Top Factors Driving Growth in the Saudi Arabia Steel Market

The Kingdom of Saudi Arabia is undergoing an unprecedented economic transformation, shifting its traditional reliance on hydrocarbon revenues toward a diverse, knowledge-based economy. Central to this monumental shift is the steel industry in Saudi Arabia, a sector that serves as a foundational pillar for virtually every national development project. The demand for steel, a universal commodity crucial for construction, manufacturing, and energy infrastructure, is experiencing a robust period of expansion. This significant upward trajectory is underpinned by a combination of ambitious government planning, massive investments in giga-projects, and a global pivot toward sustainable industrial practices. Understanding the underlying forces is key to grasping the future direction of the Saudi Arabia steel market.

Introduction to the Saudi Arabia Steel Industry:

The steel industry in Saudi Arabia has historically been a critical player in the wider Middle East and North Africa region, leveraging the Kingdom’s inherent energy advantages, particularly low-cost natural gas, to fuel energy-intensive production processes like Direct Reduced Iron (DRI). While long steel products, primarily rebar for construction, have traditionally dominated local output, the national strategy is now emphasizing high-value flat products and specialty steel grades to achieve greater self-sufficiency and enhance its global Saudi Arabia steel market share.

This repositioning is about increasing output and fundamentally about industrial quality and diversification. The industry is currently in a phase of strategic evolution, aiming to close the capacity gaps in specialized steel types that were previously met solely through imports. This strategic shift is aimed at enhancing local content and ensuring a secure supply chain for the nation’s mega-projects, which require vast quantities of high-specification steel. The robust ecosystem of local manufacturers, suppliers, and distributors is becoming increasingly sophisticated, creating a competitive environment that encourages technological adoption. This ambitious structural development indicates a strong Saudi Arabia steel market outlook for the next decade.

Explore in-depth findings for this market, Request Sample

Rising Infrastructure Development and Construction Projects:

Undoubtedly, the single most powerful catalyst for the current growth phase in the Saudi Arabia steel market is the massive wave of infrastructure and construction development sweeping across the Kingdom. At the heart of this expansion are the Vision 2030 giga-projects—new, futuristic urban centers and tourism hubs that are unparalleled in their scale and complexity. Projects like NEOM, The Red Sea Project, Qiddiya, and Diriyah, alongside the continuous development of urban centers like Riyadh and Jeddah, are consuming steel at an extraordinary rate.

These projects demand not just tonnage but also specialized structural steel, high-quality rebar, and advanced fabrication capabilities. The Saudi Arabia prefabricated building and structural steel market size reached USD 1,827.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,585.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.73% during 2025-2033. The requirement for structural integrity in high-rise buildings, vast transportation networks including metros and high-speed rail, and complex industrial facilities places immense pressure and opportunity on steel producers. The sheer volume of material required for these developments is a defining factor shaping the Saudi Arabia steel market growth. The commitment to meeting aggressive construction timelines further accelerates demand for efficiently supplied and fabricated steel products, favoring suppliers with localized, responsive production and delivery mechanisms. This continuous flow of projects guarantees substantial demand for various steel grades for the foreseeable future, driving the overall steel market across the Kingdom.

Expansion of the Oil & Gas and Petrochemical Sectors:

While diversification is the goal, the traditional strengths of the Saudi economy, specifically the oil, gas, and petrochemical sectors, continue to be significant drivers of steel demand. These industries require highly specialized steel grades, known as tubular products, for exploration, production, processing, and transportation infrastructure. Seamless and welded pipes are essential components for high-pressure applications, pipelines, and downstream processing facilities.

