Saudi Arabia Sauces and Seasonings Market Trends: Navigating Changing Food Preferences and Culinary Innovation

Introduction:

The Saudi Arabia sauces and seasonings market size is expanding steadily as consumers embrace more diverse flavors, convenient food formats, and global culinary influences. Evolving lifestyles, greater exposure to international cuisines, and a strong shift toward home cooking have collectively shaped the contemporary marketplace. In 2025, Tanmiah Food Company signed an MoU with Griffith Foods to establish a halal-certified R&D and production facility for sauces and seasonings in the Kingdom, strengthening domestic innovation capabilities. As a result, the Saudi Arabia sauces and seasonings market share is increasingly defined by brands that deliver authenticity, convenience, and premium taste experiences. The Kingdom’s maturing food culture—supported by demographic diversity and rising urbanization—continues to stimulate demand for a broad spectrum of sauces, spices, marinades, herbs, pastes, and ready-to-use culinary enhancers.

Another critical driver behind the expanding Saudi Arabia sauces and seasonings market trends is the growing influence of the foodservice sector. Restaurants, cafés, cloud kitchens, quick-service outlets, and international food chains are shaping mainstream flavor preferences across regions. These channels introduce consumers to global flavors, consequently expanding retail demand for similar condiments. This interplay between foodservice innovation and household purchasing habits is accelerating the Saudi Arabia sauces and seasonings market growth, especially for products that combine convenience with authentic taste.

Manufacturers, distributors, and retail platforms play a crucial role in this transformation. Manufacturers invest in local production facilities, flavor R&D, and modern packaging solutions, while distributors ensure wider reach across hypermarkets, supermarkets, convenience stores, and online platforms. In 2024, the Saudi Food and Drug Authority (SFDA) launched an initiative to streamline approval processes for locally produced packaged foods—including sauces and seasonings—to encourage domestic manufacturing and faster product innovation. Retailers are simultaneously expanding their private-label offerings to capture value-driven consumers. This integrated ecosystem supports continuous innovation and shapes how people across the Kingdom explore and enjoy food.

Explore in-depth findings for this market, Request Sample

How Vision 2030 Is Transforming the Saudi Arabia Sauces and Seasonings Industry:

Saudi Arabia’s Vision 2030 agenda has a profound influence on the Saudi Arabia sauces and seasonings market size and its long-term direction. The national transformation plan emphasizes developing domestic manufacturing capabilities, advancing food processing technologies, fostering entrepreneurship, and attracting international brands to establish local operations. This encourages investment in modern food production facilities, culinary research centers, and supply chain enhancements for sauces, seasonings, and condiments.

One of the most notable impacts of Vision 2030 is the diversification of the Kingdom’s consumer culture. As entertainment, tourism, and hospitality sectors expand, residents and international visitors develop greater interest in premium food experiences. This influences the Saudi Arabia sauces and seasonings market share, as demand rises for gourmet condiments, artisanal blends, ethnic flavors, and healthier alternatives. These preferences further stimulate market competition, pushing brands to introduce differentiated offerings.

The plan’s digital transformation pillar is also shaping the Saudi Arabia sauces and seasonings market trends. E-commerce adoption, online grocery platforms, and cloud kitchens are becoming mainstream. These platforms require innovative packaging, optimized delivery formats, bulk supply capabilities, and convenience-driven product lines. Together, these developments strengthen the overall ecosystem, contributing to sustainable Saudi Arabia sauces and seasonings market growth in the coming years.

Key Industry Trends:

Growing Demand for Ready-to-Use Cooking Sauces and Convenience Seasonings

One of the most defining Saudi Arabia sauces and seasonings market trends is the rising popularity of ready-to-use sauces and seasoning mixes. Busy lifestyles, increasing female workforce participation, and a desire for faster meal preparation drive consumers towards convenient flavor solutions. In 2025, Pakistani firm ITT Foods announced plans to reopen a tomato-processing plant in Jeddah to locally manufacture its Dipitt sauce line — a move clearly aimed at serving Saudi demand for imported, ready-to-use sauces more efficiently. Ready-made curry pastes, stir-fry sauces, salad dressings, gravies, and specialized spice blends are becoming pantry staples in both households and foodservice kitchens.

