How India’s Pet Food Sector is Changing

Introduction:

India’s pet sector has experienced a remarkable transformation, driven by urbanization, evolving lifestyles, and a stronger emotional bond between people and their companion animals. What was once a niche trend among a few urban families has now become a widespread practice across Indian households, where pets are regarded as integral members of the family. This shift has fueled the growth of the India pet food market, defined by greater product diversity, premium formulations, and expanding retail accessibility. In May 2025, Nestlé S.A. reinforced this momentum by acquiring a minority stake in Drools Pet Food Private Limited, underscoring the growing investor confidence and international interest in India’s thriving pet nutrition segment. This evolution signifies not just the modernization of consumer behavior but also India’s transition toward a more structured, health-conscious, and premium pet care ecosystem.

Rising disposable incomes, exposure to global pet care standards, and growing awareness of animal welfare have further strengthened the demand for specialized and nutritionally balanced pet food. Pet owners increasingly favor scientifically developed diets that ensure both taste and optimal health benefits over traditional home-prepared meals. This change in consumption habits has encouraged innovation across product categories and fostered the expansion of organized retail networks, e-commerce platforms, and supply chains. As a result, the Indian pet food industry continues to evolve rapidly, reflecting a broader cultural and economic shift toward responsible and well-informed pet ownership.

How Big Is the Pet Food Market in India?

The pet food market in India has evolved from a niche category into one of the most promising segments within the broader consumer goods landscape. The market’s expansion reflects a confluence of macroeconomic and social factors, including a burgeoning middle class, greater pet adoption rates, and an influx of global pet care brands. Pet ownership is particularly concentrated in metropolitan areas such as Delhi, Mumbai, Bengaluru, and Hyderabad, where rising urban isolation and nuclear family structures have contributed to higher adoption of companion animals.

Moreover, increased exposure to international pet care trends through digital platforms and veterinary education has made Indian consumers more aware of dietary needs across species and breeds. As per sources, In March 2025, Paws For Greens launched a vegan, cruelty-free pet food line made with human-grade, plant-based ingredients to provide ethical and nutritious options for health-conscious pet owners. Moreover, the transition from table scraps and leftovers to commercially formulated food represents a major cultural shift. Product segmentation has grown extensive, encompassing dry, wet, semi-moist, and treat categories for both dogs and cats. Retail diversification has also accelerated, with e-commerce platforms, veterinary clinics, and pet specialty stores becoming primary sales channels.

While the sector’s potential is immense, sustained growth depends on continued awareness and affordability. Manufacturers are addressing this by launching value-based formulations and smaller pack sizes to appeal to a wider demographic. In September 2024, Growel Group entered India’s pet food market with the launch of its premium yet affordable brand Carniwel, designed to meet evolving nutritional needs of dogs and cats. Collectively, these developments underscore the potential for India to become one of the fastest-growing pet food markets in Asia.

India Pet Food Market Size & Share Analysis:

