Saudi Arabia Ethanol Market Trends: Evolving Industrial Applications and Clean Fuel Adoption

Introduction:

The Saudi Arabia ethanol market represents a critical segment within the Kingdom's evolving industrial landscape. As one of the world's leading energy producers, Saudi Arabia strategically diversifies its economic portfolio beyond traditional hydrocarbon dependence. Ethanol, a versatile alcohol compound with applications spanning pharmaceuticals, personal care, chemicals, and fuel blending, has emerged as an essential component in this transformation.

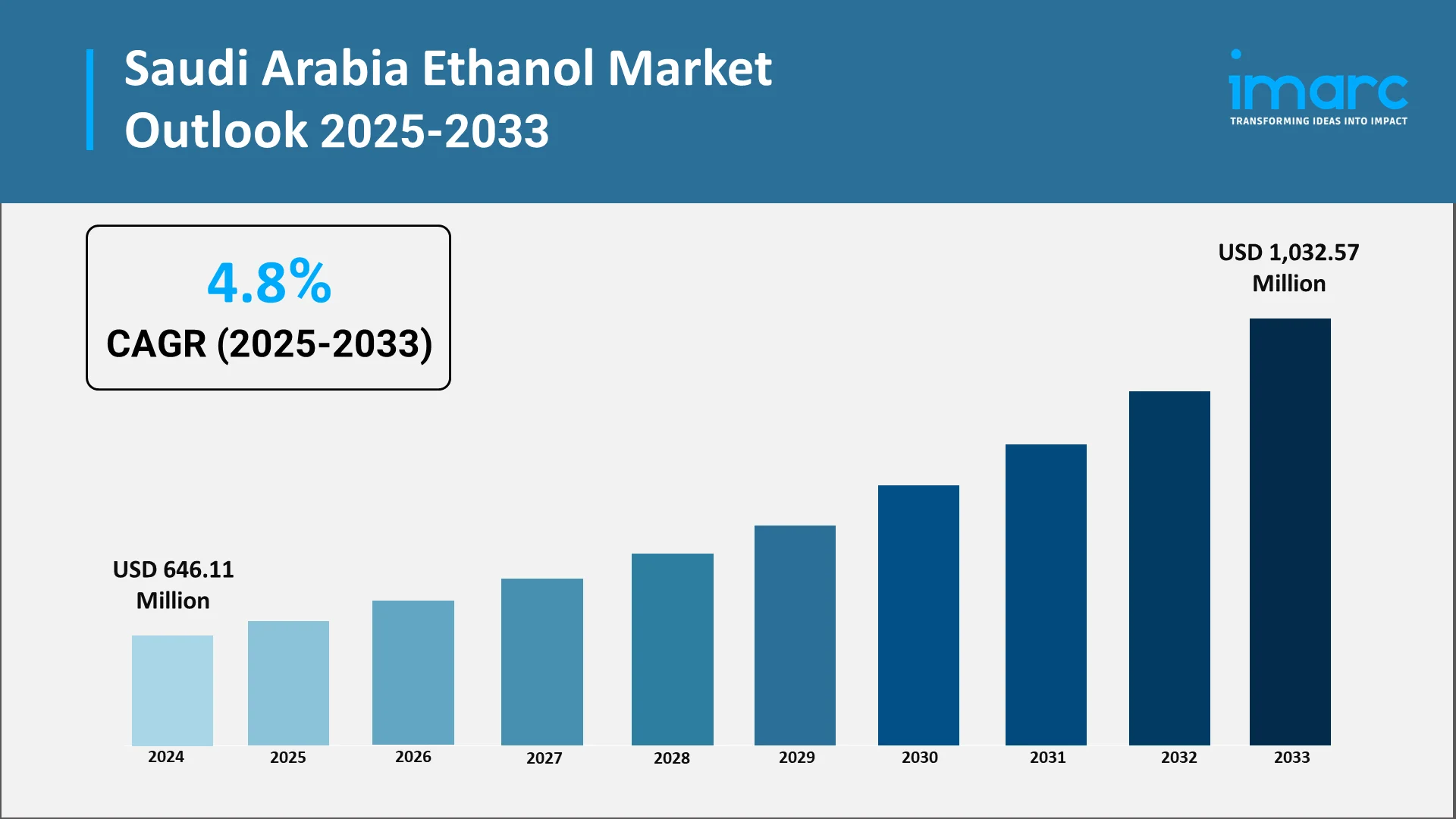

The demand for industrial ethanol in Saudi Arabia continues expanding across multiple sectors, driven by the Kingdom's ambitious modernization initiatives and commitment to sustainable development. Manufacturing facilities, healthcare institutions, cosmetics producers, and chemical processors increasingly rely on ethanol as an essential input material. This growing consumption reflects broader trends in industrialization, healthcare infrastructure development, and the adoption of international quality standards across Saudi industries. In 2024, the Saudi Arabia ethanol market size reached USD 646.11 Million.

