Top Factors Driving Growth in the GCC Ceramic Tiles Market

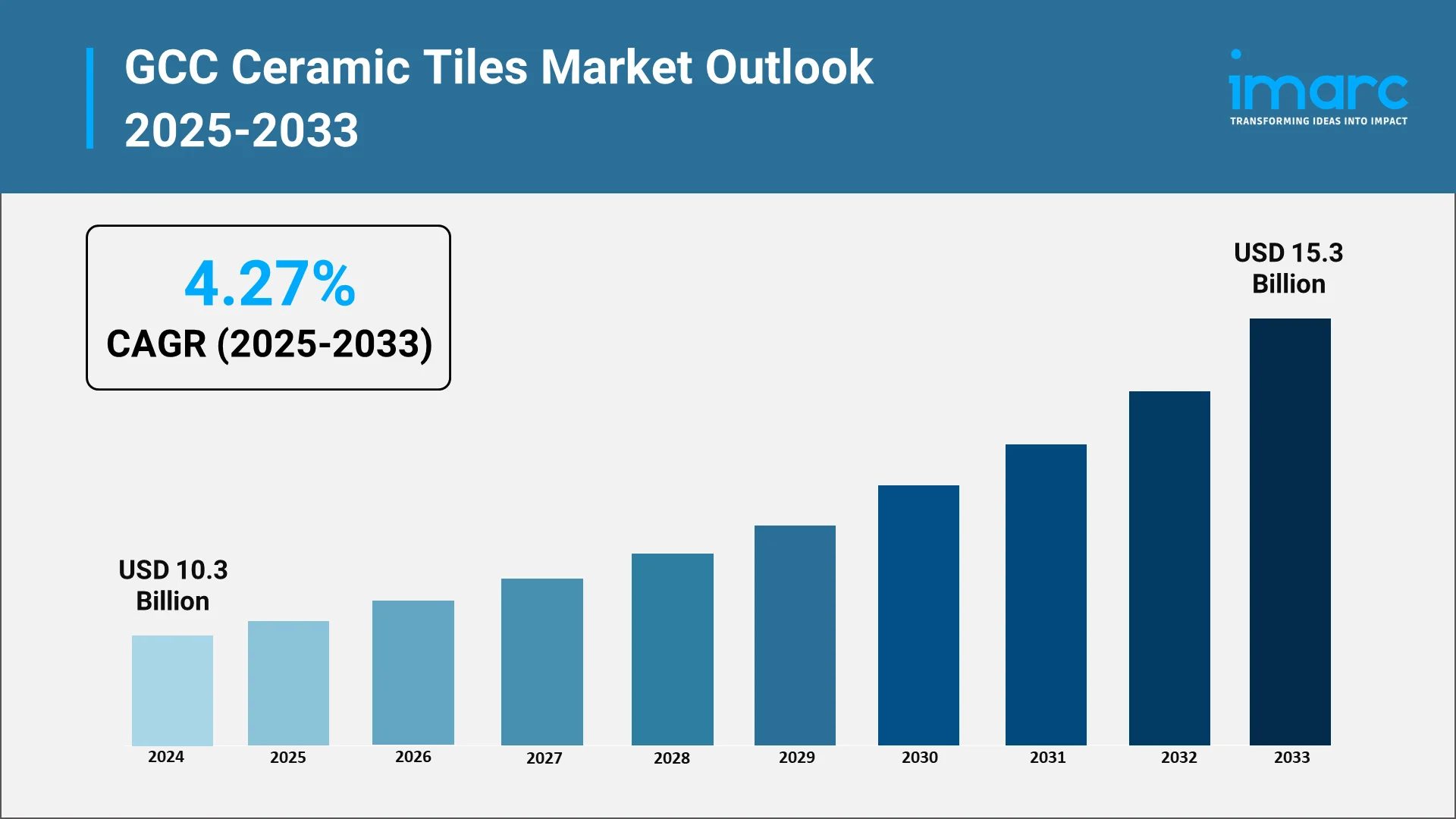

The GCC ceramic tiles market has emerged as one of the most dynamic segments in the region's construction and building materials sector. Spanning countries including United Arab Emirates, Saudi Arabia, Kuwait, Oman, Qatar, and Bahrain, the market reflects the Gulf region's ambitious transformation from oil-dependent economies to diversified, modern nations. The GCC ceramic tiles market size reached USD 10.3 Billion in 2024. Looking forward, the IMARC Group expects the market to reach USD 15.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.27% during 2025-2033.

