GCC Bottled Water Market Trends: Rising Demand for Premium and Healthy Hydration

Introduction:

The Gulf Cooperation Council (GCC) region continues to position itself as one of the fastest-evolving markets for packaged beverages, with bottled water standing at the forefront of this transformation. The GCC bottled water market size has expanded steadily in recent years, supported by a strong shift toward health-driven consumption, improved hydration awareness, and evolving lifestyle patterns across the member countries. As consumers increasingly associate bottled water with purity, convenience, and wellness, the category has emerged as an essential household and on-the-go product. Alongside these changes, the region is witnessing robust growth in purified, mineral, sparkling, and premium water offerings, further strengthening its competitive landscape.

The rise in fitness culture, greater preference for safe and hygienic beverages, and the growing influence of wellness-centric consumption have significantly shaped the GCC bottled water market trends in recent years. While hydration has traditionally been a necessity in the region’s hot climate, modern consumers now link it to holistic well-being, detoxification, and balanced lifestyles. In fact, in May 2023, Al Ain Water (Agthia Group) launched “Al Ain Plus,” a sodium-free bottled water fortified with zinc and magnesium — a move clearly aimed at health-conscious consumers seeking functional hydration. This shift has not only heightened demand for daily drinking water but also triggered increased interest in functional, mineral-enriched, and premium hydration solutions.

As local and global brands continue to strengthen their product portfolios, consumers today enjoy a broader spectrum of choices, ranging from value-driven options to luxury hydration experiences. This diversification plays a pivotal role in boosting the GCC bottled water market demand, thereby driving product innovation, packaging advancements, and brand differentiation across the region. Altogether, these developments are contributing to sustained GCC bottled water market growth, feeding into the region’s focus on wellness, sustainability, and long-term hydration awareness.

How Vision 2030 is Transforming the GCC Bottled Water Industry:

The GCC’s long-term national transformation agendas—particularly Saudi Arabia’s Vision 2030 and the UAE’s sustainability frameworks—are accelerating innovation and modernization within the bottled water industry. These policies aim to reduce dependency on imports, enhance local manufacturing, and introduce advanced production technologies. According to reports, in July 2025, Naqi Water signed a €8.53 million deal to install a new water-bottling production line in Riyadh — a clear push to scale up domestic output in line with national industrialization goals. As part of broader food and beverage diversification efforts, governments are encouraging companies to adopt resource-efficient operations, water purification technologies, and sustainable packaging systems. This shift is enabling the sector to align with circular economy goals while boosting the GCC bottled water market share for domestic producers. Additionally, Vision 2030 emphasizes improved supply chain capabilities, increased private-sector participation, and enhanced quality control, all of which are transforming the bottled water landscape into a progressive, innovation-driven industry.

Explore in-depth findings for this market, Request Sample

Key Industry Trends:

Rising Demand for Packaged Drinking Water Due to Health and Hygiene Awareness

Increasing health-consciousness among consumers is significantly reshaping the GCC bottled water market trends, with packaged drinking water becoming the preferred hydration option. As residents prioritize safe and clean water, bottled water has transitioned from a convenience product into a daily essential. Growing concerns around water contamination, coupled with the desire for hygienically processed beverages, are leading consumers to rely more heavily on packaged water over unfiltered alternatives. For instance, in April 2024, Nova Water became the first Saudi brand to launch a bottle made from 100% recycled plastic — reflecting a push not only for safety but also sustainability in wellness-driven hydration. This trend is particularly evident among working professionals, parents, athletes, and individuals seeking balanced and consistent hydration routines. As a result, bottled water brands continue to see rising visibility, trust, and sustained inclusion in everyday consumption habits, ultimately fueling GCC bottled water market growth.

Growth of Premium, Alkaline, and Mineral-Enriched Water Segments

One of the most dynamic shifts reshaping the GCC bottled water market demand is the surge in consumer preference for premium hydration products. Premium, alkaline, and mineral-enriched water options are gaining traction as consumers look for added health benefits beyond basic hydration. Alkaline water is increasingly perceived as beneficial for balancing body pH levels, while mineral-rich varieties appeal to individuals interested in enhanced nutrient intake. These segments also align well with the region’s luxury-oriented consumer mindset, where product quality, purity, and brand positioning play integral roles in purchasing decisions. As the market expands, more brands are emerging with specialized formulations, luxury packaging, and exclusive distribution partnerships, further reinforcing the premiumization trend across the region.

Adoption of Eco-Friendly and Recyclable PET Packaging Solutions

Sustainability has become a defining component of the modern beverage industry and is now a critical element of the GCC bottled water market trends. With governments promoting circular economy models and consumers showing stronger ecological awareness, companies are exploring greener alternatives to traditional packaging. Recyclable PET bottles, biodegradable materials, and lightweight packaging formats are increasingly being adopted to reduce environmental impact. Many brands are also integrating refill programs, recycled plastics, and eco-friendly labelling practices to align with global sustainability standards. This shift toward environmentally responsible packaging is not only aiding in the reduction of plastic waste but also enhancing brand credibility and consumer trust among eco-conscious buyers.