The expansion of domestic refining and petrochemical capacities, driven by the desire to capture more value from extracted hydrocarbons, necessitates substantial investment in new plants and upgrades to existing infrastructure. This requires corrosion-resistant, high-strength alloy steel, often sourced from specialized global suppliers but increasingly a target for domestic production under the localization initiatives. Furthermore, the expansion of supporting infrastructure, such as ports, logistics hubs, and storage tanks, which are integral to the hydrocarbon supply chain, also relies heavily on steel. This industrial segment provides a stable base of demand for the steel industry in Saudi Arabia, complementing the more cyclical needs of the construction sector. The intersection of traditional energy prowess with modern industrial expansion ensures a dynamic and resilient market.

Growing Demand for Sustainable and Recycled Steel:

A key factor distinguishing the current phase of growth is the emphasis on sustainability, aligning the Saudi Arabia steel market trends with global environmental standards. The Kingdom’s commitment to achieving net-zero emissions has translated into a growing demand for green steel and steel produced using more circular economy principles. This shift is particularly evident in the construction sector, where developers of giga-projects are increasingly prioritizing materials with lower embodied carbon footprints.

Manufacturers in Saudi Arabia are responding by investing in advanced technologies, such as Electric Arc Furnaces (EAFs), which primarily utilize scrap metal as feedstock. This process is significantly less carbon-intensive than traditional methods. Furthermore, the nation is strategically positioned to transition towards next-generation production methods, including hydrogen-based direct reduction (H2-DRI), leveraging its massive, planned investments in green hydrogen production. This proactive adoption of cleaner production methods creates a distinct market segment for high-quality, recycled, and low-carbon steel. As green building certifications and sustainability mandates become standard, the demand for sustainably produced steel will continue to grow, positively influencing the entire Saudi Arabia steel market. This evolution toward environmentally conscious practices is reshaping the competitive landscape and technological priorities within the industry.

Increasing Investments in Industrial and Manufacturing Facilities:

The national strategy for economic diversification includes a strong focus on enhancing the domestic manufacturing base, moving beyond commodity production to higher-value goods. This drive involves establishing new industrial cities, specialized manufacturing zones, and large-scale industrial complexes. The construction of these facilities—from automotive manufacturing plants and machinery production hubs to specialized material processing centers—requires significant volumes of steel.

This growth segment is crucial because it generates long-term, recurrent demand for steel products that goes beyond the initial construction phase. Once operational, these manufacturing facilities become steady consumers of flat steel products, sheets, coils, and specialized components for their ongoing operations and production needs. The government’s National Industrial Development and Logistics Program (NIDLP) is specifically designed to foster these industries, thereby guaranteeing a consistent demand source that reinforces the overall market growth. These investments are aimed at creating an intricate industrial ecosystem, where local steel producers are strategically integrated into the domestic supply chains of various manufacturing sectors. This planned horizontal integration provides greater stability and resilience to the Saudi Arabia steel market.

Government Initiatives under Vision 2030 to Boost Domestic Steel Production:

The strategic blueprint provided by Saudi Vision 2030 is arguably the master plan governing the acceleration of the Saudi Arabia steel market. The government has explicitly targeted the steel sector for massive capacity expansion and technological modernization. The core aim is to achieve near self-sufficiency in steel production, thereby securing critical material supply for national projects and reducing import dependency. This comprehensive plan is designed to restructure the industry, addressing historical weaknesses and focusing on producing specialized flat products where the Kingdom was previously reliant on foreign sources.

Initiatives include substantial financial incentives, policy support for local content (often through mandated local procurement), and the facilitation of large-scale industrial partnerships with global steel majors. These alliances are crucial for technology transfer and access to high-grade production expertise. The policy framework includes measures to ensure fair trade and support environmental, social, and governance (ESG) standards, promoting the growth of a high-quality, competitive steel industry in Saudi Arabia. These top-down government interventions create a highly favorable investment climate, ensuring that strategic projects necessary for national goals receive priority access to domestic steel capacity. The strategic alignment between government vision and industrial execution is a primary guarantor of the positive Saudi Arabia steel market outlook.