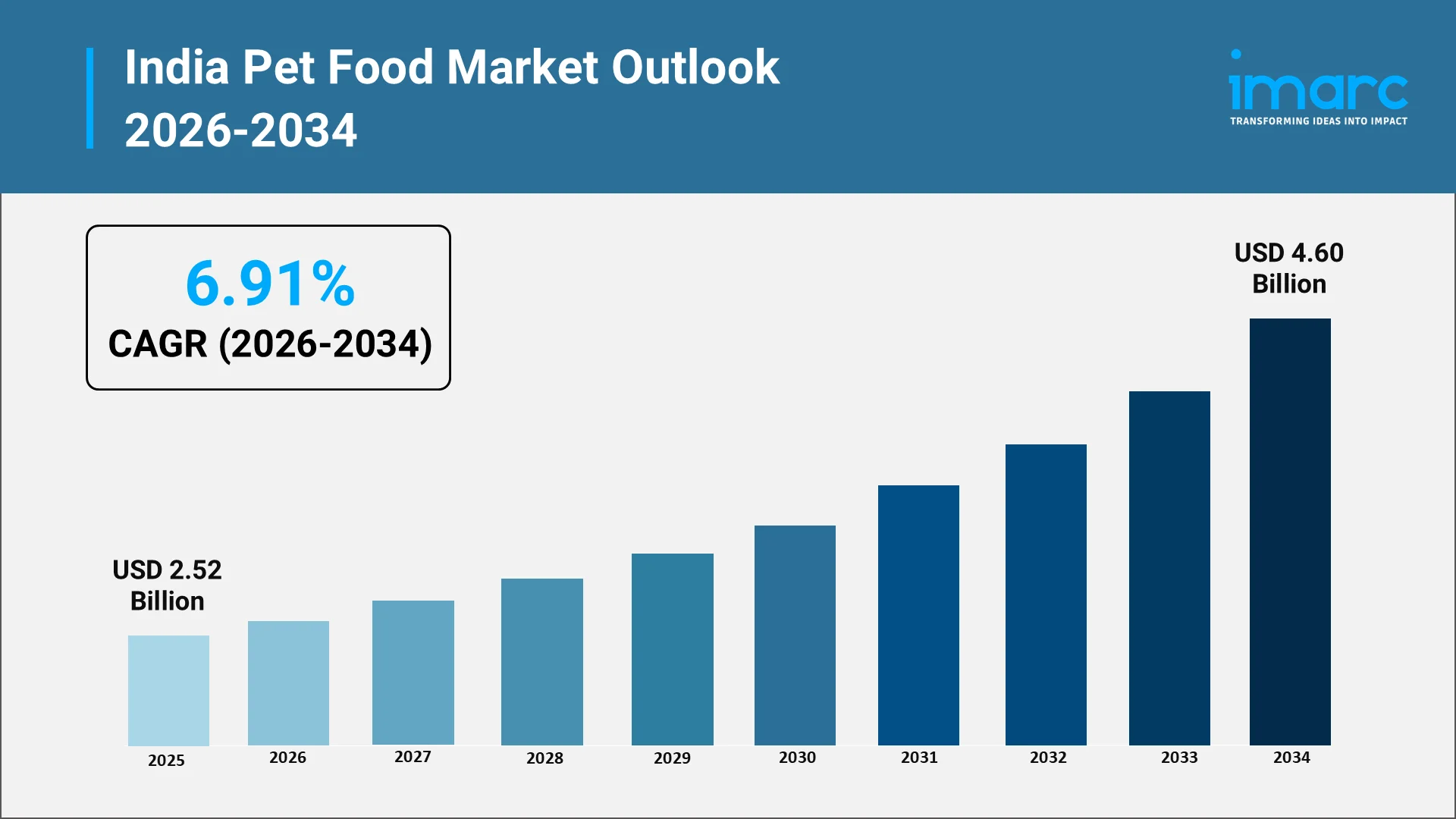

The India pet food market size reflects the industry’s progressive expansion driven by economic development, evolving consumer demographics, and the formalization of the pet care value chain. As per sources, The India pet food market size was valued at USD 2.52 Billion in 2025. The market is projected to reach USD 4.60 Billion by 2034, exhibiting a CAGR of 6.91% from 2026-2034. Moreover, domestic manufacturers and international players alike are investing heavily in capacity expansion, nutritional research, and local sourcing to meet rising demand. The country’s growing middle-income population, coupled with enhanced purchasing power, supports consistent spending on high-quality nutrition and pet wellness.

A significant aspect of growth lies in the rising focus on premium and functional food categories. Urban consumers, particularly millennials, prefer products fortified with vitamins, probiotics, and natural ingredients. They view nutrition as an extension of personal health values, often mirroring human dietary preferences such as grain-free, protein-rich, and organic formulations. Consequently, premium brands are registering faster growth than mass-market alternatives.

The India pet food market share is also shaped by regional diversity. North and South India dominate consumption due to higher urbanization and pet adoption rates. However, Tier II and Tier III cities are emerging as new growth zones as affordability improves and awareness campaigns penetrate smaller urban clusters. Retail innovation, including online subscription models and doorstep delivery services, further enhances accessibility. As a result, both organized and unorganized players are intensifying competition through pricing strategies, brand differentiation, and marketing campaigns that highlight trust and transparency.

