Emergency Food Market Growth Outlook: Key Drivers, Global Expansion Strategies & Resilience Planning

Introduction:

The global emergency food market has emerged as a critical component of household preparedness infrastructure, disaster response frameworks, and government stockpiling programs worldwide. In March 2025, the National Disaster Response Force (NDRF), established in India, conducted a National Capacity Building Competition for State Disaster Response Forces (SDRFs) to improve their readiness and effectiveness in managing collapsed structure emergencies. Given that 59.4% of India’s territory was situated in earthquake-sensitive zones IV and V, this initiative sought to enhance disaster response abilities and encourage effective practices in disaster management. As societies increasingly recognize the importance of resilience planning in the face of natural disasters, geopolitical uncertainties, and supply chain disruptions, the demand for reliable emergency food solutions has expanded significantly.

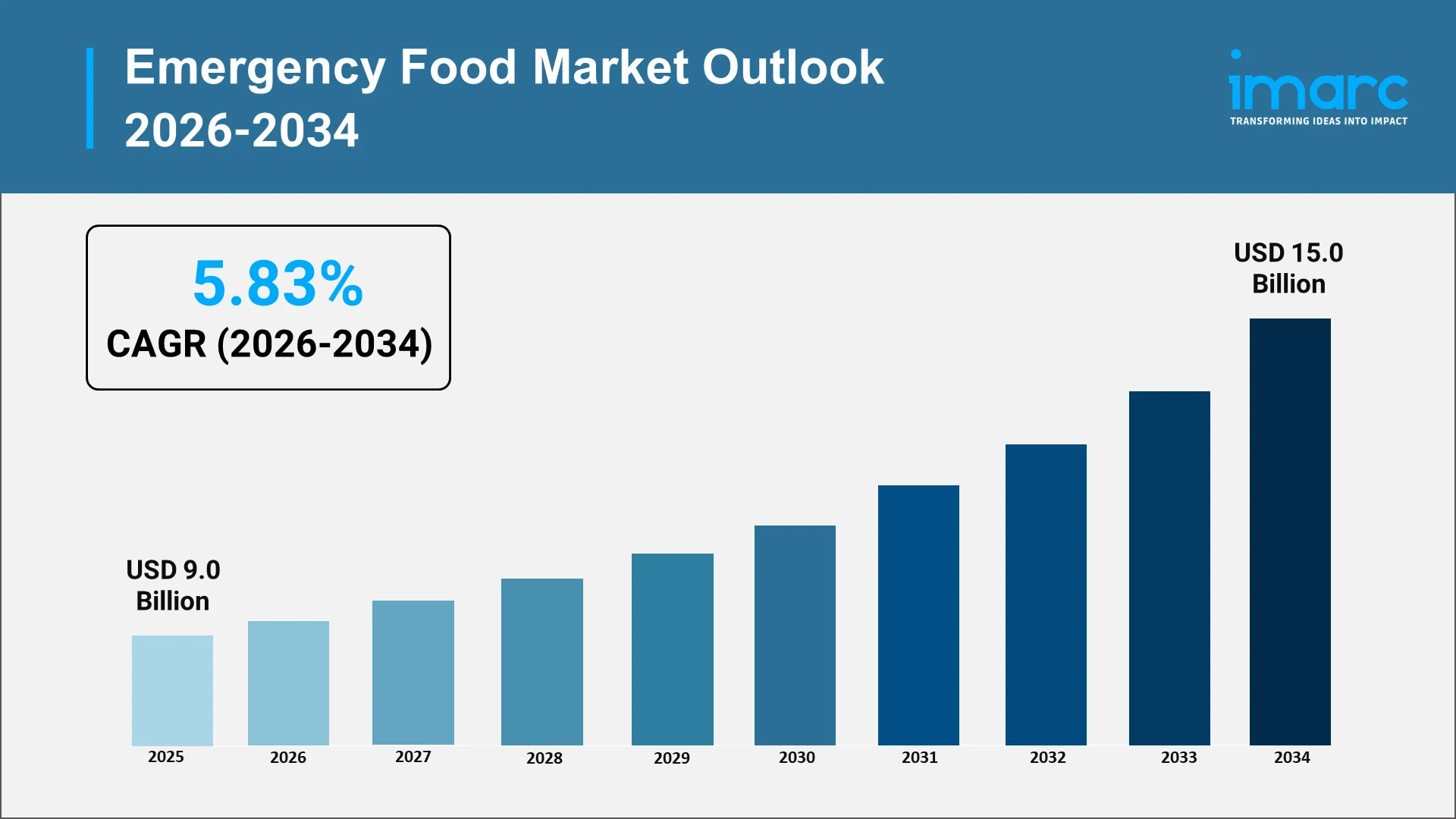

Market value reached USD 9.0 Billion in 2025 and it has grown immensely due to the instrumental role of emergency food storage solutions in enhancing supply chain stability and community resilience across multiple dimensions. At the household level, families are investing in preparedness strategies that ensure food security during unexpected emergencies, such as hurricanes, earthquakes, floods, and prolonged power outages. Government agencies and humanitarian organizations maintain strategic emergency reserves to support rapid disaster response capabilities and ensure the continuity of essential services during crisis periods, propelling the emergency food market share.

Explore in-depth findings for this market, Request Sample

Key Industry Trends:

Growing Demand for Long-Shelf-Life Survival Food Kits

The contemporary emergency food market is witnessing a fundamental transformation in consumer preferences towards comprehensive survival food kits that offer extended shelf life combined with nutritional adequacy. Modern consumers are increasingly sophisticated in their approach to emergency preparedness, seeking solutions that balance convenience, nutritional value, and long-term storage capability.

Manufacturers are employing innovative packaging technologies and food preservation methods that significantly extend product viability. Advancements in oxygen absorption technology, moisture barrier materials, and vacuum sealing processes have enabled the creation of emergency food products with shelf lives extending beyond twenty-five years under appropriate storage conditions. These technological improvements have democratized access to professional-grade emergency food solutions previously available primarily to military and institutional buyers.

The growing demand for comprehensive survival food kits reflects evolving consumer understanding of emergency preparedness requirements. Rather than assembling disparate food items, consumers increasingly prefer curated solutions that provide balanced nutrition across multiple meal occasions over extended periods, fueling the emergency food market growth.