Opportunities and Challenges in the Saudi Arabia Steel Industry:

The robust Saudi Arabia Steel Market presents compelling opportunities alongside notable challenges. The primary opportunity lies in the sustained and predictable long-term demand generated by giga-projects, which offers a reliable pipeline for domestic producers. Furthermore, the focus on diversification creates a strong opening for manufacturers to move into high-margin products like automotive-grade steel, specialty alloys for the energy sector, and advanced construction materials. The pivot towards green production also positions the Kingdom as a potential leader in the future low-carbon steel market.

However, several critical challenges must be navigated. One major concern is the reliance on imported raw materials, particularly iron ore, which exposes the industry to volatility in global commodity prices and international shipping dynamics. Successfully meeting the massive projected Saudi Arabia steel market size requires overcoming logistical and supply chain hurdles. Another significant challenge is the need for a highly skilled workforce, particularly in advanced manufacturing and digitalized operations, a gap that requires substantial investment in human capital development and training. Furthermore, maintaining profitability amidst global capacity fluctuations and trade policy changes remains a constant balancing act for the steel industry in Saudi Arabia.

Future Outlook for the Saudi Arabia Steel Industry:

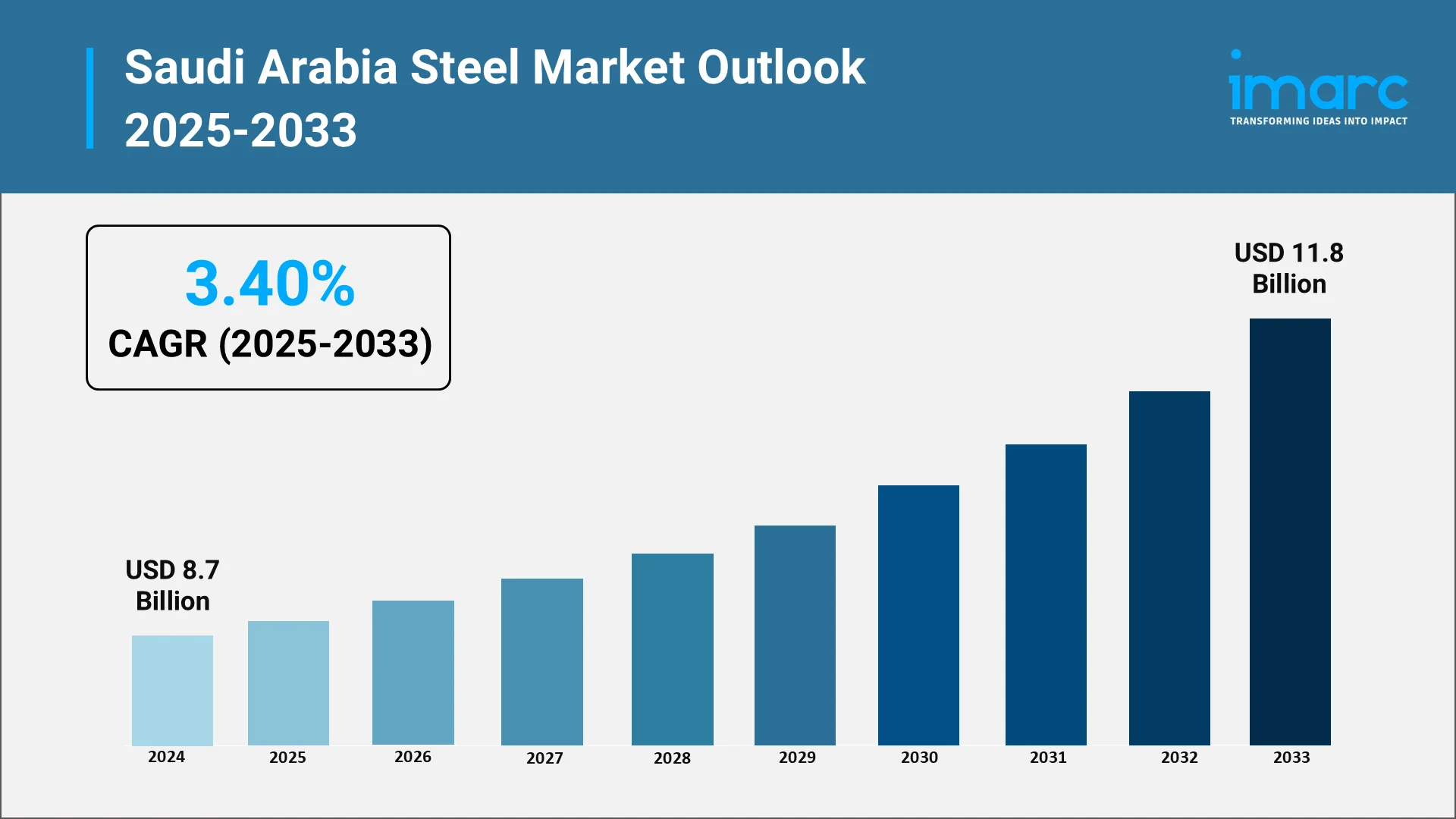

The Saudi Arabia steel market outlook is overwhelmingly positive, driven by the sustained momentum of the Vision 2030 agenda. The industry is transitioning from being primarily a supplier of commodity construction steel to becoming a strategic, technologically advanced sector capable of providing specialized materials for a diversified economy. This future growth is underpinned by key saudi arabia steel market trends, including the increasing adoption of Industry 4.0 technologies—automation, digitalization, and Artificial Intelligence—to optimize production efficiency and product quality. The Saudi Arabia steel market size was valued at USD 8.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.8 Billion by 2033, exhibiting a CAGR of 3.40% from 2025-2033.