The steady influx of investments in production facilities, logistics optimization, and product standardization ensures that India’s pet food market remains structurally sound and capable of long-term expansion.

Explore in-depth findings for this market, Request Sample

Key Growth Drivers & Trends in the Indian Pet Food Industry:

- Rising Pet Ownership and Changing Lifestyles

The Indian pet food industry is directly influenced by shifting lifestyle patterns. Urbanization, longer working hours, and smaller households have encouraged companionship through pets, primarily dogs and cats. Millennials, in particular, are driving this shift as they associate pet ownership with emotional well-being and stress relief. Increased pet adoption from shelters and rescue organizations further strengthens this trend, contributing to consistent market demand.

- Humanization of Pets and Nutritional Awareness

Pet owners increasingly view their animals as integral family members, leading to heightened attention toward their diet and overall health. The market now emphasizes nutritionally balanced and age-specific formulations, developed with veterinary guidance. Owners are demanding clean-label products free from artificial preservatives and fillers. This shift is also reflected in the India Organic and Natural Pet Food Market, where demand for premium, chemical-free, and health-focused products is rising steadily. This preference aligns with the global “pet humanization” trend, where premium, functional, and natural foods are replacing traditional feeding practices.

- Expanding Retail Ecosystem and E-Commerce Penetration

Digital transformation has revolutionized the pet care landscape. Online platforms offer extensive product variety, competitive pricing, and doorstep delivery, appealing to the tech-savvy consumer base. Simultaneously, offline specialty stores and veterinary clinics are evolving into experiential centers that educate consumers on nutrition, grooming, and healthcare. This integrated retail environment ensures that quality pet food reaches a broader audience across urban and semi-urban areas.

- Local Manufacturing and Supply Chain Formalization

Historically, India’s pet food segment depended heavily on imports. However, policy reforms, investment incentives, and growing domestic expertise have spurred local manufacturing. Companies are sourcing ingredients locally, ensuring freshness, traceability, and cost efficiency. This shift not only reduces dependence on foreign supply chains but also strengthens India’s competitiveness in regional export markets. In April 2025, Nutrition Nxt launched its ‘Parent’ pet food line with an investment of around USD 10 million to establish a state-of-the-art manufacturing facility in Wargal, Telangana, underscoring the sector’s progress toward self-reliance and advanced production capabilities.

- Diversification into Species-Specific and Functional Foods

The cat food market and the dog food market in India are expanding beyond generic formulations. As per sources, Avanti Pet Care, a subsidiary of Avanti Feeds, launched its Avant Furst dog food range in New Delhi, marking its entry into the dog food industry in collaboration with Thailand’s Bluefalo Group. Furthermore, product innovation now caters to breed-specific, age-specific, and dietary-specific requirements such as hypoallergenic, digestive care, and weight management. Functional foods infused with Omega-3, antioxidants, and probiotics are gaining momentum. Such diversification reflects the maturing consumer understanding of preventive pet healthcare and tailored nutrition.

- Influence of Veterinary Professionals and Social Media

Veterinarians play an instrumental role in shaping purchase decisions, particularly among first-time pet owners. Nutritional recommendations from trusted professionals enhance consumer confidence in branded food products. Additionally, digital media and pet influencer communities amplify brand visibility and educate audiences about responsible feeding habits. In June 2025, BLEP launched its nationwide #NeverAgain digital campaign to raise awareness about pet nutrition issues in India, promoting ingredient transparency and informed feeding choices among pet owners through social media engagement. This convergence of expert guidance and online advocacy strengthens the credibility and reach of the pet food ecosystem.

Is Dog Food Business Profitable in India?

The dog food market in India presents compelling prospects for both established brands and new entrants. Profitability is supported by expanding consumer bases, rising premiumization, and the normalization of commercial pet diets. Dogs remain the most popular pets in Indian households, representing a significant share of total pet ownership. This dominance ensures steady product demand across dry, wet, and treat categories.