Ethanol adoption in Saudi Arabia aligns closely with the nation's sustainability goals and cleaner energy solutions outlined in Vision 2030. The Kingdom's leadership recognizes that transitioning toward more environmentally responsible industrial practices requires incorporating alternative materials and fuels. Ethanol serves as a bridge technology, offering immediate environmental benefits while supporting the gradual shift away from more carbon-intensive processes and products.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming the Saudi Arabia Ethanol Industry:

Vision 2030 stands as the Kingdom's comprehensive blueprint for economic diversification, social development, and environmental sustainability. This transformative national agenda directly influences the trajectory of the Saudi Arabia ethanol market through multiple interconnected pathways. The Columbia University Center on Global Energy Policy reports that Saudi Arabia has set a lofty target to obtain at least 50% of its electricity from renewable sources by 2030, increasing its capacity to 130 gigawatts, of which 40 GW will come from wind and 58.7 GW from solar.

The manufacturing and industrial diversification pillar of Vision 2030 particularly impacts ethanol demand patterns. As Saudi Arabia invests heavily in pharmaceutical manufacturing, cosmetics production, specialty chemicals, and advanced materials, the requirement for high-purity ethanol naturally increases. These industries depend on consistent access to quality ethanol supplies that meet international standards for pharmaceutical-grade, cosmetic-grade, and industrial-grade applications.

Healthcare sector expansion under Vision 2030 generates substantial indirect demand for ethanol products. The Kingdom's commitment to building world-class medical facilities, increasing healthcare accessibility, and developing a robust pharmaceutical industry creates sustained requirements for ethanol-based disinfectants, sanitizers, and pharmaceutical preparations.

The sustainability and clean energy components of Vision 2030 open new possibilities for bioethanol and fuel-grade ethanol applications. While Saudi Arabia has historically focused on petroleum-based fuels, the national strategy acknowledges the importance of exploring alternative and complementary fuel solutions. According to a February 2025 analysis from SolarQuarter, Saudi Arabia's Vision 2030 and Green Finance Framework calls for renewable energy sources to account for 50% of the country's total electricity output, or roughly 130GW by 2030, with solar power accounting for about 60% of new capacity.

Key Industry Trends:

- Rising Demand for Ethanol in the Pharmaceutical and Healthcare Industries

The pharmaceutical and healthcare sectors represent one of the most significant growth areas for ethanol market demand in Saudi Arabia. Ethanol serves essential functions throughout pharmaceutical manufacturing, from being a primary solvent in drug formulation to serving as a key ingredient in tinctures, extracts, and liquid medications. The Kingdom's push toward domestic pharmaceutical production capabilities amplifies these requirements substantially.

Healthcare facility expansion across Saudi Arabia creates parallel demand for ethanol-based disinfection and sanitization products. Hospitals, clinics, diagnostic centers, and specialized medical facilities require consistent supplies of alcohol-based hand sanitizers, surface disinfectants, and medical equipment sterilization solutions.

The pharmaceutical industry's regulatory environment increasingly emphasizes quality standards that align with international benchmarks. Manufacturing facilities seeking certification from bodies such as the FDA or EMA must utilize pharmaceutical-grade ethanol that meets stringent purity specifications.

- Increasing Use of Ethanol as a Solvent in Personal Care and Cosmetics Manufacturing

The personal care and cosmetics industry in Saudi Arabia demonstrates robust growth trajectories, driven by rising consumer purchasing power and increasing domestic production capabilities. Industrial ethanol in Saudi Arabia plays a crucial role as a solvent in countless cosmetic formulations, including perfumes, deodorants, hair sprays, skincare products, and color cosmetics.