Expansion of On-the-Go Consumption and Travel Retail Channels

Modern lifestyles and mobility patterns are significantly influencing bottled water consumption behavior in the GCC. The increasing pace of urban life, combined with busy work schedules and high travel frequency, is driving the need for convenient hydration options. On-the-go bottles, smaller pack sizes, and durable packaging formats are becoming increasingly popular as consumers seek products that can support rapid, active, and mobile routines. In fact, in September 2024, Emirati brand Ma Hawa launched “water-from-air” bottled solutions that are now available at 10 premium ADNOC petrol-station outlets and Union Coop stores — making sustainable, portable hydration easier for commuters and travelers. Additionally, travel retail channels—including airports, metro stations, convenience stores, and tourism hubs—are playing a vital role in shaping GCC bottled water market demand. As tourism and business travel continue to flourish across the region, bottled water remains a primary beverage choice for visitors, further boosting the presence of both regional and global brands.

Strengthening Market Presence of Local and International Bottled Water Brands

The GCC bottled water landscape is characterized by intense competition between locally established brands and globally recognized players. Local companies benefit from deep market understanding, strong distribution networks, and competitive pricing strategies, which help them secure substantial portions of the GCC bottled water market share. Meanwhile, international brands continue to appeal to premium and expatriate consumers through high-end offerings, mineral-rich compositions, and distinctive brand identities. This combination of domestic and global participation fosters a dynamic market environment, encouraging product innovation, marketing diversification, and continuous improvement in packaging, quality, and water sourcing methods.

Market Segmentation & Regional Insights:

The GCC bottled water market size spans a diverse consumer base and is segmented by water type, packaging format, distribution channel, and country-wise demand patterns. Still water remains the most popular category, as it caters to daily hydration needs and offers a wide availability across retail shelves. Sparkling and flavored variants are gaining traction among younger consumers and those seeking refreshing alternatives to sugary or carbonated drinks.

Packaging preferences vary widely, with PET bottles dominating due to their convenience, affordability, and extensive distribution networks. However, glass bottles and advanced eco-friendly materials are gaining interest in premium consumer segments. Distribution is spread across supermarkets, hypermarkets, convenience stores, online sales platforms, HoReCa establishments, and travel retail locations, each contributing differently to the overall GCC bottled water market demand.

Regionally, the market demonstrates variations based on lifestyle patterns, climate conditions, tourism activity, and purchasing power. Countries like the UAE and Saudi Arabia exhibit diverse consumption behaviors and strong product availability, owing to advanced retail ecosystems and high brand competitiveness. Meanwhile, countries with growing expatriate populations and expanding tourism sectors exhibit rising interest in both daily hydration and premium water choices, strengthening overall GCC bottled water market growth.

Forecast (2025–2033):