The long-term expansion of the Saudi Arabia steel market size will be intrinsically linked to the successful completion of the giga-projects and the establishment of a vibrant local manufacturing ecosystem. The focus on sustainability, particularly the shift to hydrogen-based production and enhanced recycling efforts, will not only ensure compliance with global environmental standards but will also confer a competitive edge in international markets. As the Kingdom continues its trajectory of economic transformation, the steel sector is set to remain a powerful engine of industrial growth, reinforcing the nation's position as a regional economic powerhouse and solidifying its Saudi Arabia steel market share on a global scale. The long-term forecast suggests an era of profound expansion, modernization, and strategic importance for the nation’s steel producers and related industries.

Choose IMARC Group for Unmatched Market Intelligence and Strategic Advisory:

- Comprehensive Data-Driven Analysis: Access detailed insights into the Saudi Arabia steel market through extensive research covering production capacity, consumption patterns, trade flows, and competitive dynamics across all major steel product categories and end-use segments.

- Strategic Growth Forecasting: Leverage sophisticated modeling techniques to anticipate emerging trends in steel demand driven by infrastructure development, industrial expansion, sustainability initiatives, and technological innovation throughout the Kingdom and broader region.

- Competitive Intelligence Services: Gain actionable understanding of competitive forces shaping the Saudi steel industry through detailed benchmarking of major producers, analysis of capacity expansion plans, and tracking of technology adoption patterns and strategic partnerships.

- Policy and Regulatory Guidance: Stay ahead of evolving government policies affecting steel production and consumption, including local content requirements, trade measures, environmental regulations, and Vision 2030 implementation priorities that shape market conditions.

- Customized Consulting Solutions: Receive tailored intelligence aligned to your specific organizational objectives—whether entering the Saudi steel market, evaluating acquisition opportunities, optimizing product portfolios, or developing long-term strategic plans for regional expansion.

At IMARC Group, we empower steel industry stakeholders with the clarity and intelligence required to navigate complex market dynamics and capitalize on growth opportunities. Partner with us to make informed decisions that drive competitive advantage—because strategic insight makes the difference between opportunity and achievement. Click here for more details: https://www.imarcgroup.com/saudi-arabia-steel-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104