Saudi Arabia's position as a major consumer market for premium personal care products encourages both domestic manufacturing and international brand presence. Local production facilities manufacturing cosmetics under license or developing regional brands require reliable ethanol supplies that meet cosmetic-grade specifications.

The fragrance industry specifically depends heavily on high-purity ethanol as the primary carrier for aromatic compounds. Traditional Arabian perfumes, modern Western fragrances, and hybrid creations all utilize ethanol to deliver olfactory experiences effectively.

- Growing Focus on Bioethanol as a Cleaner Fuel Alternative Under Vision 2030

The exploration of bioethanol as a transportation fuel component represents one of the most strategically significant trends in the Saudi Arabia ethanol market. While the Kingdom's economy remains deeply rooted in petroleum production, environmental considerations and global climate commitments create imperatives to investigate lower-carbon fuel alternatives.

Bioethanol derived from sustainable biomass sources presents particular appeal within Saudi Arabia's sustainability framework. Agricultural residues, energy crops cultivated on marginal lands, and organic waste streams could potentially serve as feedstocks for domestic bioethanol production.

The technical feasibility of ethanol fuel blending aligns with Saudi Arabia's existing fuel distribution infrastructure. Lower-percentage ethanol blends can be utilized in conventional vehicles without modifications, while higher blends suit flex-fuel vehicle technologies.

- Expansion of Industrial-Grade Ethanol for Chemical Processing and Manufacturing

Chemical manufacturing and processing industries consume substantial quantities of industrial ethanol in Saudi Arabia across diverse applications.

Ethanol serves as a reaction medium, cleaning agent, intermediate compound, and specialty solvent in countless chemical synthesis pathways. The Kingdom's expanding petrochemical sector, specialty chemicals production, and downstream processing capabilities all contribute to rising industrial ethanol requirements.

The production of ethyl esters, ethyl ethers, and other ethanol derivatives represents significant industrial demand. These compounds find applications in plasticizers, surfactants, fuel additives, and specialty chemicals that serve both domestic consumption and export markets.

- Increasing Import Activity Due to Limited Domestic Production Capacity

The ethanol production in Saudi Arabia remains relatively limited compared to consumption requirements, creating substantial import dependencies. The Kingdom relies on international suppliers to meet the majority of its ethanol needs across pharmaceutical, industrial, cosmetic, and fuel-grade applications.

Major ethanol-producing regions including North America, Europe, South America, and Asia serve as primary sources for Saudi imports. Trade relationships with countries possessing established bioethanol industries provide access to sustainably produced ethanol that meets environmental and quality standards.

The regulatory framework governing ethanol imports balances multiple considerations including quality assurance, safety standards, environmental criteria, and trade policy objectives. Customs procedures, documentation requirements, and compliance verification processes ensure imported ethanol meets Saudi standards.

Market Segmentation & Regional Insights:

IMARC Group has categorized the market based on type, raw material, purity, and application.

Type Insights:

Based on the type, the market has been segmented into bio ethanol and synthetic ethanol.

- Bio Ethanol: Renewable-source ethanol aligned with Vision 2030 sustainability objectives and growing renewable fuel demand.

- Synthetic Ethanol: Petroleum-derived ethanol serving cost-effective industrial applications with consistent specifications.

Raw Material Insights:

on the basis of the material, the market has been segregated into sugar and molasses, cassava, rice, algal biomass, ethylene and lignocellulosic biomass.

- Sugar and Molasses: Traditional feedstock with established production technology and reliable supply chains.

- Cassava: Emerging feedstock suitable for arid climate cultivation enabling domestic production diversification.

- Rice: Agricultural residue supporting waste reduction and bioethanol production initiatives.

- Algal Biomass: Advanced sustainable feedstock under research without competing with food crops.

- Ethylene: Petrochemical-derived material for synthetic ethanol through established industrial processes.

- Lignocellulosic Biomass: Second-generation feedstock from agricultural waste supporting circular economy principles.

Purity Insights:

Based on the purity, the market has been bifurcated into denatured and undenatured.

- Denatured: Industrial-grade ethanol with additives for solvent and cleaning applications offering cost advantages.

- Undenatured: Pure ethanol essential for pharmaceutical formulations, beverages, and applications requiring absolute purity.

Application Insights:

On the basis of the application, the market has been categorized into fuel and fuel additives, beverages, industrial solvents, personal care, disinfectants and others.