Throughout the GCC, ceramic tiles are crucial parts of construction projects for homes, businesses, and industries. They are essential for floors, walls, facades, and decorative applications due to their adaptability, strength, and visual appeal. Policymakers, investors, and industry players must comprehend the major forces driving market expansion as the region continues its rapid development trajectory.

This comprehensive analysis examines the multifaceted factors contributing to the robust growth of the GCC ceramic tiles industry. From massive infrastructure projects to evolving consumer preferences, from technological innovations to sustainability initiatives, these growth drivers collectively shape the market's impressive expansion and future potential.

Explore in-depth findings for this market, Request Sample

Key Growth Drivers in the GCC Ceramic Tiles Market:

Unprecedented Construction Boom and Infrastructure Development

There are no indications that the remarkable construction boom in the GCC region will slow down. The region's governments are making significant investments in innovative infrastructure initiatives that improve connectivity and modify urban environments. Massive amounts of building materials are needed for these enormous projects, and ceramic tiles are essential for both practical and decorative uses.

Major initiatives like that of Saudi Arabia's Vision 2030, UAE's economic diversification plans, and Qatar's National Vision have catalyzed unprecedented construction activity. These strategic frameworks emphasize infrastructure modernization, smart city development, and enhanced quality of life for residents. The ambitious scope of these projects translates directly into sustained demand for high-quality ceramic tiles across multiple sectors.

One particularly important growth driver is transportation infrastructure. Extensive tiling solutions that blend durability and aesthetic appeal are needed for harbor constructions, airport expansions, metro systems, and railway networks. These high-traffic areas require ceramic tiles that can endure continuous use without losing their aesthetic appeal or structural integrity over time.

Real Estate Sector Expansion and Housing Demand

The GCC real estate sector continues its upward trajectory, driven by population growth, urbanization, and evolving lifestyle preferences. Both residential and commercial real estate segments contribute significantly to ceramic tile consumption. Government initiatives promoting homeownership, coupled with attractive mortgage financing options, have stimulated demand for quality housing units that prominently feature ceramic tile installations.

Luxury residential developments have proliferated across GCC capitals and major cities. These upscale projects cater to affluent local populations and expatriate communities seeking premium living spaces. High-end ceramic tiles featuring innovative designs, imported materials, and sophisticated finishes have become hallmarks of these exclusive developments, driving demand for premium product categories.

The expansion of the market has also been aided by the development of commercial real estate. Large-scale ceramic tile installations are necessary for lobbies, common areas, restrooms, and external facades of office towers, shopping centers, retail complexes, and mixed-use developments. The significance of carefully chosen ceramic tile products has increased due to the focus on designing unique, memorable locations that improve brand identification and customer experience.

Tourism and Hospitality Sector Growth:

The GCC's strategic pivot toward tourism as an economic pillar has generated substantial demand for ceramic tiles. Countries throughout the region are developing world-class hospitality infrastructure to attract international visitors and establish themselves as premier tourist destinations. This sector transformation requires countless hotels, resorts, entertainment venues, and cultural attractions—all significant consumers of ceramic tile products.

Luxury hotel development has accelerated dramatically. International hospitality brands continue expanding their presence across the GCC, bringing with them exacting standards for interior finishes and materials. Ceramic tiles must meet rigorous specifications for durability, hygiene, ease of maintenance, and aesthetic sophistication. The hospitality sector's emphasis on creating immersive, memorable guest experiences has made premium ceramic tiles indispensable.

Theme parks, museums, cultural centers, and entertainment complexes further amplify demand. These facilities require specialized ceramic tile solutions that can withstand heavy foot traffic while contributing to distinctive design narratives. The region's ambition to host major international events and establish itself as a global entertainment hub ensures continued growth in this market segment.

