Top Factors Driving Growth in the India Edible Oil Market

Introduction:

The India edible oil market stands as one of the most dynamic sectors within the country's consumer goods landscape. As households increasingly prioritize quality, health, and convenience, demand for diverse oil varieties continues to surge. The transformation from traditional purchasing habits to modern retail experiences reflects broader shifts in consumer awareness and lifestyle choices.

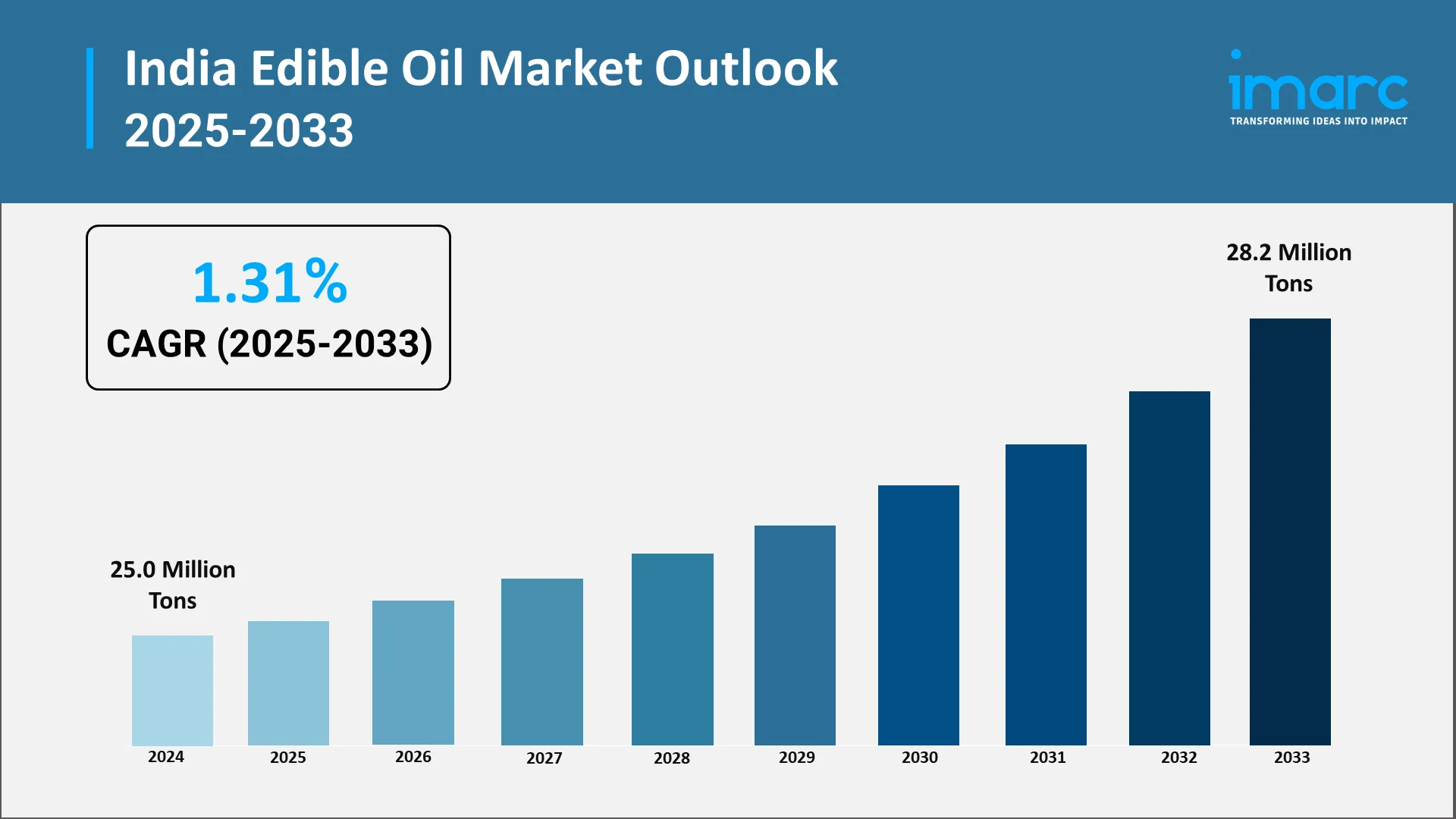

India's position as a major consumer of edible oils creates substantial opportunities for domestic producers, international brands, and emerging health-focused players. The market encompasses multiple oil categories ranging from traditional mustard and groundnut to contemporary choices like olive and rice bran oil, catering to regional preferences and evolving nutritional consciousness. In 2024, the India edible oil market size reached a volume of 25.0 Million Tons.

From the rise of packaged offerings to quick-commerce platforms, multiple forces are reshaping how Indian households purchase cooking oils. This analysis explores the primary factors propelling market expansion and strategic implications for industry stakeholders.

Explore in-depth findings for this market, Request Sample

Shift Toward Packaged & Branded Oils:

Perhaps the most important transition in India's edible oil market has been from loose oil purchases to packaged and branded variants. This trend is more marked in urban households, which are increasingly discarding the age-old habit of purchasing unbranded oils from local traders and switching over to sealed, quality-assured products sold by reputable manufacturers. This trend is partly driven by a growing concern for purity, hygiene standards, and product authenticity.

Branded edible oils offer the consumers tangible benefits in terms of assured quality, clear labeling, and guaranteed nutritional value. The packaging itself is a cue for trust, as it contains in-depth information on ingredients, processes, and health benefits. With this trend, manufacturers have also launched premium product lines where they include refined oils and cold-pressed versions that appeal to quality-conscious buyers.

Urban migration and changing household structures have accelerated this transformation. Nuclear families with dual-income earners prefer the convenience and reliability of branded products over the time-intensive process of verifying loose oil quality. Modern retail formats have made packaged oils more accessible, and marketing campaigns have managed to position branded variants as superior choices for health and taste.