Economies of scale are achievable through localized manufacturing and distribution, which reduce import costs and retail prices. Furthermore, the market offers diversified opportunities for small-scale entrepreneurs and regional brands to serve niche segments such as organic treats or breed-specific diets. The integration of digital marketing and e-commerce enables direct-to-consumer models, lowering operational expenses and enhancing margins.

However, profitability depends on consistent quality, brand trust, and competitive pricing. Companies investing in veterinary collaborations, nutritional transparency, and consumer education are likely to maintain stronger brand equity. Given the sustained rise in pet adoption and income growth, the dog food business in India remains both viable and scalable in the long term.

Relationship Between Pet Food and Broader Animal Nutrition:

The expansion of the India animal feed market complements developments in the pet food sector. Both industries benefit from shared advances in ingredient processing, nutritional formulation, and safety regulation. India’s extensive agricultural base provides a rich supply of grains, proteins, and additives essential for feed production. This synergy supports local manufacturing capacity and enhances overall supply chain resilience.

Moreover, cross-sectoral collaboration between livestock feed producers and pet food manufacturers encourages innovation in processing technologies and quality control systems. Such integration strengthens domestic expertise in balanced nutrition, enabling India to serve not only the domestic market but also export-oriented pet food opportunities across Asia and the Middle East.

Future Outlook: What’s Next for the India Pet Food Market?

The India pet food market is set for strong and sustained growth over the coming decade as social, economic, and cultural factors align to create lasting demand. Market penetration will expand beyond large metropolitan areas into smaller cities and semi-rural regions, driven by rising incomes and better access to organized retail. New consumers are entering the formal pet food space as awareness of nutrition, hygiene, and convenience continues to increase. Product innovation will further accelerate this growth, with greater focus on health-based, customized, and environmentally responsible formulations. Ingredients derived from plant proteins and alternative animal sources are gaining attention as pet owners increasingly adopt sustainable and ethical choices for their companion animals.

Digital transformation will continue to shape the evolution of the pet care landscape. E-commerce platforms, subscription-based services, and social media engagement will play central roles in brand visibility and consumer loyalty. Companies that use data-driven personalization and consumer insights are expected to maintain a competitive edge. Regulatory alignment with global quality standards will enhance transparency and trust, helping local producers compete in both domestic and international markets. The relationship between pet food and wider pet care services such as grooming, veterinary health, and insurance will strengthen further. This integrated ecosystem will create new opportunities in packaging, logistics, and nutritional supplements. In essence, the pet food market in India reflects a deeper societal transition toward informed and responsible pet ownership. With innovation, regulation, and consumer sophistication evolving together, the sector is positioned to become one of the most dynamic and influential segments within India’s broader consumer goods industry, offering significant growth potential across multiple value chains.

Choose IMARC Group - Your Trusted Partner for Pet Industry Intelligence:

At IMARC Group, we provide unmatched expertise in analyzing the evolving India pet food market and the broader animal nutrition ecosystem. Our in-depth research empowers businesses to make data-backed decisions, explore emerging opportunities, and gain a competitive edge in the Indian pet food industry. Whether entering new segments or scaling operations, we deliver the insights needed to thrive in the dynamic pet food market in India.

- Data-Driven Market Research: Access comprehensive analyses on pet ownership patterns, evolving nutritional preferences, and growth trends in the dog food and cat food categories.

- Strategic Growth Forecasting: Anticipate market shifts driven by consumer lifestyles, technological integration, and regional expansion within the India pet food market.

- Competitive Benchmarking: Gain clarity on market positioning through evaluation of product portfolios, distribution models, and brand strategies influencing the India pet food market share.

- Policy and Supply Chain Advisory: Stay informed on regulatory developments, quality standards, and logistics frameworks shaping the India animal feed market and pet nutrition ecosystem.

- Custom Reports and Consulting: Obtain tailored intelligence for product innovation, market entry, and investment strategy within the India pet food market size and its key subsegments.

At IMARC Group, our mission is to equip industry leaders with actionable intelligence, enabling them to capture sustainable growth in India’s fast-evolving pet care industry.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)