This shift enhances the Saudi Arabia sauces and seasonings market size as consumers seek products that reduce cooking time without compromising taste. Additionally, companies are expanding their product lines with localized flavors to appeal to traditional taste preferences.

Rising Popularity of International Cuisines in Urban Centers

Urbanization and exposure to global cultures have increased interest in Asian, American, Italian, Mediterranean, and Latin cuisines. As a result, international sauces such as teriyaki, soy, salsa, barbecue, Alfredo, pesto, and ramen seasonings are gaining relevance in the Saudi Arabia sauces and seasonings market share.

Cooking enthusiasts and young consumers frequently experiment with fusion recipes, driving retail demand for international condiments. Foodservice outlets also expand their menus with global dishes, contributing to consistent Saudi Arabia sauces and seasonings market growth.

Shift Toward Premium, Organic, and Clean-Label Seasonings

Health awareness is pushing consumers to choose natural, preservative-free, MSG-free, and organic seasoning blends. In 2024, Nestlé signed an agreement with MODON to establish its first Saudi Arabia food factory, which includes a focus on developing healthier, cleaner-label product lines to support rising demand for transparent ingredient profiles in the Kingdom. Clean-label products that emphasize ingredient transparency are becoming central to the Saudi Arabia sauces and seasonings market trends.

Premium offerings—such as artisanal spice blends, single-origin herbs, infused oils, specialty marinades, and exotic seasoning combinations—are increasingly available across premium retail shelves, enhancing market differentiation.

Expansion of Private Label Sauces & Seasonings in Major Retail Chains

Major retail chains are launching private-label sauces and seasonings to meet the needs of value-driven shoppers. These products typically offer competitive pricing without compromising quality, enabling retailers to capture a greater portion of the Saudi Arabia sauces and seasonings market share.

Private labels are expanding into categories such as cooking sauces, vinegars, herbs, spices, marinades, and ready blends, appealing to households seeking cost-effective options that still deliver flavor variety.

Surging Consumption of Hot Sauces and Spicy Flavors Among Young Consumers

Younger demographics are increasingly drawn to bold, spicy, and globally inspired flavors. Hot sauces, chili pastes, fiery marinades, and spice-infused condiments are some of the fastest-evolving categories in the Saudi Arabia sauces and seasonings market size landscape.

Social media trends, food challenges, and restaurant innovations amplify the demand for spicier products, reinforcing their relevance in ongoing Saudi Arabia sauces and seasonings market growth.

Growth in Foodservice Sector Driving Bulk Sauce and Seasoning Purchases

The expansion of dine-in restaurants, QSRs, food trucks, cafeterias, and cloud kitchens contributes significantly to the Saudi Arabia sauces and seasonings market trends. Foodservice operators require large-volume sauce packets, bulk spice containers, and professional-grade cooking bases.

This commercial demand supports domestic production, fosters B2B partnerships, and stimulates product innovations catering to professional kitchens.

Innovation in Flavored Marinades, Pastes, and Cooking Bases for Home Cooking

Consumers are increasingly exploring advanced culinary techniques at home, including grilling, braising, roasting, and slow cooking. This inspires product innovation in marinades, concentrated pastes, infused butters, and multipurpose bases. Such items elevate home-cooked meals and enrich the Saudi Arabia sauces and seasonings market share.

Brands are introducing options inspired by Middle Eastern, Asian, and Mediterranean cuisines, aligning with evolving taste preferences across Saudi households.

Increasing Preference for Low-Sodium, Sugar-Free, and Health-Oriented Sauces

Health-conscious consumers are actively seeking lighter alternatives such as low-sodium soy sauces, sugar-free dressings, keto-friendly condiments, and gluten-free spice blends. SADAFCO, a major Saudi food company, has committed to developing “low sodium” products in its future portfolio as part of its sustainability strategy, stating in its 2021 sustainability report that it aims to “launch new products with health benefits … and healthy value propositions” including reduced sodium. This segment is becoming more influential in shaping Saudi Arabia sauces and seasonings market size and overall purchasing behavior.

