GCC Chocolate Market Trends: Navigating Consumer Preferences and Premium Product Growth

Introduction:

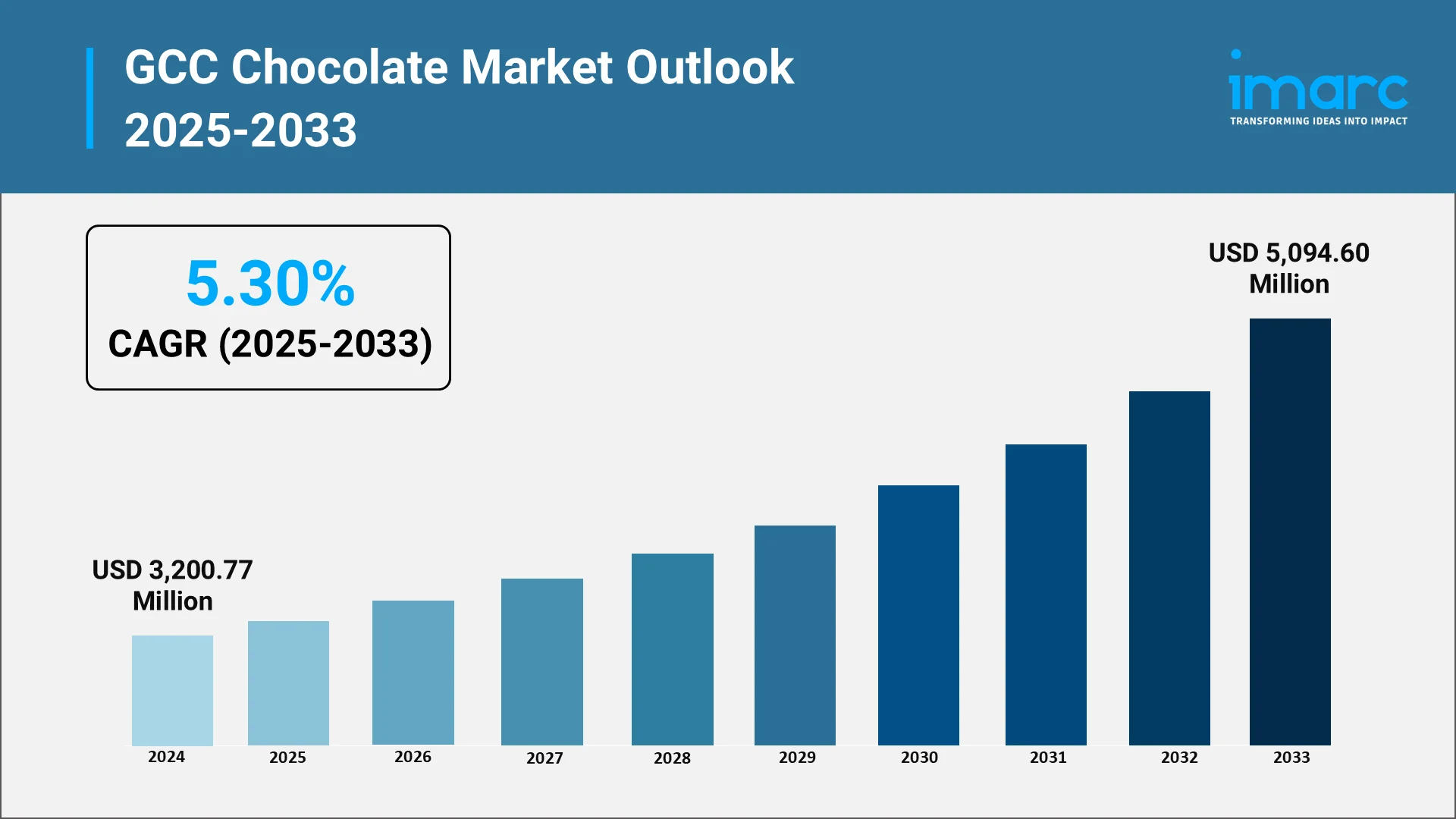

The GCC chocolate market has experienced robust expansion in recent years, driven by evolving consumer preferences, rising disposable incomes, and the proliferation of international brands. In 2024, the GCC chocolate market size reached USD 3,200.77 Million, reflecting sustained growth across premium, artisanal, and mass-market segments. The region’s diverse consumer base, composed of expatriates, tourists, and high-income local populations, has fueled demand for high-quality chocolate products. Rising premiumization, gifting culture, and the influence of global confectionery trends have further reinforced the sector’s development.