Rise in Government Procurement and Strategic Emergency Reserves

Government procurement activities represent a substantial and expanding dimension of the emergency food market, driven by heightened awareness about national security considerations and disaster preparedness imperatives. National, regional, and local government agencies across diverse geographical contexts are systematically enhancing their strategic emergency reserves to ensure rapid response capabilities during natural disasters, public health emergencies, and other crisis situations. This trend encompasses both routine maintenance of existing stockpiles and strategic expansion of emergency food reserves to accommodate the growing population and evolving threat assessments.

The institutional procurement landscape differs significantly from consumer markets in terms of specification requirements, quality standards, and procurement processes. Government agencies typically establish rigorous nutritional standards, shelf-life requirements, and packaging specifications that emergency food manufacturers must satisfy to participate in institutional tenders. These procurement frameworks often emphasize caloric density, micronutrient content, allergen management, and special dietary accommodations to serve diverse populations during emergency situations.

Strategic emergency reserves extend beyond immediate disaster response to encompass broader considerations of food security and national resilience. Governments recognize that robust emergency food stockpiles contribute to social stability during crisis periods, reduce dependency on potentially disrupted international supply chains, and demonstrate governmental capacity to protect citizen welfare.

Innovation in Nutritionally-Balanced Freeze-Dried Meal Solutions

The emergency food market is experiencing remarkable innovations in freeze-dried meal technologies that deliver superior nutritional profiles, enhanced taste characteristics, and improved reconstitution properties compared to previous generation products. Freeze-drying technology, which removes moisture from food through sublimation under vacuum conditions, preserves nutritional content more effectively than traditional preservation methods while significantly reducing product weight and volume.

Contemporary freeze-dried meal solutions reflect sophisticated culinary development that transcends the utilitarian image historically associated with emergency food products. Manufacturers are collaborating with professional chefs and nutritionists to create freeze-dried meals that deliver genuine gastronomic satisfaction while meeting rigorous nutritional standards. This emphasis on taste quality recognizes that emergency situations often involve significant psychological stress, and familiar, enjoyable food experiences contribute meaningfully to emotional well-being and resilience.