Premiumisation in the packaged oil segment continues to show traction. Consumers nowadays are increasingly open to spending more for value propositions such as better nutritional profiles, ethical sourcing, or specialist processing methods. This readiness to upgrade opens up avenues for marketers to introduce new premium offerings that can command a premium price while offering perceived value for health benefits and quality assurance. For example, KRBL Limited entered into the health-oriented edible oil market in February 2025 by launching its "India Gate Uplife" with a range of premium blended variants targeted at weight control and gut health. This diversification reflects the rising demand for functional cooking oils among urban, health-conscious consumers.

Market Size & Growth Opportunity:

India's vast population and cooking traditions create an enormous consumption foundation for the edible oil industry. The country's appetite for cooking oils spans diverse demographic segments, economic classes, and geographic regions. This large consumption base provides stable platform for sustained growth and innovation. According to the IMARC Group, the market is projected to reach a volume of 28.2 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.31% during 2025-2033.

Per-capita oil consumption continues rising as incomes enable households to afford better-quality products. The expanding middle class demonstrates increasing purchasing power, translating directly into higher demand for premium oil varieties. This multichannel distribution through retail outlets and e-commerce platforms ensures broad market coverage and caters to diverse shopping preferences.

Regional variations in oil preferences present distinct growth opportunities. Northern states favor mustard oil while southern regions prefer groundnut and coconut varieties. Understanding these regional nuances enables companies to develop targeted strategies that resonate with local consumers while building national brand presence.

The untapped potential in rural markets represents significant growth frontier. As infrastructure improvements reach smaller towns, packaged oil adoption accelerates. Brands establishing strong distribution networks position themselves to capture substantial market share in these emerging segments.