Rapid Urbanization and Population Expansion:

Urban population growth across the GCC region represents a fundamental driver of ceramic tile demand. Cities throughout the Gulf continue expanding both vertically and horizontally to accommodate increasing populations. This urban expansion necessitates comprehensive building materials supply chains capable of meeting sustained high-volume demand.

The region's demographic profile contributes to market dynamism. Young, growing populations with rising disposable incomes drive demand for modern housing and contemporary living spaces. These demographic trends translate into preferences for quality ceramic tile products that offer both functional performance and design versatility.

Smart city initiatives across the GCC are reshaping urban development paradigms. These forward-thinking projects emphasize sustainability, connectivity, and quality of life. Ceramic tiles play crucial roles in these developments, particularly products that incorporate innovative features like enhanced thermal properties, easy maintenance characteristics, and integration with smart building systems.

Evolving Design Trends and Aesthetic Preferences:

Consumer preferences for contemporary interior design have transformed the ceramic tiles market landscape. GCC consumers increasingly seek products that combine traditional regional aesthetics with modern design sensibilities. This cultural fusion creates demand for diverse tile collections that can satisfy varying tastes while maintaining high quality standards.

Large-format tiles have gained remarkable popularity throughout the region. These oversized products create seamless, expansive surfaces that enhance spatial perception and deliver a minimalist aesthetic. Their reduced grout lines simplify maintenance while providing a sophisticated, contemporary appearance highly valued in modern architecture.

Digital printing technologies have revolutionized ceramic tile aesthetics. Manufacturers now produce tiles that convincingly replicate natural materials like marble, wood, concrete, and stone. These realistic surface textures and patterns allow designers and homeowners to achieve desired visual effects without the cost, maintenance requirements, or environmental concerns associated with natural materials.

Sustainability Imperatives and Green Building Adoption:

Environmental sustainability has emerged as a critical consideration in GCC construction practices. Governments throughout the region have introduced green building standards and environmental regulations that influence material selection decisions. Ceramic tiles align well with these sustainability objectives due to their natural composition, durability, and recyclability.

LEED certification and other green building rating systems have gained traction across the GCC. These frameworks incentivize the use of environmentally responsible materials that contribute to energy efficiency and occupant health. Ceramic tiles can help projects earn certification points through their low VOC emissions, thermal mass properties, and long lifecycle performance.

Energy efficiency considerations particularly favor ceramic tiles in the GCC's extreme climate. Their thermal mass properties help moderate interior temperatures, reducing cooling loads and energy consumption. Cool roof tiles with reflective surfaces further contribute to building energy performance, addressing both environmental concerns and operational cost considerations.

Technological Innovations in Tile Manufacturing:

Manufacturing technology advancements have fundamentally transformed the ceramic tiles industry. Digital inkjet printing enables unprecedented design flexibility, allowing manufacturers to create intricate patterns, realistic textures, and customized designs that were previously impossible or prohibitively expensive to produce.

Nanotechnology applications have introduced enhanced tile properties that address specific market demands. Anti-bacterial surfaces, self-cleaning coatings, and stain-resistant treatments provide practical benefits highly valued in healthcare, hospitality, and residential applications. These technological enhancements differentiate premium products and justify higher price points.

Porcelain tile technology has achieved remarkable sophistication. Through-body porcelain extends design patterns throughout the tile thickness, ensuring consistent appearance even with surface wear. Enhanced densification processes create products with superior strength, frost resistance, and low water absorption rates suitable for diverse applications including exterior facades and harsh environments.

Economic Diversification and Industrial Development:

GCC governments' commitment to economic diversification has stimulated manufacturing sector growth, including local ceramic tile production. Strategic initiatives encourage domestic manufacturing capabilities to reduce import dependence and create employment opportunities. This policy environment has attracted international tile manufacturers to establish production facilities within the region.