- Fuel and Fuel Additives: Emerging segment aligned with transportation decarbonization and Vision 2030 bioethanol blending programs.

- Beverages: Specialized segment for alcoholic beverage production with strict quality and regulatory compliance.

- Industrial Solvents: Major segment supporting chemical manufacturing, pharmaceutical production, and diverse industrial operations.

- Personal Care: Growing segment driven by cosmetics expansion and domestic fragrance production.

- Disinfectants: Critical application amplified by healthcare infrastructure expansion and sustained hygiene awareness.

Regional Insights:

Region-wise, the market has been divided into Northern and Central region, western region, Eastern region and Southern region.

- Northern and Central Region: Riyadh's healthcare facilities and pharmaceutical manufacturing drive steady consumption.

- Western Region: Jeddah serves as import gateway supporting cosmetics and personal care industries.

- Eastern Region: Industrial heartland with petrochemical complexes and pharmaceutical operations generating concentrated demand.

- Southern Region: Emerging market driven by industrial development and expanding healthcare infrastructure.

Forecast (2025–2033):

The Saudi Arabia ethanol market size is expected to reach USD 1,032.57 Million by 2033, exhibiting a growth rate (CAGR) of 4.8% during 2025-2033, driven by multiple reinforcing trends. Industrial diversification initiatives, healthcare sector growth, manufacturing capacity development, and sustainability priorities collectively support robust demand trajectories.

Rising industrialization and expansion of manufacturing sectors represent primary demand drivers throughout the forecast period. Vision 2030 implementation continues generating new industrial facilities, expanded production capacities, and enhanced manufacturing sophistication.

Growing use of disinfectants and sanitizers across healthcare and commercial spaces establishes another structural demand driver. Heightened hygiene awareness, expanded healthcare infrastructure, and evolving workplace safety standards embed alcohol-based disinfection protocols throughout Saudi society.

Shift toward sustainable and low-emission fuel options represents a longer-term but potentially transformative demand driver. As Saudi Arabia progresses toward its environmental commitments and explores transportation decarbonization pathways, bioethanol could transition from experimental pilot programs to meaningful market volumes.

Increasing adoption of ethanol in personal care and household products reflects consumer trends, market sophistication, and product innovation cycles. Rising disposable incomes, evolving beauty standards, and premiumization trends in consumer products all favor ethanol-based formulations.

Conclusion:

The Saudi Arabia ethanol market stands at an inflection point characterized by traditional industrial applications, emerging sustainability priorities, and transformative economic diversification initiatives. Understanding the forces shaping this market provides essential intelligence for business leaders, investors, and policymakers navigating the Kingdom's evolving industrial landscape.

Vision 2030 serves as the organizing framework through which ethanol market trends should be interpreted. The national strategy's emphasis on industrialization, healthcare excellence, sustainability, and private sector development creates the enabling environment for sustained market growth.

Choose IMARC Group for Unmatched Market Intelligence and Strategic Insights:

- Data-Driven Market Research: Deepen your knowledge of ethanol consumption patterns, industrial applications, and technological advancements such as bioethanol production, sustainable feedstocks, and green hydrogen integration through in-depth market research reports.

- Strategic Growth Forecasting: Predict emerging trends in ethanol utilization, from pharmaceutical-grade applications and fuel blending initiatives to Vision 2030 sustainability programs and petrochemical sector expansion across Saudi regions.

- Competitive Benchmarking: Analyze competitive forces in the ethanol market, review import dynamics and supplier positioning, and monitor breakthroughs in production technologies and value chain optimization strategies.

- Policy and Infrastructure Advisory: Stay one step ahead of regulatory frameworks, government-sponsored renewable energy initiatives, and import standards affecting ethanol production, distribution, and industrial accessibility.

- Custom Reports and Consulting: Get tailored insights geared to your organizational objectives—be it launching ethanol-dependent manufacturing operations, investing in bioethanol production ventures, or building sustainable supply chain infrastructure for industrial chemicals.

At IMARC Group, our goal is to empower industrial leaders, investors, and strategic decision-makers with the clarity and intelligence required to navigate Saudi Arabia's dynamic ethanol market. Join us in supporting the Kingdom's diversification journey—because sustainable industrial growth matters. Click here for more details: https://www.imarcgroup.com/saudi-arabia-ethanol-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)