Growing Preference for Health-Focused Oils:

Rising health awareness among Indian consumers has fundamentally altered purchasing decisions. Households increasingly scrutinize nutritional labels and actively seek oils that support wellness goals. This consciousness extends beyond calories to encompass fatty acid profiles, vitamin content, and health impacts.

Sunflower oil has emerged as preferred choice due to its light flavor and nutritional characteristics. Similarly, rice bran oil gains popularity for cardiovascular wellness properties. Traditional oils like mustard oil and groundnut oil experience renewed interest as consumers rediscover their nutritional value and cultural significance.

Olive oil, once a niche import, has penetrated mainstream Indian kitchens as awareness about Mediterranean dietary patterns spreads. The premium positioning appeals to affluent consumers viewing it as investment in long-term health.

Manufacturers are introducing specialized variants targeting specific health concerns. From cholesterol-free formulations to vitamin-enriched products, the diversity of health-focused offerings continues expanding, creating differentiation opportunities while addressing genuine consumer needs. On April 8, 2025, the Solvent Extractors' Association of India (SEA) and TechnoServe inked a strategic Memorandum of Understanding, to improve nutritional quality countrywide and fortify edible oils in accordance with FSSAI's voluntary fortification requirements.

Cold-pressed and organic oils represent the premium tier, appealing to consumers prioritizing minimal processing. These products command higher prices justified by production processes and perceived purity, reflecting trends toward clean eating among educated, affluent urban consumers.

Rising Penetration of Supermarkets & Quick-Commerce Delivery:

The transformation of retail infrastructure has profoundly impacted how consumers purchase edible oils. Modern supermarkets have established themselves as preferred shopping destinations, offering extensive selections, competitive pricing, and convenient experiences. These formats enable consumers to compare multiple brands and make informed choices.

Quick-commerce platforms like BigBasket, Blinkit, and Zepto have revolutionized purchasing through ultra-fast delivery. The convenience of receiving branded oils within minutes appeals to time-pressed urban consumers. This delivery speed, combined with competitive pricing and extensive catalogs, disrupts traditional patterns.

The integration of online and offline channels creates seamless shopping experiences. This omnichannel approach maximizes customer touchpoints while accommodating diverse preferences. Consumers can research products digitally before purchasing in stores, or vice versa, enhancing purchase confidence.

Supermarkets leverage physical presence for product sampling and in-store promotions. Quick-commerce platforms excel at providing consumer data enabling personalized marketing and targeted promotions, creating competitive advantages while enhancing shopping experiences.

The geographic expansion of modern retail formats continues unlocking new markets. As supermarket chains open stores in tier-two cities and quick-commerce platforms extend delivery networks, branded edible oils gain access to previously underserved segments, democratizing access to quality products.

Top Companies in India Edible Oil Market:

The competitive landscape of India's edible oil market features established domestic players, multinational corporations, and emerging regional brands, each commanding significant market presence. These companies have built their positions through decades of operations, extensive distribution networks, and strong brand equity.

- Adani Group

Adani Wilmar, a joint venture between Adani Group and Wilmar International, dominates India's edible oil market with flagship brand Fortune. The company offers refined oils, vanaspati, and specialty fats through extensive distribution networks, maintaining leadership in consumer-packaged edible oils across multiple segments.

- BCL Industries Ltd.

BCL Industries operates integrated grain-based distilleries producing ethanol, extra neutral alcohol, and edible oils including rice bran oil. The company leverages by-product utilization from rice processing, targeting health-conscious consumers and industrial buyers with competitively priced, nutritionally beneficial oil products.

- Bunge

Bunge India operates as a leading agribusiness and food company producing refined edible oils, vanaspati, and specialty fats. With brands like Dalda and modern processing facilities, the company serves retail consumers and food service industries, leveraging global expertise in oilseed processing and distribution.

- Cargill, Incorporated

Cargill India operates across the edible oil value chain, from oilseed crushing to refined oil production. Offering brands like Gemini and Nature Fresh, the company serves retail, food service, and industrial segments with diverse product portfolios including sunflower, rice bran, and blended oils.