Industrial clusters and free zones provide attractive conditions for ceramic tile manufacturing investments. These designated areas offer infrastructure, logistics advantages, and regulatory incentives that enhance operational efficiency. Growing local production capacity improves supply chain reliability while supporting regional economic objectives.

Trade agreements and regional cooperation frameworks facilitate ceramic tile commerce throughout the GCC. Standardization initiatives and mutual recognition of quality certifications streamline cross-border trade. These developments strengthen the region's position as both a major consumer and emerging producer of ceramic tile products.

Renovation, Retrofitting, and Replacement Markets:

Beyond new construction, the renovation and replacement market represents a substantial growth opportunity. As buildings age throughout the GCC, property owners increasingly undertake renovation projects to maintain competitiveness, update aesthetics, or adapt spaces for new functions. These activities generate consistent ceramic tile demand independent of new construction cycles.

Heritage building restoration and adaptive reuse projects require specialized ceramic tile solutions that respect historical authenticity while meeting contemporary performance standards. These projects blend traditional craftsmanship with modern manufacturing capabilities, creating niche market segments for artisanal and custom tile products.

Retail and hospitality sectors exhibit particularly strong renovation demand. Businesses regularly update facilities to maintain brand relevance and customer appeal. Fashion trends, branding evolution, and competitive pressures drive periodic refreshments that consistently require ceramic tile replacements and installations.

Government Policies and Regulatory Support:

Government housing programs throughout the GCC directly stimulate ceramic tile demand. Initiatives providing affordable housing to nationals create substantial market volume through standardized specifications and bulk procurement. These programs ensure baseline demand levels while encouraging local manufacturing capacity development.

Building codes and quality standards influence product specifications and drive quality improvements. Regulatory frameworks establishing minimum performance criteria for safety, durability, and environmental impact elevate overall market standards. Compliance requirements favor established manufacturers with quality assurance systems while protecting consumers from substandard products.

Public sector construction projects provide predictable demand anchors for the ceramic tiles market. Government investments in schools, hospitals, administrative facilities, and public spaces generate substantial material requirements. These projects often incorporate specifications favoring domestic production, supporting local industry development objectives.

Looking Ahead: Sustained Growth Trajectory:

The confluence of these diverse growth drivers positions the GCC ceramic tiles market for continued robust expansion. The region's transformation ambitions, demographic dynamics, and evolving consumer preferences create a favorable environment for sustained market development. Industry stakeholders who understand and adapt to these driving forces will be well-positioned to capitalize on emerging opportunities.

Market success will increasingly depend on innovation capabilities, sustainability credentials, and alignment with regional development priorities. Manufacturers offering products that combine aesthetic excellence with environmental responsibility and technological sophistication will command premium positions. The market's evolution toward value-added segments presents opportunities for differentiation and margin enhancement.

As the GCC continues its remarkable transformation journey, the ceramic tiles industry stands as both beneficiary and enabler of regional development aspirations. The sector's growth trajectory reflects broader economic, social, and environmental trends reshaping the Gulf region. Understanding these interconnected dynamics becomes essential for effective strategic planning and investment decision-making.

Choose IMARC Group for Comprehensive Market Intelligence:

- Data-Driven Market Research: Access in-depth analysis of the GCC ceramic tiles market including production trends, consumption patterns, import-export dynamics, and technology adoption through comprehensive research reports.

- Strategic Growth Forecasting: Anticipate emerging market opportunities in design innovation, smart materials, and sustainability-driven product development across GCC markets.

- Competitive Benchmarking: Monitor competitive market landscapes, manufacturing capabilities, and strategic positioning of key market players.

- Policy and Infrastructure Advisory: Navigate complex regulatory frameworks, building standards, and government procurement requirements affecting market access.

- Custom Reports and Consulting: Receive tailored insights supporting market entry strategies, capacity expansion, distribution strategy, or investment evaluation.

At IMARC Group, we deliver actionable intelligence empowering construction industry leaders, manufacturers, distributors, and investors to make informed strategic decisions. Our expertise in the dynamic GCC ceramic tiles market ensures your organization stays ahead of industry trends and capitalizes on growth opportunities.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)