The nutritional optimization of freeze-dried meals represents a critical innovation dimension addressing specific physiological requirements during emergency situations. Food scientists are formulating freeze-dried products with carefully calibrated macronutrient ratios, comprehensive micronutrient profiles, and functional ingredients that support immune function, stress response, and physical endurance. The incorporation of protein diversity from multiple sources, complex carbohydrates for sustained energy release, and essential fatty acids for cognitive function demonstrates the sophistication of contemporary emergency food product development.

Expansion of E-Commerce-Driven Preparedness Retail Channels

The broadening of e-commerce portals and retail channels is among the major emergency food market trends. As per the IBEF, in FY25, India's e-commerce industry reached a GMV of around INR 1.19 Lakh Crore (USD 14 Billion), showing a 12% year-over-year increase. Online retail channels have democratized access to emergency food products by eliminating geographical constraints and enabling consumers across diverse locations to purchase specialized preparedness solutions previously available only through limited retail outlets. This channel expansion has simultaneously increased market transparency and intensified competition, driving continuous improvements in product quality, pricing, and customer service.

E-commerce platforms provide unique advantages for emergency food distribution by accommodating the bulk purchasing patterns typical of preparedness consumers. Emergency food kits designed to support families for extended periods represent significant physical volumes and weights that challenge traditional retail infrastructure.

The information-rich environment of e-commerce platforms has elevated consumer education and informed decision-making within the emergency food market. Online retailers provide detailed product specifications, nutritional information, preparation instructions, and shelf-life documentation that enable consumers to evaluate options systematically. Customer review systems and rating mechanisms create transparent feedback loops that guide purchasing decisions and reward manufacturers delivering superior value.

Increasing Popularity of Allergen-Free and Clean-Label Emergency Foods

Consumer demand for allergen-free and clean-label emergency food products reflects broader dietary trends emphasizing ingredient transparency, allergen management, and minimal processing. The market is responding to this demand by developing specialized product lines that exclude common allergens, such as gluten, dairy, soy, tree nuts, and shellfish, while maintaining nutritional adequacy and taste quality. This innovation addresses both medical necessity for individuals with genuine food allergies and consumer preferences for simplified ingredient profiles that align with contemporary wellness philosophies.

The development of allergen-free emergency food solutions presents significant technical challenges that manufacturers are progressively overcoming through ingredient innovation and manufacturing process optimization. Firms are exploring diverse protein sources, including pea protein, rice protein, and other plant-based alternatives that deliver complete amino acid profiles without triggering common allergenic responses.

Clean-label positioning within the emergency food market emphasizes ingredient simplicity, recognizable components, and minimal use of synthetic additives or preservatives. This approach resonates with health-conscious consumers who prioritize whole food ingredients even in emergency preparedness contexts. Manufacturers pursuing clean-label strategies are reformulating products to eliminate artificial colors, flavors, and preservatives while maintaining necessary preservation characteristics through natural alternatives.

Market Segmentation & Regional Insights:

The emergency food market exhibits significant segmentation across multiple dimensions, including product type, sales channel, end user, and region. This multidimensional segmentation reflects the diverse applications and requirements that emergency food solutions address across society.

Based on the product type, non-perishable pasteurized milk constitutes the largest segment, holding 20.6% share. It combines long shelf life with high nutritional value, making it ideal for disaster preparedness and relief kits. It does not require refrigeration, is easy to transport and store, and offers essential protein and calcium.

On the basis of sales channel, offline leads the market with 92.4% of the market share. Emergency food is often purchased in bulk through government agencies, defense bodies, and humanitarian organizations via direct procurement and contracts. Physical retail stores remain important for households building emergency supplies.

Based on the end user, civil dominates the market with 52.3% share. Households increasingly prepare for natural disasters, blackouts, and supply disruptions. Awareness campaigns and survival preparedness trends have encouraged families to maintain emergency food reserves. Civil demand also exceeds military volumes due to the larger population base, making regular consumer purchases a major driver of overall market size.

North America remains the prominent region with 41.3% share, due to strong disaster preparedness culture, high consumer spending capacity, and frequent extreme weather events such as hurricanes and wildfires. As per the emergency food market research, government emergency-response programs and advanced distribution networks further support large-scale stocking.