Functional sauces enhanced with probiotics, herbs, or plant-based ingredients also appeal to wellness-focused shoppers, strengthening future Saudi Arabia sauces and seasonings market growth.

Market Segmentation & Regional Insights:

The Saudi Arabia sauces and seasonings market trends reflect a clear segmentation across product categories, distribution channels, and consumer groups. Sauces may include table sauces, cooking sauces, dips, dressings, and pastes, while seasonings span herbs, spices, blends, rubs, and gourmet condiments.

Urban regions serve as hubs of culinary experimentation due to higher access to international cuisines, premium retail outlets, and diverse foodservice formats. These regions hold a notable portion of the Saudi Arabia sauces and seasonings market share, benefiting from affluent consumers and evolving dining habits.

Meanwhile, suburban and emerging cities demonstrate rising demand for affordable sauces, spice mixes, and ready blends. Online platforms extend market reach to remote areas, reinforcing nationwide accessibility. This geographic diversity strengthens the overall Saudi Arabia sauces and seasonings market size, allowing brands to target multiple consumer segments simultaneously.

Forecast (2025–2033):

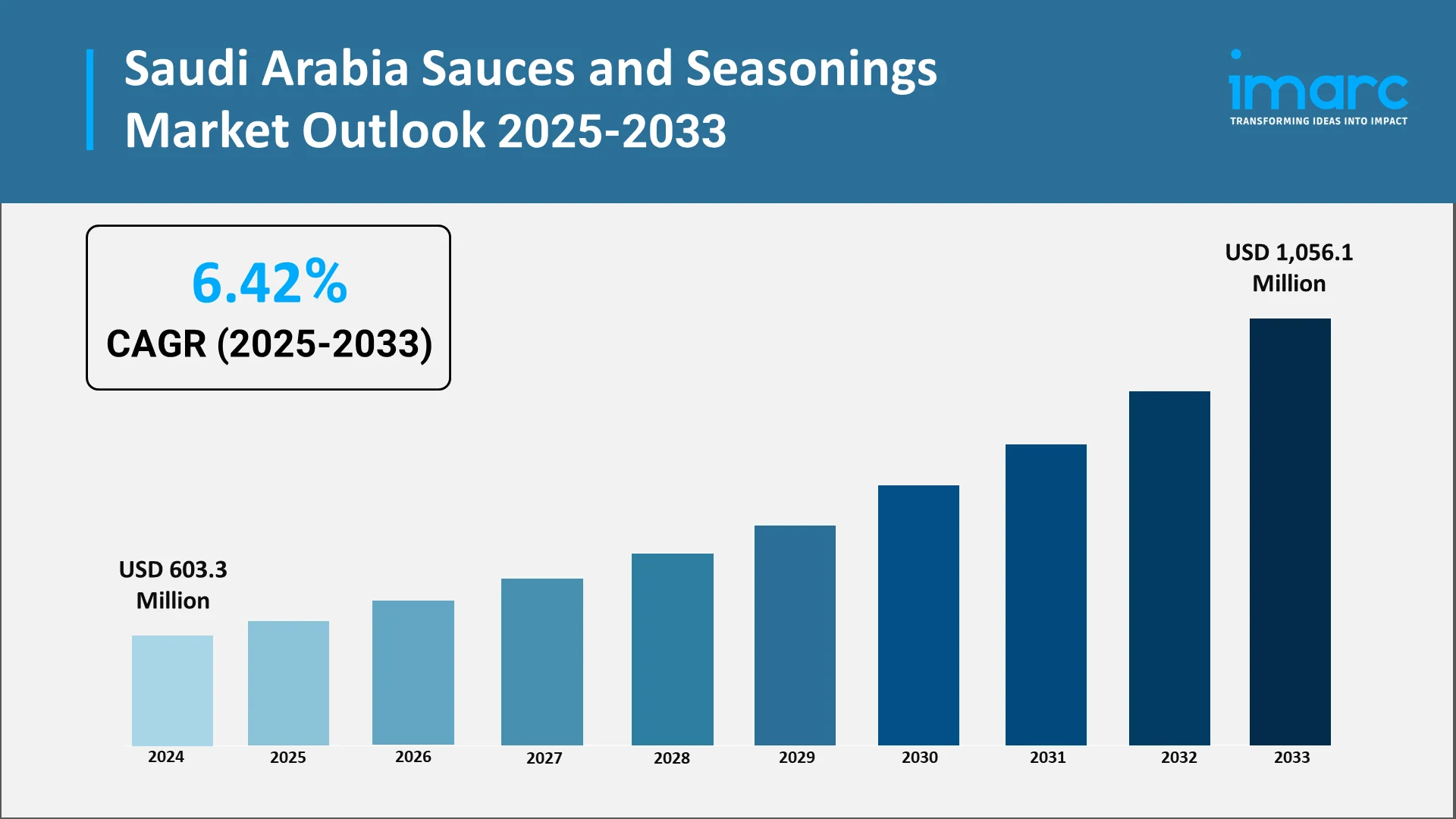

The next decade will continue to shape the Saudi Arabia sauces and seasonings landscape as consumer demand accelerates. The Saudi Arabia sauces and seasonings market size reached USD 603.3 Million in 2024, and looking forward, the marker is expected to reach USD 1,056.1 Million by 2033, reflecting a robust CAGR of 6.42% from 2025-2033. This sustained momentum highlights evolving taste preferences, rising product diversification, and expanding retail availability driving overall Saudi Arabia sauces and seasonings market growth.

Demand Drivers:

- Growth in Quick-Service Restaurants & Cloud Kitchens: The foodservice sector will play a major role by consistently introducing new flavors, international dishes, and fusion menus that influence retail purchasing patterns.

- Rising Consumption of Packaged and Convenience Foods: Evolving lifestyles and busy routines reinforce demand for ready sauces, instant seasonings, and simplified meal solutions—core categories contributing to the broader Saudi Arabia sauces and seasonings market trends.

- Increasing Culinary Experimentation at Home: Home cooks are exploring diverse recipes, prompting demand for global condiments, flavorful pastes, authentic herbs, and gourmet sauces.