- Emami Agrotech Ltd

Emami Agrotech produces edible oils under brands like Healthy & Tasty and Himani. Offering mustard, soybean, sunflower, and rice bran oils, the company targets health-conscious consumers across eastern and northern India through strong regional distribution networks and competitive pricing strategies.

- Gulab Oil & Foods

Gulab specializes in traditional mustard oil and refined edible oils, maintaining strong presence in northern Indian markets. The company emphasizes authentic processing methods and regional taste preferences, targeting households seeking traditional flavors alongside modern refined oil options through established distribution channels.

- Mahesh Edible Oil Industries Limited

Mahesh Edible Oil Industries produces refined edible oils including sunflower, soybean, and groundnut oils. Operating modern processing facilities, the company serves regional markets with competitively priced products, focusing on consistent quality and efficient distribution to retail and institutional buyers.

- Marico Limited

Marico dominates India's premium edible oil segment with flagship brand Saffola, positioned for heart health. The company offers refined oils, functional blends, and specialty products targeting health-conscious, urban consumers through extensive retail networks and strong brand equity built over decades.

- N.K Proteins Pvt Ltd

N.K Proteins specializes in soybean crushing and refined oil production, offering soybean oil and related products. Operating modern processing facilities, the company serves retail consumers and industrial clients, focusing on quality extraction processes and efficient supply chain management across regional markets.

- Patanjali Ayurved Limited

Patanjali offers diverse edible oils including mustard, groundnut, sesame, and coconut under Ayurvedic wellness positioning. Leveraging founder Baba Ramdev's brand influence and Swadeshi appeal, the company targets value-conscious consumers through extensive retail networks and competitive pricing across urban and rural markets.

- Sanwaria Consumer Limited

Sanwaria Consumer produces edible oils under brands like Mantra and Profitt. Offering mustard, soybean, sunflower, and blended oils, the company targets middle-income households across northern and central India through strong distribution networks, emphasizing quality and affordability in competitive price segments.

- Sundrop Brands Limited

Sundrop, owned by Agro Tech Foods, offers premium refined sunflower and blended oils positioned for health and taste. Targeting urban, health-conscious consumers, the company maintains strong brand equity through consistent quality, modern processing facilities, and strategic marketing emphasizing nutritional benefits.

Conclusion:

The India edible oil market stands at a transformative juncture characterized by evolving consumer preferences, expanding retail infrastructure, and heightened health consciousness. The shift from loose to packaged oils reflects modernization trends, while diverse oil varieties cater to sophisticated demands.

Health awareness emerges as defining theme shaping purchasing decisions. Consumers seek oils aligning with wellness goals while satisfying culinary requirements, driving innovation and premiumization opportunities.

The competitive landscape features established players alongside nimble entrants targeting niche segments. Success requires understanding regional variations, anticipating trends, and building distribution capabilities across traditional and modern commerce channels.

Choose IMARC Group for Unmatched Expertise and Core Services:

- Data-Driven Market Research: Enhance your understanding of consumption patterns, processing technologies, and emerging oil varieties through comprehensive research reports on the edible oil sector.

- Strategic Growth Forecasting: Anticipate trends in health-focused oils, packaging innovations, and distribution evolution across regions to inform expansion strategies.

- Competitive Benchmarking: Analyze competitive dynamics, brand positioning, and product portfolios to identify market opportunities and threats.

- Policy and Infrastructure Advisory: Navigate regulatory frameworks, food safety standards, and quality certifications affecting edible oil production and distribution.

- Custom Reports and Consulting: Access tailored insights for launching products, entering regional markets, or optimizing supply chains.

At IMARC Group, we empower industry leaders with intelligence required to succeed in competitive markets. Partner with us for strategic growth and market leadership by clicking here: https://www.imarcgroup.com/india-edible-oil-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)