Retail modernization, including the expansion of hypermarkets, convenience stores, and travel retail outlets, has also played a critical role in shaping chocolate consumption across GCC nations. Additionally, the growing tourism industry, particularly in Saudi Arabia, the UAE, and Qatar, has introduced international chocolate brands to new audiences, amplifying market penetration.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming GCC Chocolate Industry:

Vision 2030 initiatives, particularly in Saudi Arabia and the UAE, are reshaping the GCC chocolate industry by fostering economic diversification, encouraging retail innovation, and stimulating tourism. Investments in infrastructure, entertainment, and hospitality sectors are driving footfall in shopping malls, duty-free outlets, and gourmet retail stores, thereby enhancing chocolate sales opportunities. Additionally, the regulatory environment supports foreign investment and brand expansion, allowing global confectionery players to introduce premium offerings in the region. These developments, combined with initiatives promoting local production and quality standards, are positioning the GCC chocolate market as a strategic hub for premium chocolate consumption and innovation.

Key Industry Trends:

- Growing Demand for Premium, Artisanal, and Dark Chocolate Varieties

Consumer preferences in the GCC are shifting toward premium and artisanal chocolate products, with higher acceptance of dark chocolate, single-origin cocoa, and small-batch manufacturing. Health-conscious and affluent buyers are willing to pay a premium for products that emphasize flavor complexity, ethical sourcing, and unique textures. Boutique brands, as well as global luxury players, are expanding their portfolios with dark chocolate bars, truffles, and limited-edition assortments to capture evolving taste preferences. Expansion of Duty-Free and Travel Retail Chocolate Sales

Duty-free stores, airport retail outlets, and travel-focused chocolate retailers have become pivotal channels for market growth. The GCC confectionery market benefits significantly from tourists and expatriates purchasing high-end chocolate brands, limited-edition collections, and gift sets. Travel retail also enables cross-border brand exposure, increasing brand recognition and loyalty among international visitors. In August 2025, Kreol Travel Retail launched Petit Gourmet’s Pistachio Kunafa Chocolate at Riyadh Duty Free, following a successful debut in Abu Dhabi. The exclusive 470g sharing bar blends Middle Eastern flavors and targets regional and international travelers, marking a new phase of local innovation in Saudi travel retail. Premium packaging, personalized offerings, and collaborative campaigns with luxury hotels or airlines have strengthened chocolate sales in these environments. As travel rebounds post-pandemic, strategic partnerships with airports and tourism operators are expected to sustain the expansion of duty-free chocolate consumption.

- Increasing Popularity of Health & Functional Chocolate Innovations

Functional and health-oriented chocolate products, including sugar-free, vitamin-fortified, high-protein, and antioxidant-rich offerings, are gaining traction among GCC consumers. In October 2025, Cavella Food announced its plans to launch its complete sugar-free chocolate and filling range at Gulfood Manufacturing 2025. The new lineup features real and compound chocolates along with unique fillings, including a sugar-free Kunafa. Rising awareness of nutrition, combined with lifestyle shifts favoring wellness, has prompted manufacturers to innovate and diversify product portfolios. Brands are integrating ingredients such as nuts, superfoods, and natural sweeteners to appeal to health-conscious consumers without compromising flavor quality.

- Rise of E-Commerce and Online Gifting Platforms in Chocolate Retail

The e-commerce landscape in the GCC is witnessing rapid growth, with online sales of confectionery and premium chocolate rising sharply. Consumers increasingly leverage online platforms for convenience, personalized gift packaging, and access to a wider selection of chocolate brands. Subscription models, holiday-specific promotions, and bundled offerings have further strengthened the penetration of e-commerce in the confectionery sector. Digital marketing strategies, social media campaigns, and influencer collaborations are driving consumer engagement and online purchases. This trend is expected to continue, contributing to sustained GCC chocolate market trends by enhancing accessibility and offering innovative purchasing experiences.

