Saudi Arabia's Mushroom Market Booms with Health-Conscious Consumers Driving Demand

Introduction:

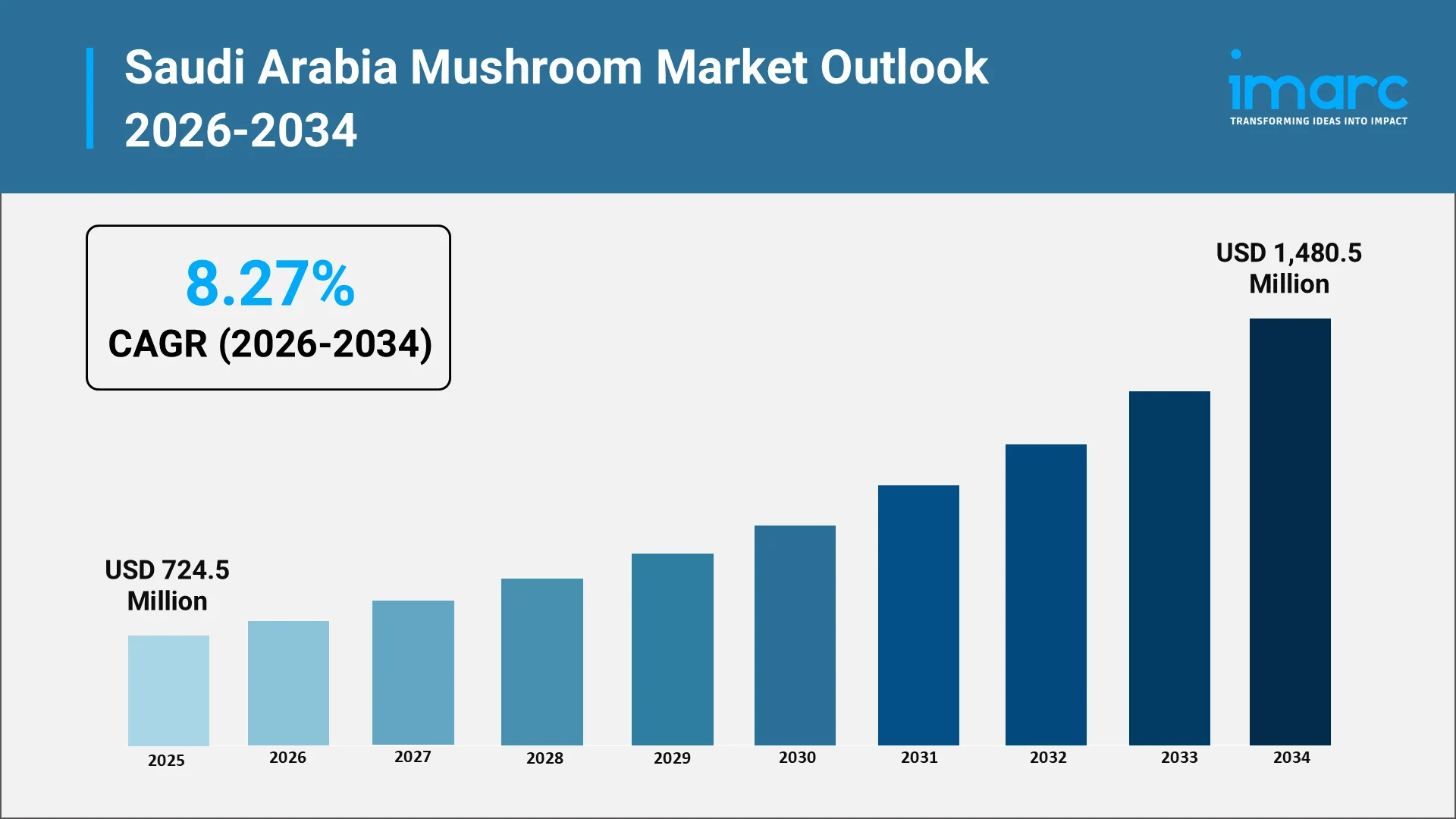

The Saudi Arabia mushroom market stands at a pivotal juncture, experiencing remarkable transformation as health-conscious consumption patterns reshape dietary preferences across the Kingdom. In 2025, Saudi Arabia mushroom market size reached USD 724.5 Million. As consumers increasingly prioritize nutritious, sustainable, and protein-rich food alternatives, mushrooms have emerged as a compelling choice that aligns perfectly with evolving lifestyle trends. The growing awareness about mushrooms' nutritional benefits, combined with their versatility in culinary applications, has positioned this agricultural segment as a significant contributor to Saudi Arabia's food security ambitions.