- Expansion of Modern Trade & Online Grocery Platforms: Omnichannel retail strategies strengthen visibility, access, and purchase frequency, expanding the Saudi Arabia sauces and seasonings market size across all income segments.

- Growing Popularity of International Food Brands: As international brands enter the Kingdom and introduce new flavors, the market becomes more competitive and dynamic, enhancing the overall Saudi Arabia sauces and seasonings market share.

Conclusion:

The Saudi Arabia sauces and seasonings market trends reflect a transforming culinary landscape shaped by global influences, rising home cooking activity, expanding foodservice formats, and increasing demand for convenience-driven flavor solutions. Healthier ingredients, premium options, and diverse ethnic flavors continue to enrich the consumer experience. With strong participation from manufacturers, retailers, and distributors, the Saudi Arabia sauces and seasonings market size is positioned for ongoing development. As brands innovate with clean-label products, spicy condiments, cooking bases, and private-label offerings, the Kingdom's flavor ecosystem will continue to thrive.

To explore deeper insights, proprietary forecasts, competition mapping, and emerging opportunities, businesses and stakeholders are encouraged to access the full IMARC report.

Choose IMARC Group: Unmatched Insight for the Sauces & Seasonings Industry

IMARC Group stands as a trusted partner for organizations aiming to navigate the evolving food and beverage landscape in Saudi Arabia. Our expertise enables clients to identify emerging opportunities, evaluate competitive dynamics, and make informed business decisions.

- Data-Driven Market Research: Comprehensive, industry-validated information to understand evolving consumer dynamics and market forces.

- Strategic Growth Forecasting: Forward-looking perspectives that help companies anticipate future demand patterns and investment opportunities.

- Competitive Benchmarking: In-depth analysis to assess market positioning, product differentiation, and strategic strengths.

- Policy and Infrastructure Advisory: Guidance on regulatory developments, domestic production opportunities, and supply chain strategies aligned with national frameworks.

- Custom Reports and Consulting: Tailored solutions addressing specific business needs, from product innovation to market expansion strategies.

Partner with IMARC Group to gain clarity, confidence, and competitive advantage in the Saudi Arabia sauces and seasonings industry.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)