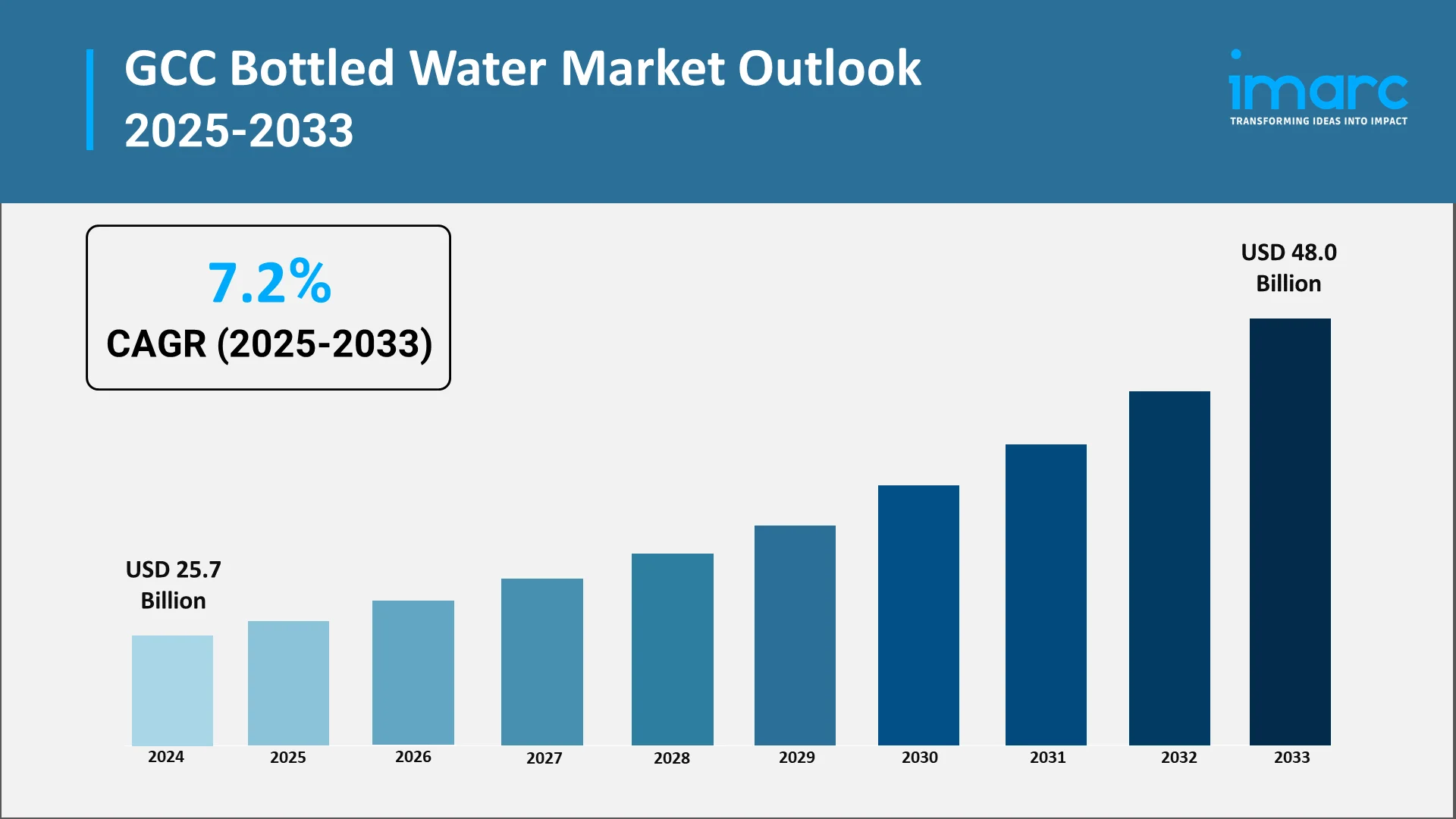

The GCC bottled water market trends over the forecast period indicate continued expansion, shaped by a blend of lifestyle-driven consumption habits, evolving wellness preferences, and incremental enhancements in product offerings. The GCC bottled water market size reached USD 25.7 Billion in 2024, and looking forward, the market is expected to reach USD 48.0 Billion by 2033, exhibiting a strong CAGR of 7.2% during 2025-2033. This robust outlook underscores sustainable growth, supported by consumers’ rising focus on hydration quality, safety, and convenience.

Key demand drivers over the next decade include:

- Shift Toward Health-Conscious Hydration

Residents are becoming more proactive about their hydration habits, seeking purified, mineralized, and functional water products that support daily wellness goals.

- Rising Tourism and Expat Population

A growing influx of tourists and expatriates ensures consistent demand for bottled water across hotels, restaurants, airports, and retail outlets.

- Hot Climate and Year-Round Hydration Needs

The region’s high temperatures and prolonged summer seasons naturally elevate bottled water consumption throughout the year, reinforcing its necessity.

- Expansion of HoReCa and Retail Distribution Networks

Hotels, cafés, and restaurants remain major contributors to the GCC bottled water market demand, while retail expansion across urban and suburban areas further enriches product accessibility.

Overall, the forecast points toward continued GCC bottled water market growth, supported by innovation-driven packaging solutions, strong marketing strategies, and brand diversification across the region.

Conclusion:

The GCC bottled water industry is witnessing a significant transformation fueled by rising health awareness, evolving consumer preferences, and the growing prominence of premium hydration products. As sustainability efforts gain traction and travel-driven consumption increases, both local and global brands are strengthening their market presence. Collectively, these factors are shaping the future of the GCC bottled water market size, influencing the competitive environment and encouraging continued innovation in water sourcing, purification, and packaging. The sector is poised for sustained expansion, with the GCC bottled water market share expected to remain dynamic and competitive amid shifting preferences and higher wellness standards.

As consumers continue to seek purity, convenience, and premium hydration experiences, the GCC bottled water market trends will revolve around innovation, sustainability, and elevated lifestyle expectations. For businesses, investors, and stakeholders seeking a strategic understanding of the industry’s evolving landscape, exploring a detailed market analysis can offer valuable insights and direction.

To dive deeper into segment-level trends, competitive positioning, and long-term growth opportunities, you can explore or purchase IMARC Group’s full report.

Why IMARC Is Your Ideal Research Partner for the GCC Bottled Water Industry:

IMARC Group stands as one of the world’s leading consulting and market research firms, offering comprehensive insights tailored to dynamic industries such as bottled water, beverages, and fast-moving consumer goods. Our methodologies are built on accuracy, strategic foresight, and deep industry expertise, ensuring that businesses make informed, future-ready decisions.

- Data-Driven Market Research: We deliver rigorously curated market assessments, helping clients understand evolving consumer behavior, category segmentation, and competitive scenarios.

- Strategic Growth Forecasting: Our team provides forward-looking analysis to support long-term planning, investment decisions, and market-entry strategies.

- Competitive Benchmarking: IMARC’s benchmarking tools help businesses assess their position relative to key competitors and identify opportunities for differentiation.

- Policy and Infrastructure Advisory: We support clients in navigating regulatory frameworks, sustainability mandates, and infrastructure requirements across GCC countries.

- Custom Reports and Consulting: From product development insights to country-specific strategy building, our tailored services address unique business challenges and growth objectives.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)