs supporting automotive manufacturing and infrastructure development that influence lubricant demand patterns and market access conditions.

- Custom Reports and Consulting: Access tailored insights aligned with your organizational objectives whether launching new lubricant formulations, evaluating acquisition targets, optimizing distribution strategies, or assessing opportunities in electric vehicle lubricants and emerging automotive technologies.

At IMARC Group, our mission is to empower automotive industry leaders with clarity and intelligence necessary to navigate the dynamic Philippines passenger vehicles lubricants market. Partner with us to transform market knowledge into strategic action and sustainable competitive advantage.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)