The expansion of the mushroom market in Saudi Arabia reflects broader shifts in consumer behavior, where wellness-oriented choices are becoming mainstream. From traditional button mushrooms to exotic varieties such as shiitake, oyster, and king trumpet, Saudi consumers are demonstrating an expanding palate that mirrors global food trends. This diversification in demand has created substantial opportunities for domestic producers, importers, and food processors alike.

Saudi Arabia mushroom production has evolved considerably in recent years, driven by technological innovations in controlled-environment agriculture and hydroponic farming systems. These advanced cultivation methods have proven particularly suitable for the Kingdom's arid climate, enabling year-round production capabilities that reduce dependence on imports while ensuring consistent quality and freshness.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming Saudi Arabia's Mushroom Industry:

Saudi Arabia's Vision 2030 initiative has fundamentally reshaped the agricultural landscape, creating unprecedented opportunities for specialized sectors including mushroom cultivation. The comprehensive economic diversification program emphasizes reducing oil dependency while fostering sustainable industries that contribute to long-term national prosperity.

Saudi Arabia's agricultural GDP hit a record-breaking SAR 114 Billion in 2024, exceeding interim projections, according to Saudi FoodTech's Vision 2030 Annual Report. With local dairy production reaching 109% of domestic demand and egg production matching 116% of needs, the Kingdom has attained previously unheard-of levels of food self-sufficiency.

Government-backed initiatives have prioritized investment in controlled-environment agriculture facilities, recognizing that traditional open-field farming faces inherent limitations in desert environments. Financial support mechanisms established under Vision 2030 have substantially lowered barriers to entry for aspiring mushroom farmers and agricultural entrepreneurs. Subsidized loans, technical assistance programs, and reduced import duties on farming equipment have collectively stimulated private sector participation.

According to the FAO's Agrifood Policy Highlights (September–October 2025), Saudi Arabia and South Korea have established a Smart Agriculture Complex that combines vertical farming to increase productivity on scarce arable land, Internet of Things systems to monitor crops, and artificial intelligence to regulate water.

Key Industry Trends:

- Growing Demand for Functional and Medicinal Mushrooms

Consumer interest in functional and medicinal mushrooms represents one of the most significant trends reshaping the mushroom market in Saudi Arabia. Beyond their traditional culinary uses, mushrooms are becoming more and more prized for their potential health benefits, such as immune system support and anti-inflammatory actions. Varieties such as reishi, lion's mane, and chaga have gained particular traction among health-conscious consumers seeking natural approaches to wellness maintenance.

- Expansion of Controlled-Environment Agriculture and Hydroponic Mushroom Farming

Controlled-environment agriculture has emerged as the cornerstone of sustainable Saudi Arabia mushroom production. In February 2025, Mowreq Specialized Agriculture finished the biggest indoor vertical agricultural project in Saudi Arabia in Riyadh. With 19 layers and a total growing space of 20,000 meters, the facility is 15 meters high. The farm uses automation and AI-driven monitoring systems to produce 2,200 kg of leafy greens per day while using up to 90% less water than traditional agriculture. These sophisticated facilities utilize advanced climate control systems, automated irrigation, and precision monitoring technologies to create optimal growing environments regardless of external weather conditions.

- Increasing Preference for Organic and Locally Produced Mushrooms

The demand for organic mushrooms Saudi Arabia has witnessed substantial growth as consumers increasingly prioritize food safety, environmental sustainability, and production transparency. Fresh mushrooms Saudi Arabia producers have responded by pursuing organic certifications and implementing sustainable farming practices that meet international standards. The emphasis on local production addresses consumer preferences for reduced food miles while supporting broader national objectives around agricultural self-sufficiency.

- Rising Penetration of Mushroom-Based Ready-to-Cook and Processed Food Products

Convenience-oriented food products incorporating mushrooms have gained significant traction among Saudi consumers. Ready-to-cook meal kits, pre-sliced mushroom packages, and mushroom-based frozen foods address the growing desire for quick, nutritious meal solutions. Food processors have expanded their portfolios to include mushroom soups, sauces, seasonings, and plant-based meat alternatives appealing to health-conscious and environmentally aware consumers.

- Adoption of Import Substitution Strategies to Boost Local Production

Strategic efforts to reduce import dependency have positioned domestic mushroom production as a priority within Saudi Arabia's agricultural development agenda. Government procurement policies increasingly favor domestically produced agricultural products, providing guaranteed demand that supports investment in production capacity expansion. The import substitution agenda has stimulated innovation in spawn production, substrate formulation, and cultivation techniques adapted to local conditions.

Market Segmentation and Regional Insights:

IMARC Group has categorized the market based on mushroom type, form, distribution channel, and end use.