Forecast (2026–2034):

The global emergency food market is set to reach USD 15.0 Billion by 2034, exhibiting a CAGR of 5.83% from 2026-2034, driven by converging demand drivers operating across household, institutional, and commercial customer segments. The fundamental outlook reflects growing recognition that emergency preparedness represents a prudent investment rather than optional expenditure, particularly as climate-driven natural disasters increase in frequency and severity.

The growing climate-driven natural disaster frequency constitutes a primary demand driver reshaping emergency food market dynamics. Scientific evidence demonstrates that extreme weather events, including hurricanes, floods, wildfires, and droughts, are occurring with greater frequency and intensity, as global climate patterns are shifting. These events create immediate emergency food requirements during active crisis periods and motivate preparedness investments during normal conditions as communities and households recognize vulnerability to future disruptions.

Rising focus on survival preparedness among individual consumers reflects broader societal awareness about system vulnerabilities and the importance of personal resilience. Global events, including supply chain disruptions, geopolitical tensions, and economic volatility, have reinforced the value of preparedness planning across diverse household demographics. This awareness translates into sustained demand for emergency food solutions, as families invest in stockpiles that provide security and peace of mind.

Increasing military and defense rations procurement represents a stable institutional market demand driver. Military organizations worldwide maintain substantial emergency food requirements for field operations, training exercises, disaster response deployments, and strategic reserves. Defense procurement budgets accommodate regular replacement of aging rations and expansion of stockpiles to support evolving force structures and operational requirements.

The expansion of emergency response infrastructure and logistics strengthens institutional capacity to deploy emergency food resources rapidly during crisis situations. Authorities and aid organizations are consistently improving storage facilities, transportation resources, and distribution methods that facilitate effective emergency food delivery. This infrastructure investment is creating the demand for emergency food products, specifically designed for institutional distribution systems, including appropriate packaging formats, documentation requirements, and quality standards.

Conclusion:

The emergency food market stands at an inflection point, characterized by expanding demand across diverse customer segments, accelerating product innovations, maturing distribution infrastructure, and the growing recognition of preparedness as a fundamental resilience strategy. The convergence of climate-driven disaster frequency, evolving consumer attitudes towards preparedness, government policy emphasis on disaster readiness, and technological advancements in food preservation is creating favorable conditions for sustained market expansion.

The key trends examined throughout this analysis demonstrate the sophistication and maturation occurring within the emergency food industry. The evolution from basic survival provisions towards nutritionally optimized, taste-forward solutions reflects deeper understanding of human needs during crisis situations. The expansion of government procurement and strategic reserves underscores institutional recognition that emergency food capabilities contribute meaningfully to national security and social resilience. The innovations occurring in freeze-dried meal technologies, the democratization of access through e-commerce channels, and the accommodation of contemporary dietary preferences through allergen-free and clean-label offerings collectively position the market for mainstream acceptance beyond traditional enthusiast communities.

Partner with IMARC Group for Comprehensive Emergency Food Market Intelligence:

Understanding the complex dynamics shaping the global emergency food market requires access to rigorous market research, strategic growth forecasting, competitive benchmarking, and actionable insights tailored to organizational objectives. At IMARC Group, we deliver comprehensive intelligence that empowers industry participants to navigate market opportunities with confidence.

Our data-driven market research deepens understanding of emergency food demand drivers, consumer preferences, technological innovations, and regulatory developments across global regions. We provide strategic growth forecasting that predicts emerging trends in disaster preparedness, evolving government procurement patterns, and shifts in household emergency planning behavior. Our competitive benchmarking analyzes market positioning strategies, product portfolio developments, and distribution channel approaches employed by leading emergency food manufacturers and retailers.

We offer policy and infrastructure advisory services that help organizations stay informed about regulatory frameworks affecting emergency food standards, government stockpiling programs, and disaster response protocols across jurisdictions. Our custom reports and consulting services deliver tailored insights aligned with specific business objectives.

At IMARC Group, our mission centers on equipping industry leaders with the clarity and strategic intelligence required to capitalize on market expansion opportunities while building resilience across communities worldwide. Partner with us to advance your organizational goals and contribute to global preparedness capabilities, because readiness matters.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)