- Sustainability Shift: Ethical Cocoa Sourcing and Eco-Friendly Packaging

Sustainability considerations are influencing chocolate purchase decisions across the GCC, particularly among millennials and Gen Z consumers. Brands are adopting ethically sourced cocoa, transparent supply chains, and eco-friendly packaging solutions to meet rising consumer expectations. Environmental responsibility, coupled with premium quality and flavor differentiation, is increasingly shaping brand loyalty and driving repeat purchases. Companies investing in sustainable practices are also able to enter institutional and corporate gifting programs, reinforcing the relevance of eco-conscious chocolate in the GCC confectionery market.

Market Segmentation & Regional Insights:

Product Type Insights:

- White Chocolate: White chocolate is increasingly used in premium confectionery and gift assortments due to its creamy texture and visual appeal. It is popular for seasonal promotions, festive gifting, and specialty desserts.

- Milk Chocolate: Milk chocolate remains a staple across retail and gifting segments, appealing to broad consumer demographics. Its versatility in baking, confectionery, and packaged treats drives consistent demand.

- Dark Chocolate: Dark chocolate is experiencing growth due to rising health-conscious consumption and premiumization trends. Its high cocoa content, functional benefits, and sophisticated taste appeal to affluent and wellness-focused consumers.

Product Form Insights:

- Molded: Molded chocolate products, including bars and blocks, provide consistency, ease of packaging, and broad consumer acceptance. These forms allow for premium branding, seasonal themes, and customization opportunities. Manufacturers are leveraging molded formats to enhance visual appeal and cater to gifting, retail, and tourism-driven consumption in the GCC chocolate market.

- Countlines: Countline chocolates, such as individually wrapped sticks, mini bars, and multipacks, are popular for impulse buying and convenience consumption. They are widely distributed in hypermarkets, convenience stores, and travel retail. This format supports brand visibility, cross-promotion, and product sampling initiatives, aligning with GCC chocolate market trends.

Application Insights:

- Food Products: Food product applications, including bakery, confectionery, and desserts, continue to drive chocolate consumption. Incorporating chocolate into cakes, pastries, and candies enhances flavor, indulgence, and premium appeal. Manufacturers and foodservice providers are leveraging chocolate-based innovations to address evolving taste preferences in the GCC chocolate market.

- Beverages: Chocolate-based beverages, including hot chocolate, flavored milk, and specialty drinks, are gaining traction in cafes, restaurants, and retail-ready solutions. Beverage applications support brand extension and encourage cross-category consumption. They also offer opportunities for functional or health-focused formulations, aligning with consumer trends in the GCC chocolate market.

Pricing Insights:

- Everyday Chocolate: Everyday chocolate caters to routine consumption and price-sensitive buyers, offering smaller packs and affordable pricing. These products are widely distributed through supermarkets, convenience stores, and online channels.

- Premium Chocolate: Premium chocolate commands higher price points and emphasizes quality, ethical sourcing, and innovative flavors. This segment targets affluent consumers, gifting occasions, and tourism-driven purchases. Investment in packaging, brand storytelling, and limited editions enhances visibility and supports GCC premium chocolate demand growth.

- Seasonal Chocolate: Seasonal chocolate products are designed for festivals, holidays, and special occasions, offering themed packaging, assortments, and promotional tie-ins. These products encourage impulse buying and gifting, supporting higher-margin opportunities and reinforcing brand engagement within the GCC chocolate industry.

Distribution Insights:

- Direct Sales (B2B): Direct B2B sales target hotels, restaurants, catering services, and corporate clients. This channel ensures bulk supply, customization, and consistent service. It plays a key role in establishing strategic partnerships and driving volume growth in the GCC chocolate market.

- Supermarkets and Hypermarkets: Supermarkets and hypermarkets provide high visibility and convenience, catering to both everyday and premium chocolate segments. Wide product assortments, promotional displays, and seasonal campaigns in these outlets enhance consumer engagement and sales performance across the GCC chocolate industry.

- Convenience Stores: Convenience stores facilitate impulse purchases and on-the-go consumption. They provide strategic access to commuter and urban populations and support small-pack offerings, countline products, and multipacks. Convenience retail strengthens accessibility and market reach for chocolate brands in the GCC.

- Online Stores: E-commerce platforms offer wide selection, personalization, and home delivery, aligning with modern shopping trends. Online channels are increasingly leveraged for gifting, bulk purchases, and premium assortments, contributing to digital penetration and sustained GCC chocolate market growth.