- Mushroom Type Insights:

Based on the mushroom type, the market has been categorized into button mushroom, shiitake mushroom, oyster mushroom and others. Button mushroom is high in demand due to mild flavor, affordability, and widespread use in everyday Saudi cuisine. Shiitake mushroom is gaining popularity among health-conscious consumers for its immune-boosting properties and rich umami taste. Oyster mushroom is preferred for meat-like texture, making it ideal for plant-based dishes and gourmet preparations.

- Form Insights:

On the basis of the form, the market has been segmented into fresh mushroom, canned mushroom, dried mushroom, and others. Fresh mushroom leads consumption driven by demand for quality produce in retail and foodservice sectors. Canned mushroom is popular for convenience and extended shelf life in processed foods and home cooking. Dried mushroom is valued for concentrated flavor and year-round availability in traditional and international cuisines.

- Distribution Channel Insights:

Based on the distribution channel, the market has been segregated into supermarkets and hypermarkets, grocery stores, online stores, and others. Supermarkets and hypermarkets are primary retail channel offering diverse mushroom varieties under one roof. Grocery stores serve neighborhood demand with accessible pricing and convenient locations. Online stores are rapidly expanding channel for specialty and organic mushroom purchases among urban consumers.

- End Use Insights:

On the basis of the end use, the market has been classified into food processing industry, food service sector, direct consumption, and others. Food processing industry is the major consumer utilizing mushrooms in soups, sauces, and convenience food manufacturing. Food service sector, including hotels, restaurants, and catering operations drive premium mushroom demand significantly. Direct consumption which includes household purchases for home-cooked meals represent substantial retail volume.

- Regional Insights:

Region-wise, the market has been divided into Northern and Central Region, Western Region, Eastern Region, and Southern Region. Mushrooms are demanded in the Northern and Central region, including Riyadh, due to highest population density and purchasing power. Western region, which includes Jeddah and Makkah, drive demand through tourism and hospitality sector growth. Industrial hubs and expatriate communities in the Eastern region support steady mushroom consumption patterns. Southern region is the emerging market with growing health awareness and expanding retail infrastructure.

Forecast:

The Saudi Arabia mushroom market size is expected to reach USD 1,480.5 Million by 2034, exhibiting a growth rate (CAGR) of 8.27% during 2026-2034, underpinned by multiple converging demand drivers that collectively support sustained expansion through 2033. The structural factors propelling market growth demonstrate durability and alignment with broader societal trends.

The growing shift toward healthy food choices constitutes the most fundamental demand driver, reflecting evolving consumer priorities that favor nutritious, natural, and minimally processed food options. Mushrooms' nutritional profile positions them favorably within wellness-oriented dietary frameworks gaining prominence among Saudi consumers.

Expansion of commercial mushroom farms represents the supply-side response to strengthening demand, with investment in production capacity expected to continue throughout the forecast period. Rising HORECA demand, stimulated by tourism development and hospitality sector expansion, provides additional growth impetus. Supportive government agriculture diversification initiatives will continue providing favorable policy environments for mushroom industry development.

Conclusion:

The Saudi Arabia mushroom market exemplifies the transformative potential of strategic agricultural development aligned with national economic diversification objectives. Health-conscious consumption patterns, technological innovation in controlled-environment agriculture, and supportive policy frameworks have collectively positioned this specialized sector for sustained expansion.

Key trends including growing demand for functional mushrooms, increasing preference for organic and locally produced options, and rising penetration of convenience-oriented processed products signal a maturing market with diverse opportunity sets for industry participants.

Choose IMARC Group as We Offer Unmatched Expertise and Core Services:

- Data-Driven Market Research: Deepen your knowledge of mushroom consumption patterns, production technologies, and emerging trends including controlled-environment agriculture, specialty varieties, and functional mushroom applications through comprehensive market research reports.

- Strategic Growth Forecasting: Predict emerging developments in Saudi Arabia's mushroom industry, from advanced cultivation technologies and organic certification trends to changing consumer preferences and food service sector expansion across key regions.

- Competitive Benchmarking: Analyze competitive dynamics in the mushroom market, review production capabilities across domestic and international suppliers, and monitor innovations in cultivation methods, packaging solutions, and value-added processing.

- Policy and Infrastructure Advisory: Stay informed about regulatory frameworks, government agricultural initiatives, and support programs affecting mushroom cultivation, food safety compliance, and market access throughout the Kingdom.

- Custom Reports and Consulting: Obtain tailored insights aligned with your organizational objectives—whether entering the mushroom production sector, investing in controlled-environment agriculture ventures, or expanding food processing capabilities for mushroom-based products.

At IMARC Group, our mission is to empower agricultural and food industry leaders with the clarity and intelligence required to capitalize on Saudi Arabia's growing mushroom market opportunity. Partner with us in supporting sustainable food production—because informed decisions drive lasting success. For more details, click here: https://www.imarcgroup.com/saudi-arabia-mushroom-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)