Country Insights:

- Saudi Arabia: Saudi Arabia represents a key market due to its large population, high disposable incomes, and growing retail infrastructure. Premium chocolate, gifting assortments, and tourism-oriented sales are driving consistent demand.

- UAE: The UAE benefits from high tourism and expatriate populations. Luxury chocolate offerings, duty-free retail, and online platforms cater to premium consumer segments and gifting occasions.

- Qatar: Qatar’s expanding hospitality sector and international events stimulate chocolate consumption. Retail modernization and gifting culture support market diversification across premium and mainstream segments.

- Bahrain: Bahrain demonstrates a steady rise in chocolate adoption due to rising disposable income and retail expansion, with consumers showing interest in premium and artisanal products.

- Kuwait: Kuwait’s affluent population drives demand for premium chocolate assortments, gift boxes, and branded products. Retail and online channels contribute to enhanced accessibility and engagement.

- Oman: Oman is experiencing gradual growth in chocolate consumption, driven by retail modernization, tourism, and gifting trends, creating opportunities for both mass-market and premium segments.

Forecast (2025–2033):

The GCC chocolate market is expected to continue its upward trajectory, reaching a projected market value of USD 5,094.60 Million by 2033, exhibiting a CAGR of 5.30% during 2025-2033, supported by rising consumer incomes, tourism, and gifting culture.

Demand Drivers:

- Rising Tourism & Expat Population: Growing international travel and expatriate communities increase exposure to global chocolate brands and premium products, expanding market consumption.

- Growth of Luxury Gifting Culture: Seasonal gifting trends, corporate gifting, and festive promotions drive demand for high-end chocolate assortments.

- Increasing Health-Conscious Consumption: Rising awareness of wellness encourages adoption of sugar-free, functional, and high-cocoa-content chocolate products.

- Expansion of Retail & Hypermarkets in GCC: Modern retail formats enhance accessibility and encourage impulse purchases, strengthening overall market growth.

Each of these drivers is anticipated to contribute substantially to the GCC chocolate industry growth and further consolidate market penetration.

Conclusion:

The GCC chocolate market is undergoing a transformative period driven by premiumization, health-focused innovations, retail modernization, and sustainability initiatives. Rising consumer preferences for artisanal and ethically sourced chocolates, combined with the expansion of e-commerce and travel retail channels, are shaping GCC chocolate market trends. Key demand drivers, including growing tourism, gifting culture, and health-conscious consumption, are expected to sustain growth. Stakeholders can leverage these insights to strategically position their brands, innovate product offerings, and capture long-term value in the GCC confectionery market.

How IMARC Group is Guiding Strategic Growth in the GCC Chocolate Market:

IMARC Group empowers stakeholders across the GCC chocolate industry with actionable insights to navigate evolving consumer preferences, premiumization trends, and retail expansion. Our research equips businesses to identify emerging opportunities, mitigate market risks, and innovate across product, distribution, and marketing strategies.

- Market Insights: Gain a comprehensive understanding of GCC chocolate market trends, including the rising demand for premium, artisanal, and functional chocolates, growth of duty-free and travel retail channels, and consumer shifts toward health-conscious and ethically sourced products. We provide in-depth analyses of market dynamics, competitive positioning, and segmentation across product types, distribution channels, and regional markets.

- Strategic Forecasting: Plan for the future of the GCC chocolate market with data-driven projections of market size, growth trajectories, and emerging opportunities. Our forecasts cover trends such as the expansion of e-commerce platforms, rising gifting culture, and retail modernization, enabling stakeholders to make informed investment and operational decisions.

- Competitive Intelligence: Monitor industry developments, including product innovations, sustainability initiatives, and strategic partnerships. Our insights highlight how leading chocolate brands are differentiating themselves through premium formulations, eco-friendly packaging, and digital marketing strategies, offering guidance to enhance market positioning.

- Customized Consulting Solutions: From market entry strategies to portfolio optimization, IMARC Group delivers tailored consulting solutions aligned with organizational goals. Whether expanding premium chocolate offerings, exploring health-focused products, or optimizing distribution channels, our services help clients stay competitive in a rapidly evolving market.

With the GCC chocolate market growing steadily, IMARC Group remains a trusted partner, providing essential insights, guiding innovation, and supporting strategic decision-making. For detailed analyses, forecasts, and expert guidance, access the complete GCC Chocolate Market report here: https://www.imarcgroup.com/gcc-chocolate-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)